After Earnings, Is Tesla Stock a Buy, a Sell, or Fairly Valued?

With price cuts and a worse-than-expected profit margin decline, here’s what we think of Tesla stock.

Tesla TSLA released its third-quarter earnings report on Oct. 18, after the close of trading. Here’s Morningstar’s take on Tesla’s earnings and stock.

Key Morningstar Metrics for Tesla

- Fair Value Estimate: $210.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Tesla’s Q3 Earnings

- Tesla’s earnings results were below consensus estimates, as the company’s price cuts weighed heavily on profits. The market was expecting price cuts to result in another sequential profit margin decline versus the second quarter, but the extent of the decline was worse than anticipated.

- The much-anticipated Cybertruck finally has a date for deliveries, and the company continues to invest heavily in its long-term strategy of developing autonomous driving software that will be sold on a monthly subscription basis. However, investors should be wary of management’s outlook that there may be further price cuts and that we may see lower profits and a slowing pace of investment in new vehicle capacity next year.

- Tesla is a high-growth company. This means the stock will be extremely volatile based on the market’s view of the company’s growth trajectory. When the market prices in a higher growth rate, Tesla shares can rapidly rise, but when the market assumes a lower rate, the stock can quickly fall. This is a dynamic that investors should be aware of when considering investing in Tesla.

Tesla Stock Price

Fair Value Estimate for Tesla Stock

With its 3-star rating, we believe Tesla’s stock is fairly valued compared with our long-term fair value estimate.

Our fair value estimate of Tesla is $210 per share. We use a weighted average cost of capital of just under 9%. Our equity valuation adds back nonrecourse and non-dilutive convertible debt. In the near term, we forecast that Tesla will grow its annual total vehicle delivery volume to around 1.8 million in 2023, or roughly 37% versus 2022. However, due to price cuts far exceeding cost savings, we forecast automotive gross margin contraction in 2023 to 19% from the 29% achieved in 2022.

In the longer term, we assume Tesla will deliver around 5 million vehicles per year in 2030. This includes fleet sales—an expanding opportunity for the company. Our forecast is well below management’s aspirational goal of selling 20 million vehicles by the end of this decade. However, it is nearly 4 times the 1.31 million vehicles delivered in 2022. Our forecast assumes Tesla increases its Model 3 and Model Y deliveries and successfully launches the Cybertruck in 2023 while ramping up volumes over several years. We also assume Tesla will ramp up semi-truck volumes over time. Further, we forecast Tesla will launch its sports car and eventually its affordable sedan and SUV platforms in the second half of the decade.

We think Tesla will successfully continue to reduce its manufacturing costs on a per-vehicle basis. Combined with a shift to producing a greater proportion of higher-priced Model Y vehicles, we forecast segment gross margins will expand to roughly 30%, near the 29% level achieved in 2022, as automotive profit growth grows faster than revenue over the medium and long term.

Read more about Tesla’s fair value estimate.

