Ahead of Earnings, Is Apple Stock a Buy, a Sell, or Fairly Valued?

Intangible assets, growing traction in newer markets make us optimistic for Apple’s continued growth.

Apple AAPL is scheduled to release its first-quarter earnings report on May 4, after the close of trading. Here’s Morningstar’s take on what to watch for in earnings and Apple’s stock.

Key Morningstar Metrics for Apple Stock

- Fair Value Estimate: $150

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Fair Value Estimate for Apple

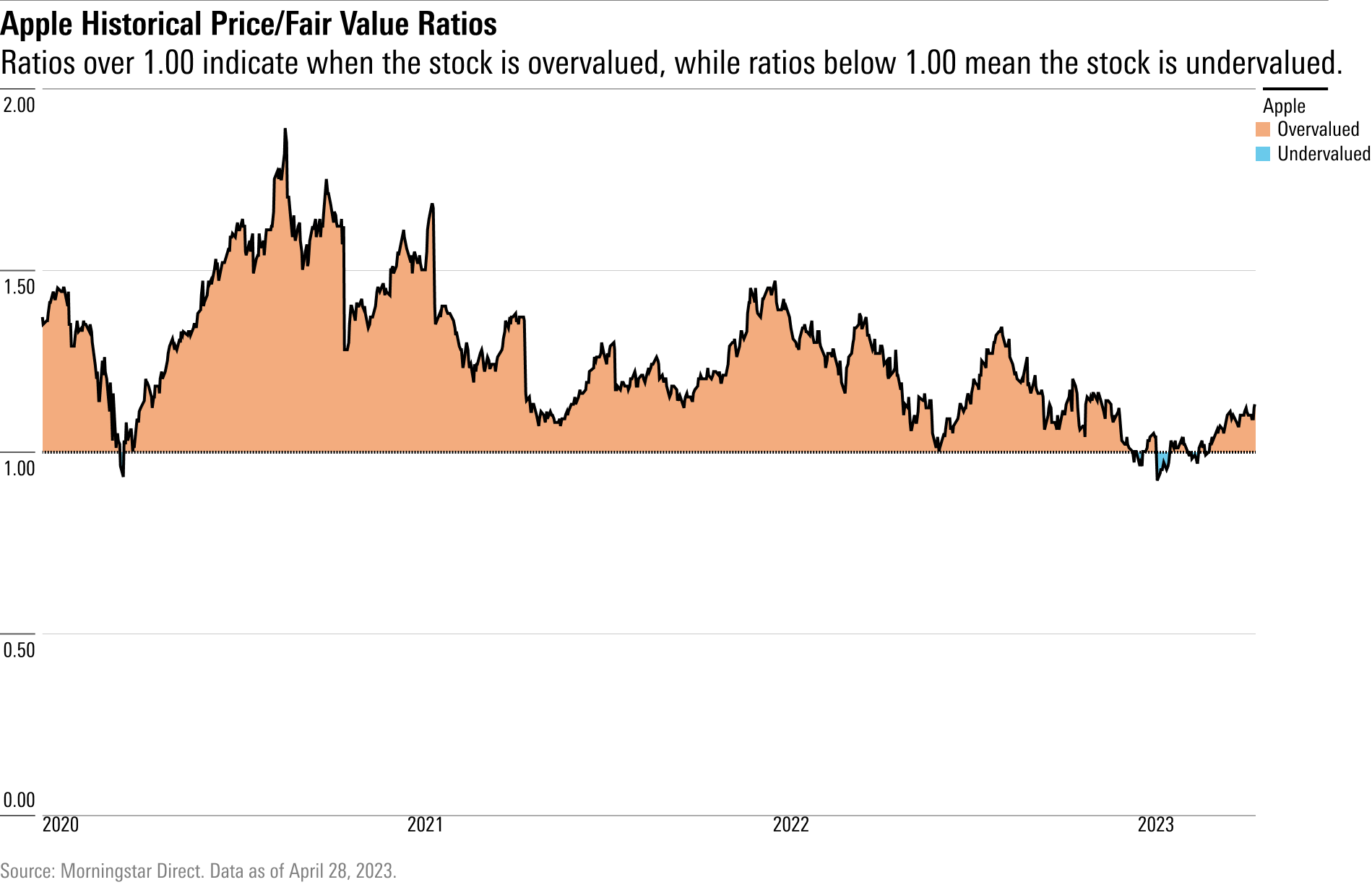

With its 3-star rating, we believe Apple stock is fairly valued when compared with our fair value estimate.

