6 Wide-Moat Companies Positioned to Succeed in the Packaged-Food Industry

Intangible assets and cost advantages buoy the edge of some packaged-food firms.

We don’t expect an evolving retail landscape to spoil packaged food’s hearty cash hoard.

We believe there is an interdependent relationship between retailers and packaged-food manufacturers to sell their wares profitably, particularly as consumers shop a number of channels.

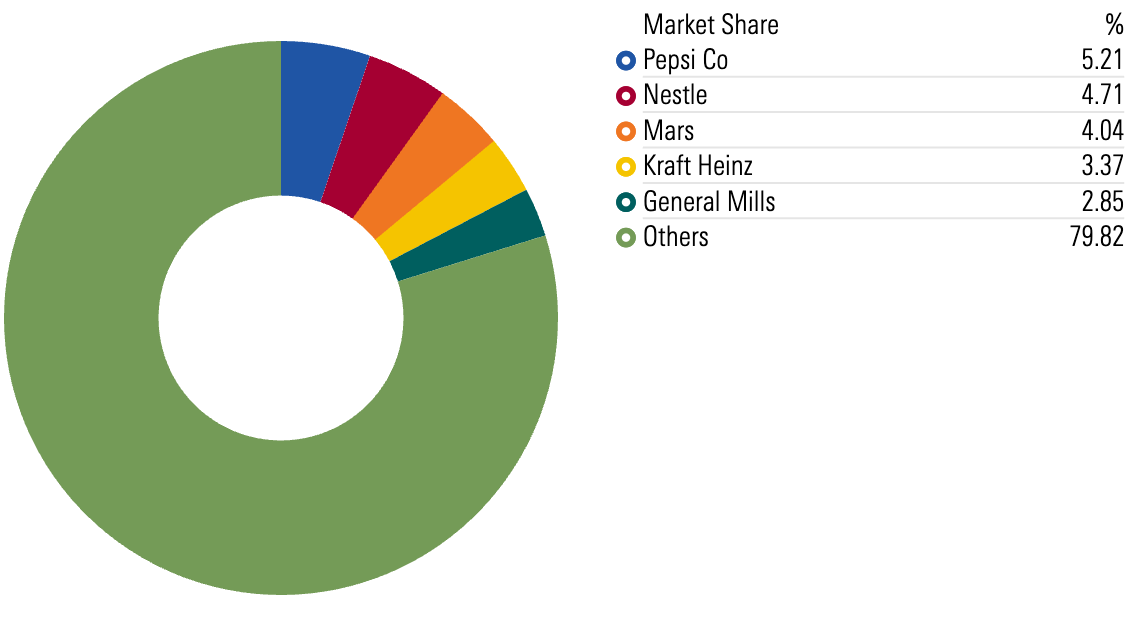

In terms of market leaders, the top five companies by revenue in the US packaged-food realm collectively accounted for a mere 20% of total sales in 2023.

The chart below shows that Pepsi’s PEP packaged-food segments chalked up a 5.2% share, slightly ahead of Nestle’s NESN 4.7% mark. Mars (4%), Kraft Heinz KHC (3.4%), and General Mills GIS (2.9%) round out the top cohort.

Pepsi Nudges Out Nestle for the Top Spot in the US Packaged-Food Arena

Morningstar’s packaged-food industry coverage includes several names that have Morningstar Economic Moat Ratings of narrow or wide: Specifically, 52% of our packaged-food coverage has garnered a moat (owed to intangible assets and cost advantage), just under the 58% for our coverage across all sectors.

Here, we outline our views on the state of the packaged-food industry and the companies that are best positioned to succeed in this environment.

6 Wide-Moat Stocks in the Packaged-Food Space

Within the packaged-food landscape, Morningstar covers around 30 companies with a wide range of market capitalizations.