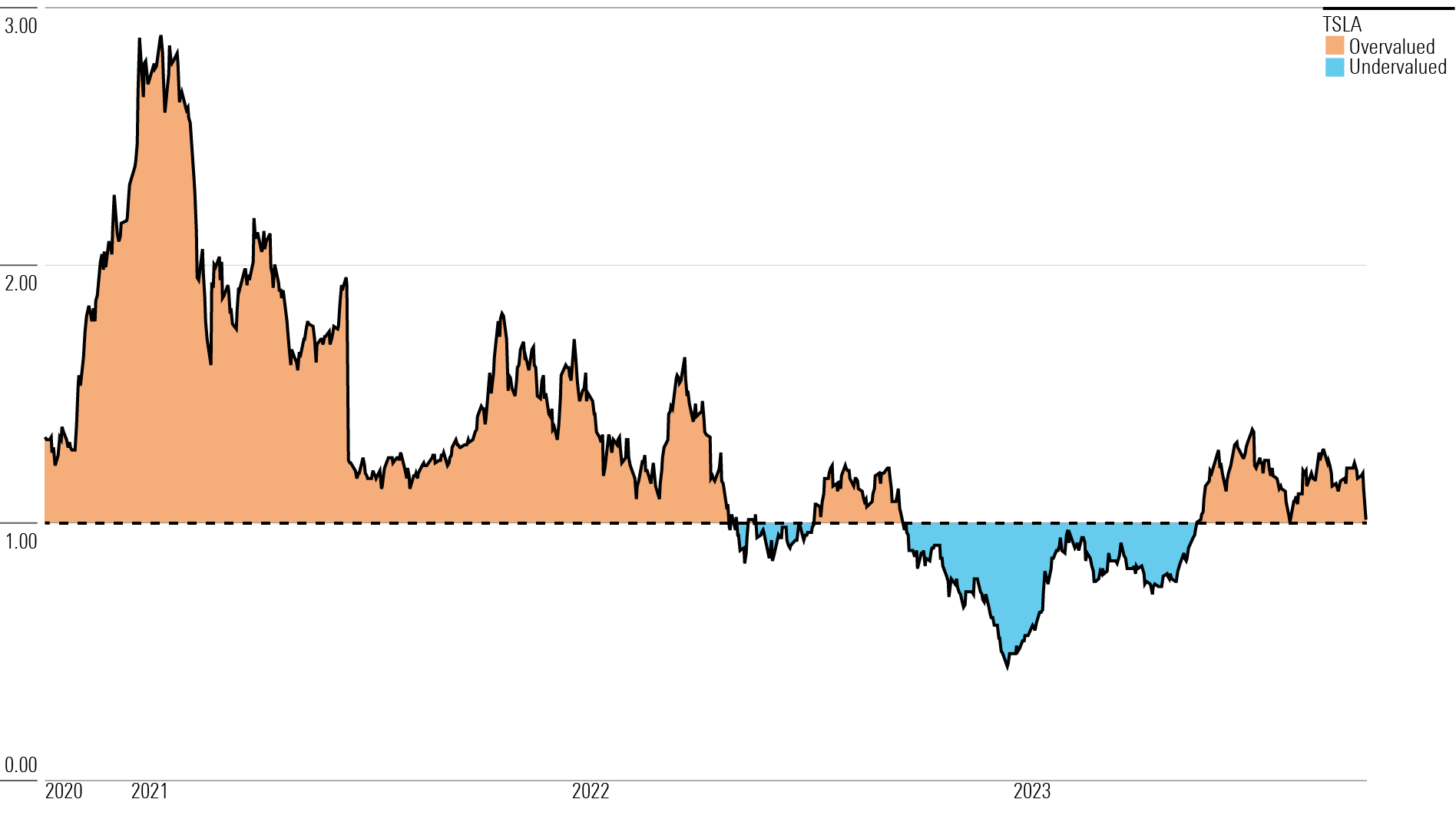

Tesla Historical Price/Fair Value Ratio

Economic Moat Rating

We award Tesla a narrow moat, stemming from its intangible assets and cost advantage. The company’s strong brand cachet as a luxury automaker commands premium pricing, while its electric vehicle manufacturing expertise allows it to make its products more cheaply than competitors.

Tesla’s brand cachet is not likely to be impaired anytime soon as other automakers move into the battery EV space, because we expect the company to keep innovating to stay ahead of competitors. By focusing on the luxury auto market first, Tesla was able to create tremendous media publicity that reached beyond its customers. This generated strong consumer demand for its subsequent cheaper vehicles like the Model 3 and Model Y. As other new vehicles are launched, such as the Cybertruck or the platform that will produce the affordable sedan and SUV (known as the $25,000 vehicle), we expect the company’s strong brand will continue to generate consumer demand.

We think Tesla benefits from a cost advantage in EV production thanks to its manufacturing scale. Tesla’s total vehicle volume has grown from just over 100,000 in 2017 to over 1.3 million deliveries in 2022. During the same period, the company’s average cost of goods sold per vehicle has fallen over 50%, from $84,000 to under $39,000, and gross profit margins have expanded from 20% to 26%, excluding the sale of regulatory credits. While some of this is due to manufacturing a greater proportion of midsize cars and SUVs versus luxury autos, the majority of the decline in the cost of goods sold has come from the company’s focus on reducing manufacturing costs due to scale.

Legacy automakers are gradually transitioning to battery EV production from internal combustion engines, but we expect they will be saddled with legacy internal combustion engine costs for a long time. Even as legacy automakers begin to produce more EVs, we expect Tesla will continue to have lower costs, as it has outlined a plan to further reduce battery cell costs by 56% over the next several years. With Tesla’s cost per vehicle set to fall, incumbent automakers may take years to catch up, if ever, as they won’t want to build many new factories from scratch like Tesla is doing.

Read more about Tesla’s moat rating.

Risk and Uncertainty

We assign Tesla a Very High Morningstar Uncertainty Rating, as we see a wide range of potential outcomes.

The automotive market is highly cyclical and subject to sharp demand declines based on economic conditions. As the EV market leader, Tesla is vulnerable to growing competition from traditional automakers and new entrants. As new lower-priced EVs enter the market, Tesla may be forced to continue to cut prices, reducing its industry-leading profits. With more EV choices, consumers may view Tesla less favorably. The firm is investing heavily in capacity expansions that carry the risk of delays and cost overruns. The company is also investing in research and development in an attempt to maintain its technological advantage and generate software-based revenue with no guarantee these investments will bear fruit.

Tesla faces environmental, social, and governance risks. As an automaker, it is subject to potential product defects that could result in recalls, including its autonomous driving software. We see a moderate impact should this occur. Another risk involves employee retention. If Tesla is unable to retain key employees, such as CEO Elon Musk, its favorable brand image could decline.

Read more about Tesla’s risk and uncertainty.

TSLA Bulls Say

- Tesla has the potential to disrupt the automotive and power generation industries with its technology for EVs, AVs, batteries, and solar generation systems.

- Tesla will see higher profit margins as it reduces unit production costs over the next several years.

- Through the combination of Tesla’s industry-leading technology and its unique supercharger network, the company’s EVs offer the best function of any on the market, which should help Tesla maintain its market-leader status as EV adoption increases.

TSLA Bears Say

- Traditional automakers and new entrants are investing heavily in EV development, which will result in Tesla seeing a deceleration in sales growth and being forced to cut prices due to increased competition, eroding profit margins.

- Tesla’s reliance on batteries made in China for its lower-price Model 3 vehicles will hurt sales, as these autos will not qualify for U.S. subsidies.

- Solar panel and battery prices will decline faster than Tesla can reduce costs, resulting in little to no profits for the energy generation and storage business.

This article was compiled by Adrian Teague.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)