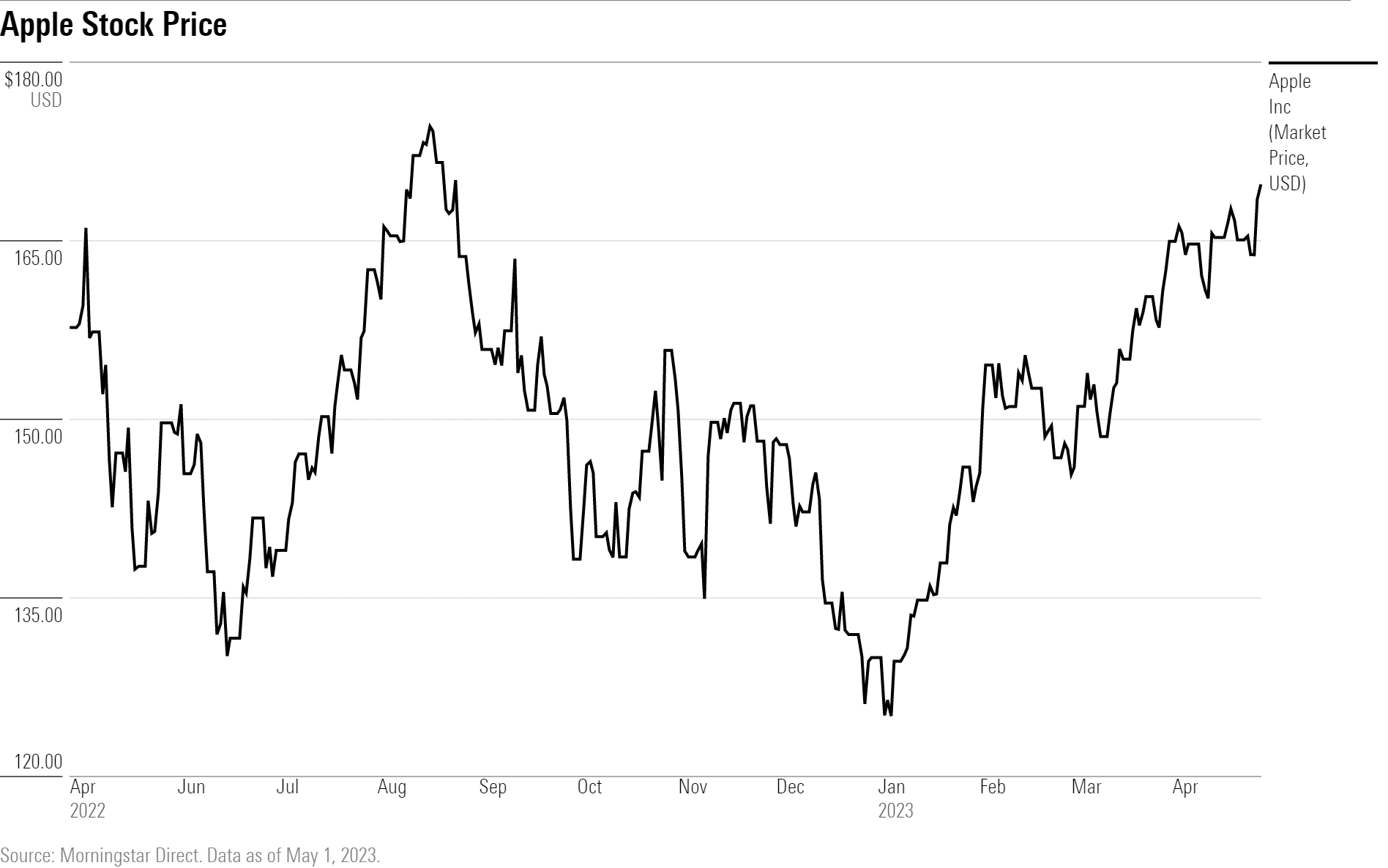

Our fair value estimate for Apple stock is $150 per share. Our estimate implies a forward generally accepted accounting principles price/earnings ratio of 24 times. In fiscal 2023, we expect total revenue to be up 3% thanks to strength in iPhone, wearables, and services sales, partially offset by weaker Mac and iPad revenue following multiple strong years associated with work- and learning-from-home trends due to the coronavirus. We expect gross margins to normalize around 40%, thanks to Apple’s exceptional premium pricing strategy and stable iPhone margins.

Read more about Apple’s fair value estimate.

What to Watch for in Apple’s Quarterly Earnings

Apple has not given guidance since the start of COVID-19 due to “macro uncertainty,” and we do not expect that to change.

We think consensus estimates remain too high for this year, especially for the hardware businesses (such as iPhone, iPad, and Mac). Considerable declines are likely for revenue in those segments. Because of broader macro weakness, we also expect declines in Apple’s services segment, particularly for app store ad sales and in-app purchases.

On the positive side, we’ll be looking for ongoing traction in India, where the firm has historically had a smaller presence.

Economic Moat Rating

We assign a wide economic moat rating for Apple that stems from the combination of switching costs, intangible assets, and network effects associated with its iOS ecosystem. We think the firm’s primary moat source stems from high customer switching costs, based on a variety of aspects of Apple’s hardware, software, and services. Apple’s iPhone fostered the industry and has maintained its position as the premier smartphone, and we expect the firm to increasingly monetize its valuable installed base with the iPhone as the catalyst. Beyond the iPhone, Apple’s other key hardware products such as the iPad, Mac, Watch, and AirPods each fill a computing niche that enhances the experience of the user. Beyond switching costs, we believe Apple’s expertise in hardware, software, semiconductors, and services represents an intangible asset that even the strongest of tech firms have struggled to replicate.

Read more about Apple’s moat rating.

Risk and Uncertainty

