5 Sustainable Food-Related Stocks for Long-Term Investors

A portfolio specialist at Stewart Investors discusses investing in the food supply chain.

Food waste may be a dirty secret in your household—as it is in mine—but it poses a bigger sustainability challenge as the world grapples with feeding a growing global population.

Factory farming is carbon-intensive: Food accounts for nearly a fourth of global greenhouse emissions. Feeding ourselves without inflaming climate change requires a multipronged approach, including paring waste, cutting emissions, boosting yields, and precision agriculture.

This presents profitable opportunities for companies up and down the complex food ecosystem. We talked with Edinburgh-based Stewart Investors, a global asset manager that practices sustainable investing, about the charms of food-related stocks. (The firm has a Morningstar ESG Commitment Level of Leader.) The firm begins with a focus on quality companies that dates to its origins in Asia 30 years ago. “Shining a light on the quality of the management and how well they treat all stakeholders is really important to us,” says Clare Wood, a portfolio specialist at Stewart Investors. “Because as a minority shareholder, you want to feel like you’re going to be considered by the management as well as any other sort of party that’s at the table.”

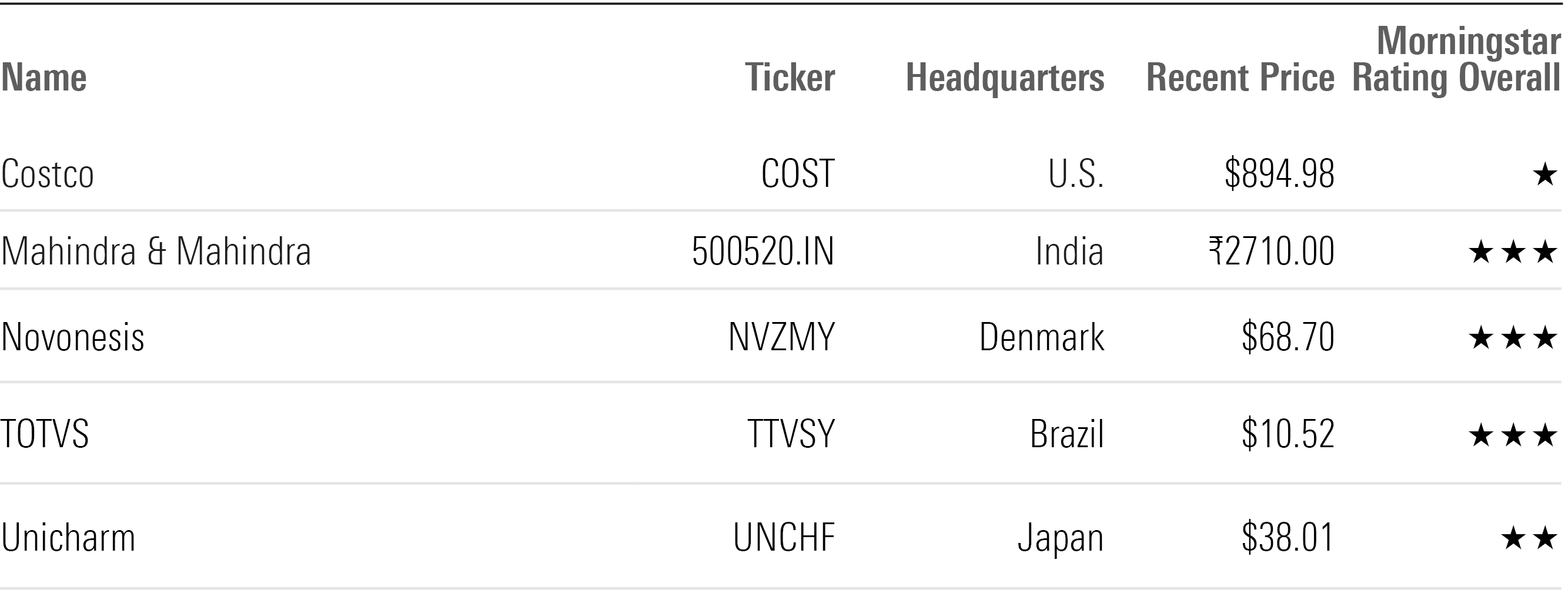

The firm tends to hold for the long term, and all the food-related companies that Wood mentions left cheap behind a while ago, as you’ll see in the table below. Still, they have merits galore. I talked with Wood about why they’re worth considering for the long haul.

