Rounding Up Big Pharma Earnings

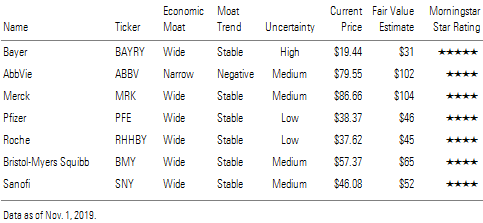

Recent results from some of the most undervalued large drugmakers we cover.

Bayer Shows Strength Across Portfolio as Litigation Concerns Continue Bayer BAYRY reported third-quarter results largely in line with our projections. We continue to view the company as undervalued, with the market attributing too much concern to the ongoing glyphosate litigation. While the number of glyphosate-related plaintiffs increased to 42,700 as of early October, we believe many of these cases hold little merit and are joining the lawsuit due to aggressive advertising campaigns by trial lawyers ($51 million spent in the third quarter, up from $6 million in the first quarter). Despite some early plaintiff wins for substantial amounts, we expect the appeals process to significantly reduce the costs. Overall, our base projections include EUR 2 billion in legal costs related to the glyphosate litigation, which leads to our current fair value estimate. However, our bear case projects more than EUR 13 billion in costs related to the litigation, which is a key driver behind our high fair value uncertainty rating.

All divisions posted steady gains in the quarter, leading to 5% normalized sales growth, and business operations continued to track well, supporting our wide moat rating. In the largest segment, pharmaceuticals, almost all of Bayer’s leading drugs posted strong gains. Top drug Xarelto (for cardiovascular disease) looks well positioned for future gains with the recently added new indication in coronary and peripheral artery disease. However, we expect a slowing in growth for ophthalmology drug Eylea (up 16% in the quarter) in 2020 due to competitive pressures from Novartis’ NVS new competing drug, Beovu. The crop science segment generated solid growth, partly rebounding from challenges in North America caused by poor weather earlier in the year. The consumer division generated encouraging growth of 4%, which suggests a potential return to more stable growth following a prolonged period of poor performance.

Bayer continues to make strides with the pipeline. In the late-stage pipeline, we remain most bullish on prostate cancer drug darolutamide, which despite entering a crowded market should be successful, given the large size of the market and potential safety benefits. Additionally, we are encouraged by the high number of early-stage cancer drugs that can reach the market quickly if the data is supportive.

AbbVie Sees Strong Immunology Drug Launches; Allergan Deal on Track AbbVie ABBV reported third-quarter results largely in line with our expectations. We don't think the market fully appreciates the company's next-generation immunology and cancer drugs. However, despite the strength of these new drugs, we continue to view AbbVie as having a narrow economic moat (lower than its peer group's wide moat average) largely because of the heavy biosimilar pressure on immunology drug Humira over the next four years.

In the quarter, total sales increased 4% operationally, with strong U.S. Humira sales and new product launches offsetting international biosimilar pressure on Humira, a trend that should continue over the next two years. We don’t expect significant pressure on the top line until 2023-24, when U.S. Humira biosimilars will likely launch. However, based on strong efficacy, we expect AbbVie’s next generation of immunology drugs will offset some of these Humira headwinds. The robust recent launches of Skyrizi in psoriasis and Rinvoq in rheumatoid arthritis generated $91 million and $14 million, respectively. While these drugs are launching slightly behind other drugs with similar mechanisms of action, the markets are large, and AbbVie will probably leverage its strong formulary entrenchment with Humira to gain favorable positioning for its new drugs.

AbbVie’s oncology platform continues to show robust growth, which we expect will continue for several years. Blood cancer drugs Imbruvica and Venclexta hold leading efficacy, and while competitive threats are emerging, especially from Astra’s AZN Calquence (data expected in December), we expect AbbVie’s entrenchment to be hard to displace.

AbbVie remains on track to close the Allergan acquisition in the first quarter of 2020, likely following the divestment of Allergan’s brazikumab and Zenpep (competitors to AbbVie’s Skyrizi and Creon, respectively) to appease antitrust regulators.

Keytruda, Vaccines, and Animal Health Aid Merck's Quarter Merck MRK reported strong third-quarter results ahead of both our and CapIQ consensus expectations. We have increased our fair value estimate mostly to reflect increased projections for cancer drugs Keytruda and Lynparza as well as HPV vaccine Gardasil. We view Merck as undervalued, with the market underappreciating its potential in immuno-oncology. Merck's strength in oncology coupled with solid traction in vaccines and animal healthcare supports a wide moat rating.

In the quarter, total sales increased 16% operationally year over year, led by cancer drug Keytruda (up 64%), and we expect continued steady gains for the drug. Keytruda’s first-mover advantage in the largest market segment of first-line lung cancer combined with excellent efficacy data should enable the drug to gain more than 70% of the metastatic lung immuno-oncology market. Recent competitive data from Bristol’s Opdivo and Yervoy (in Checkmate 227) looks potentially competitive in the small subsegment of the market that can’t take chemotherapy. Further, while positive top-line data has been announced from Astra and Bristol with the Poseidon and Checkmate 9LA studies, respectively, we are skeptical that the forthcoming details from the studies will provide strong enough data to displace Merck’s entrenchment. Also, Keytruda’s new indications in renal cancer, adjuvant melanoma, and esophageal cancer should further drive near-term growth. Longer term, we expect favorable data in adjuvant lung cancer to add significant growth potential.

