September 2024 US Market Outlook: Tailwinds Offsetting Headwinds

Following August rebound, US stock market fully valued.

Key Takeaways

- US equity market fully valued; long-term investors should earn normalized equity returns going forward

- Might be rough seas as elections approach, but tailwinds are offsetting headwinds

- Time to underweight the utility sector

After a brief dip in early August as a weaker than expected jobs report stoked recessionary fears, stocks ramped right back up and approached their highs by the end of the month. Tailwinds from moderating inflation, declining interest rates, and soon to be easing monetary policy are offsetting the headwind from a slowing rate of economic growth. For details on each of these market dynamics, see Don’t Panic: It’s Not 2022 All Over Again, where we outlined our forecasts and explained why we thought investors should maintain their equity positions.

In addition to the macro dynamics, better than expected fundamentals led us to increase our fair values on a number of market-moving stocks. For example, following their earnings reports, we upgraded our fair value estimates on several stocks that have the largest market capitalizations and whose performance can skew broad market averages. For example, we increased our fair value on Alphabet GOOGL by 15% to $209 per share. Following the increase, as of Aug. 30, Alphabet was rated 4 stars, as it traded at a 22% discount to fair value. In addition, we increased our fair value on Microsoft MSFT by 13% to $409 per share. Microsoft was rated 4 stars, as it traded at a 16% discount to fair value. While each of these companies’ fundamental performance is hitting on all cylinders, the preponderance of our fair value increase was driven by an acceleration in our assumptions of the growth in their cloud businesses in the short to medium term.

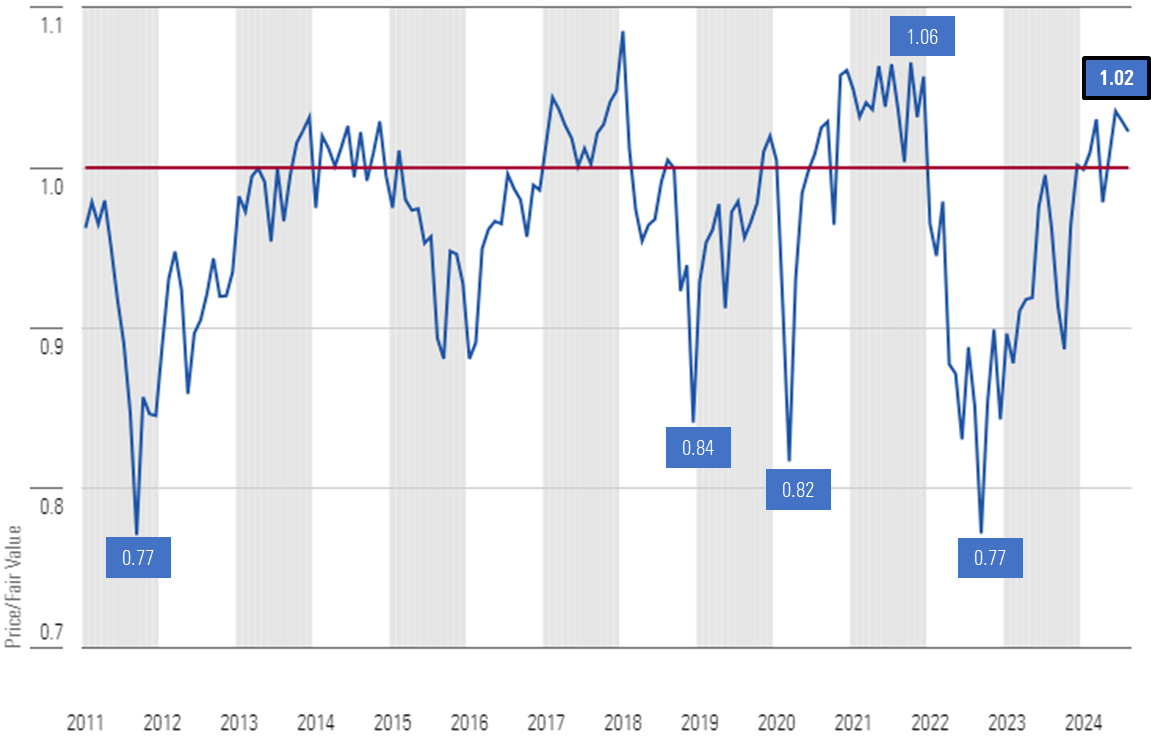

Incorporating these fair value increases in light of the market recovery, as of Aug. 30, the price/fair value of the US stock market was 1.02.

