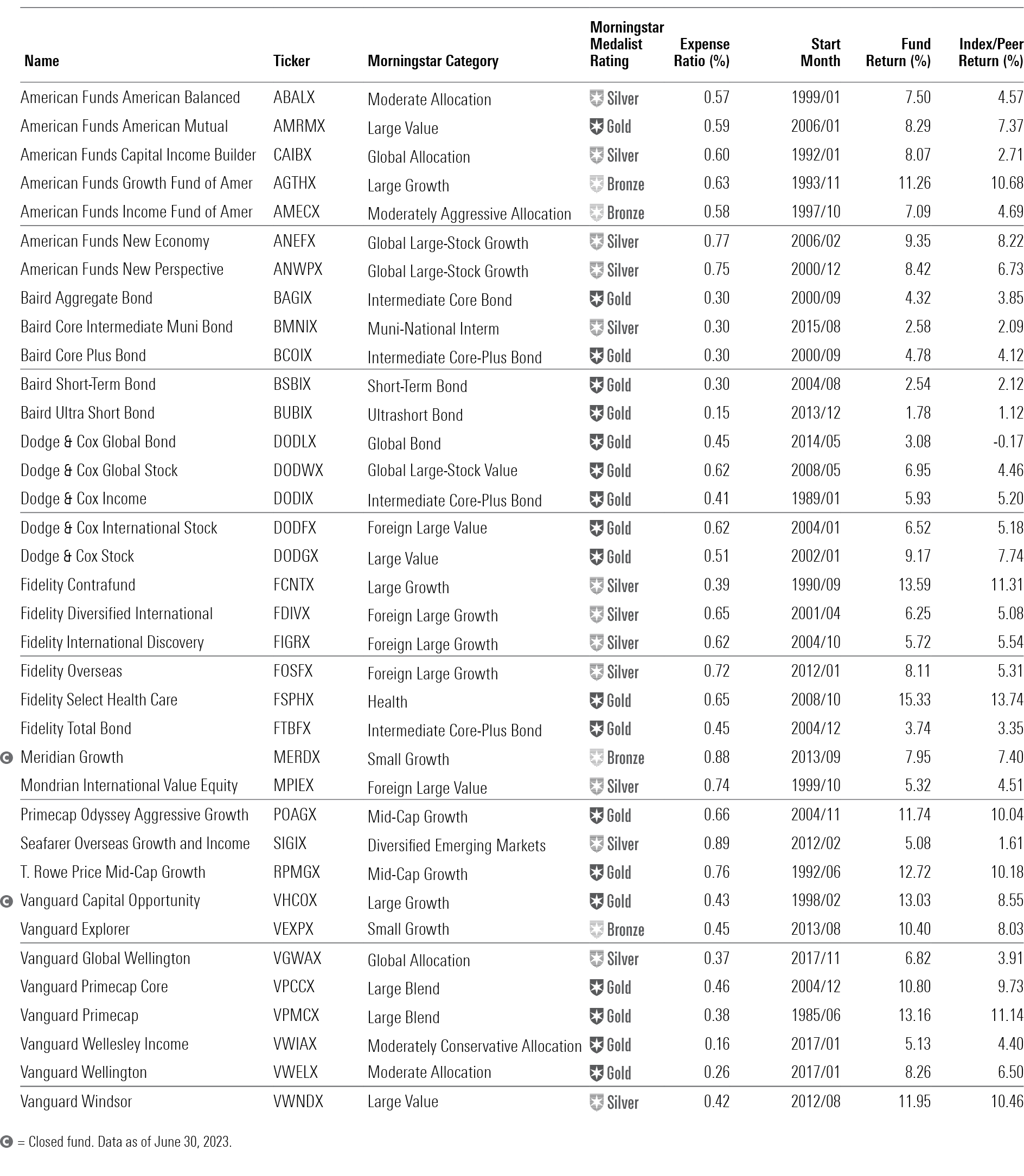

The Thrilling 36

Here are the funds that meet my strict tests.

It’s time once again for our popular Thrilling funds feature. As you may recall, this is a list I generate with some simple, strict screens to narrow a universe of 15,000 fund share classes down to a short list ranging between 25 and 50. It’s purely a screen; I don’t make any additions or subtractions. So, if your favorite fund didn’t make the cut, it is because it failed a test, not because I hate it.

The basic idea: With so many funds out there, you can be choosy. It’s better to be choosy by setting high standards on the most important factors than by screening on a lot of minor data points. I emphasize fees, the Morningstar Medalist Rating, long-term performance, and fund company quality.

I also throw out funds with Morningstar Risk ratings of High because investors have a hard time using the most volatile funds well—they’re hard to hold on to in downturns and tempting to buy after they’ve already rebounded from past lows. The Morningstar Risk measure is relative to peers, meaning there are emerging-markets funds with Low risk ratings and short-term bond funds with High risk ratings. It tells you about relative risk, not absolute risk. Specifically, it tells you about downside volatility over the trailing three, five, and 10 years.

Here are the tests:

• Expense ratio in the Morningstar Category’s cheapest quintile. (I use the prospectus adjusted expense ratio, which includes underlying fund fees but does not include leverage and shorting costs. In addition, I screen out active funds charging less than 10 basis points if those funds are limited to platforms that charge other fees.)

• Manager investment of more than $1 million in the fund (the top rung of the investment ranges reported in SEC filings).

• Morningstar Risk rating lower than High.

• Morningstar Medalist Rating of Bronze or higher.

• Parent Pillar rating better than Average.

