Is the Era of Dormancy for Japanese Stocks Over?

Corporate activism is driving change in Japan, and so far it’s paying off.

Japanese stocks have been laggards for more than three decades. Over the period from January 1990 to February 2023, Dimensional’s Japanese index returned just 0.8% per year. However, in March 2023, the Tokyo Stock Exchange asked all companies with price/book ratios below 1 to issue a plan to get to 1 times book. In response, Japanese companies are making big changes in capital allocation (dividends and buybacks) and governance. The reforms were aimed to help Japan shake off its reputation as a “value trap.”

Research from Verdad found that at the time of the announcement, around 50% of companies in the Prime Section (large, established firms with strong financial performance, robust corporate governance, and international competitiveness that are expected to meet stringent listing requirements and adhere to high standards of disclosure and transparency) and 60% of firms in the Standard Section (medium-sized companies that have solid track records but may not meet the strict criteria of the Prime Market; their requirements are less stringent) had a price/book ratio of less than 1, reflecting pessimism and perhaps inattention by investors.

Japanese Companies Get the Message

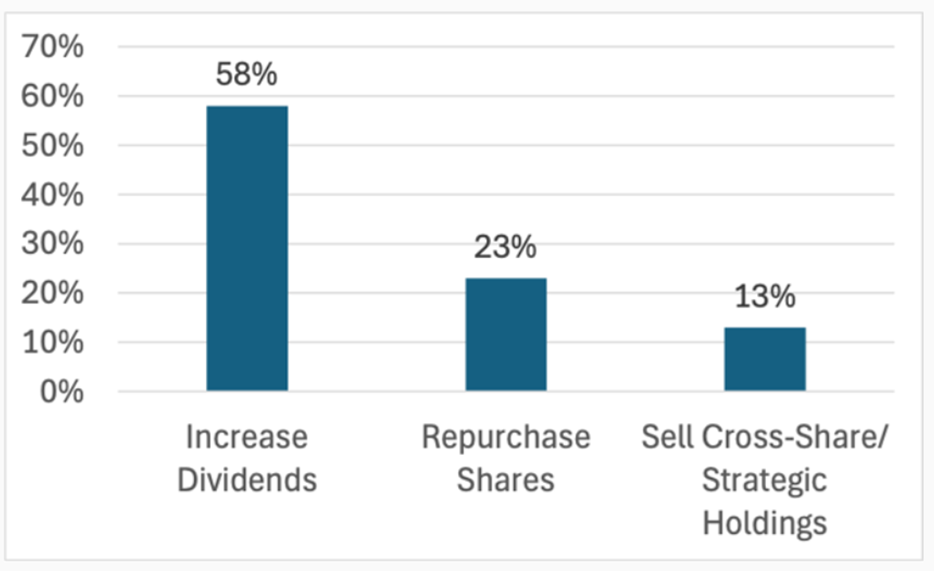

Over the past year, companies issued plans to address the directive and posted them to the Toyko exchange’s website. Verdad performed a systematic review of every plan issued by companies in the exchange’s Prime and Standard sections (3,247 firms) to assess the impact of these reforms. As of the end of June, based on the exchange’s monthly list of disclosed companies, 50.9% of firms have disclosed plans and 9.8% are considering doing so. As the chart below demonstrates, the majority of companies have increased dividends, almost a fourth have repurchased shares, and about an eighth have sold cross-share/strategic holdings.

Changes Driving Japan Stock Market Performance.

Examining the performance between March 31, 2023, and June 30, 2024, of companies that had made changes versus those that had not, Verdad found dramatic differences with firms that made an effort to lay out a specific and tangible action plan to reach 1 times book. These firms experienced a significant rise in their stock prices, more than double compared with companies that haven’t disclosed or are still considering doing so.

The Tokyo exchange’s “name and shame” tactic is clearly having an effect on corporate behavior. Verdad’s findings led it to conclude, “It seems like whether the Japanese stock market continues to build on its momentum depends on the willingness of companies to be transparent about and responsive to the [exchange’s] request to reach 1x book.”

Investor Takeaways

Japanese stocks are trading at much cheaper valuations than US stocks. For example, using Morningstar data as of July 31, 2024, iShares MSCI Japan ETF EWJ had a price/earnings ratio of 15.9 as compared with the 21.9 P/E of iShares Russell 3000 ETF IWV. Similarly, the price/book and price/cash flow ratios are 1.4 and 8.1 for EWJ and 3.9 and 14.3 for IWV, respectively.

What should be of interest to investors is that despite the dramatic gap in valuations, Morningstar’s long-term earnings projections (an average of analysts’ projections for a company’s earnings growth over the next three to five years) for EWJ’s portfolio is slightly higher than for IWV’s: 12.6% versus 12%.

The takeaway, then, is that the era of dormancy for Japanese stocks may finally have come to an end thanks to the actions of the Tokyo Stock Exchange to try to force better governance and more efficient capital allocation. The long-term underperformance of Japanese stocks has left them trading at much cheaper valuations. That should lead to higher returns, especially if more companies take action—which seems likely given that companies can see the positive effects on their cost of capital. And that could add momentum to Japanese stock returns, providing a further tailwind to their returns, and to diversified international portfolios in general, as Japanese stocks are about 20% of the global ex US market.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)