PIMCO CEFs Not Immune to Grossapalooza Hangover

It's been a rocky year for shareholders of Bill Gross' former CEFs, despite solid performance from the new management team; PIMCO High Income's shares have fallen 26% this year through September.

A little over a year ago Bill Gross shocked the investment world by abruptly resigning from PIMCO, the bond giant he co-founded in the 1970s. PIMCO's open-end mutual funds are still feeling the sting from the departure. Its flagship,

At the time of his departure, Gross also managed five closed-end funds that had a history of trading at strong premiums to their underlying net asset value, which is something of a rarity in the CEF world. Those premiums were primarily attributable to both Gross' reputation as a star fixed-income manager and the typically above-average distribution rates each of the CEFs offered.

Because CEFs have a fixed amount of assets, they don't experience inflows and outflows like traditional open-end funds. Instead, investor sentiment can be gauged by how the fund's shares are trading relative to the NAV of the fund. When relative premiums are shrinking or discounts are widening, it's a sign that there's more selling momentum than buying and vice versa. Share-price movements are also how investors realize capital gains and losses on their investments, rather than the underlying holdings' actual performance; so, any selling or buying momentum has an immediate impact on CEF shareholder returns, unlike in the open-end structure.

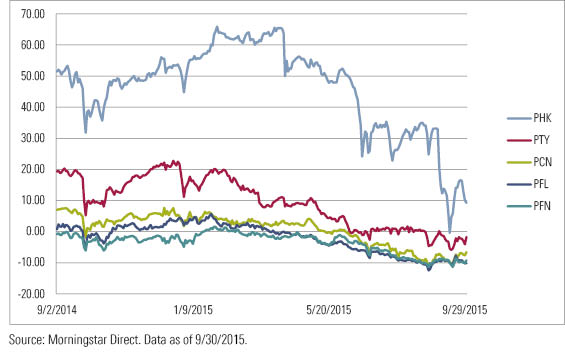

In the immediate wake of Gross' departure, each of the five CEFs (PIMCO High Income Fund PHK, PIMCO Corporate & Income Strategy PCN,

The share price of each of the Gross Five took an immediate dip toward its NAV in September 2014--the time of the departure--but rebounded shortly thereafter. Over the past six months, however, the allure seems to be wearing off. Of course, all taxable-bond CEF share prices have struggled lately. As detailed in last month's edition, at the end of August the average taxable-bond CEF was trading at its widest discount to NAV since the financial crisis.

In past periods of large market dislocations, like the summer of 2011 or during the taper tantrum of 2013, these five CEFs were the outliers. In August 2011, for example, the average taxable-bond CEF's discount hit a low of 8.52%. At the time, three of these CEFs (PIMCO High Income Fund, PIMCO Corporate & Income Opportunities, and PIMCO Corporate & Income Strategy) were still trading at double-digit premiums. PIMCO Income Strategy Fund II had the widest discount, but it only reached negative 2.50%.

These CEFs' resilience against greater market forces seems to have slowly subsided over the trailing 12 months, having finally come to a head in September, when PIMCO announced it was cutting the distribution of PIMCO High Income by 15%. Shares of PIMCO High Income, which have traded at an average premium of 45% over the past three years and as high as a 61% premium within the past 12 months, briefly dipped into discount territory in mid-September before quickly rebounding to a 10% premium in the weeks that followed. It was the first time the CEF had traded at a discount since November 2008. Even after the distribution cut, the CEF's 16% distribution rate based on share price is still the highest in the multisector bond CEF category and almost double the category average of 9%, which is likely why the share price rebounded so quickly.

The small rebound in share price might be little respite to shareholders who have stuck around. For the year to date through the end of September, PIMCO High Income's shares have fallen 26%, despite the new management team outperforming 70% of multisector bond CEF peers over the same time period. The only thing management seems to lack is the household name of Bill Gross.

The firm named Alfred Murata and Mohit Mittal as the new managers on all five of Gross' ex-CEFs following his departure. Murata had recently received the Morningstar Fixed-Income Fund Manager of the Year award in 2013, along with his comanager Dan Ivascyn, for the performance of

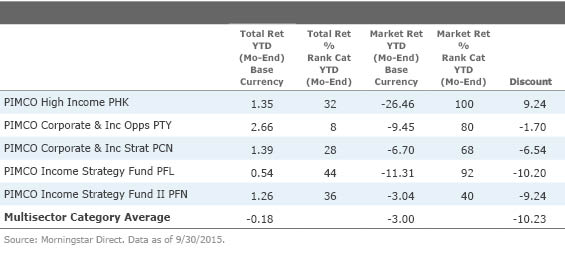

Exhibit 2 shows how the five CEFs have performed for the year to date through the end of September based on both NAV (which the managers do control) and the share price's market return (which the managers don't control) and how they rank versus peers in the multisector bond CEF category.

The new management team has turned in a solid year across the board when measured by the performance of the fund's net asset value. Each of the funds handily tops the multisector CEF category norm in a year that's been challenging for fixed-income investors. The share prices' market returns tell a much different story, however, and unfortunately for investors it is the return of the share price that matters at the end of the day. All but PIMCO Income Strategy Fund II ranked in the bottom half of the category by that measure, one by over 20 percentage points.

It is clear that whatever premium investors were willing to pay for a Gross-managed CEF has left the building along with Gross, and it has led to some unfortunate outcomes for shareholders over the short term. Whether or not the current discounts, or much lower premium in the case of PIMCO High Income, represent an attractive entry point or a new normal will likely depend on if the management team can keep NAV performance strong over a longer time frame.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)