The AI Revolution Is Ready to Power Up. It Just Needs Electricity

Our top US utilities picks in key regions for AI data center growth.

The artificial intelligence revolution is ready to power up—it just needs electricity.

Developers of data centers in states like Mississippi, Georgia, Indiana, Oregon, and Wisconsin have lofty growth plans but need utilities to expand the energy infrastructure. This will require state regulators to sign off on utilities’ investment plans and customer rates.

Speeding up the lengthy regulatory process will be difficult for many states—so it might be several years before AI reaches its full potential in these areas.

In our recent report, we analyze state regulation, grid reliability outlooks, and retail energy prices to identify the utilities that are best positioned to benefit from data center growth.

Our key takeaways include:

- We think data center developers will look for areas where utilities have regulatory support for infrastructure investment. Our regulatory rankings consider a utility’s allowed returns on equity, timely cost recovery, management’s ability to keep costs within budget, and regulatory stability.

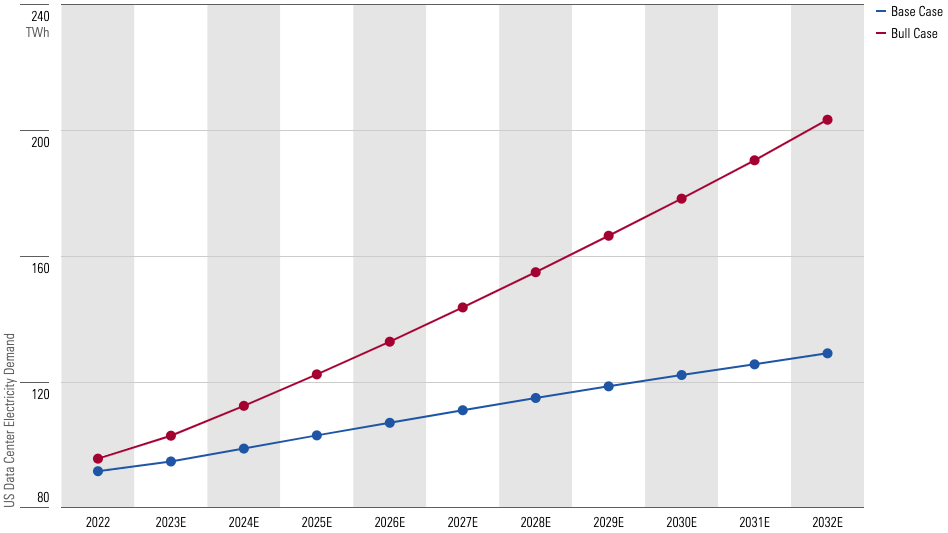

- We forecast US data center electricity demand will more than double by 2032 in our bull case.

- After rallying more than 30% from their October 2023 lows, utilities are fairly valued, offering select buying opportunities.

- Utilities’ dividend yields near 3.5% are historically attractive if interest rates fall later this year.

The Unappreciated Upside of Electricity Demand for Data Centers

Data center electricity demand growth is a key source of upside for US utilities that we don’t think the market appreciates.

We forecast 1.4% annualized US electricity demand growth through 2032, including data centers (higher than most forecasts). This would be the fastest growth in two decades.

In our base case, we assume data center electricity demand is 100 terawatt hours now and grows 46% cumulatively by 2032, representing 3% of US electricity demand. New demand from data centers is much smaller than new electricity demand from electric vehicles in this scenario.

However, the outlook for data center electricity demand is trending toward our bull-case scenario.

In this scenario, data center electricity demand more than doubles by 2032 and represents 4.5% of national demand. If EV sales slow and data center growth accelerates, new data center electricity demand would top EVs during the next decade and represent a larger share of total electricity demand by 2032.

US Data Center Electricity Demand More Than Doubles in Our Bull Case

Is There a New Leader in the AI Race?

What Challenges Are Data Centers Facing?

Data center growth presents several challenges for utilities, regulators, and grid operators.

For example:

- The infrastructure investments that are required to add a large data center to the grid typically involve multiple layers of regulatory approvals. These approvals will determine how quickly utilities can raise the capital necessary to complete growth projects. Utilities that work with regulators to resolve issues like stranded asset risk, operating cost budgets, and rate freezes should realize the most earnings growth.

- A large increase in data center demand will make it difficult for utilities providers to serve peak summer and winter demand while maintaining grid reliability. The Southeast and mid-Atlantic have an advantage in their ability to build out the electric grid to accommodate this growth, while areas like New England and the Upper Midwest will struggle to accommodate new data center demand without substantial investment.

