Where to Find Value in Japanese Stocks

Matthews Japan manager explains why corporate profit growth and valuation remain compelling, despite the recent collapse.

The bull market thesis for Japan was seriously mauled in early August. The Bank of Japan raised interest rates at the end of July, just as weaker-than-expected economic data hoisted expectations of a rate cut in the United States. The yen’s subsequent rise pummeled the carry trade (borrowing in cheap yen to fund more expensive bets elsewhere). Japanese stocks plunged, as did global equities.

The central bank raised its ultralow benchmark policy rate to around 0.25% from the previous range of 0.00%-0.10% and said it would reduce purchases of Japanese government bonds. On Aug. 5, the benchmark Nikkei 225 Index fell more than 12%, dragging other global markets lower. That same day, the Morningstar Japan Index was down 9.7%, which came on the heels of a nearly 4% decline on Aug. 2. The Japanese stock market bounced strongly on Aug. 6 but remains far from its peak.

1-Year Performance of the Morningstar Japan Index

Is the structural thesis for Japan’s previous rally—based on low valuations and investor-friendly reforms—still intact? Tim Hayes, chief investment strategist of Ned Davis Research, says, “The question is whether the yen will consolidate and [avoid] rapid appreciation. But I don’t think we’ll go back to see the yen weaken.”

Still, many specialists think the bullish thesis remains valid. This includes Shuntaro Takeuchi, who manages the Matthews Japan Investor MJFOX fund and Matthews Japan Active ETF JPAN. There are promising sections in the Japanese market where he shopped as prices fell.

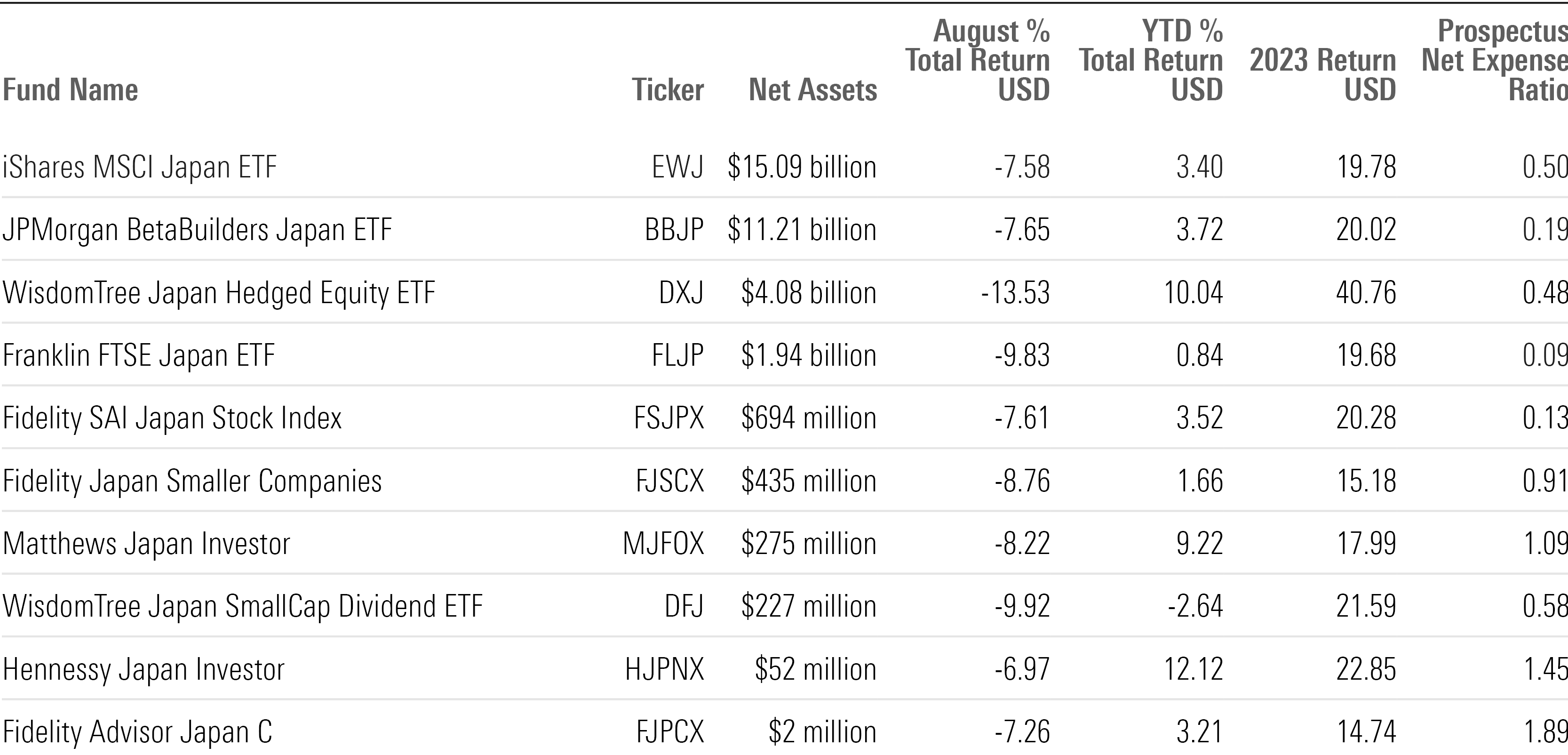

Matthews Japan was down 8.2% from Aug. 1 to Aug. 9. That’s marginally better than the rout in US-listed Japan funds, which went down an average of 8.7% during that time. On average, the largest Japan funds are up 4.5% this year, but that’s a far cry from the 20% rise in US dollar terms that the Nikkei posted in 2023.

