Taking a Closer Look at a Bond Fund’s Credit Risk

Direct’s Quicktake and Fixed Income Exposure Analysis can help you gain an insight into a bond fund’s credit risk.

Understanding how much credit risk a strategy is taking on, comparing where that stands versus peers, and knowing which sectors and regions the credit risk is from are important considerations when assessing a bond fund’s risk profile.

The first of those can be assessed, in part, through credit quality data that is typically readily available on an asset manager’s website. In this article, I’ll walk through how to gain an initial insight into the latter two through Morningstar Direct, with a particular focus on how to find the sector and regional breakdown of a fund’s credit quality profile through the Fixed Income Exposure Analysis tool.

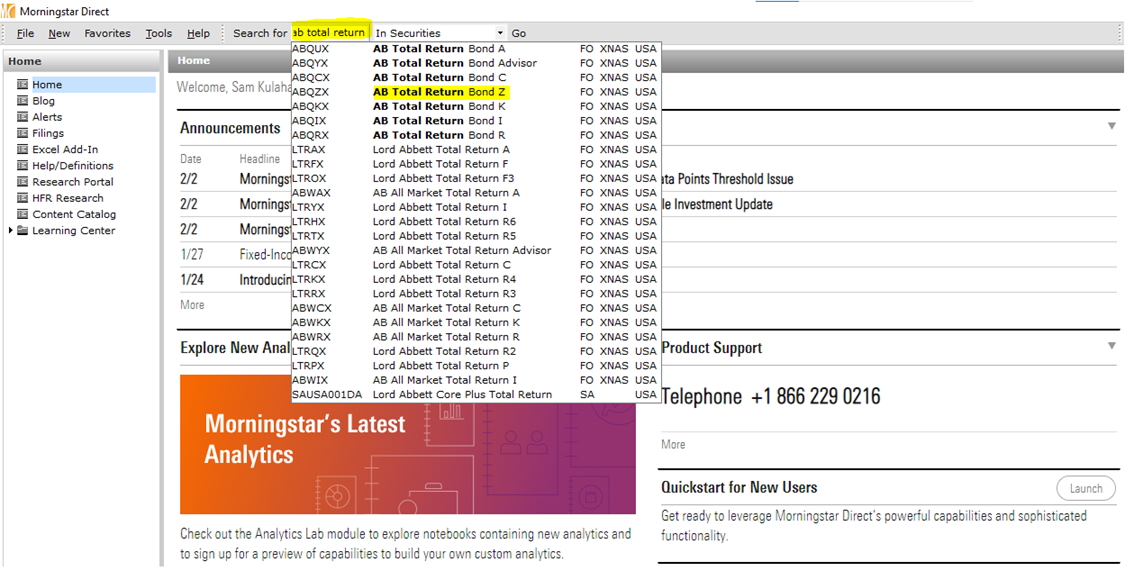

A fund’s credit quality breakdown and how it compares with its peers can be quickly found in Direct. One of the easiest ways is to pull up its Morningstar Quicktake report. I will pick one of the funds I cover, AB Total Return (ABQZX), which is in the intermediate core-plus bond Morningstar Category, to demonstrate this.

You can access a fund’s Quicktake report in a number of ways. For instance, if a fund is part of one of your investment lists in Direct, you can double-click on the fund in the list and the Quicktake report will automatically open. Another easy way is through the search box at the top of the Direct interface. From the home screen of Direct, you can begin typing either the fund’s ticker or its name into the "Search for" box at the top of the window. That brings up a drop-down menu of funds. Upon clicking the appropriate fund share class in the drop-down menu, the Quicktake report will load.

The Quicktake report contains a wealth of information for each fund, but for this purpose, we will navigate straight to the Portfolio section by clicking the Portfolio tab at the top of the report.

