Consumer Defensives: Even Amid Macro Pressures, Deals Permeate the Landscape

Our top picks for this sector include Estee Lauder, WK Kellogg, and Kraft Heinz.

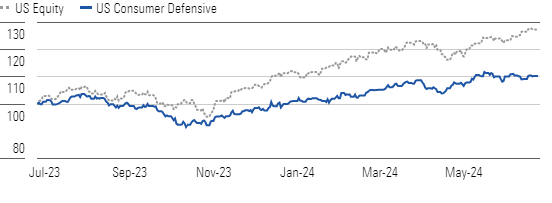

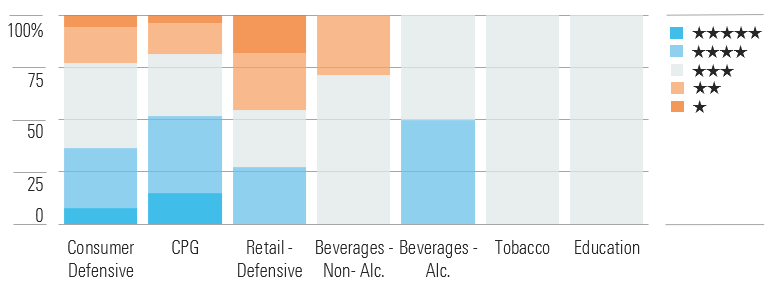

The Morningstar US Consumer Defensive Index edged up 1.5% in the second quarter, lagging the market’s 3.4% bump. The median stock in the sector trades at just a 5% discount to our intrinsic valuations. However, we think opportunities still exist for investors hungry for a slice of the pie, with 30% of names in the space trading in 4- or 5-star territory.

Consumer Defensive Stocks Edge Up but Lag the Market’s Climb In Q2

More specifically, we’d point to the consumer packaged goods aisle offering ample picks. The market’s concerns center around the intensifying promotional landscape, as well as how operators might blunt the hit to volumes. But we think moaty players will tolerate short-term market share degradation in favor of brand spending to buoy their competitive standing with retailers and consumers in the longer term.

Bargains Remain Among Consumer Packaged Goods Manufacturers

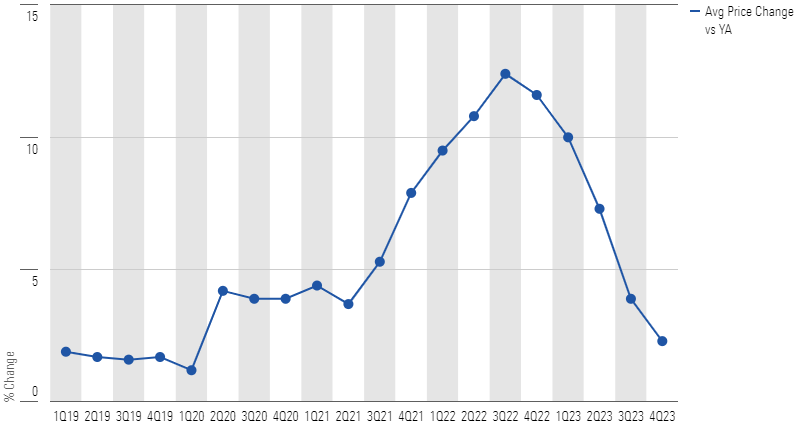

After an extended period, consumer product manufacturers are beginning to ration price increases—up by low single digits of late, a far cry from the low-double-digit clip that had become more commonplace in 2022 and early 2023. We attribute this shift to the moderating pace of inflation that has since emerged, concentrated more recently in cocoa, coffee, sugar, transportation, and wages. However, we don’t surmise that price is the only lever that consumer product manufacturers will toggle to the extent that inflation rears its ugly head again. Rather, we posit firms will simultaneously work to extract costs and alter price/packs to dull any impending downdraft in profits.

Regardless of the cost environment, we believe consumer product manufacturers will continue to funnel resources toward consumer-valued innovation and marketing support to ensure its fare continues to win on the shelf.

CPG Firms Have Had Their Fill of Inflation-Induced Price Hikes

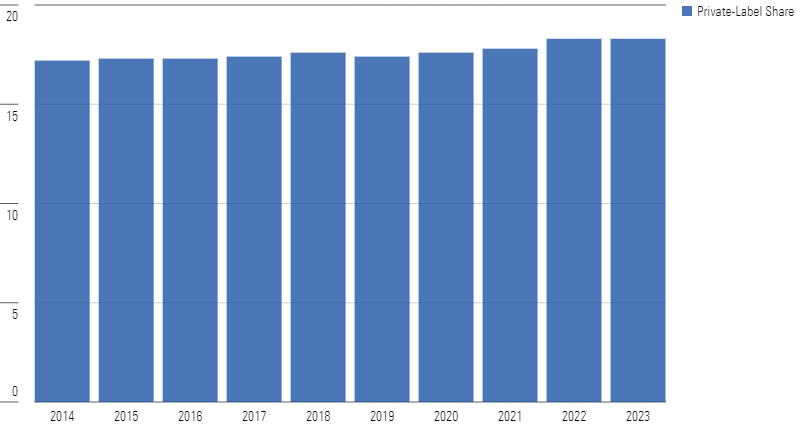

We’ve seen this manifest in a fairly stagnant share position for private-label offerings within the domestic staple foods category, which sat at just north of 18% at the close of 2023, about 100 basis points north of the level in 2014. From our vantage point, losing sight of consumer preferences tends to open the door to an onslaught of competition from other brands, as well as lower-priced private-label options—a particularly poignant challenge amid waning consumer spending. However, we don’t expect competitively advantaged operators to be keen to siphon this spending and jeopardize their standing.

Investments In Innovation Should Keep Private-Label Fare in Food Staples at Bay

Top Consumer Defensive Sector Picks

Estee Lauder

- Fair Value Estimate: $210.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We believe Estee Lauder’s EL shares are attractive, trading at around a 45% discount to our $210 fair value estimate. Although a slow travel retail recovery in China has impaired demand and margins, we remain optimistic about the firm’s long-term prospects. Estee’s stepped-up brand investments and solid execution should help bring its margins back to historical levels while ensuring the firm’s standing (underpinned by category-leading brands and preferred vendor status) remains in place. Further, we believe Estee is poised to benefit from secular premiumization trends across developed and emerging markets.

WK Kellogg

- Fair Value Estimate: $27.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Medium

Kellogg KLG trades at an approximately 35% discount to our $27 fair value estimate. While its singular exposure to the challenged cereal category and small scale have diminished its standing with retailers and suppliers, we see a path to higher profits. The firm still prioritizes updating its outdated supply chain, which we believe will enhance operational efficiencies and structurally lift margins, with our midcycle EBITDA margin exceeding 14% (from 9% in fiscal 2023). In addition, we think this should provide the fuel to invest in product innovation and marketing support to solidify its standing in the mature, domestic cereal aisle.

Kraft Heinz Company

- Fair Value Estimate: $57.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

At a more than 40% discount to our $57 fair value estimate, and with a 4%-5% dividend yield, we think Kraft Heinz KHC is attractive. We suspect investors are skeptical it will shun a material volume contraction in a tough economy (higher inflation and lackluster consumer spending) amid intense competition (increased promotions by other brands and private labels) after recent price hikes. However, we favorably view the firm’s efforts to unearth cost savings to support brand spending (research, development, and marketing), which should help drive top-line growth in the longer term.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)