• Returns greater than the fund’s category benchmark over the manager’s tenure for a minimum of five years. In the case of allocation funds, I also used category averages because benchmarks are often pure equity or bond and therefore not good tests.

• Must be a share class accessible to individual investors with a minimum investment of no greater than $50,000.

• No funds of funds.

• Funds must be rated by Morningstar analysts.

Subscribers to Morningstar Direct, our institutional fund database, can run these screens for themselves by using our Fantastic Funds notebook. The only difference is that I didn’t screen out institutional share classes. For those who don’t have Morningstar Direct, there’s a simple tool on the Morningstar FundInvestor site that lets you enter a ticker and see how your fund stacks up on the tests.

New to the List

There is remarkably little change from last year’s list. Only six funds joined the list this year, and only two of last year’s funds fell off. Let’s start with the newbies.

Fidelity Diversified International FDIVX

We recently upgraded this fund to Silver from Bronze, but that’s not what made it pop onto the list. Rather it’s that the fund’s prospectus adjusted expense ratio dropped significantly last year to 0.65%, taking it into the cheapest quintile of its category. Poor performance relative to its benchmark in 2022 tipped the performance fee into the penalty zone and thus the lower fee. Performance fees act as pendulums that subtract as much for underperformance as they add for outperformance. The fund has performed well since then, so the fee may rise a bit. Even if it does, though, this fund still has a lot of appeal. Bill Bower is a seasoned manager running a growth-at-a-reasonable-price strategy that’s a pretty steady performer. Over 23 years, Bower has beaten the index by a little more than 100 basis points per year.

Fidelity International Discovery FIGRX

It’s a similar story here. This fund’s prospectus adjusted expense ratio fell from 0.98% in 2022 to 0.65% in 2023 and 0.62% today. That fee cut also led to a Medalist Rating upgrade to Silver from Bronze. Bill Kennedy, who has run the portfolio since 2004, is a big believer in visiting companies in person to understand them and the local economy. Excellent results so far this year also helped to keep this fund ahead of its benchmark over Kennedy’s 20 years at the helm.

Fidelity Overseas FOSFX

This is one of my favorite Fidelity funds. Vincent Montemaggiore runs a unique strategy. As with the other two Fidelity funds, performance fees have cut the fund’s expense ratio to a very appealing level. The strategy emphasizes quality and valuation and has a distinct tilt toward Europe. The Silver-rated fund has 70% of its assets in Europe compared with 46% for the benchmark. The results have been brilliant. Montemaggiore leads the benchmark by more than 300 basis points per year.

Fidelity Total Bond FTBFX

This Gold-rated fund is rated High for People and Process. It’s a fund capable of outperforming in most market environments. Ford O’Neil and Celso Munoz keep duration close to that of the benchmark but shift among Treasuries, mortgages, investment-grade credit, and high yield. Fidelity tackles fixed income with tremendous amounts of technology and analysts so that the managers here have advantages that few can boast of. The managers are working on their sixth year of outperforming the category index.

Vanguard Global Wellington VGWAX

The two-person management team has been on this fund since its November 2017 inception. The fund has an appeal that’s similar to that of Vanguard Wellington VWELX. You have a very cheap fund (0.37% expense ratio) employing a conservative strategy with a 65% equity/35% bond mix. The fund holds 57% of its assets in North America.

Vanguard Wellesley Income VWIAX

This conservative fund is so useful. It’s super cheap and heavily tilted toward bonds so that you get steady income and fairly steady returns. Loren Moran has managed the bond side for seven years, and Matthew Hand has guided the value-leaning equity portfolio since 2022. The fund leads its benchmark over Hand’s tenure and lost much less than the benchmark and peers in 2022. In 2023, the fund’s value tilt held it back. The fund charges only 0.16%, and it has a set 65/35 split in favor of bonds.

Gone From the List

Fidelity Limited Term Bond FJRLX no longer meets the manager investment test, and Vanguard Dividend Growth’s VDIGX longtime manager Donald Kilbride retired at the end of 2023, leaving the fund in the hands of Peter Fisher.

The Rundown on the Big Fund Companies

A few fund companies dominate the list, so I’ll take a minute to run down the central appeal of each.

Stability is a big draw at American Funds. Buy one of these funds today, and you’ll have almost the same fund in 10 or 20 years. The funds stick to their strategies, always have low costs, and boast unique management structures. The firm has an extraordinary depth of managers and analysts, and each manager of a fund runs a sleeve of that fund. Typically, between five and 10 managers run a fund, and a chunk is handed off to analysts. The beauty of that system is that if one or two people retire, that’s only maybe 8% or 16% of the fund.

Baird offers conservatively run bond funds. That’s it. Firms like Pimco and BlackRock get into exotic derivatives, and many others drive up yield by taking on a ton of credit risk. Baird seeks to modestly outperform without taking on more credit or interest-rate risk.

Dodge & Cox delivers straight-up value exposure that you can set your watch to. It conducts deep fundamental research with a long-term focus.

Fidelity brings all the resources that money can buy to bear on top-level securities selection in stocks and bonds. It’s no accident that the firm is riding high now as it goes to great lengths to get the biggest stocks in the market right.

Vanguard brings ultralow costs to active and passive strategies. That means its funds start with an edge over everyone else. The other key is that Vanguard has relationships with elite active managers Primecap and Wellington that have made many of its active funds very rewarding for investors.

The Thrilling 36

This article first appeared in the July 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NPR5K52H6ZFOBAXCTPCEOIQTM4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)