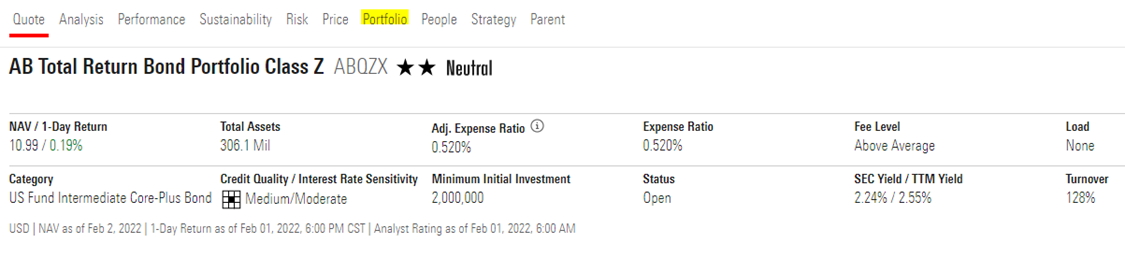

Within the Portfolio section, you can find a fund’s latest available credit quality profile under the Bond Breakdown section. The Bond Breakdown by Credit Quality for AB Total Return is shown below.

AB Total Return: Bond Breakdown – Credit Quality

From this, we can see that AB Total Return does take on more credit risk than its typical intermediate core-plus bond Morningstar Category peer, particularly in BBB rated issues (28%), where it holds 6 percentage points more than the category average. It also holds just under double the category norm in not-rated credits, which aren’t necessarily lower-quality issues but can be an indication of heightened risk.

While a strategy’s credit quality profile in isolation is useful, it’s also important to consider where the fund is taking on credit risk. Morningstar’s Fixed Income Exposure Analysis, or FIEA, is a particularly helpful tool for this as it uses holdings-based analysis to provide an indication of a fund’s credit quality breakdown by sector and region, among other views, as it can also show a breakdown of a fund’s duration and yield-to-worst profile. (Note: Small differences can occur owing to the various ways fund companies classify and report data, and the FIEA view is based on a fund's bond portfolio rather than its total assets.)

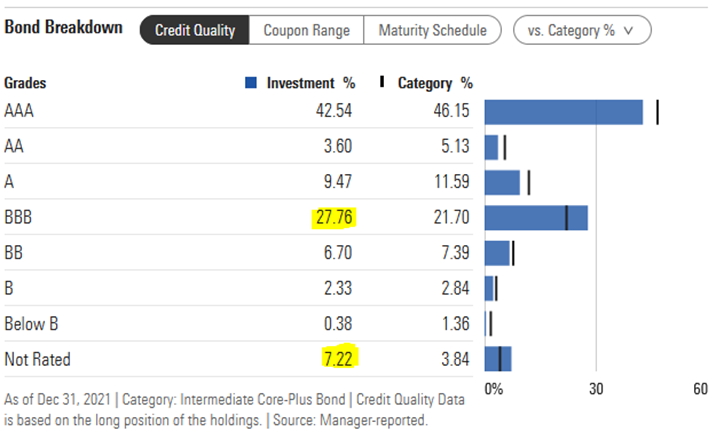

To illustrate this, I’ll take a look at the FIEA for both AB Total Return and another fund in the core-plus category, MFS Total Return Bond (MRBIX), which, at first glance, has a not too dissimilar credit quality profile based on its Bond Breakdown.

MFS Total Return Bond: Bond Breakdown – Credit Quality

On the whole, MFS Total Return Bond’s allocations at credit rating rung are generally no more than a few percentage points away from AB Total Return’s. It does tilt higher-quality by holding more investment-grade issues, but it also has a modestly higher allocation to BB rated bonds.

