Basic Materials: As Sector Underperforms, We See Strong Opportunities

Chemicals, metals and mining, and forest products offer windows for investors.

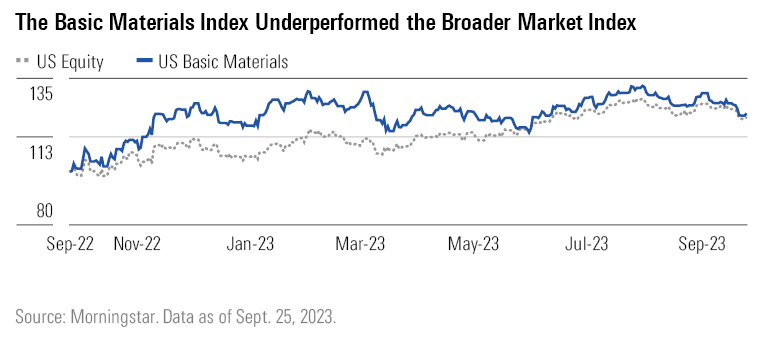

The Morningstar US Basic Materials Index underperformed the broader market during the third quarter of 2023. The index declined 4.6% during the quarter, while the U.S. market index was down 2.3%. However, over the past 12 months, the sector outperformed the market by 150 basis points.

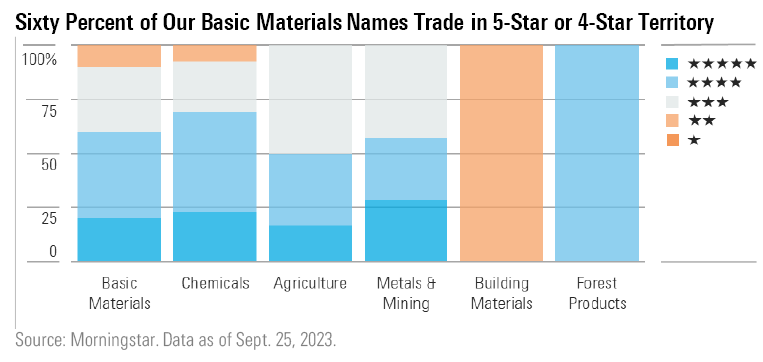

We see opportunities across the sector, with 60% of the stocks trading in either 4- or 5-star territory, particularly in chemicals, metals and mining, and forest products.

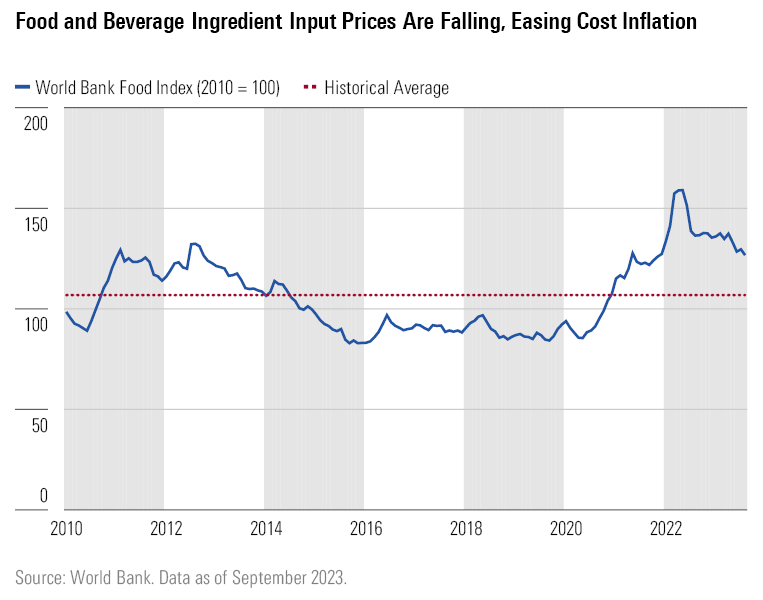

Specialty chemicals producers will likely see profits decline in 2023 due to an economic slowdown. For food and beverage specialty ingredients producers (which are typically less affected by slowdowns), recent cost inflation has resulted in some consumers trading down to private-label brands, causing volume declines at many consumer-packaged goods companies. As a result, demand for ingredients is seeing a larger-than-normal slowdown.

