Markets Brief: Four Stocks Made Up 80% of the Gains. Can It Last?

Plus: When to expect a rate cut, Musk’s payday, and more Fed talk.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Last week, the latest inflation data and the Federal Reserve’s decision to leave interest rates unchanged dominated conversation among market participants. Subsequent commentary fueled investor optimism and increased expectations of more than one interest rate cut this year, according to the CME FedWatch tool. You can read about how Morningstar Wealth portfolio managers are incorporating this news into their decisions and how this fits into a broader economic context.

Equity Market Gains Are Very Narrow

Although the Morningstar US Market Index rose sharply (1.44%) over the week, these gains were unusually concentrated, with only the technology, communication services, consumer cyclical, and real estate sectors making gains. Technology was the key driver of the overall market return, rising 5.8%. Nvidia NVDA, Apple AAPL, Microsoft MSFT, and Broadcom AVGO accounted for approximately 80% of that gain.

The breadth (or narrowness) of contributors to market movements is often a gauge of the sustainability of the current price trends, with narrow market leadership seen as an indication of a future reversal. While following such predictions can often lead to disappointment, diversification in these trends provides opportunities for those willing to undertake research, think independently, and focus on the long term.

Musk’s Big Payday

One big surprise last week was Tesla TSLA shareholders acquiescing to the circa $50 billion compensation package for Elon Musk, designed to address the perceived risk that he may lose interest in a company where he currently has an investment of $100 billion. The belief in an individual’s ability to provide sufficient value to overcome such a high cost is reminiscent of the investment industry’s “star fund manager” culture at the start of the century. This climate was undone by passive investment firms like Vanguard, which demonstrated the importance of minimizing costs. Vanguard’s support of Musk in this latest vote is a fascinating reminder that costs migrate with changing fashions, and investors must remain vigilant.

The Week Ahead: More Talk

Comments from Fed officials will likely dominate the week to come. While such comments are typically watched carefully in the hope of understanding future Fed policy, investors’ current consensus will not be easily dislodged. A strong consensus can push prices far from their fair value, requiring unusual patience from those with a long-term, valuation-driven approach. However, the market consensus often feels strongest when a change is underway.

Highlights of This Week’s Market and Investing Events

- Tuesday, June 18: May Retail Sales

- Wednesday, June 19: Markets closed in observance of Juneteenth National Independence Day

- Friday, June 21: June Purchasing Managers Index Composite

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended June 14

- The Morningstar US Market Index rose 1.40%.

- The best-performing sectors were technology, up 5.79%, and real estate, up 1.02%.

- The worst-performing sector was energy, down 2.10%.

- Yields on 10-year US Treasury notes fell to 4.20% from 4.43%

- West Texas Intermediate crude prices rose 3.85% to $78.44 per barrel.

- Of the 702 US-listed companies covered by Morningstar, 242, or 34%, were up, 1 was unchanged, and 459, or 65%, were down.

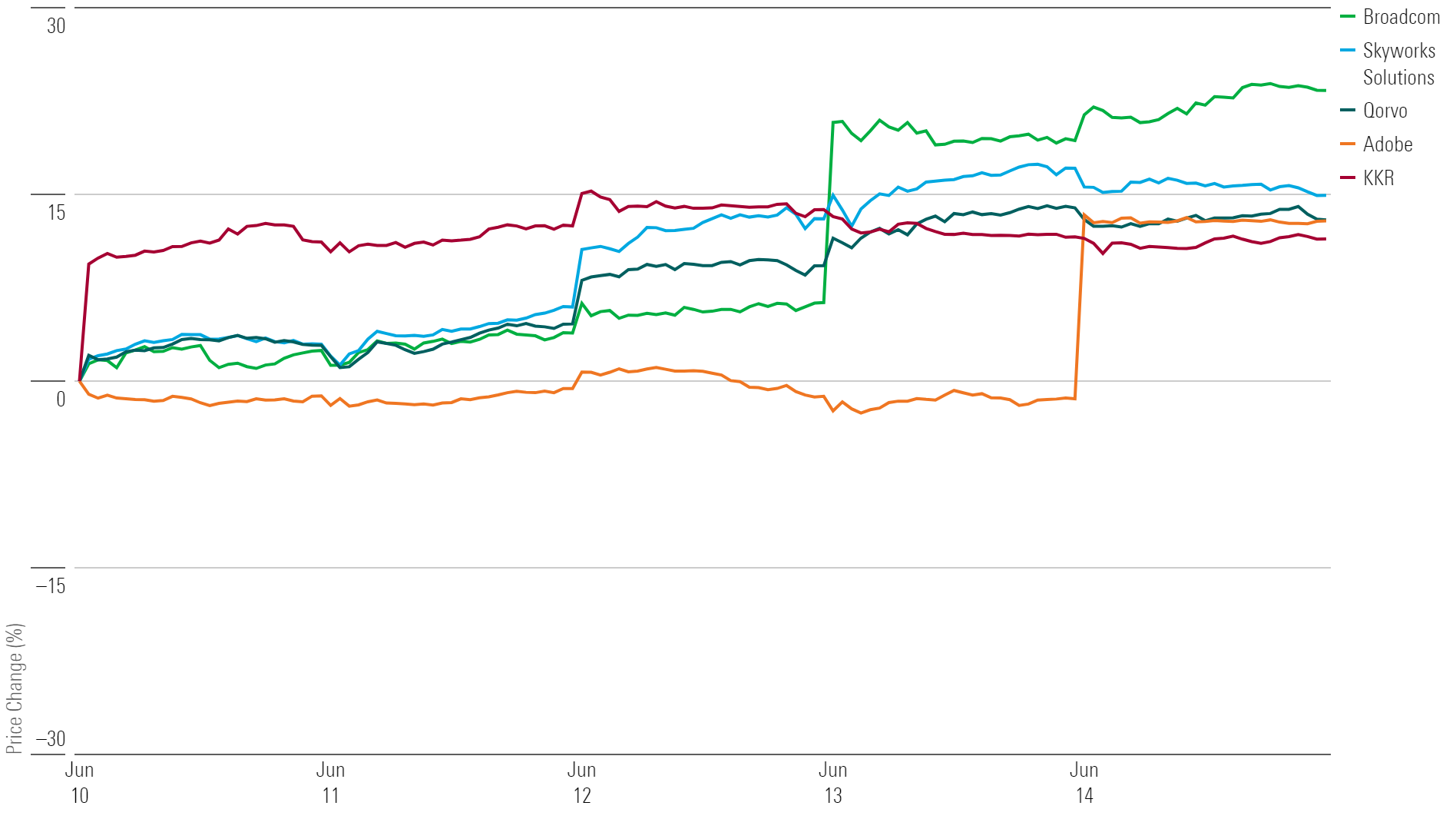

What Stocks Are Up?

Broadcom AVGO, Skyworks Solutions SWKS, Qorvo QRVO, Adobe ADBE, and KKR KKR.

Best-Performing Stocks of the Week

What Stocks Are Down?

Celsius Holdings CELH, RingCentral RNG, Arcadium Lithium ALTM, Uniti Group UNIT, SunPower SPWR.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-24-2024/t_02e621614b3b42078e17000bf20c9bf2_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)