Merck’s other cancer drugs (Lynparza and Lenvima), vaccines, and animal health products posted steady gains, which should continue over the next several years. Strong efficacy data behind the cancer drugs and robust demand in China for vaccines set up solid growth potential.

The strong growth in sales of high-margin drugs is helping Merck’s operating margins. We expect this trend to continue and have modeled in almost 500 basis points of margin expansion over the next five years.

In the early-stage pipeline, we see the most encouraging data coming from its oncology platform. We believe the next major developments in Merck’s pipeline will be with Keytruda in adjuvant/neoadjuvant use, especially focused on lung cancer.

Pfizer's Innovative Drugs Look Well Positioned for Long-Term Growth Pfizer PFE reported third-quarter results ahead of our and CapIQ consensus expectations. We continue to view the company as undervalued, with the market probably underappreciating the company's recently launched drugs and late-stage pipeline, both of which increase our conviction in our wide moat rating.

In the quarter, total sales fell 3% operationally year over year, but the biopharma segment increased 9%, which is important as this segment will be the remaining part of Pfizer following the divestment of the Upjohn segment (established older drugs) to Mylan in mid-2020. While we expect some moderation of the biopharma segment’s growth, we expect recently launched drugs to continue to drive biopharma growth of close to 6% annually over the five-year period after the Upjohn divestment, in line with management expectations. Key drivers of growth include cancer drugs Ibrance and Xtandi, both of which hold good potential to expand into new indications, with Ibrance likely to report important early (adjuvant) breast cancer data in 2020. Also, cardiovascular drug Eliquis is well positioned for continued gains against the older treatment of warfarin based on leading efficacy data. Surprisingly, immunology drug Xeljanz continues to post excellent growth (up 34% in the U.S.) despite safety concerns, likely showing the need for alternative treatments in rheumatoid arthritis.

Pfizer is making solid strides on the pipeline side. Importantly, the company’s next-generation pneumococcal vaccine showed good data in the infant patient population and now looks only marginally behind Merck’s competing late-stage vaccine V114 in reaching the market. With Pfizer’s vaccine covering five more valents than V114, we view this franchise as largely secure for Pfizer. We also view the strong data from cancer drugs Braftovi and Mektovi in colorectal cancer as a major opportunity for Pfizer.

Roche's Global Launches in 2020 to Offset U.S. Biosimilar Hit Roche RHHBY reported strong third-quarter results that were similar to our expectations, and we're maintaining our $45 fair value estimate. The shares continue to look undervalued despite strong price performance so far this year. Pharmaceutical growth of 15% in the quarter (at constant currency) and diagnostics growth of 6% represent steady improvement in growth over the past two quarters, as Roche benefits from solid U.S. launch trajectories of new drugs, begins to see biosimilar pressure abate for Herceptin and Rituxan in Europe, and awaits a noticeable impact from U.S. biosimilars of Herceptin and Avastin (launched by Amgen AMGN in July). Our estimates are in line with management's updated guidance for high-single-digit top- and bottom-line growth, and higher consensus expectations for five-year growth (4% top line and 5% bottom line) are also getting closer to our own 5% top- and bottom-line growth estimates. Roche's wide moat looks solid as new oncology, hematology, and immunology products more than counter biosimilar pressure on older cancer drugs.

While some analysts appear concerned that Roche’s strong 2019 performance could create a very high hurdle for 2020 growth, particularly given growing biosimilar threats in the U.S., we think newer products will offset the hit, particularly as the launches of Ocrevus, Hemlibra, and Tecentriq in key indications are still just ramping up outside the U.S. market. Beyond 2020 we’re also bullish on Roche’s ability to continue to drive growth with new products. For example, Roche is filing for approval for oral spinal muscular atrophy drug risdiplam and neuromyelitis optica spectrum disorder drug satralizumab later this year, and we think peak combined sales of these new neurology therapies could surpass $2 billion. Also in neurology, Roche and partner Ionis IONS have expanded a phase 3 trial for Huntington’s disease drug HTT-ASO, and we continue to assume a 50% chance of approval in 2021.

In hematology, we’re watching for potential for new diffuse large B-cell lymphoma therapy Polivy to move to first-line DLBCL in combination with Rituxan (phase 3 data expected by 2021), continued Venclexta expansion in acute myeloid leukemia and chronic lymphocytic leukemia, as well as progress with bispecific antibody programs (at least one CD20/CD3 franchise should move forward to phase 3 in lymphoma next year).

