Q3 2024 Stock Market Outlook: Is the AI Stock Trade Over?

Themes that have driven the market appear to be nearing an end.

Key takeaways:

- US stock market at a 3% premium, not yet overvalued, but getting stretched

- We doubt what’s worked for the past one and a half years, will be what continues to work in the future

- Value category and small caps remain most undervalued, shifting core category to underweight

3Q 2024 US Market Outlook and Valuation

Through June 24, the Morningstar US Market Index, our proxy for the broad US equity market, rose 3.20% quarter to date. Year to date, the Morningstar US Market Index has risen 13.77%.

While the broad market index was able to post a healthy gain thus far in the second quarter, it was only able to do so on the back of concentrated gains in stocks tied to artificial intelligence. An attribution analysis reveals that without the gains from Nvidia, Apple, Microsoft, Alphabet, and Broadcom, the broad market index would have fallen thus far this quarter.

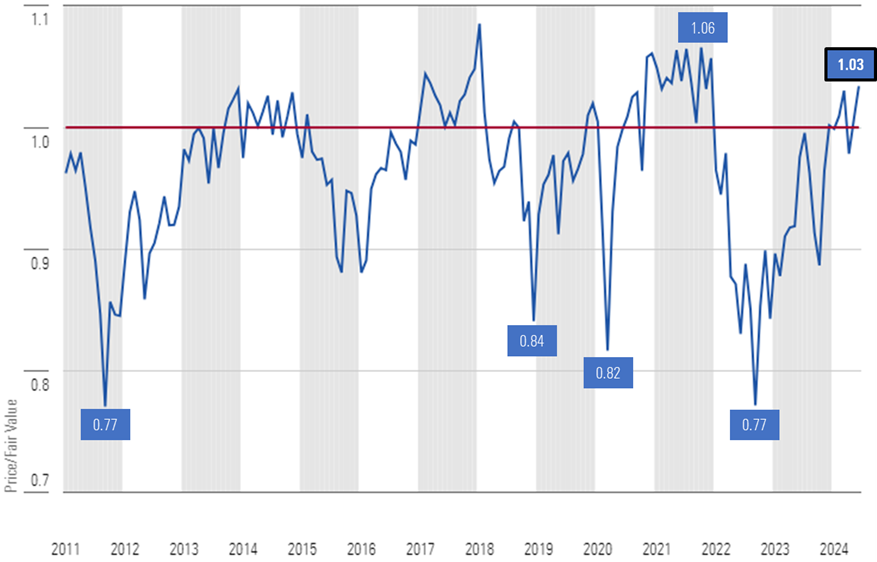

As of June 24, the price/fair value of the US stock market rose to 1.03, representing a 3% premium to our fair value estimates. While the market valuation is not yet in overvalued territory, this places it near the top end of the fair value range. In fact, since the end of 2010, the market has traded at this much of a premium, or more, only 10% of the time.

