After Earnings, Is Palantir Stock a Buy, a Sell, or Fairly Valued?

With strong billings and healthy customer growth, here’s what we think of Palantir stock.

Palantir PLTR released its second-quarter earnings report on Monday, Aug. 7, 2023, after the market close. Here’s Morningstar’s take on Palantir’s earnings and stock.

Key Morningstar Metrics for Palantir

- Fair Value Estimate: $11.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Palantir’s Q2 Earnings

The results were largely in line with our expectations, but billings growth was strong, which typically implies upcoming revenue acceleration. Strong billings growth and healthy customer adds both are good indicators for the argument that Palantir is a golden artificial intelligence play.

Billings growth: Palantir’s sales for the second quarter clocked in at $533 million, up 13% year over year and below our above-consensus estimate of $547 million. However, we were encouraged to see Palantir report strong forward-looking metrics. Billings expanded 52% year over year to $603 million (a comparable growth rate was last seen in 2021). We attribute this strong expansion to increased interest in Palantir’s products, jump-started by rising customer interest in AI.

Customer growth: Palantir’s customer count was robust, growing 38% year over year to 421. While this growth has slowed over the past few quarters, we were pleased to see the firm continuing to add customers at a good clip, which corroborates management’s commentary on increased adoption of and spending on Palantir’s solutions.

Profitability: Palantir’s adjusted operating margins came in at 25%, slightly ahead of our 24% estimate. We believe the firm’s laser focus on profitability amid its bid for inclusion in the S&P 500 is timely as investors key in on margins amid a tough macro environment.