Price/Fair Value of Morningstar's US Equity Research Coverage at Month-End

The Morningstar US Market Index increased 2.26% in August. The Morningstar US Value Index led the way, rising 2.49%, followed by the Morningstar US Core Index, which increased 1.96%, and the Morningstar US Growth Index, which only rose 1.34%.

By capitalization, large-cap stocks continued to lead the market as the Morningstar US Large Cap Index rose 2.44%, closely followed by the Morningstar US Mid Cap Index, which increased 2.40%. Small-cap stocks gave up some of their outsize gains from July, as the Morningstar US Small Cap Index fell 0.19%.

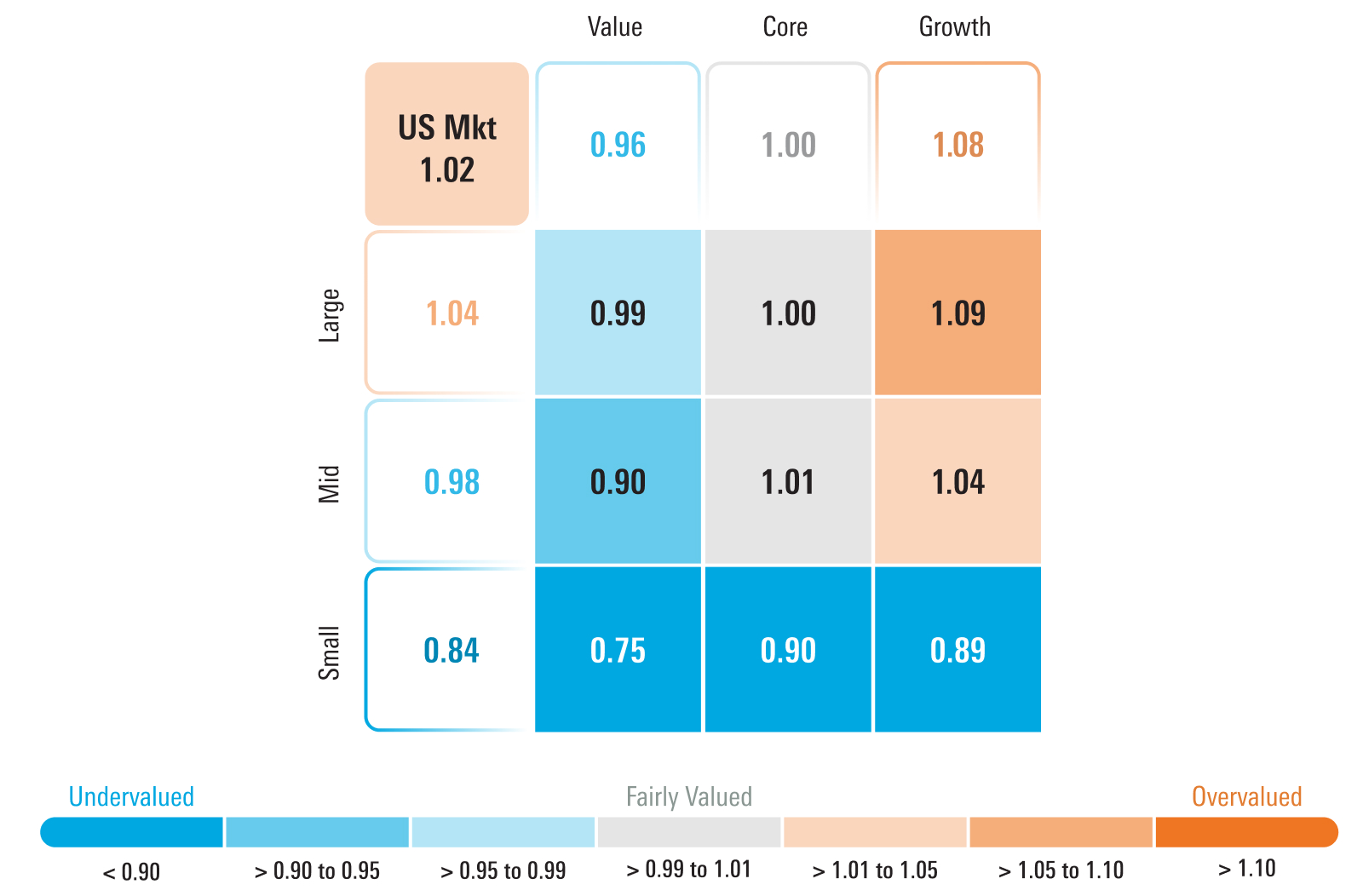

Following these market movements, the value category remains the most attractive, trading at a 4% discount to fair value. Core stocks trade at the broad market average, and growth stocks remain most overvalued at an 8% premium.

By capitalization, small-cap stocks remain the most attractive at a 16% discount, followed by mid-caps at a 2% discount, while large caps are slightly above fair value, trading at a 4% premium to a composite of our fair values.