As the largest publicly traded company in the world by market capitalization, Apple is prone to material competition. Over the course of its iPhone-fueled dominance, Samsung, Microsoft, and Google have taken their best shots at Apple, with fleeting success.

We also suspect that many customers are holding on to their phones longer as premium devices are more than good enough for today’s needs (web browsing, streaming, social media). Some peers are willing to sell hardware essentially at-cost to drive market share and stickiness in other business segments. Should these devices supersede their iOS counterparts, Apple’s devices may be at risk. On the environmental, social, and governance front, the biggest issue we see for Apple is its app store commission structure, which is facing legal and regulatory scrutiny as Apple is accused of using tactics that hurt competition. Apple’s service revenue could be negatively affected if any antitrust rulings go against it.

Read more about Apple’s risk and uncertainty.

AAPL Bulls Say

- Between greater smartphone penetration in emerging markets and repeat sales to current customers, Apple has plenty of opportunity to reap the rewards of its iPhone business.

- Apple’s iPhone and iOS operating system have consistently been rated at the head of the pack in terms of customer loyalty, engagement, and security, which bodes well for long-term customer retention.

- We think Apple is still innovating, with introductions of Apple Pay, Apple Watch, Apple TV, and AirPods; each of these could drive incremental revenue but more crucially help to retain iPhone users over time.

AAPL Bears Say

- Apple’s decisions to maintain a premium pricing strategy may help fend off gross margin compression but could limit unit sales growth, as devices may be unaffordable for many customers.

- If Apple were to ever launch a buggy software update or subpar services, it could diminish the firm’s reputation for building products that “just work.”

- Apple is believed to be behind firms like Google and Amazon in artificial intelligence, or AI, development (notably Siri voice recognition), which could be problematic as tech firms look to integrate AI in order to deliver premium services to customers.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/426795a6-50a8-4320-8dea-8c93d2bfd246.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/237L6UCCT5DIJOTXSUHF5NKFYM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/426795a6-50a8-4320-8dea-8c93d2bfd246.jpg)