Markets Brief: Return of the Meme Stocks

Plus: US jobs boom, small-cap stocks underperform, and the case for bonds.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Meme stocks have been back in the headlines, as GameStop GME rose 101% and then fell 39% on Friday to finish flat on the week. This followed the firm’s announcement of a 29% decline in year-over-year sales and its second capital raising in a month. While capital markets are designed to enable investment, they are often used for speculation, and investors can confuse the two.

The essential difference is that investment is always focused on the long term, is supported by research, and enjoys a positive expected return. Speculation is any activity that does not comply with those rules. To understand why we get drawn into speculation and how to avoid it, check out this article by Morningstar behavioral scientist Danielle Labotka.

Small-Cap Stocks Struggle

The price of US equities rose sharply, with the Morningstar US Market Index up 1.06% over the week. The path of larger, growth-oriented companies differed sharply from smaller, value-orientated companies, as evidenced by the Morningstar Small Value Index, which fell 2.88%. In such an environment, it is worth digging deeper into the opportunities provided by a market. Morningstar’s new sector pages can help you do this.

US Jobs Boom

Friday’s US employment report showed higher growth than expected, with 272,000 new jobs created in May. While commentators made much of this and its impact on the path of interest rates, investors were unfazed. The CME FedWatch tool shows that expectations around interest rates were virtually unchanged over the week. This commentary from Philip Straehl, Morningstar Wealth’s chief investment officer for the Americas, puts the results in a longer-term investing context.

Don’t Ignore Bonds

In contrast to equities, core bond prices have changed little this year, as investors wavered over the economy and interest rates. Following falling prices, this lackluster outcome can encourage investors to ignore this asset class. However, with higher yields and lower inflation, it is a good time to consider the contrarian view. Danny Noonan presents the case for bonds.

All Eyes on the Fed This Week

Market commentators will focus firmly on the Federal Reserve Open Market Committee meeting this week. While few expect any change in interest rates, Chair Jerome Powell’s comments at the subsequent press conference will be parsed for any hint of the central bank’s plans. Reading tea leaves can be entertaining but is unlikely to yield useful information. For those serious about reaching their financial goals, patience, independent thought, and fundamental research remain the best virtues for success.

Highlights of This Week’s Market and Investing Events

- Tuesday, June 11: Earnings from Oracle ORCL

- Wednesday, June 12: May Consumer Price Index report, June Federal Open Market Committee meeting, earnings from Broadcom AVGO

- Thursday, June 13: May Producer Price Index report, earnings from Adobe ADBE

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended June 7

- The Morningstar US Market Index rose 1.03%.

- The best-performing sectors were technology, up 3.45%, and healthcare, up 1.93%.

- The worst-performing sector was utilities, down 3.88%.

- Yields on 10-year US Treasury notes fell to 4.43% from 4.51%.

- West Texas Intermediate crude prices fell 4.69% to $75.26 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 249, or 36%, were up, five were unchanged, and 449, or 64%, were down.