However, we expect the inventory destocking will prove temporary, with demand beginning to normalize by the end of the year. Additionally, falling input prices (namely crop prices) should provide input cost relief, helping to restore profits.

In agriculture, falling crop prices have led to lower demand from farmers for crop inputs. While farmers may cut back on fertilizer and crop chemicals in such an environment, they will typically continue to pay up for premium seeds, as these products can boost crop yields in excess of their premium cost, supporting higher farmer incomes.

As Basic Materials Underperform, We See Strong Opportunities

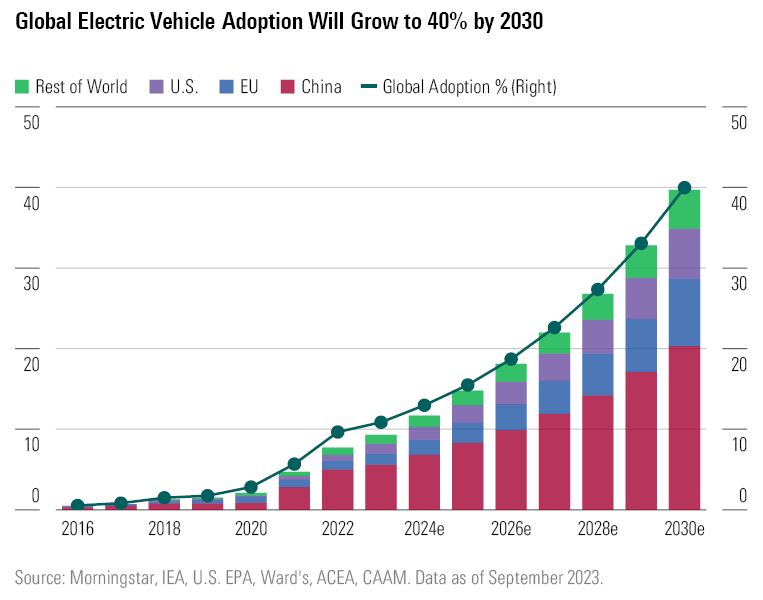

Lithium demand will more than triple from 2022 to 2030, largely because of increased electric vehicle adoption. EVs are projected to rise to 40% of global auto sales by 2030 from 10% in 2022. Lithium is one of the best ways to invest in this trend, as all EV batteries require lithium. Lithium prices are currently near $30,000 per metric ton. As EV sales continue to grow, we forecast that demand growth will accelerate, leading to prices rising by the end of the year. We forecast prices will average $35,000 per metric ton from 2023 to 2030.

Top Basic Materials Sector Picks

International Flavors & Fragrances

- Fair Value Estimate: $130.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

International Flavors & Fragrances IFF is our top investment pick for specialty ingredients recovery. It trades at nearly a 50% discount to our fair value estimate. Shares plunged following the company’s second-quarter earnings call, which came as management cut guidance for the third time in 2023 and demand declined in the commodity ingredients business more than management’s prior guidance. However, IFF’s specialty businesses, which generate 75% of revenue, have held up fairly well, with two of the four starting to see profit recovery during the second quarter. As demand for specialty ingredients stabilizes and input costs decline, we expect profits will recover.

Corteva

- Fair Value Estimate: $70.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Our top pick for investing in strong seed demand is Corteva CTVA, an agricultural inputs pure-play company. Its stock trades at a discount of more than 25% to our fair value estimate. Corteva’s seeds and crop protections each generate around half of its profits. As the company develops new premium products, we forecast that it will see profit growth and margin expansion over the next couple of years, even if crop prices continue to fall.

Albemarle

- Fair Value Estimate: $350.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Albemarle ALB is our top pick to play the strong demand and higher prices for lithium thanks to rising EV adoption. The firm’s stock trades at a little over 50% of our fair value estimate. Its main business is lithium, which generates roughly 90% of its profits. Albemarle produces lithium from three of the globe’s best resources, creating the cost advantage that underpins its moat rating. The company also offers the lowest relative risk among the lithium producers under our coverage, as its plan to quadruple lithium production capacity by the end of the decade will be accomplished largely through the replication of its existing downstream conversion facilities.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q3KIND5VXRCNHHH6JQHCCYBSSA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)