Six of these companies’ stocks currently offer a wide moat:

- Nestle

- Mondelez MDLZ

- The Hershey Company HSY

- Lindt & Sprungli LISN

- McCormick & Company MKC

- Campbell Soup CPB

| Stock | Ticker | Morningstar Rating | Uncertainty Rating | Fair Value Estimate (as of Aug. 23, 2024) | Price/Fair Value Estimate (as of Aug. 23, 2024) |

|---|---|---|---|---|---|

| Nestle | NESN | 4 stars | Low | CHF 105 | 0.85 |

| Mondelez | MDLZ | 4 stars | Low | $75 | 0.94 |

| The Hershey | HSY | 4 stars | Low | $210 | 0.93 |

| Lindt & Sprungli | LISN | 2 stars | Low | CHF 94,000 | 1.17 |

| McCormick & Company | MKC | 2 stars | Medium | $67 | 1.17 |

| Campbell Soup | CPB | 4 stars | Medium | $61 | 0.83 |

The economic moats in this industry stem from intangible assets (such as strong brands and a status as valued partners to retailers) and/or cost advantages.

- Intangible assets: Firms with strong brands tend to enjoy dominant market shares in their respective categories and pricing power that permits manufacturers to pass inflation through to consumers without a material and lasting pullback in volumes.

- Cost advantages are typically underpinned by scale (buying power, manufacturing processes, economies of scope, route density, or advertising), proximity to customers, or access to low-cost raw materials. This allows businesses to either extract higher margins or secure greater volumes by offering lower prices.

It is rare to enjoy a cost advantage without also having earned an intangible asset edge.

3 Key Themes to Keep an Eye on in the Packaged-Foods Industry

We see three themes driving the packaged-foods industry:

- Private-label share hasn’t oscillated much historically. Private-label market share has generally held steady over the past 10 years—at a midteens level on a value basis. It has won out in more commoditized categories like processed fruits and vegetables, dairy, and meat, amassing around one third or more of each category. We’ve also seen value options find favor in aisles where innovation has been lacking. From a macro perspective, consumers will likely continue adding private label to their baskets when the economic backdrop sours.

- Store dominance holds despite e-commerce adoption. Packaged-food firms need to ensure their products are stocked where consumers are shopping. Prior to covid-19, e-commerce represented just a low-single-digit percentage of food purchases, even as the online channel proved disruptive to other categories. However, in 2020, nearly 10% of food sales occurred online, and that share grew to 12% in 2023. As consumers prefer to seek out what’s familiar or repurchase from prior orders, we think leading players command favorable product positioning in this emergent channel.

- Dividends are a priority for capital in packaged food. Packaged-food manufacturers have gobs of cash and several options for where to direct it. Beyond brand spending, dividends tend to take top billing, accounting for 35% of cash flow from operations generated across our coverage. Spending on capital investments comes in a close second, as firms work to weave in automation enhancements to unlock efficiencies. A hunger for deals has also characterized the industry, as firms look to prudently expand their category and/or geographic reach.