Based on these valuations, we recommend an overweight position in value, an underweight in growth, and market weight in core. By capitalization, we advocate for an underweight position in large-cap stocks in favor of overweighting small-cap stocks and a market weight in mid-cap stocks.

Price/Fair Value by Morningstar Style Box

Market Rotation Into Defensive Sectors Sends Valuations Too High

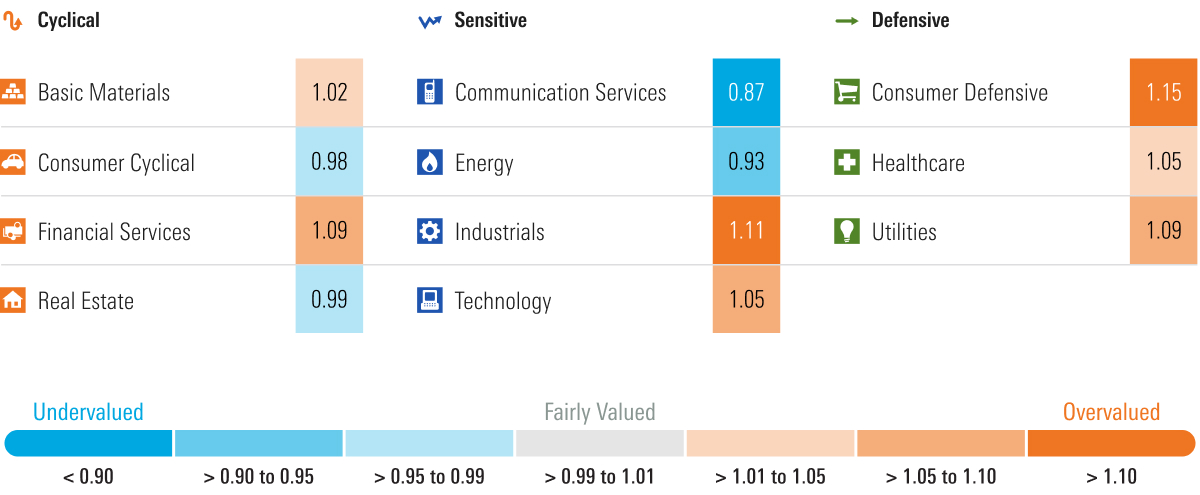

As momentum ran out on stocks leveraged to artificial intelligence, investors rotated into stocks with defensive characteristics. In August, the Morningstar US Healthcare Index increased 5.16% and the Morningstar US Consumer Defensive Index rose 5.08%. Leading the market higher was the long-beleaguered Morningstar US Real Estate Index, which rose 5.37%, following a 7.50% gain in July.

According to our valuations, the consumer defensive sector is now the most overvalued sector, trading at a 15% premium to a composite of our fair values. In fact, this sector contains some of the more overvalued stocks across our coverage. While many of these companies are rated with wide economic moats and are fundamentally performing well in the short term, we think the market is overestimating their long-term earnings power. For example, wide-moat-rated Procter & Gamble PG trades in the 2-star range and Costco COST in 1-star territory.