- Serving constant data center demand with intermittent wind and solar will require that utilities invest in energy storage, gas generation, and grid upgrades, as many new data centers aim to use clean energy.

What Regions Are Best Positioned for Data Center Growth?

We think data centers in the Midwest, mid-Atlantic, and Southeast are best positioned to benefit from data center growth because of their access to reliable, low-cost energy; while the Northeast, Texas, and Southwest face challenges.

| Region | Overview | Regulatory Ranking | Grid Capacity | Energy Prices |

|---|---|---|---|---|

| West Coast | Tech capital but burdened by above-average energy prices and inconsistent regulation, and the grid is strained to meet renewable energy targets. | Below Average | Above Average | High |

| Southwest | Low energy prices but inconsistent regulation slows grid expansion for demand growth and clean energy. | Below Average | Below Average | Average |

| Central & Texas | Reasonable energy prices, mixed regulation, and renewable energy growth creates reliability issues. Texas faces particular grid concerns. | Average | Average | Low |

| Midwest | Data center interest has surged in Wisconsin, Indiana, and Ohio; while interest in other Midwest states remains tepid. | Average | Above Average | Average |

| Southeast | Top-notch regulation, access to low-cost energy, and support for grid investments should attract growth. | Above Average | Above Average | Low |

| Mid-Atlantic | Regulations have been mostly constructive. The Mid-Atlantic also offers “data center alley,” robust grid planning, and access to shale gas. | Average | Above Average | Average |

| Northeast | The already-tight grid is being stretched by high energy prices, a history of tough utility rate regulation, and clean energy mandates. | Below Average | Below Average | High |

Our Top US Utilities Picks

Duke Energy DUK

- Morningstar Rating: 3 stars

- Moat Rating: Narrow

- Fair Value Estimate: $112

- Price/Fair Value Estimate (as of Aug. 2, 2024): 1.02

After divesting its renewable energy business, Duke has a clear pathway to achieving management’s 5%-7% annual earnings growth target. Duke’s $73 billion capital investment plan for 2024-28 is focused on clean energy and infrastructure upgrades to reduce carbon emissions. New legislation in North Carolina supports the clean energy transition. Florida offers opportunities for solar growth. Duke’s 3.7% yield is higher than the sector average, but dividend growth will lag earnings growth until the company’s payout ratio comes down.

Entergy ETR

- Morningstar Rating: 4 stars

- Moat Rating: Narrow

- Fair Value Estimate: $126

- Price/Fair Value Estimate (as of Aug. 2, 2024): 0.96

Entergy offers one of the most attractive combinations of yield, growth, and value in the utilities sector with a 3.7% dividend yield and our 7% annual earnings growth outlook. Entergy’s 17 P/E is a 15% discount to the sector average P/E. Above-average electricity demand growth, clean energy investments, and reliability/resiliency network investments are core growth drivers. Entergy also should benefit from industrial carbon emissions cuts, global energy demand, and green hydrogen development. We expect Entergy’s valuation discount to disappear as the market becomes comfortable with Entergy’s decadelong business transformation away from commodity-sensitive businesses.

NiSource NI

- Morningstar Rating: 4 stars

- Moat Rating: Narrow

- Fair Value Estimate: $34

- Price/Fair Value Estimate (as of Aug. 2, 2024): 0.94

Even though NiSource trades at a similar valuation as its peers, we think it has one of the longest runways of growth in the sector. NiSource’s transition from fossil fuels to clean energy in the Midwest and data center demand supports at least a decade of faster growth than peers. We expect NiSource to invest $17 billion over the next five years, leading to 7% annual earnings growth and similar dividend growth. Its electric utility plans to close its last coal-fired power plant in 2028 and replace the generation with wind, solar, and energy storage. Its six gas utilities have ample near-term investment and regulatory support in regions that are unlikely to abandon gas.

WEC Energy Group WEC

- Morningstar Rating: 4 stars

- Moat Rating: Narrow

- Fair Value Estimate: $96

- Price/Fair Value Estimate (as of Aug. 2, 2024): 0.94

WEC Energy combines best-in-class management and above-average growth opportunities supported by constructive regulation across most of its jurisdictions. The company’s new five-year capital investment plan totals $23.7 billion, a $3.6 billion increase from its prior plan. WEC will increase investments in renewable generation, natural gas generation, and transmission because of significant economic development in Southeastern Wisconsin. This supports our expectations for the company to achieve the high end of management’s 6.5%-7% earnings guidance range.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7AHOQA64TFEQDMYMIMM6VUHYLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JA7LQ2INFNFTZFBJLSDUZGIPJQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)