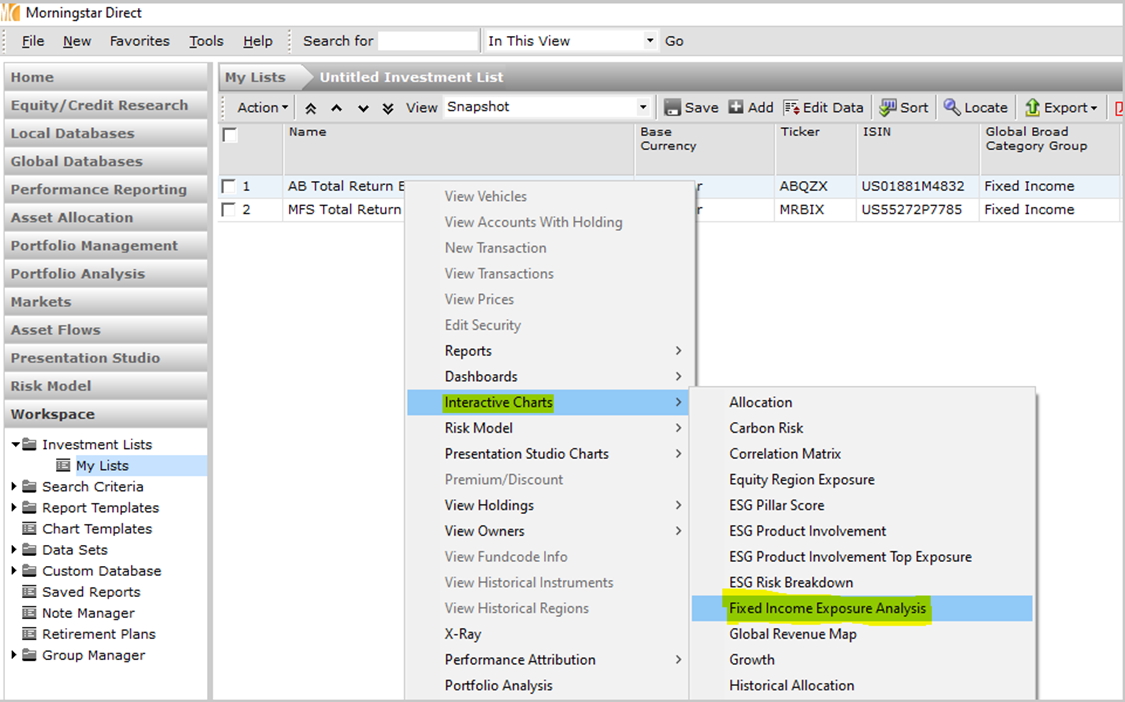

The FIEA tool can be accessed through the Workspace section of Direct by right-clicking on a fund in an investment list and selecting Fixed Income Exposure Analysis under the Interactive Charts menu. A slimmed-down version of the FIEA tool can also be found in the Portfolio section of the Quicktake report, just below the Bond Breakdown.

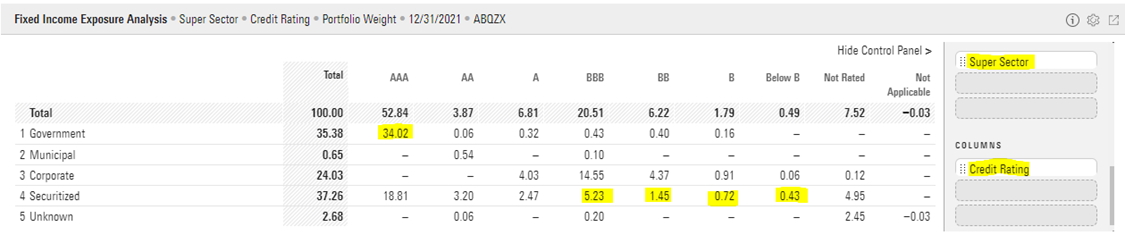

Within the FIEA control panel on the right-hand side of the pop-up window, dragging the attribute's Super Sector into the Rows field and Credit Quality into the Columns field provides a breakdown of a fund’s credit quality profile by sector. I’ve done so for both funds below, and you can see that, while the two funds have a similar credit quality profile in their government debt allocation, AB Total Return is notably more willing to take on credit risk in its securitized allocation, with more sizable stakes in securitized debt rated BBB and below-investment grade. AB Total Return balances this with more overall in AAA rated government debt. MFS Total Return Bond, on the other hand, holds more AAA rated securitized credit and prefers to dip down the credit quality spectrum in corporate credit, holding more A, BBB, BB, and B rated corporates than AB Total Return. So, based on this, we know that, as of late 2021, AB Total Return prefers to take on credit risk in securitized debt, while MFS Total Return Bond prefers taking on risk via corporates. This comparison provides us with a starting point for further analysis, which would involve understanding in which subsectors and issues each fund favors taking on credit risk. It also helps us understand how, among other things, each fund might react going forward in market environments where corporate credit fares better than securitized debt or vice versa.