The Largest Japan Funds

What’s Next for Japanese Stocks?

Morningstar spoke with Takeuchi on Aug. 9. He believes a strengthening economy will lift corporate profits. Read on for his views.

Leslie Norton: The coming days mark the end of earnings season for the June quarter, or the first fiscal quarter for many Japanese companies.

Shuntaro Takeuchi: We’re seeing double-digit earnings growth. The March quarter was around 9% growth, and the June quarter was close to 10% overall. Progress in earnings has been quite steady Eddie.

Norton: How big an impact will the currency movements have? Isn’t Japan an exporting market?

Takeuchi: Currency fluctuation and its impact on earnings per share are getting smaller. For decades, Japanese companies made things in Japan and exported them, and profits were boosted by a weaker yen. Today, Toyota TM makes all its trucks in Texas. Multinational Japanese companies make their products in areas where they sell. So the impact of currency fluctuation is less than half of what it was 10-20 years ago. A 1-yen change affects 0.4% of earnings per share

Global investors have this image of Japan that 50% of earnings come from outside the country, and a stronger currency will hurt. Half the S&P 500′s earnings come from overseas, right? Then why don’t people say, ‘Oh the dollar is so strong, we should sell US equities?’ The logic is the same.

Norton: What happens to stocks if the economy is too weak?

Takeuchi: The corporate profit cycle is more impacted by manufacturing cycles. Corporate profit momentum continues to be robust, with high single-digit growth. The risk is that the industrial production cycle is decelerating. The most recent global PMI data went below 50 again. The manufacturing ISM numbers in the US basically said things were decelerating. All the volatility happened because the BoJ action took place at the same time.

Right now, my expectation is this is forming a bottom and starting to improve, but the magnitude and the delta of improvement are a little slower than people expected. That’s why the global market is taking a breather.

Norton: That’s the corporate profit side of things. How about valuations?

Takeuchi: Over the past 10 years, the Japanese market has averaged 14.6 times earnings for the forward 12-month period. It has ranged from 12 to 18. A month ago, Japan was at 16. Yesterday it was at 13.4 times forward earnings. When the market plummeted 12%, it went to a 10-year low. If you think that the global PMI is not growing or shrinking, and isn’t in a recession, Japan should be trading at its 10-year average of around 15.

What you need to decide is: A) Are we going into recession? Will it be mild or severe? Will there be a crisis? Or: B) Are we just in a lull, and a gradual recovery will continue?

My expectation is the recovery is basically taking longer. We’re in a lull and we’re starting to climb out. The general direction of improvement stays intact.

Norton: What does this mean for Japanese stocks?

Takeuchi: A plummet in valuation is an opportunity.

Norton: Is the bullish thesis still valid?

Takeuchi: The general sense among the people I talk to is that Japan’s corporate profit fundamentals are on the right track. Japan has more country-specific return potential in terms of increasing buybacks and dividends, in which the macroeconomy matters less because companies are using excess cash on their balance sheets, not borrowing money to buy back shares. Dividends and buybacks are growing by double digits year over year. And earnings growth is in the high single digits. Valuation is at the lower end of a 10-year range. The rest is based on the macroeconomy. And since Japan’s corporate structure is much better than 10 years ago, then basically it’s an opportunity.

Norton: What did you do when the market plunged?

Takeuchi: Each position in our portfolio has an entry/add target and a trim/exit target. We have 48 investments in our portfolio. We had been reducing core names because they were in the trim target range. All of a sudden, they went to an add level. So we sold positions to put back into our core names. At most, this affected 5% of the portfolio.

Norton: Are you expecting more rate increases in Japan?

Takeuchi: Not in the near term. After the 12% market drop, the deputy governor of the BoJ said the bank wouldn’t raise rates if the macroeconomy isn’t improving. For the currency, it’s really the spread between the US and Japan that matters. Japan’s absolute level of interest rates has changed by 50 basis points in 10 years. In the US, it changes in three months.

Norton: What do you like in the Japanese market?

Takeuchi: Multiple sectors. We like corporate change, leaders in the manufacturing space, and solution providers in healthcare and for a declining population. So the cyclical industry, which is bottoming out and improving, idiosyncratic conglomerates that are becoming more efficient, software that enhances labor productivity.

My top 10 names include Orix IX, a leasing company. It does aircraft leasing and hotels in Japan. Their Orix USA business does mortgage guarantees in the US, and it struggled because mortgage rates were high and there were fewer transactions. US housing will benefit when rates come down. That’s on top of the general recovery of economic activity in Japan.

Hitachi HTHIY does IT services and energy grids. The CEO has been executing extremely well in rightsizing the businesses. They’ve been exiting asset-heavy businesses and focusing on higher returns on invested capital businesses. That corporate strategy, coupled with the two main engines of the energy grid business and the IT service business, are all working very well.

Finally, Keyence KYCCF is the most well-run company among the factory automation equipment companies globally and is classically exposed to the [manufacturing cycle], forming a bottom.

Liz Angeles contributed research for this story.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)