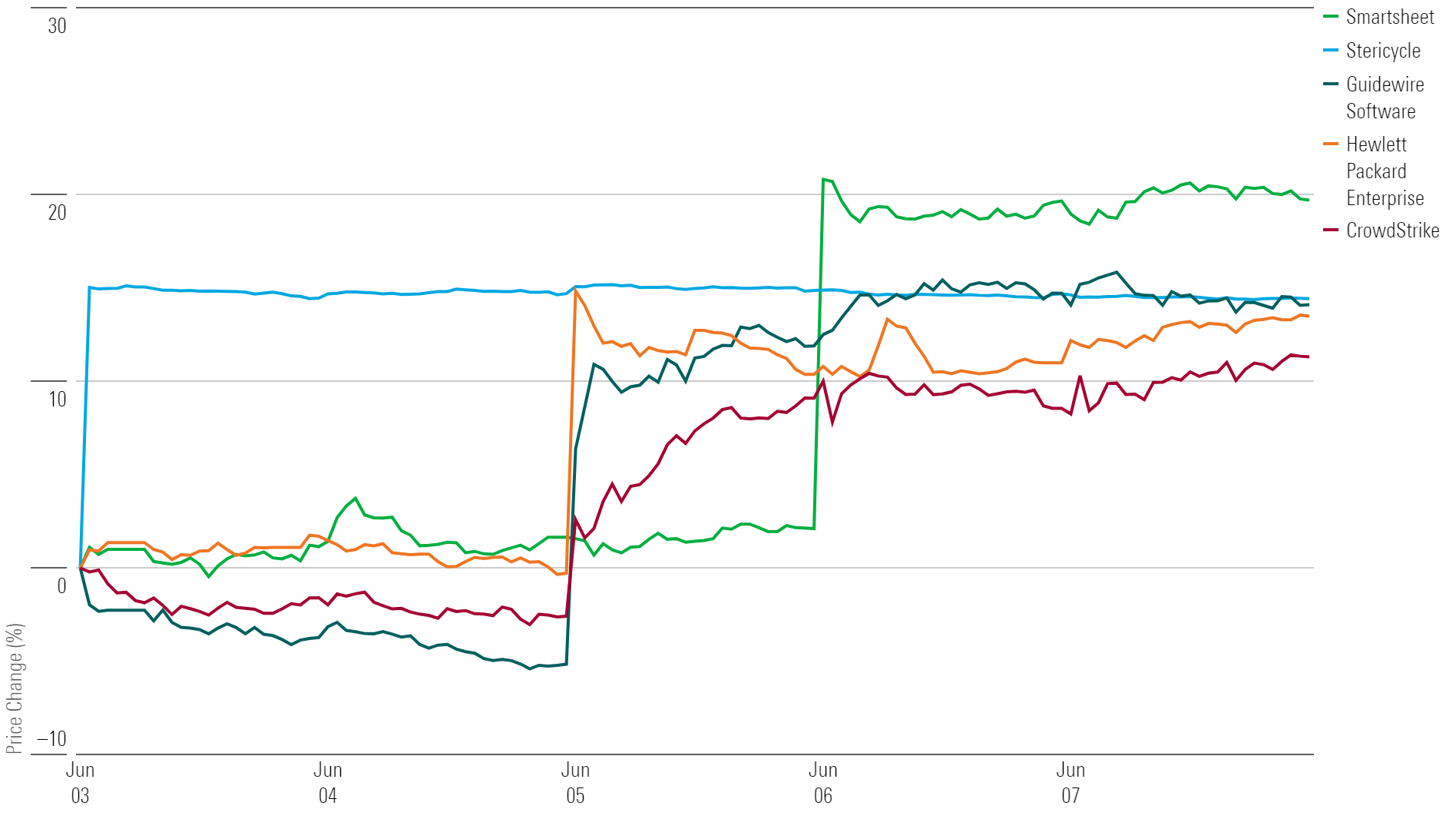

What Stocks Are Up?

Smartsheet SMAR, Stericycle SRCL, Guidewire Software GWRE, Hewlett Packard Enterprise HPE, and CrowdStrike Holdings CRWD.

Best-Performing Stocks of the Week

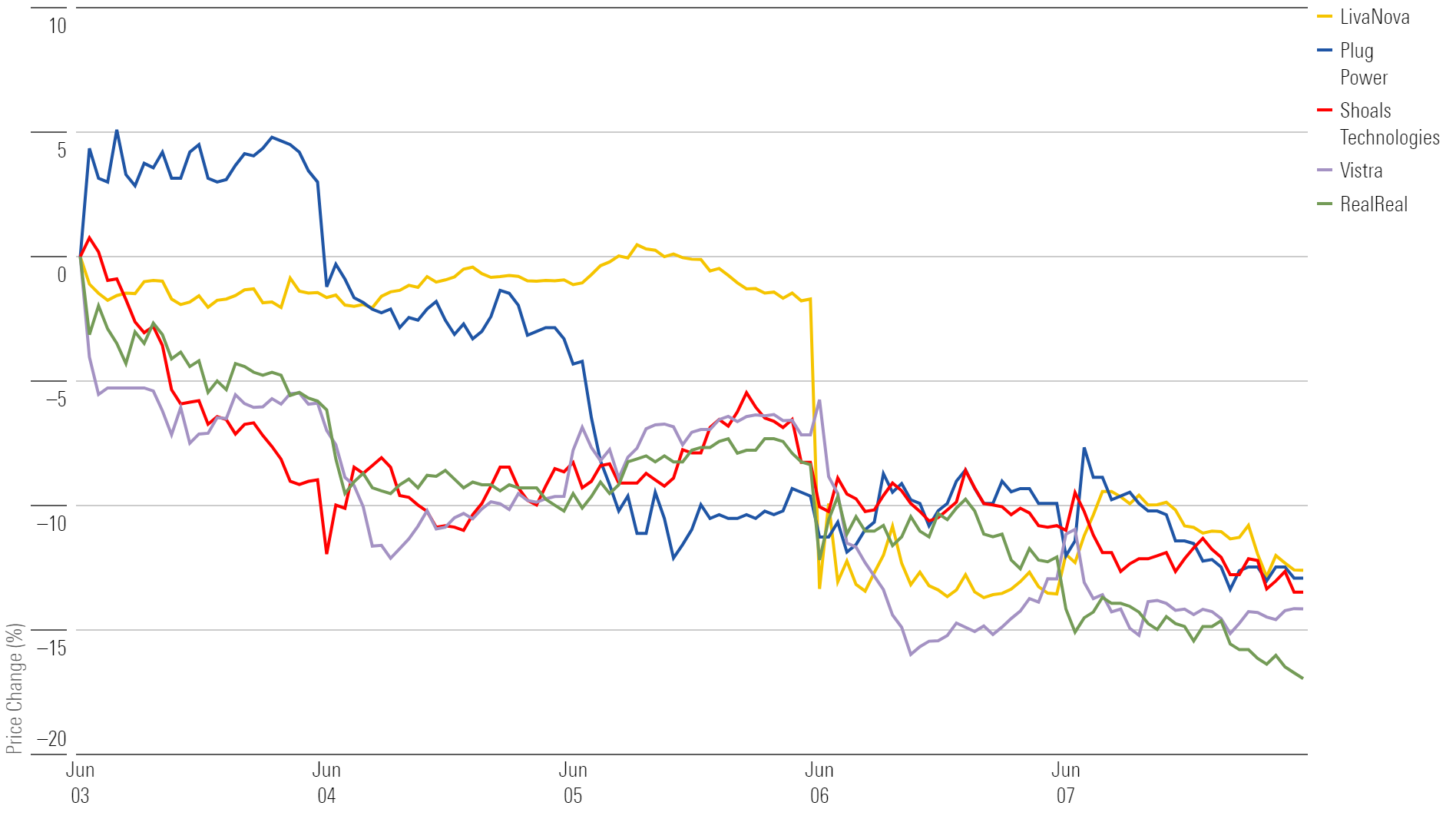

What Stocks Are Down?

The RealReal REAL, Vistra VST, Shoals Technologies SHLS, Plug Power PLUG, and LivaNova LIVN.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-24-2024/t_02e621614b3b42078e17000bf20c9bf2_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)