AB Total Return: FIEA – Credit Rating vs. Super Sector

MFS Total Return Bond: FIEA – Credit Rating vs. Super Sector

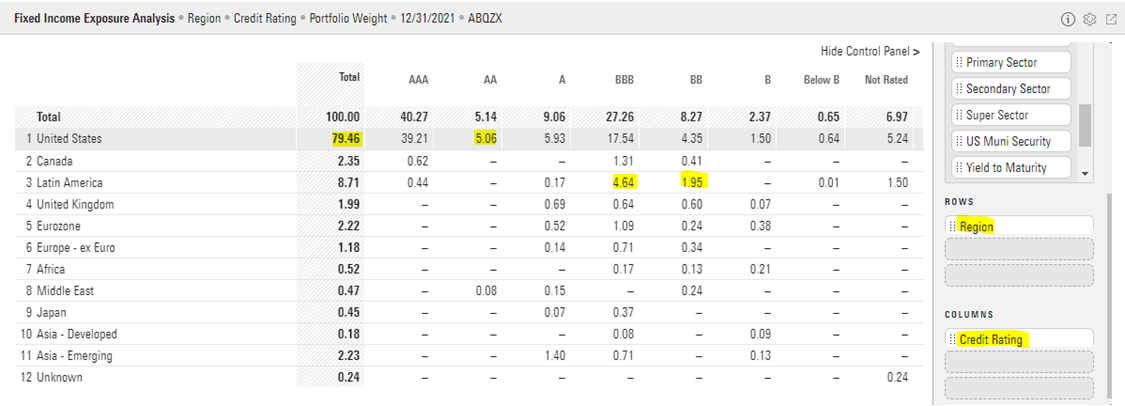

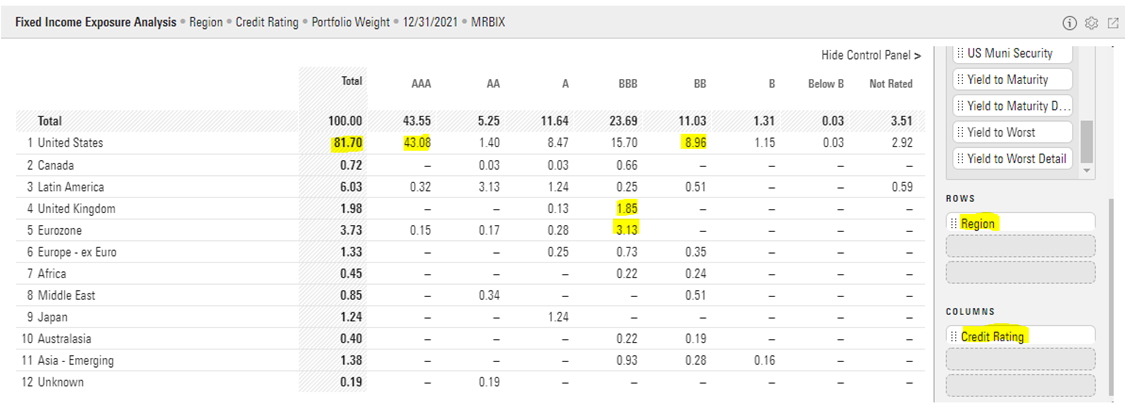

It can also be interesting to look at the Credit Rating vs. Region part of the FIEA tool, which can be accessed by dragging Region into the Rows field in the control panel. Comparing the outputs below, on the whole, MFS Total Return Bond holds a little more in bonds issued in the United States, while AB Total Return is slightly more willing to go global. MFS Total Return Bond holds more AAA rated debt from issuers in the U.S. but then pairs that with more in BB rated U.S.-issued bonds. It also favors dipping into BBB rated debt from issuers in the United Kingdom and eurozone. On the other hand, AB Total Return notably holds more Latin American debt rated BBB or BB, which adds an extra element to its risk profile given that emerging-markets debt brings elevated geopolitical risks, but it pairs that with more in U.S. AA rated bonds than MFS Total Return Bond has in them.

AB Total Return: FIEA – Credit Rating vs. Region

MFS Total Return Bond: FIEA – Credit Rating vs. Region

Portfolios can change rapidly, and sometimes materially so, but the Bond Breakdown and Fixed Income Exposure Analysis tables are together a great way to gain initial insight into how much credit risk a fund is taking on at a point in time, where that stands versus a peer or the category norm, and from which sectors and regions the credit risk comes.

/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fbf946b1-332c-41b4-94b4-79ab30a12219.jpg)