Healthcare: Valuations Look Fair Overall, With Select Industries Still Undervalued

Humana, Baxter, and Moderna are our top picks in this sector.

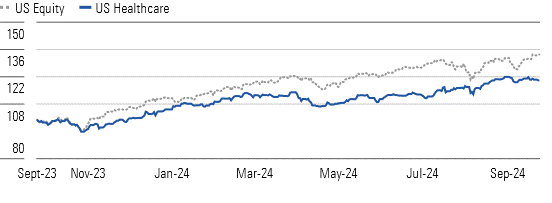

Over the past 12 months, overall equity performance has outperformed the Morningstar US Healthcare Index by over 13%. The sector’s more defensive nature likely led to underperformance earlier this year, but renewed recession concerns in the third quarter led to around 1% outperformance.

Healthcare Outperformed in Q3

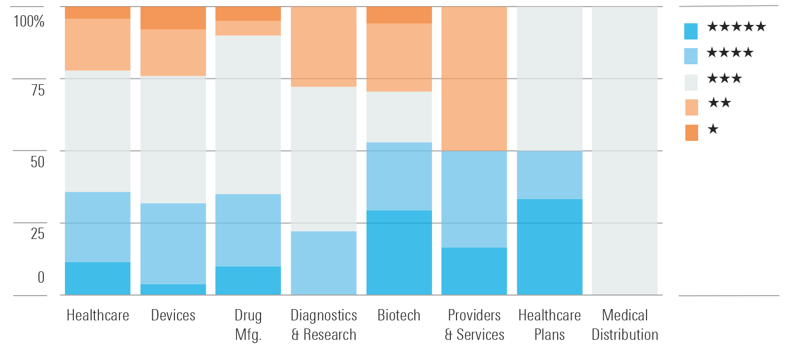

Following this, the sector overall looks relatively fairly valued, with the average stock trading at roughly a 4% premium (on a market-cap-weighted basis) to our fair value estimate. Medical distribution looks like the most overvalued industry, while drug manufacturers and biotechs look the most undervalued.

Healthcare Rating Distribution by Industry Shows Undervaluation in Biopharma

We expect healthcare stocks to perform better when the market appreciates its steady drivers regardless of macroeconomic factors. Within biopharma, the market is not fully appreciating innovation beyond obesity leaders Eli Lilly LLY and Novo Nordisk NVO. In managed care, we believe the short-term headwinds of potential pharmacy benefit reforms, Medicaid redeterminations, and Medicare Advantage pricing are creating undervalued opportunities. Device and diagnostic valuations are stabilizing after falling due to over-optimism during the peak of the covid-19 pandemic.

We believe the United States will face some volatility during the 2024 election cycle, but we are not expecting major changes for most healthcare industries. Managed care faces regulatory risks that can crop up during election cycles, but we think risks look manageable this cycle. Biopharma is still digesting Medicare reforms as part of the Inflation Reduction Act, and we see a low probability of additional significant pricing reforms.