Price/Fair Value of Morningstar's US Equity Research Coverage at Month-End

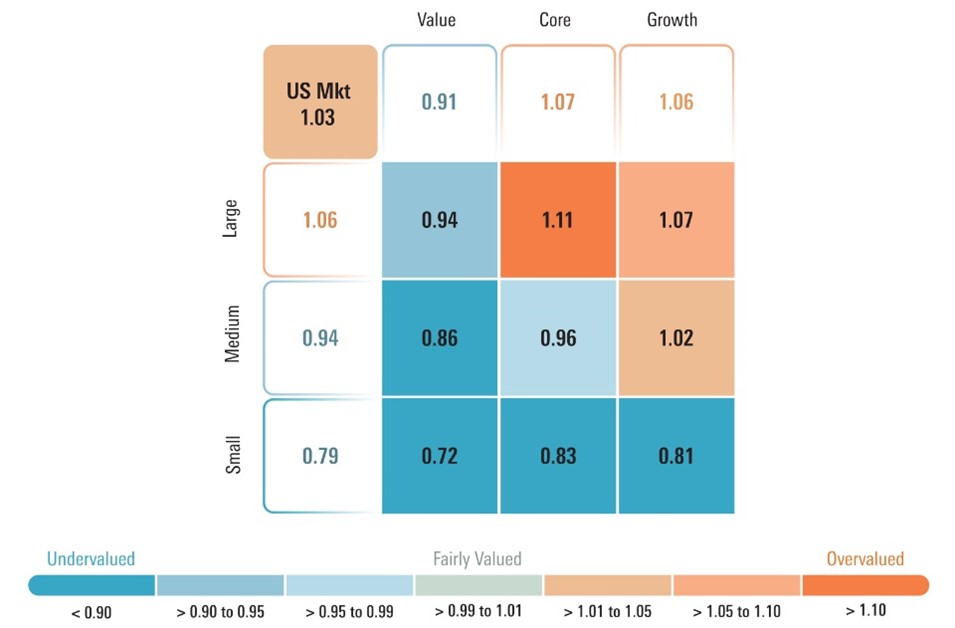

Anything related to artificial intelligence continued to surge in the second quarter. These stocks are largely held within the Morningstar US Growth Index and in the case of Alphabet, Meta Platforms, and Broadcom are contained in the Morningstar US Core Index. Both of these indexes have well outperformed the Morningstar US Value Index. However, based on our valuations, we suspect that the preponderance of this outperformance is behind us. As of June 24, growth stocks are trading at a 6% premium to a composite of our stock coverage and core stocks are trading at a 7% premium, whereas value stocks remain attractively priced at a 9% discount to our valuations.

While a rising tide can lift overvalued AI stocks even further into overvalued territory in the short term, in the future we think long-term investors will be better off paring down positions in growth and core stocks, which are becoming overextended, and reinvesting those proceeds into value stocks, which trade at an attractive margin of safety.

Price/Fair Value by Morningstar Style Box Category

Based on these valuations, as compared with our Q2 US Stock Market Outlook, we now advocate for moving to an underweight in the core category following its second-quarter outperformance as compared with our prior market weight. We continue to advocate an overweight in value and underweight in growth. By capitalization, we continue to advocate for an underweight position in large-cap stocks in favor of overweighting small-cap stocks and a slight overweighting in mid-cap stocks.

Where To Go From Here?

While the broad market appears to be getting frothy, much of the overvaluation is concentrated in a few thematic, mega-cap stocks. For example, if we exclude Nvidia, Meta Platforms, and Apple from our valuation calculation, the premium drops to 1% from 3%. While not tied to AI, excluding Eli Lilly (which has run up well into 1-star territory on its weight-loss drugs) from the calculation, it brings the index down to fair value.

Considering that AI stocks are generally at best fairly valued and at worst overvalued, we see much better opportunities elsewhere in the market, specifically in the value category, which remains the most undervalued according to our valuations, as well as down in capitalization into small-cap stocks.

While we may have been a little early on the call to start moving into contrarian plays last quarter, we continue to see the best opportunities among those sectors and stocks that have underperformed, are unloved, and—most importantly—undervalued. These contrarian plays are often “story stocks,” which are typically situations such as emerging turnarounds or other catalysts that may have greater short-term risk, require a greater amount of analysis, and often take time for the story to work out.