Investing in Food Stocks and the Food Supply Chain

Leslie Norton: What’s the premise for sustainable food?

Clare Wood: It’s increasingly topical as people recognize the contribution toward climate change and biodiversity loss that comes from land use and agriculture. We don’t actually invest thematically. We’re looking for great companies that help drive improvements in human development while reducing our ecological footprint, that will be great investments for a decade, and whose franchise and their growth are supported by these structural tailwinds of sustainable development. So, that leads us into a number of areas—healthcare, industrials, some financial, some tech, but also food. Food meets those requirements because of the increasing need to feed the world, reduce food waste, and make things more efficient. All of that would tend to lead us toward companies that are supported by those tailwinds.

Norton: Two questions: How do you define attractive companies, and how do you define sustainability?

Wood: We are looking for companies that we can invest our clients’ money into for the long term. A quality company has three pillars: First, the quality of the people running it; we want them to be ethical and competent. Second, the quality of the franchise, if it’s a business model that makes sense for the long term. Third, the quality of the financials, including things like conservative balance sheets and sensible decisions about booking revenue instead of gaming the tax rate. That third pillar shines a light on the quality of management. The decisions they make come through in the financials.

Sustainability is rooted in the idea of sustainable development. It’s not just green stuff. It’s this idea that we need to improve people’s lives at the same time as we’re reducing our ecological footprint. We look for companies that do either or both of those things. Some quality companies aren’t particularly sustainable. We’re not going to own big fizzy drinks manufacturers because we don’t consider that sugary drinks companies, no matter how well run, are contributing to sustainable development. Some sustainable companies are run badly. A lot of green tech might fall into that category. We’ve never invested in a wind farm, solar farm, or solar panel maker.

As long-term investors, it’s in that overlap between quality and sustainability where we’ve really found our best ideas.

Stewart Investors' Food Stock Picks

Norton: You’ve shared a few names on the theme of food, but none of them is a food company.

Wood: We don’t invest directly in any agricultural stocks or big food aggregators because we’ve never found any that meet our quality thresholds or the way we invest. So, we might look for companies that help drive the efficiency of agriculture and improve yield. We love what we call “pick-and-shovel” companies. We won’t buy wind farms, but we might buy companies that make O-rings used by wind farms.

Norton: You like Costco COST, which is already up 63% over the past year and 200% over five years. What’s the thesis?

Wood: We love Costco. Costco does a fantastic job, with its membership model and its scale, of offering really good quality food at a great price point. Costco’s business model is built on sharing scale advantage with customers. They offer a limited number of products to maximize bargaining power with suppliers and then only charge a small markup on these products. As they drive down the costs of the goods, they reduce prices for consumers. The limited number of products means they can better control and influence the quality of their supply chains. They work with suppliers to understand how they treat people, animals, and the environment and how well they can map their own supply chain. This is particularly true of the products in their Kirkland Signature range.

It’s not just about low prices but a fair return to suppliers. This feeds into the resiliency point. Costco needs to ensure that its suppliers can continue to deliver high-quality produce to them in the future, rather than driving costs down hard for the sake of short-term profit margins. This evidence of long-term thinking in company management is a key part of the Stewart Investors investment philosophy and process.

Costco has several avenues for sales growth, including sales and membership fees at existing stores, opening new stores in North America, and increasing e-commerce and overseas expansion. It is a reliable compounder of value as increasing sales drive improvements in profitability. We don’t set price targets but consider that over 10 years, the quality of Costco’s franchise and the reliability of its margins, returns, and cash flows means it will continue to be a sound investment.

Norton: Unicharm UNCHF is a Japanese diaper maker. How is it related to food?

