8 of the Biggest Fund Upgrades of 2024

These funds are on the rise.

Our analysts watch fund fundamentals like hawks. When they see significant improvement, they’ll raise a fund’s rating, and when they see deterioration, they will lower it. Today, I’ll look at some of the biggest upgrades so far in 2024.

We rate three pillars for funds: People, Process, and Parent. The Parent rating is done on a separate timetable from the individual fund ratings, but there’s an interaction between them. Trends in individual fund ratings inform our Parent rating, and changes to that rating often inform our People and Process ratings.

JPMorgan Core Bond PGBOX

We upgraded this fund’s Morningstar Medalist Rating two notches to Silver from Neutral by raising the People and Process ratings to High from Above Average. The fund has proved to be a very quiet but consistent performer. A good year means beating the index by 60 basis points or so. That’s not exciting, but doing that most years results in a nice record.

Lead manager Rick Figuly takes a bottom-up approach using the firm’s deep team of analysts and managers. It’s a very different mindset from the bold macro-driven funds we see at Western Asset or Pimco, but it certainly has its merits.

T. Rowe Price U.S. Large-Cap Core TRULX

We raised this fund’s People rating to Above Average, taking the overall rating to Bronze from Neutral. Manager Shawn Driscoll just passed the two-year mark on this fund, but he had a solid record at T. Rowe Price New Era PRNEX over a longer time frame. Driscoll’s emphasis on high-quality companies trading at modest multiples gives the fund a nice defensive side, as evidenced by its smaller loss in 2022. Driscoll incorporates a macroeconomic view into his portfolio construction, but he’s not likely to stray from the fund’s mild-mannered profile.

Fidelity Floating Rate High Income FFRHX

We raised our Process rating to High on this fund, giving it a Gold rating overall. Lead manager Eric Mollenhauer has done a fine job since taking over in 2013, and newer additions Kevin Nielsen and Chandler Perine have brought more expertise to bear for the $14 billion fund. The fund has gradually moved from the cautious end of the peer group to one with a more typical profile, but it still has mostly BB and B rated debt from fairly liquid issues.

The managers have directed that shift well, and their heft has given them an edge over peers that helps them get better access to the deals they want.

American Funds Mortgage MFAEX

We raised our People rating to High from Above Average as we’ve been impressed by management and its depth of resources. That raised this fund’s rating to Silver. The fund has three seasoned managers working with dedicated mortgage and securitized debt analysts. They adjust the portfolio based on their outlook for interest rates and yield-curve shifts. They’ve succeeded in limiting losses in a hard-hit mortgage sector.

Invesco Diversified Dividend LCEAX

We raised this fund’s Process rating to Above Average from Average, taking its overall rating to Bronze from Neutral. The People Pillar remains Above Average. Lead manager Peter Santoro, who came over from Columbia in 2021, has dialed up the emphasis on cash flows rather than absolute yield, and that has allowed more healthcare and tech stocks into the portfolio. That makes the fund more diversified, which, of course, has helped in the recent growth rally.

Fidelity Capital Appreciation FDCAX

We recently raised this fund’s Process rating to Above Average, and that raised the overall rating to Silver. The fund is run by two equal comanagers, Jason Weiner and Asher Anolic. That’s rather unusual at Fidelity, but it has worked nicely. They begin with the excellent research done by Fidelity analysts and construct mental models to better understand companies. For example, they projected Uber’s UBER business would act as expected by internet models and take market share from Lyft LYFT. This is a middle-of-the-road growth fund that has beaten peers over the managers’ tenure but has lagged the Russell 1000 Growth Index.

Oakmark International Small Cap OAKEX

Foreign small-cap funds are a quirky bunch that tend to have uneven performance. Yet, within that group, this fund stands out as one of the best. We raised the fund’s People rating to High to match its Process rating. That brought the overall rating to Gold. Longtime manager David Herro is still listed as a manager, but he has gradually handed more responsibility to Michael Manelli and Justin Hance. We’ve been impressed by their work in building a fairly focused portfolio of appealing value stocks. They have long favored well-run industrials companies.

Lately, the fund has beaten its benchmark and many peers, but in a rather volatile fashion, so you’ll need a long-term outlook to get the most from the fund.

JPMorgan International Equity JSEAX

We raised this fund’s Process rating to High from Above Average, and that brought the overall rating up to Silver. Tom Murray and the fund’s comanagers build a well-designed portfolio that delivers straightforward core exposure. The fund’s risk-adjusted results have been quite appealing under Murray, and that flows from the emphasis on healthy balance sheets and management quality. The fund has often modestly outperformed its benchmark year to year.

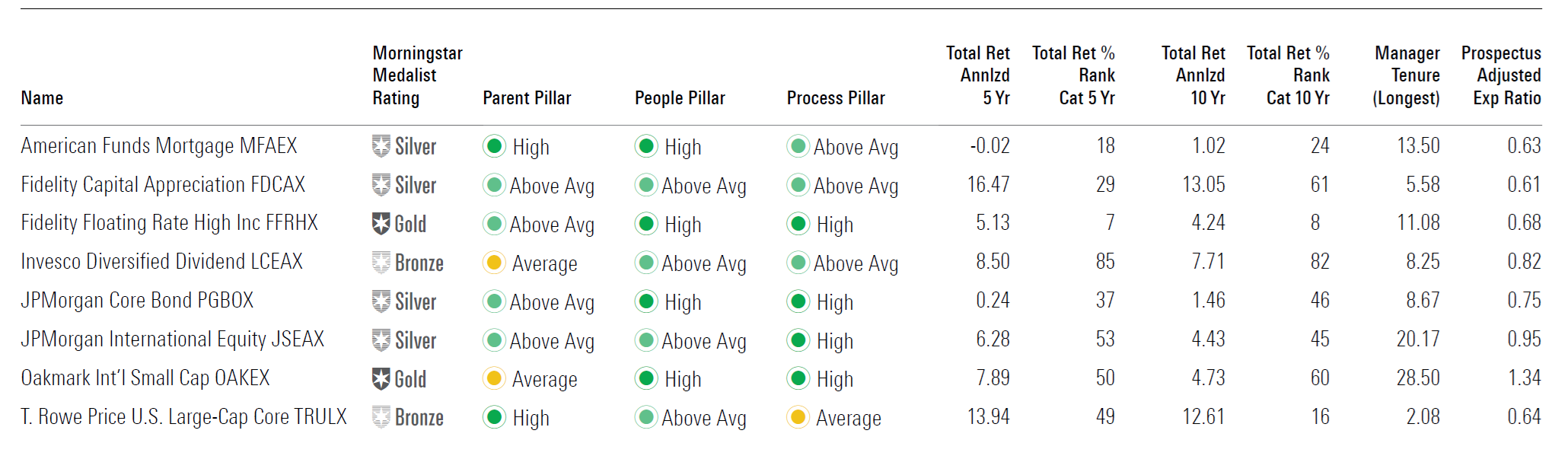

The Year's Biggest Upgrades

This article first appeared in the June 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)