Can the US Continue to Outperform?

Valuations of foreign developed markets look cheap relative to the US.

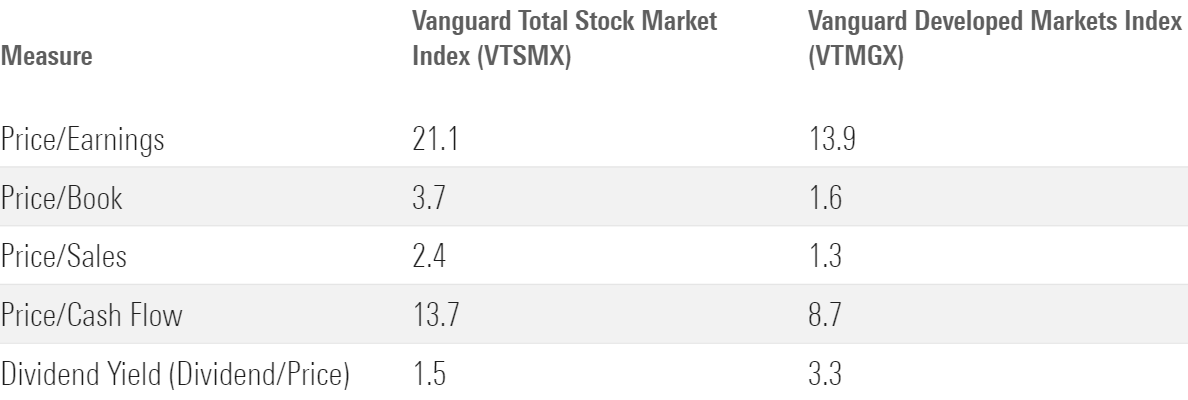

Over the past decade, US equities have far outperformed those of the other developed markets. From July 2014 to June 2024, Vanguard Total Stock Market Index VTSMX returned 12.0%, outperforming Vanguard Developed Markets Index’s VTMGX return of 4.6% by 7.4% per year. That outperformance has led to US stocks having much higher valuations than the equities of other developed markets. The table below, with data from Morningstar as of the end of May, shows that no matter the metric, US stocks have higher valuations.

VTSMX vs. VTMGX

The price/earnings ratio of US stocks was 52% higher, their price/book 131% higher, their price/sales 85% higher, and their price/cash flow 57% higher. The dividend/price of foreign developed-markets stocks was 120% higher.

Overweighted US Stocks

Recency bias and home country bias contribute to most US investors overweighting US stocks relative to their global market-cap weighting. In a 2019 article, Verdad showed that US stocks made up 77% of the holdings in Vanguard’s equity funds, more than 50% above the US’ share of the global market capitalization at the time.

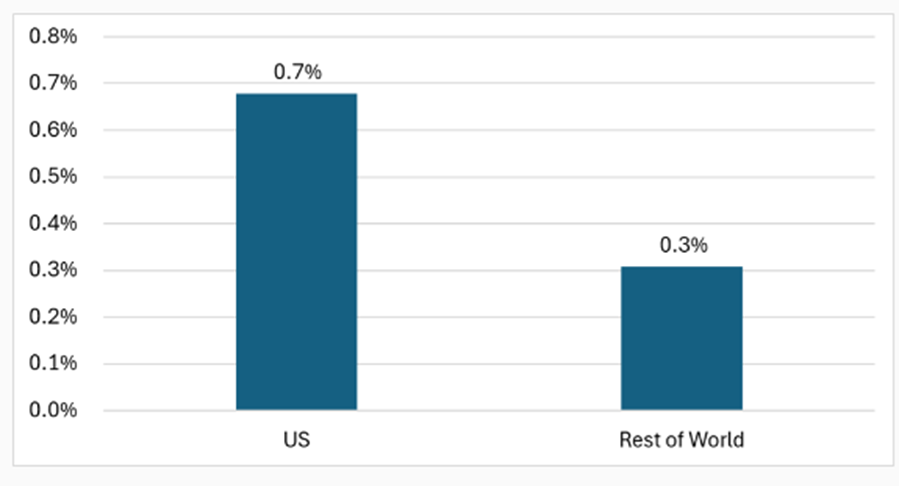

In a July 2024 article, Verdad showed that US equities have significantly higher liquidity than international equities. The chart below shows the average daily dollar value traded per dollar of market cap for US equities versus international equities on a market-cap-weighted basis.

Market-Cap-Weighted Average Daily Turnover (Daily Turnover/Market Cap

Because investors have a preference for liquidity, they are willing to pay a higher price for assets that are more liquid. That liquidity premium may help explain some of the differences in valuation. But that preference results in an illiquidity premium for those investors willing to accept that risk.

The US is now dramatically a more expensive market than less liquid international stock exchanges, raising the question of whether the much higher US valuations are justified. Of course, higher earnings growth could explain both the higher valuations and the outperformance.

According to the same Morningstar data we examined above, the long-term historical earnings growth (past five years) of foreign developed-markets stocks did trail that of US stocks. However, the difference was minor: 5.5% versus 6.3%. And while analyst expectations for future earnings growth (three to five years) also favored US stocks, it was also only by a relatively small amount: 11.7% versus 10.7%. Such small differences cannot explain the dramatic outperformance of US stocks. In other words, US stocks’ outperformance is mostly explained by rising valuations. While rising valuations can keep rising for some time, investors should not expect a repeat performance. And at some point, rising valuations create increased risk.

Investor Takeaways

US stocks have outperformed by wide margins over the past decade. However, their relatively high valuations with similar expected earnings growth rates raise the question of whether recency bias, home country bias, and a preference for liquidity have resulted in a more attractive opportunity in foreign developed markets, with their much lower valuations but relatively similar expected earnings growth rates. As always, my crystal ball remains cloudy. Only time will provide the answer. With that said, investors with the discipline to stay the course should consider allocating their US equity holdings more in line with the total global market capitalization, which is much closer to 50%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)

/d10o6nnig0wrdw.cloudfront.net/08-06-2024/t_f6fcb0f30fe44c9e93a89e6a4e1d2df1_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)