Palantir Stock Price

Fair Value Estimate for Palantir

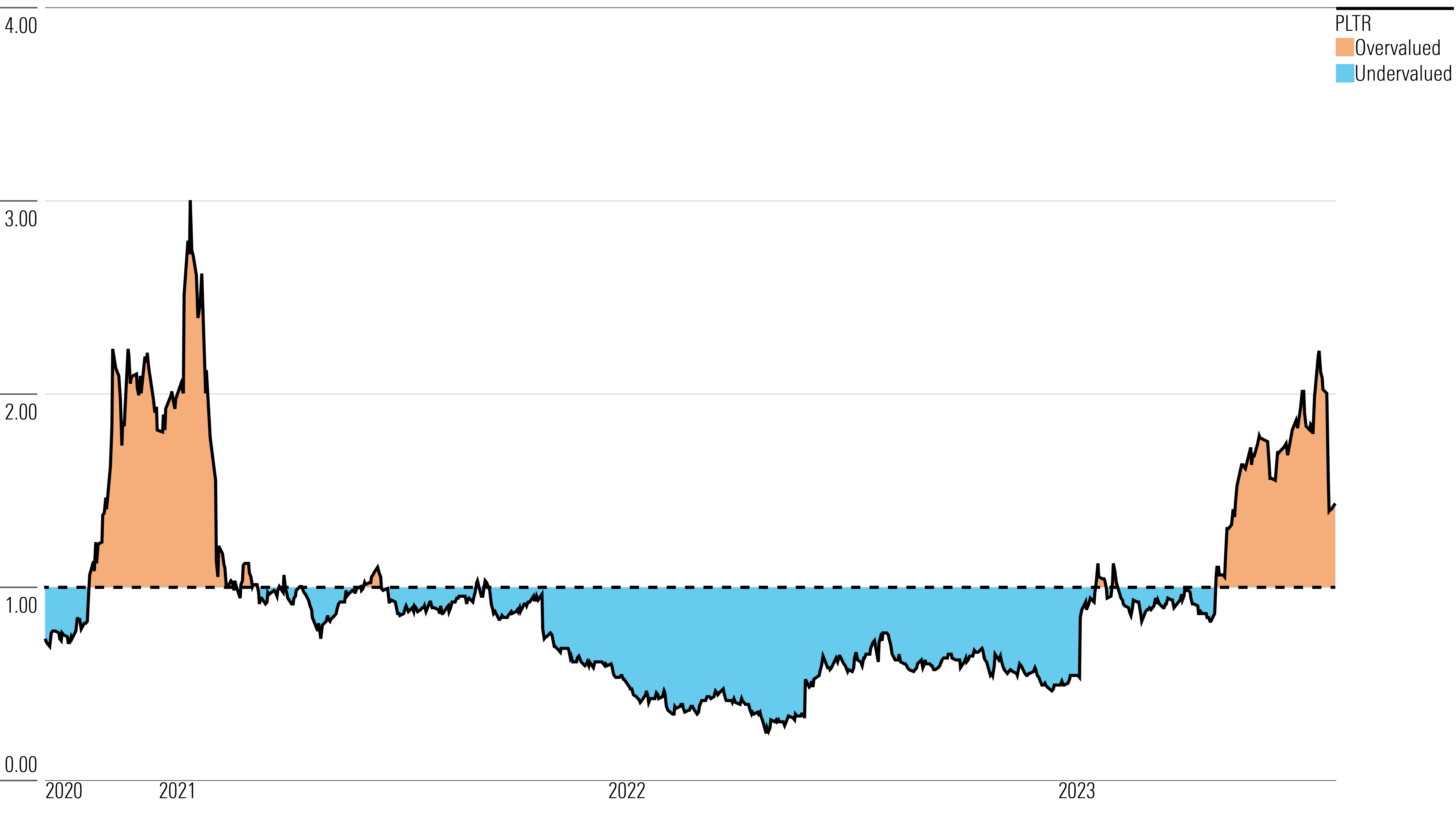

With its 2-star rating, we believe Palantir’s stock is overvalued compared with our long-term fair value estimate.

Our fair value estimate for Palantir is $11 per share, implying a 2023 enterprise value/sales multiple of 10 times.

We forecast Palantir’s revenue growing at a 23% compound annual growth rate over the next five years as it expands both governmental and commercial operations. We expect the majority of this top-line growth to be driven by commercial clients as the firm seeks to broaden that base. While government clients can be sticky, large governmental contracts create lumpiness in revenue. As a result, a shift to more commercial clients will enable Palantir to create a more ratable revenue mix. We also expect the company to continue expanding sales within its existing client base, based on its strong net retention rate.

Palantir’s GAAP gross margins have varied widely over the last few years, with 2022 gross margins clocking in at 78.6%. As the firm grows, we expect gross margin expansion. Our forecast is based on Palantir landing higher-margin commercial contracts and scaling its operations, thereby dividing its costs over a larger base. We see this phenomenon across our coverage of software companies. We are thus modeling GAAP gross margins to expand to the low 80s over our 10-year explicit forecast. Palantir has spent heavily on research and sales in the past.

Read more about Palantir’s fair value estimate.

Palantir Historical Price/Fair Value Ratios

Economic Moat Rating

We assign Palantir a narrow economic moat, owing primarily to strong switching costs associated with its platforms, as well as intangible assets in the form of strong customer relationships the firm has built over the years. We think Palantir’s two main platforms, Gotham and Foundry, both benefit from high customer switching costs, as evidenced by its strong gross and net retention metrics. Palantir has exhibited strong customer growth while diversifying its business away from government contracts toward commercial clients. As a result, although we forecast a couple more years of hefty operating losses, we ultimately expect the firm to generate excess returns over invested capital on the whole over the next decade.

The primary use case for Palantir is leveraging data to develop insights and create efficiencies in an organization’s operations. Gotham and Foundry serve the governmental and commercial end markets, respectively. More recently the firm has launched a third platform, Apollo, which ensures Palantir’s clients have continuous delivery of Gotham and Foundry irrespective of whether they have deployed these platforms on the cloud or on-premises.

Read more about Palantir’s moat rating.

Risk and Uncertainty

We assign Palantir a Very High Uncertainty Rating due to some key risks that we view as potentially impeding its growth trajectory.

While Palantir has landed high-value commercial and government clients over the years, we have found the executive team’s execution to be questionable at best. The firm’s sales strategy has led to relatively poor customer acquisition; despite being in the commercial space for many years, Palantir’s commercial customer count is only slightly more than 200. While the firm has pivoted to a module-based sales model that should bolster commercial customer additions, execution against this strategy remains to be seen.

Our lack of confidence in the executive team is highlighted by the firm’s SPAC investment program, which led to more than $300 million of losses as investments in early-stage companies went south amid market recalibration in 2022. In our view, these investments, which were based on a quid pro quo of investees becoming Palantir customers, were a bit reckless.

Read more about Palantir’s risk and uncertainty.

PLTR Bulls Say

- Palantir has strong secular tailwinds, as the AI/machine learning market is expected to grow rapidly due to the exponential increase in data harvested by organizations.

- With products targeting both commercial and governmental clients, Palantir has a distributed top line. The noncyclical governmental revenue insulates the top line during lean times.

- Palantir’s focus on modular sales could potentially lead to substantially more commercial clients, which the firm could subsequently upsell.

PLTR Bears Say

- By not selling to countries or companies that are antithetical to its mission and cultural values, the firm has self-restricted its growth opportunities.

- It will likely be several years before Palantir will achieve GAAP profitability.

- Palantir’s executive team has made questionable strategic decisions in the past. While past performance isn’t necessarily indicative of future results, we highlight some missteps as a cause for caution.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)