Shifting From Thematic to Idiosyncratic

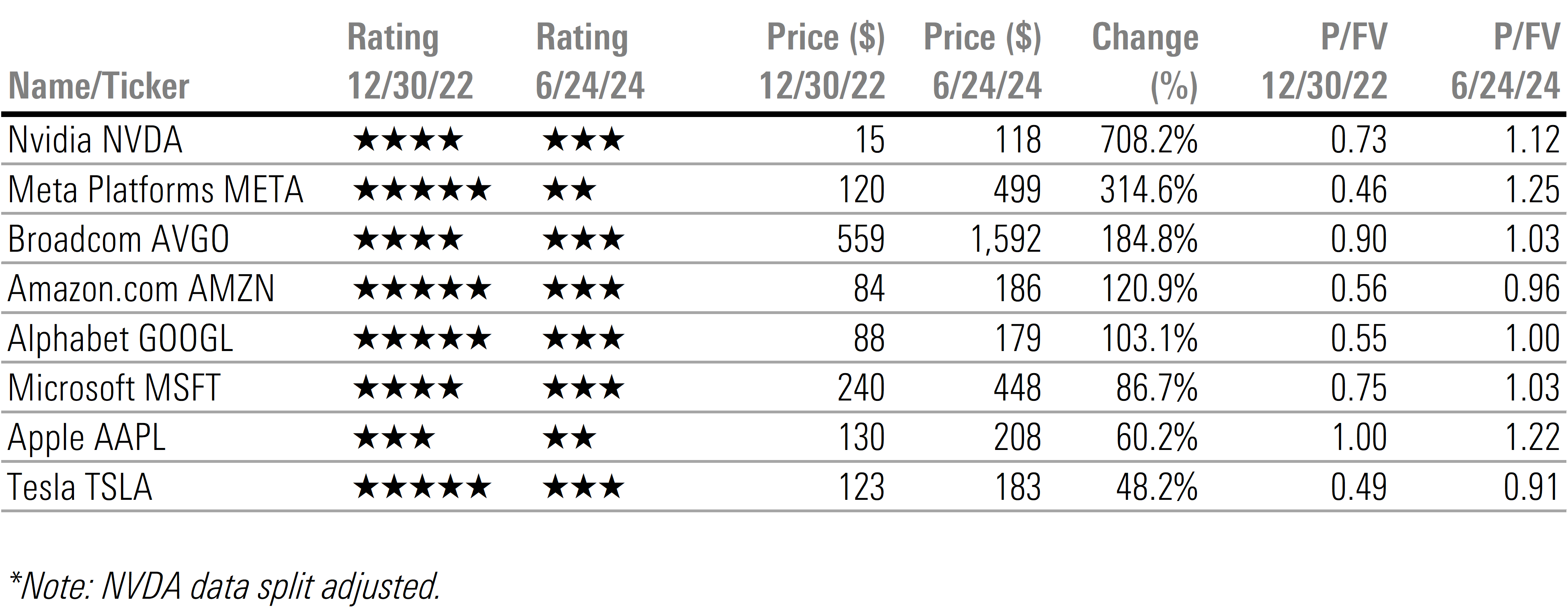

In our 2023 US Stock Market Outlook, we noted that the broad market was trading at a deep discount to our valuations, especially growth stocks, and in particular, the communication and technology sectors were among the most undervalued sectors. In our Stocks for 2023 section, many of those stocks tied to artificial intelligence were rated 4 or 5 stars. Fast-forward to one and a half years later, these same stocks tied to AI are now at best fully valued, or at worst overvalued.

Performance of Selected AI-Related Stocks

Based on these valuations, as well as those stocks closely tied to both the AI and weight-loss drug themes, we think it is unlikely that what’s worked for the past one and a half years, will be what continues to work in the future.

Opportunities Across Undervalued Sectors and Stocks

Morningstar Price/Fair Value by Sector

Real Estate

No sector is hated as much by Wall Street than real estate. Yet, this negative sentiment is also why we see numerous opportunities among REITs that invest in real estate with defensive characteristics, which have traded off in conjunction with urban office space. For example, 5-star-rated Healthpeak DOC and 4-star-rated Ventas VTR invest across a diversified range of healthcare assets including medical offices, life sciences research facilities, senior housing, and hospitals. Realty Income O, rated 5 stars, owns roughly 13,400 properties, most of which are freestanding, single-tenant, triple-net-leased retail properties. A large percentage of their tenants are in defensive industries such as grocery, convenience, dollar, and home improvement stores.

Energy

Over the long-term, we expect oil prices to decline, as our midcycle forecast for West Texas Intermediate crude is $55/barrel. Yet, even with that bearish forecast compared with today’s $80/barrel price, we see value among much of the energy sector, which trades at a 7% discount to our fair valuations. We also think exposure to the energy sector provides a good, natural hedge to portfolios to hedge against rising geopolitical risk and if inflation were to stay higher for longer.

