Utilities: Can the Stocks Keep the Rally Going?

Our top picks in the utilities sector are NiSource, Entergy, and Duke.

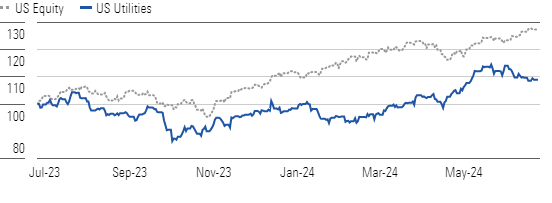

Utilities stocks’ performance since last October has been remarkable, but the momentum appears to be fading. We think investors should prepare for more modest results in the coming quarters. The Morningstar US Utilities Index climbed 33% between October and mid-May, including dividends. It was one of the sector’s biggest rallies in over 20 years. Utilities beat the US market by 7 percentage points and nearly topped the scorching-hot technology sector, which was up 35%. No other sector came close to matching this performance.

Utilities’ Market-Beating Rally Since October Appears to Be Moderating

A choppy bond rally helped, but we think the biggest factor was investors recognizing that utilities have rarely had stronger fundamentals. Balance sheets are solid, dividends are well-covered, and we believe a generational growth supercycle is just starting. Utilities even grabbed the spotlight of artificial intelligence, since investors are eyeing companies that will power energy-hungry data centers.

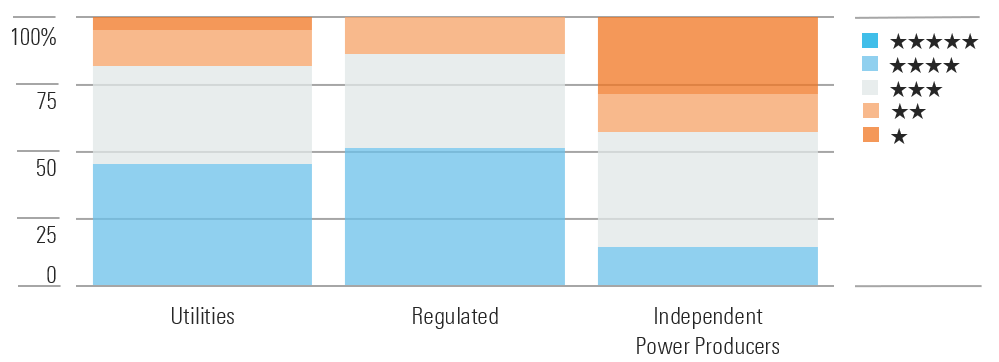

We Think There Are Still Plenty of Buying Opportunities Among Utilities

Despite the rally, utilities valuations are still well below their highs during much of the last decade. We consider the sector fairly valued as of mid-June, up from 16% undervalued in October. Almost all utilities are positioned for at least 6% annual earnings growth. The sector’s 3.6% yield is historically competitive with interest rates. We think investors aiming for solid (if not spectacular) returns should still consider utilities.