Wood: It also makes mats for food trays. The angle is really around reducing food waste. It’s an important topic to address to ensure we provide adequate nutrition to all while staying within planetary boundaries. Project Drawdown estimates that roughly one third of the world’s food is never eaten, meaning that all the resources that went into is also wasted. This ranges from the land used to produce it right through to the energy needed to transport it to the final customer. They estimate that food waste is responsible for approximately 8% of global emissions. Reducing food waste needs to be tackled at various points on its journey.

Unicharm makes a Fresh Master tray mat for the storage and delivery of food. It is used in supermarkets to increase shelf life. Unicharm has expanded the sale of the product into restaurants. Unicharm also has a couple of things going on. Obviously, Japan has a demographic problem, so Unicharm has segued into making diapers for the elderly, to support quality of life for an aging population. They’ve also expanded into Indonesia and India where they are making feminine care products. So, they’re providing a key basic need for girls in emerging markets. As their core market was shrinking, they developed adjacent markets that provide extra tailwinds of growth and improve quality of life.

Norton: How long have you owned Unicharm?

Wood: Over 10 years. Unicharm has grown its earnings by 6% to 7% per year over the last five years. It still has plenty of room to grow, partly from an expansion into products for adults, which are higher-margin than baby diapers, partly through geographic expansion, particularly into India and Indonesia, which have large populations and where awareness around sanitary items is growing.

Norton: Speaking of India, what’s the thesis for Mahindra & Mahindra?

Wood: Mahindra 500520 is an Indian tractor company that helps drive the efficiency of agriculture and improve yields. India has a very large population. It has a lot of agriculture, much of it on a very small scale. Mahindra is the world’s largest tractor company by volume, selling 350,000 tractors a year and with 40% of domestic market share. Improving agricultural efficiency improves the availability, price, and security of food. It leads to rising disposable incomes, facilitates migration from subsistence farming, and reduces labor requirements with significant implications for female education and employment. Tractors, farm equipment, and rural business finance have been huge contributors to India’s sustainable development while also driving 20 years of strong growth for the company. Earnings have grown 19% a year over the last five years. We believe it remains reasonably valued.

Norton: Why do you own Novonesis?

Wood: Novonesis NVZMY was formed by a merger of two Danish companies: Novozymes, which was actually part of the Novo Nordisk family, and Chr. Hansen. Its largest shareholder is the Novo Nordisk Foundation, which provides stable and long-term stewardship to a high-quality franchise that invests heavily and consistently in research and innovation. Novonesis has an enormous library of microscopic agents—enzymes, yeast, microbes, bacteria—which they use in a number of different applications to make things better. So, they can make bread taste better and last longer, they can make cheese last longer, they can make yogurt better, they can reduce food additives, and their agents are used to improve soil health, to improve yields in agriculture. They also make infant formula. They’ve done huge amounts of research into the enzymes in breast milk to create an infant formula that’s as close as possible. They make probiotics. And they make this thing called mood chocolate, which is chocolate with enzymes that are supposed to make you happier.

Norton: That sounds nice.

Wood: I would like some of that. They have a strong brand, a dominant franchise in industrial enzymes, and are supported by the strong tailwinds of sustainability as the vast majority of sales come from products that reduce reliance on fossil fuels, improve agricultural practices, and promote overall well-being. Because of the merger, it’s hard to look at longer-term historical growth rates, and we generally don’t consider short-term growth, but early results have been encouraging about their ability to continue to grow into the future.

Norton: Finally, what’s the thesis for Totvs?

Wood: Totvs TTVSY is a Brazilian company held in our global emerging-markets portfolios. It provides ERP [enterprise resource planning] software to small and medium-size enterprises. In agribusiness, their product offerings address business management, automation, agricultural cost control, grain origination, and harvest management, storage, and transportation. While they are not directly involved in producing, storing, processing, or selling food, they are contributing to the efficiency and success of companies that do and so are contributing to the sustainable development goal of adequate nutrition and the Project Drawdown goal of reduced food waste. It has approximately 50% market share in Brazil and a market cap of approximately $3.1 billion. It has grown sales by 17% and earnings by 21% over the past five years. And it has a solid net cash balance sheet, enabling it to weather economic downturns and invest for the future.

Norton: Thanks, Clare.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)