When You Should Invest More in Alternatives

Innovation and lower fees make alternatives a better option for retail investors.

When the facts change, I change my mind. What do you do, sir?—John Maynard Keynes

Sixteen years ago, when my book The Only Guide to Alternative Investments You’ll Ever Need: The Good, the Flawed, the Bad, and the Ugly was published, my own portfolio included no private investments, and it held only one investment—commodities—that would traditionally be considered as an alternative. To fill the “good” category in the book, I had to include such investments as public REITs, Treasury Inflation-Protected Securities, international equities, fixed annuities, and stable-value funds. Today, my portfolio has an allocation to alternatives that is in excess of 50%—including exposure to life settlements, reinsurance, private credit, private real estate, drug royalties, litigation finance, long-short factor funds, and private equity. That is similar to the allocation that the endowments of Yale and Harvard have to alternatives. The study “The Rise of Alternatives” found that the average US pension plan had increased its allocation to almost 40%.

What led to such a dramatic change in my personal allocation? Financial innovations in the form of interval funds and increasing competition have dramatically improved the opportunity set for retail investors. Sixteen years ago, high fees charged by providers kept alternatives out of my portfolio. Consider a private equity fund charging an expense ratio of 2% and an additional incentive fee of 20% once returns exceed a hurdle rate (for example, 7%). Now, assume the private equity fund delivered a 15% gross return, while the public market was returning 10%. The 2/20 fee meant that the 15% gross return was reduced to just 10% (20% of 15% is 3%, plus the 2% expense ratio, results in total fees of 5%). Thus, while investors took all the illiquidity risk of having their funds tied up for long periods (typically seven to 10 years) and had concentration risk in a small number of investments, they earned no excess return. It is the high fees that explain the empirical research findings that, while private equity has outperformed public market equivalents on a gross-return basis, they have not done so on a net-return basis.

In addition to the high fees that transferred all the value added to the fund sponsor, investors also were subject to the negative impact of the J-curve effect. Because the 2% fee was charged on the committed, not invested assets, and the investments were typically made over a three- to four-year period, the returns in the early years were negatively affected.

The J-Curve Problem

The introduction of interval funds eliminated the J-curve problem as investments are put to work immediately. Interval funds also at least partially addressed the illiquidity problem as they typically are required to meet a minimum withdrawal requirement of 5% a quarter for private credit, private real estate, and private reinsurance, and 5% semiannually for private equity.

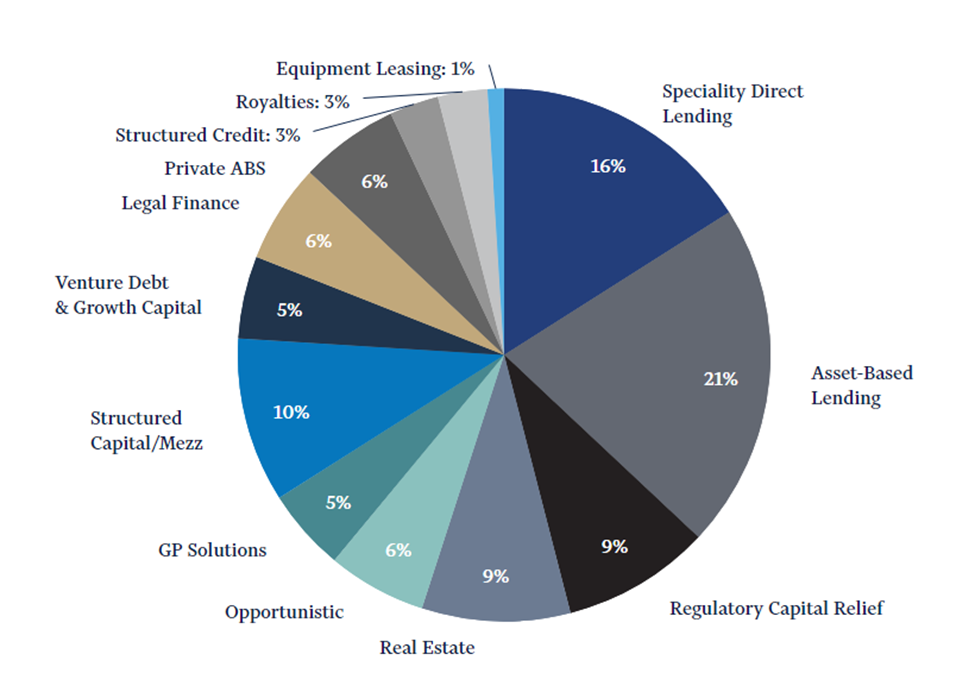

Most importantly, fees have come way down, allowing investors to capture the majority of the value added, as well as the illiquidity premium inherent in private vehicles. For example, a leader in the alternatives market is Cliffwater, a relatively new entrant that has built a large alternatives business based on its long track record as consultants to pension plans and endowments. The fee for its flagship private debt fund—Cliffwater Corporate Lending CCLFX, which invests in the senior secured debt of profitable middle-market companies that are backed by leading private equity firms—is 1.58%, and it is applied only to net, not gross, assets. If we assume the fund uses 30% leverage, the effective fee would be about 1.1%—the fund would have about $142 of assets for each $100 of investor dollars, with the result being that the investor is paying $1.58 on $142 of assets, or 1.1%. And there is no incentive fee. The fund must meet a minimum liquidity requirement of 5% per quarter. Another attraction is that because these funds are not partnerships, they provide 1099s instead of K-1s. Another convenience is that Cliffwater funds are available on custodial platforms such as Schwab and Fidelity. Cliffwater also offers Cliffwater Enhanced Lending CELFX, which provides further diversification benefits as it invests in a broad spectrum of private debt asset types, as illustrated below. Its expense ratio (which excludes borrowing costs) is 2.25%.