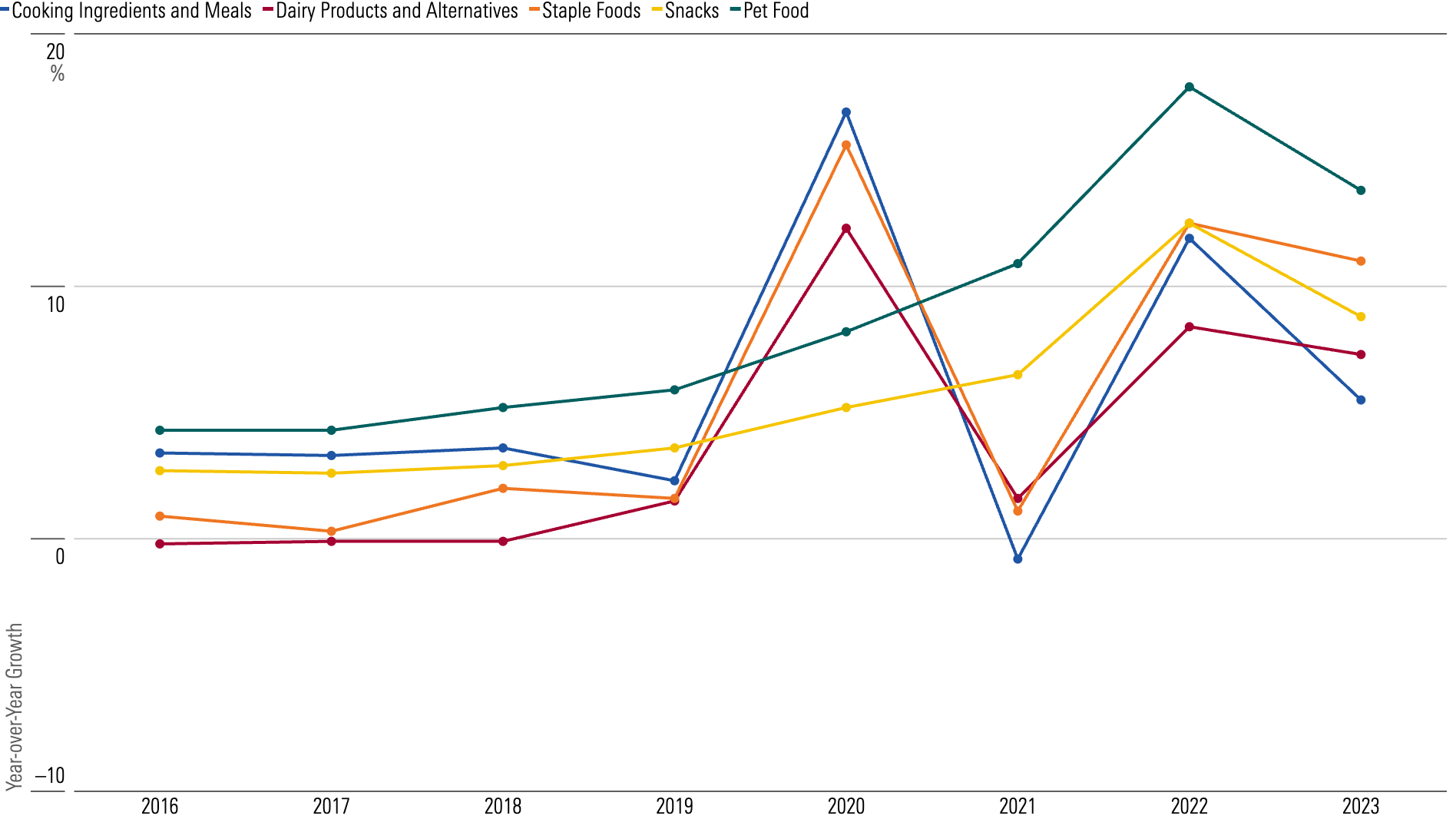

The Packaged-Food Industry Has Boasted Fairly Consistent Sales Growth

Given the more essential nature of the product mix, sales growth across the packaged-food industry tends to be steady, albeit modest, throughout economic cycles.

For example, pet care has benefited from the surge in adoptions (up midsingle digits) during the pandemic, which should persist over the life of the pet.

Further, consumers’ proclivity for convenient on-the-go meal options has propped up snacking fare relative to the rest of the group, resulting in high-single to low-double-digit category sales growth more recently, a touch above the low- to mid-single-digit rate that the category has touted in the past.

Low- to Mid-Single-Digit Sales Growth Has Historically Emanated From Most Packaged-Food Aisles

The sales and profit growth prospects for packaged-food operators could be altered based on several macro and competitive factors.

On the plus side:

- Alternative pack sizes: The inclusion of smaller and larger pack sizes can afford the opportunity to penetrate alternate channels, including discount and club.

- Emerging markets: A growing middle-income cohort could provide a large opportunity for operators that appeal to local consumers.

- Foodservice: This channel enables operators to expand their distribution, while testing new products with the benefit of more-instantaneous feedback.

- Health and wellness: With a focus on health and wellness, consumers may increasingly opt for products lacking artificial ingredients.

- Plant-based: More environmentally friendly marketed products across a number of aisles in stores could continue to win out over conventional fare.

On the downside:

- Economic downturns: A weak economic backdrop could lead to lower levels of spending, even on daily essentials.

- Inflation: Consumers could trade down or out of categories to conserve resources.

- Product recalls: If quality is questioned, consumers could balk.

- Retailer consolidation: Further consolidation could shift the balance of power in favor of retailers that could take a harder line on pricing and shelf assortment.

- Supply constraints: Any situation that jeopardizes the ability to get product to the shelf could prompt consumers to seek out alternatives.