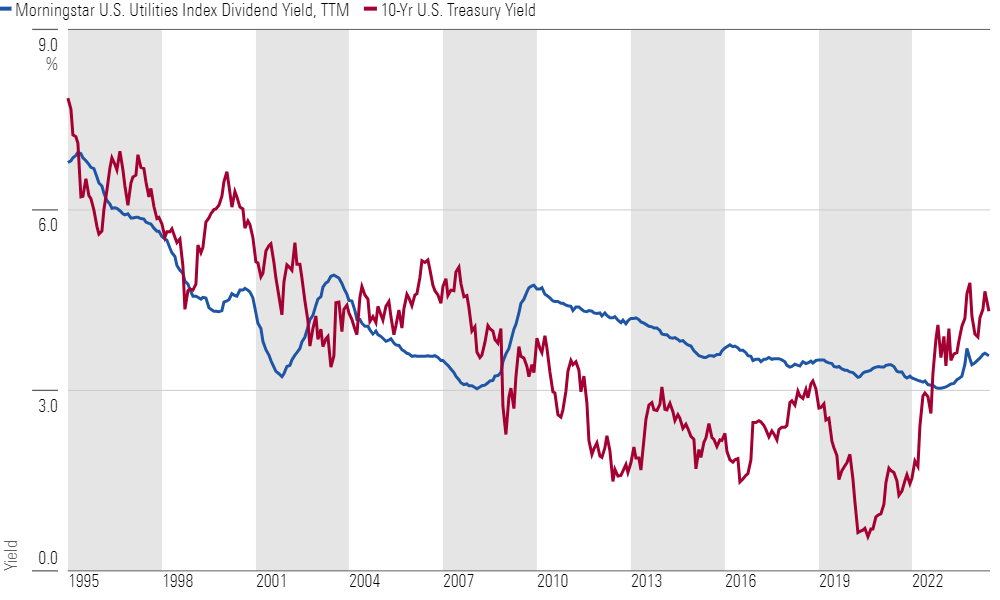

Utilities’ Dividend Growth Is an Advantage Over Bonds’ Higher Yields

Interest rates have eased, and utilities keep growing their dividends, closing their dividend yield discount to just 70 basis points as of mid-June. This is in line with the pre-2008 historical yield spread. We think utilities’ dividend yields plus growth investment opportunities in renewable energy, data centers, and grid infrastructure give these stocks a more compelling risk-return profile than fixed-income alternatives. Electricity demand growth and falling costs support clean energy investments.

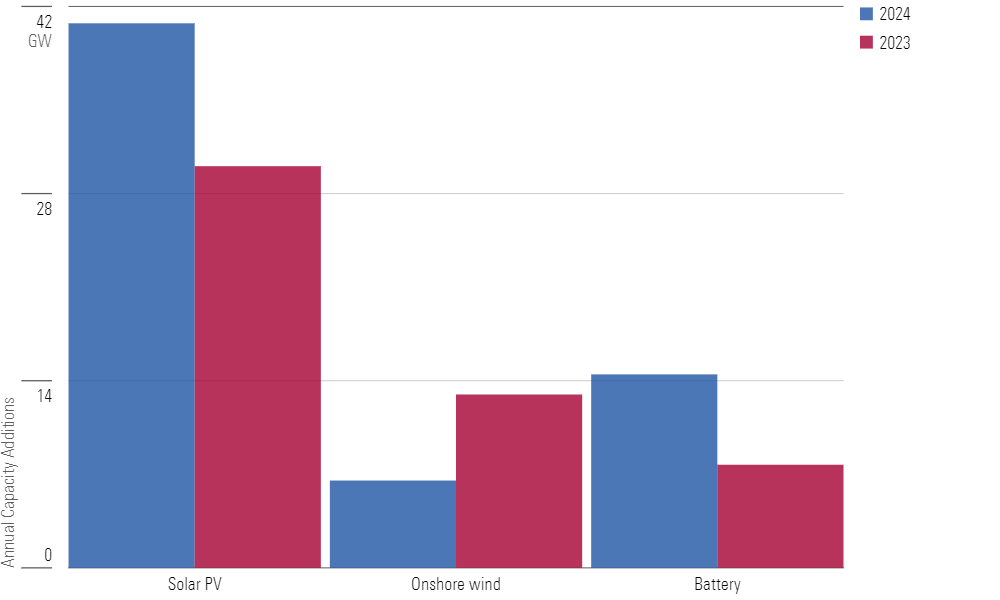

Solar and Batteries Are Among Utilities’ Biggest Growth Investments

Top Utilities Sector Picks

NiSource

- Fair Value Estimate: $34.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

We think NiSource NII deserves a premium valuation relative to its peers because of its long and transparent growth runway. The firm’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of faster growth than most US utilities. It plans to replace all coal generation with wind, solar, and energy storage by 2028. Energy demand from new industrial onshoring and data centers is another source of growth. We expect NiSource to invest $17 billion over the next five years and as much as $30 billion during the next 10, leading to 7% earnings growth and similar dividend growth. Its six gas utilities have ample near-term investment and regulatory support in regions unlikely to abandon gas.

Entergy

- Fair Value Estimate: $126.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Entergy ETR offers one of the most attractive combinations of yield, growth, and value in the sector, with a dividend yield above 4% and the potential for 7% annual earnings growth. Above-average electricity demand growth, clean energy investments, and reliability/resiliency grid investments are core drivers. Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development. We expect the company’s valuation discount to disappear as the market becomes comfortable with its decade-long transformation away from commodity-sensitive businesses.

Duke Energy

- Fair Value Estimate: $112.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

After divesting its unregulated renewable energy business, Duke DUK has a clear pathway to achieving the high end of management’s 5%-7% annual earnings growth target. The firm’s $73 billion capital investment plan for 2024-28 is focused on clean energy and infrastructure upgrades to reduce carbon emissions. New legislation in North Carolina supports Duke’s ability to invest in the clean energy transition through its regulated subsidiaries. Florida offers opportunities for solar growth. Duke has one of the highest dividend yields in the sector, but dividend growth likely will lag its earnings growth for a few years.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)