We continue to see higher long-term potential for oncology drug Tecentriq than consensus, and we’re watching for phase 3 data for Tecentriq and Avastin in first-line liver cancer, which should be presented in late November. This could give Roche another indication for this differentiated regimen, which is already approved, with chemo, in first-line non-small-cell lung cancer. Early-stage liver cancer data was promising, and success would also likely speed reimbursement talks in China, where Tecentriq is just launching, due to the high incidence of liver cancer in this geography.

There was very little noticeable hit to U.S. Herceptin and Avastin sales from Amgen biosimilars, which launched in July. While Herceptin sales declined, Herceptin is also seeing increased competition from Roche’s own Kadcyla in early breast cancer, which probably explained most of the decline, and reimbursement for Amgen’s products is likely just now being settled. One sign of uptake comes from UnitedHealth, which announced in August that Amgen’s biosimilar versions of Herceptin and Avastin would be preferred (used prior to) Roche’s branded products beginning Oct. 1 for both commercial and community plans (including Medicaid patients, but not Medicare Advantage plans). However, Roche will have data in December on a fixed dose subcutaneous combination of Herceptin and Perjeta, which is a much shorter duration than separate infusions of the individual drugs and could help make the case for hospitals to stay with Roche’s therapies despite biosimilar options, assuming Roche is willing to offer significant discounts. We still model a roughly CHF 9 billion hit from Herceptin, Avastin, and Rituxan biosimilars to Roche’s cumulative sales for 2019-23, including a nearly CHF 5 billion hit from U.S. biosimilars.

Eliquis Leads Bristol's Steady Quarter; Celgene Deal to Close by Year-End Bristol-Myers Squibb BMY reported steady third-quarter results that were slightly ahead of our expectations. Despite the stock's recent runup, we still view Bristol as undervalued, with the market not fully appreciating the company's pipeline (including the Celgene pipeline) that is largely focused on oncology and immunology, areas that typically hold strong pricing power. The strong combined pipeline and solid entrenchment in immuno-oncology reinforce our wide moat rating.

In the quarter, total sales increased 7% operationally, led by cardiovascular drug Eliquis (up 22%), offsetting mature product declines and decelerating growth from immuno-oncology drug Opdivo. We expect these trends to continue in 2020 as Eliquis looks well positioned to continue to take share from older drug warfarin. Also, Opdivo will likely fall in 2020 as the number of patients available in the second-line non-small-cell lung cancer market shrinks with more patients moving into the first-line segment, where Merck’s Keytruda is well positioned. We expect Bristol’s combination of Opdivo plus Yervoy to gain approval in first-line NSCLC in 2020 based on positive data in Checkmate 227 and 9LA, but unless detailed data from 9LA shows significantly better data than Keytruda, we continue to believe Bristol will only penetrate about 10% of the metastatic NSCLC market. Outside NSCLC, we expect Bristol’s immuno-oncology platform to perform well in melanoma and renal cancer.

Bristol is on track to close the Celgene acquisition by year-end; we believe the deal strengthens the company’s pipeline. Beyond a TYK2-focused immunology drug and additional indications in immuno-oncology, Bristol’s pipeline is relatively weak, increasing the importance of Celgene’s Inrebic (fedratinib) for myelofibrosis, ozanimod for multiple sclerosis, and blood cancer drugs liso-cel and bb2121.

Dupixent Growth Mitigates Lantus Declines for Sanofi Sanofi SNY reported third-quarter results largely in line with our expectations. Even with the recent runup in the stock price, we see the company as modestly undervalued. We continue to believe the company has a wide moat, and the strong results in specialty care drugs help reinforce our conviction in its competitive positioning.

In the quarter, total sales fell 1% operationally as insulin Lantus fell 16%, partly offset by specialty care drugs, including strong growth from immunology drug Dupixent. We expect sales growth to improve as Lantus (8% of sales) continues to represent a smaller part of the business and Dupixent (6% of sales) continues to grow. With leading efficacy, we expect continued robust growth for Dupixent as market penetration remains low across indications. Additionally, while competitive threats are emerging to Dupixent from JAK inhibitors in atopic dermatitis, we believe Dupixent’s efficacy will be challenging to surpass with clean safety. In asthma, we believe Astra’s and Amgen’s tezepelumab could offer a challenge, but Dupixent’s growing entrenchment will be hard to displace. We don’t see any major near-term competition from drugs with a similar mechanism of action (IL-4), which is unique in major drug markets and should bode well for pricing power and market share retention over the long term.

Other major operating lines performed largely as expected. Rare-disease, multiple sclerosis, and cancer drugs all posted steady gains. While vaccine sales were down, we attribute the decline to timing of vaccine shipping and expect steady full-year gains for the segment.

Sanofi continues to make progress with its pipeline, but late-stage drugs seem to hold less potential than earlier-stage drugs. We expect new CEO Paul Hudson to accelerate the early-stage drugs that target unmet medical needs in oncology, immunology, and rare diseases.

Bayer, AbbVie, Merck, Pfizer, Roche, Bristol-Myers Squibb, Sanofi

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)