Private Debt Asset Types of Cliffwater Enhanced Lending Fund

Through alternatives funds, individual investors today have access to many more areas of the market.

Private Equity

Access to private equity has increased in importance because of the passage in 2002 of the Sarbanes-Oxley Act, which increased the cost of being a public company. The result is that today companies are waiting to become much larger before going public. By 2020, the number of US publicly listed stocks had fallen 50% over the prior 20 years, to about 3,500. Another outcome from the passage of Sarbanes-Oxley has been that the smallest quintile of stocks is much larger today than it has been historically. For example, Vanguard Small-Cap ETF VB, with $58.8 billion in assets under management, had an average market cap of $6.5 billion (not so small cap) at the end of July 2024. The takeaway is that to capture the takeover premium in small companies, private markets (in the form of private equity) provide a greater opportunity than in public markets. A related takeaway is that because the factor premiums in current asset-pricing models have been larger in small caps than in large caps, the opportunity to capture them should also be greater now in private equity than in public markets while also earning the illiquidity premium. Cliffwater’s private equity strategy, Cascade Private Capital Fund CPEFX, has an expense ratio of just 0.96% and no incentive fees. The fund is required to meet a minimum liquidity of 5% semiannually. It provides a 1099 and is available on custodial platforms.

Real Estate

Private funds have a distinct tax advantage over public REITs because while the dividend distributions of public REITs are taxed as ordinary income, the vast majority (typically more than 90%) of the distribution of private REITs tends to be treated as return of capital. Blackstone Real Estate Investment Trust, for example, has an expense ratio of 1.25% of the net asset value and a performance-based incentive fee of 12.5% of the annual total return, subject to a hurdle rate of 5%. It provides a minimum monthly liquidity of 2% per month subject to a maximum of 5% per quarter. As a partnership, the fund does provide a K-1. It is available on custodial platforms.

Long-Short Strategies

Long-short factor-based strategies are the traditional playground for hedge funds and their 2/20 fees. The daily liquid AQR Alternative Risk Premia QRPRX provides exposure to four different styles (or factors)—momentum, value, defensive, and carry—across industries and asset classes (stocks, bonds, commodities, and currencies). It has an expense of 1.33%. As a mutual fund, 1099s are provided. A similar fund, AQR Style Premia Alternative QSPRX, has a slightly higher level of expected volatility. Its expense ratio is 1.42%.

Reinsurance

Reinsurance is another area where innovation has occurred. Until recently, the only way to gain access directly to reinsurance risk was through hedge funds and their typical 2/20 fees. Today, the daily liquid catastrophe-bond fund Stone Ridge High Yield Reinsurance Risk Premium SHRIX has an expense ratio of 1.74%. A quota-share interval fund, Stone Ridge Trust II—Reinsurance Risk Premium Interval Fund, with 5% minimum per quarter liquidity, has an expense ratio of 2.38% (no incentive fees).

Investor Takeaways

Pension plans and university endowments have long taken advantage of their ability to take illiquidity risk because of their very long investment horizons and limited need for short-term liquidity. And their scale, at least for the largest funds, has allowed them to benefit from their ability to negotiate lower fees. With that said, it is my experience that most high-net-worth investors can also accept significant liquidity risk. That ability allows them the opportunity to access the illiquidity premium available in private markets. (Note that, even at age 90, the required minimum distribution from an IRA is only about 10%. Thus, if you are not taking out more than that, and most are not, then you can accept the illiquidity of an interval fund with typically 5% fund-level minimum quarterly withdrawal capability). And, fortunately, the opportunity set in alternatives that are available to retail investors has greatly improved. Investing in funds such as those provided by Cliffwater provides access to leading managers who typically are not available to retail investors. Their scale also allows them to offer lower fees. And they provide the opportunity for much greater diversification than typically possible when investing directly with an originator of private investments, such as KKR and Kleiner Perkins (even if you could gain access to them).

This is important for two reasons. First, in private investments the dispersion of returns among managers is much wider than with mutual funds. Second, private vehicles are the one area where there is evidence of persistence of performance among the leading providers.

Thanks to the innovations and fee competition, individual investors can now gain access to these alternatives, which can provide significant diversification benefits to traditional stock and bond portfolios as well as providing risk premiums for their asset class—and, in many cases, an illiquidity premium as well. That is why I have more than a 50% allocation. I would add that, in 2022, when traditional stocks and bonds experienced double-digit losses, Cliffwater Corporate Lending, Cliffwater Enhanced Lending, Stone Ridge High Yield Reinsurance Risk Premium, Stone Ridge Reinsurance Risk Premium Interval Fund SRRIX, AQR Alternative Risk Premia, and AQR Style Premia Alternative, as well as Blackstone Real Estate Investment Trust, all produced positive returns, damping the volatility of the portfolio. Of course, one should not expect that to always be the case as the correlations are not negative, just very low.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BL6WGG72URAJJJCPC4376SZKX4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)