Among other lower-quality names in the index, Target TGT stock has no moat and is rated 2 stars. Target’s stock rose after it posted a 2% increase in comparable store sales this past quarter, yet this increase comes after four consecutive quarters of negative comparable store sales. In addition, Target’s increase was less than half of Walmart’s WMT 4.2% increase in comparable store sales. For investors looking for stocks in this sector, we’d highlight 5-star-rated Kraft Heinz KHC or 4-star-rated Kenvue KVUE.

Following the 7.50% surge in July, the Morningstar US Real Estate Index rose another 5.37% in August, bringing the sector valuation to the point that it is now only 1% undervalued: a far cry from being the most undervalued sector at a 17% discount as recently as May 2024. Undervalued opportunities remain, and we are most comfortable with those real estate plays tied to property with more defensive characteristics. For example, Ventas VTR, a 4-star-rated stock that trades at a 10% discount, owns a diversified portfolio of healthcare-oriented properties. Similarly, triple-net-lessor Realty Income O, whose retail tenants are mostly focused on defensive segments, is rated 4 stars and trades at an 18% discount.

The Morningstar US Healthcare Index rose 5.16%, taking the sector valuation to a 5% premium. However, almost half of the monthly return can be attributed to 1-star-rated Eli Lilly LLY, which rose 19.37% in August. While we agree with the market that there is a large addressable market for its weight loss drugs, we think the market is overextrapolating the amount of growth and earnings power over the long term. We see better value in medical-device makers such as 5-star-rated Zimmer Biomet ZBH and 4-star-rated Medtronic MDT.

Of note, following the utilities sector’s strong 22.64% return for the year to date, we recently changed our view to underweight. While we agree with the premise that the growth of AI will bolster demand for electricity, as it requires multiple times more power than traditional computing, we think this dynamic is now more than priced in. We started 2024 with an overweight recommendation and had noted in October 2023 that underlying fundamentals in the sector are better than they have been in decades, and in our Q4 2023 US Markets Outlook, we highlighted that the utilities sector was trading near its lowest level as compared with our valuations over the past decade.

For investors looking to maintain exposure in the utilities sector, we highlight several different swap ideas, such as selling 2-star-rated Southern SO or Dominion Energy D and using the proceeds to buy 4-star-rated Entergy ETR or NiSource NI.

Economically Sensitive Sectors Sink

As a result of this market rotation into defensive sectors, economically sensitive sectors pulled back in August. The Morningstar US Energy Index was the worst performer, falling 2.15%, and the Morningstar US Consumer Cyclical Index barely eked out a 0.37% gain.

Following this pullback, the energy sector is now the second most undervalued sector, trading at a 7% discount to our fair values.

While we have a bearish view on the long-term price of oil as our mid-economic cycle forecast for West Texas Intermediate crude is $55 per barrel, many oil companies are trading at a discount to our intrinsic valuations. Examples include 4-star-rated Chevron CVX. In addition to trading at a margin of safety, we think exposure to energy provides a good, natural hedge in one’s portfolio to geopolitical risk or if inflation were to stage a comeback.

The consumer cyclical sector is now trading at a 2% discount to a composite of our valuations. While lower-income consumers remain under pressure and curtail spending where they can, spending among higher-income consumers remains strong. For example, bookings for cruise lines appear strong for this holiday season. Our pick among the cruise lines is Norwegian Cruise Line NCLH, which is rated 4 stars. After sliding from its July highs, Amazon.com AMZN has dropped into 4-star territory, as it trades at an 8% discount to fair value.

Morningstar Price/Fair Value by Sector

What’s an Investor to Do?

Steady as she goes. With the broad equity market trading just a little over fair value, we advocate for investors to position themselves at a market weight within their targeted long-term asset allocations between equity and fixed income. With the rate of economic growth projected to slow for the next few quarters, stock markets could become increasingly volatile this fall, and pullbacks could provide an opportunity to move back to overweight equity positions. Within the equity portion of a portfolio, we continue to see the best valuation in the value category and in small-cap stocks.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)