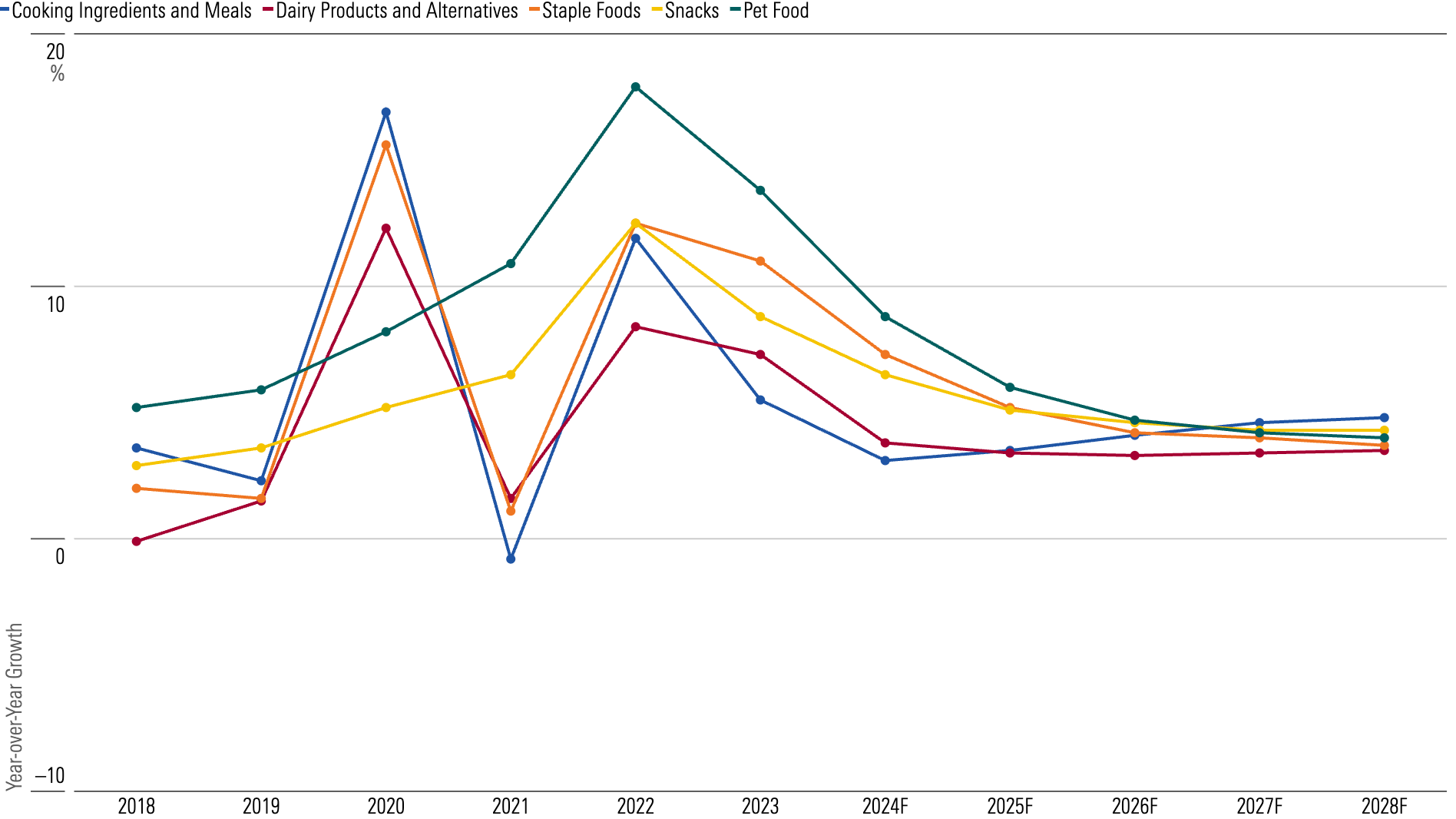

We never expected the outsize growth during the pandemic (high single to low double digits) would persist. But we still think growth can be achieved in this mature space.

In this context, we surmise snacking caters to consumers’ desire for convenient on-the-go fare, while cooking meals and ingredients should benefit from the skills consumers developed after spending so much time at home, with mid-single-digit category growth in the cards for each.

Despite the Heady Uptick the Last Few Years, We Expect Packaged-Food Sales Growth Will Temper to the Low to Midsingle Digits Through Calendar-Year 2028

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)