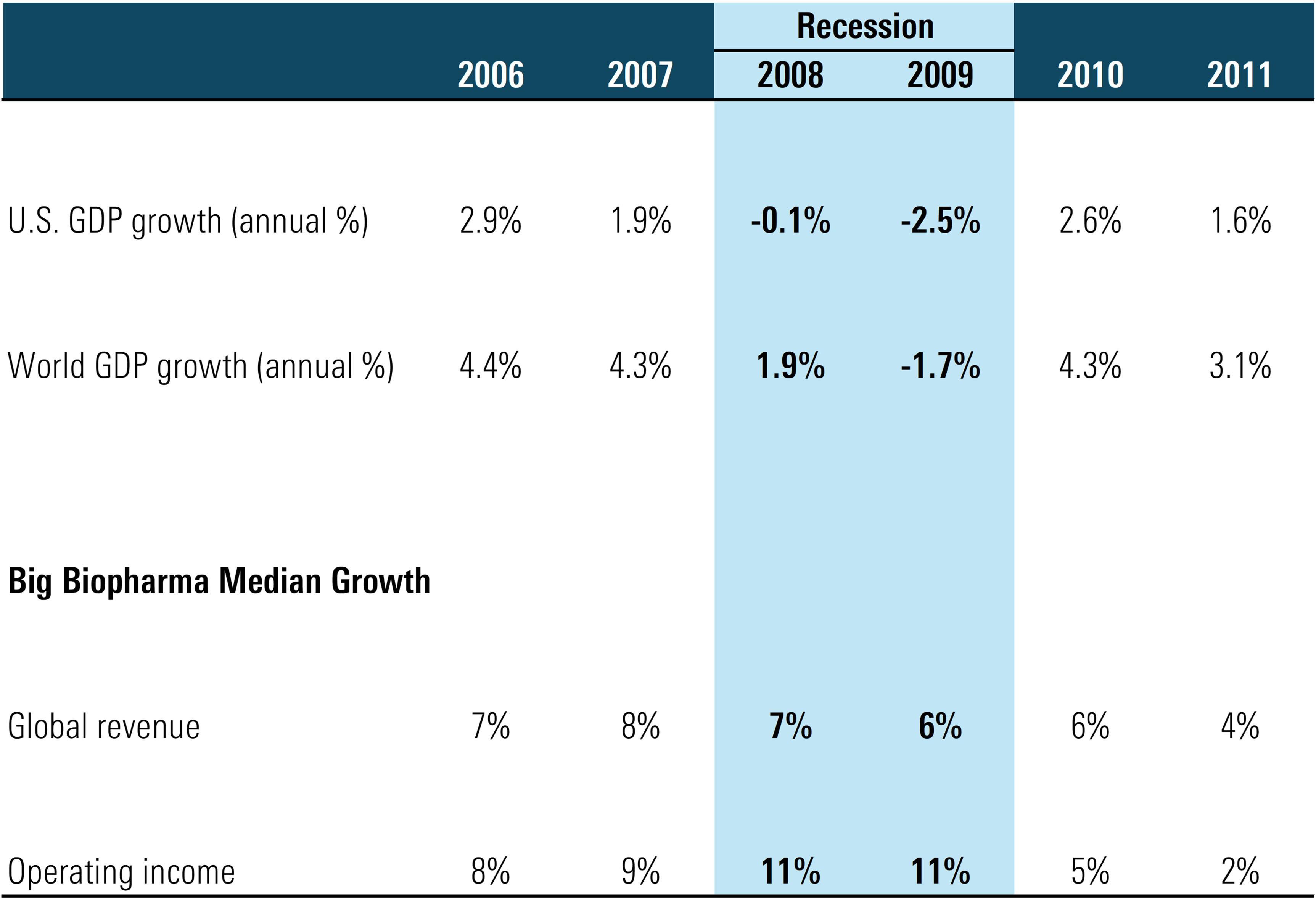

Biopharma Sales Were Largely Unaffected by Last Major Recession in 2008-09

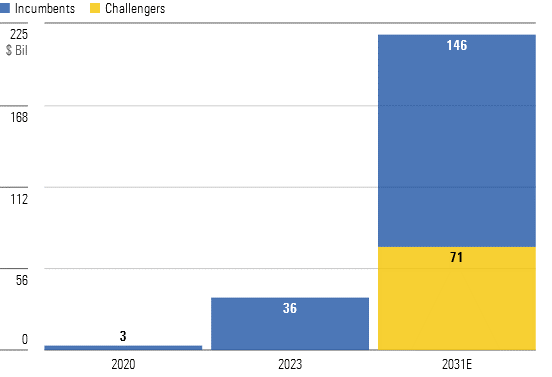

While the market has been more focused on faster-growing, more market-sensitive sectors, healthcare tends to hold up well amid macro pressures. In the global recession of 2009, the drug and biotech industries posted steady results, with limited impact on sales and profits, as healthcare demand is relatively inelastic. Within biopharma, Novo and Lilly’s valuations have surged on what we see as a potential $200 billion GLP-1 market by 2031, although we see room for competitors.

Global GLP-1 Market Driven by Novo Nordisk and Eli Lilly, but Challengers Approach

Top Healthcare Sector Picks

Baxter International

- Fair Value Estimate: $62.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Baxter BAX looks attractive, with shares trading at a significant discount to what we think they are worth. Demand is improving in most of its medical supply businesses because of rising medical utilization, and new product introductions like the Novum IQ pump platform could boost sales growth further. Baxter also represents a margin improvement story, as most inflationary challenges in its supply chain are easing, and key new group purchasing organization contracts should take effect in 2025, which should help boost Baxter’s product pricing. The recently announced sale of its kidney care segment came through at a disappointingly low price, but we expect renewed management focus on growth and margins for the remaining business could eventually boost shares toward our fair value estimate.

Humana

- Fair Value Estimate: $473.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Humana HUM reflects a significant discount to our fair value estimate and holds a strong competitive position in Medicare Advantage, which has strong mid and long-term prospects due to demographics, increasing popularity of the program, and future rate increases. We do expect deflated profits in 2024 at Humana due to mispriced Medicare Advantage plans that may not fully cover surging medical utilization. Over a multi-year period, though, we expect Humana to push that higher medical utilization onto clients and end users by increasing prices and/or reducing benefits somewhat. So while near-term uncertainty surrounds the company’s typically strong outlook, we think Humana’s longer-term prospects remain bright.

Moderna

- Fair Value Estimate: $141.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

Moderna’s MRNA shares were on a roller coaster in 2021. We think investors were first overly enthusiastic about the potential of the company’s technology but subsequently too bearish on its post-coronavirus growth. While we have modest expectations for sales of the firm’s covid vaccine following massive pandemic-fueled demand in 2021 and 2022, we think Moderna’s pipeline of mRNA-based vaccines and treatments is advancing rapidly across multiple therapeutic areas. We’re confident in the long-term sales trajectory of the firm’s diversified pipeline, despite a competitive RSV vaccine market clouding near-term prospects.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)