Among the global major oil producers, 4-star-rated Exxon XOM is our preferred integrated oil company, given its earnings-growth potential from a combination of high-quality asset additions and cost savings. For investors looking for domestic producers, we highlight 4-star-rated Devon. For investors with a higher risk tolerance, we suggest looking at APA APA, which could have significant upside from a potential play in Suriname. The evidence to date suggests a very large petroleum system that could be transformative for the company. At this point, we think it is very likely that one or more of the discoveries will progress to the development stage, though none have been officially sanctioned yet. A final investment decision for Suriname is planned by the end of 2024 with the first oil in 2028.

Basic Materials

As economic growth slows, the basic materials sector has fallen out of favor and is now trading at a 5% discount to fair value. Within this sector, we see value in select gold miners and agricultural chemicals. Gold miners such as 4-star-rated Newmont Mining NEM trade at a deep discount to our fair value, even though we have a relatively bearish view on the long-term price of gold. If gold prices stay elevated or move higher, we think there is a lot of upside leverage. Crop chemical producers, such as 5-star-rated FMC, fell throughout 2023. The agricultural industry overordered too much product in 2021-22 due to supply constraints and shipping bottlenecks. As a result, sales were constrained in 2023 as those excess inventories were used up. We think the supply/demand dynamics will normalize this year, and therefore we see opportunity in undervalued crop chemical producers.

Where to Be Wary: Sectors Trading at Premiums to our Fair Values

Technology

The technology sector has a long history of swinging between boom and bust. Right now, we are in the boom stage, where valuations are becoming increasingly stretched as the surge from artificial intelligence has propelled these stocks higher and pushed the sector to a 10% premium to our valuations.

At this point, we look at technology stocks as generally divided into three buckets: AI and cloud, traditional technology, and legacy technology.

AI and cloud is where we see the highest growth and positive long-term secular trends, yet at this point, these stocks are generally fully valued to overvalued.

The area we find undervalued opportunities in is the traditional technology stocks. These stocks include industries such as semiconductors, software, and services.

Among the semiconductors, we just upgraded our Morningstar Economic Moat Rating on 5-star-rated NXP Semiconductors NXPI to wide from narrow. Among software, we see value in 4-star-rated Adobe ADBE, which trades at a 14% discount. Within the services area, we see positive long-term secular trends in cybersecurity, of which our current pick is 4-star-rated Fortinet FTNT.

Legacy technology includes those stocks that we think have their best days behind them. This includes stocks such as 2-star-rated International Business Machines IBM, which trades at a 23% premium to our fair value and 2-star-rated HP HPE, which trades at a 12% premium.

Consumer Defensive

The consumer defensive sector is currently trading at an 8% premium to our fair value. To some degree, valuations in the sector are barbell-shaped with several large-cap stocks, such as 1-star-rated Costco COST and 2-star-rated Procter & Gamble PG, which are trading well above our intrinsic valuations. While we rate Costco with a wide moat and a Morningstar Uncertainty Rating of Medium, the stock trades at an eye-popping 50 times forward earnings.

The area we see the best value is among the packaged food companies. These companies have been under pressure the past few years as they have struggled to raise prices as fast as their own costs. As inflation moderates, we expect they will be able to raise their operating margins back toward historical averages as price increases and efficiencies improve. Two such examples include 5-star-rated Kraft Heinz KHC, of which we just increased its moat rating to narrow this past quarter and raised our fair value, and 4-star-rated Kellanova K.

Industrials

The industrials sector is trading at a 6% premium to our valuations. In our view, industrials should remain underweighted in portfolios, especially the transportation names that are the most overvalued. For example, 2-star-rated Southwest Airlines LUV and United Airlines UAL, which trade at 50% and 38% premiums, respectively, remain some of the most overvalued names across our coverage. In addition, 2-star stocks such as XPO Logistics XPO and Saia SAIA remain at high premiums of 28% and 24%, respectively. One of the few areas where we see undervalued stocks in the sector include the aerospace and defense contractors such as 5-star Huntington Ingalls HII and 4-star-rated Northrop Grumman NOC.

Stock Selection for Sectors Trading Near Fair Value

Consumer Cyclical

Investors will need to be adroit in their stock-picking across the consumer cyclical sector. Several anecdotes from first-quarter earnings reports may be the canary in the coal mine, indicating that the compound impact from two years of high inflation is weighing on the middle-income consumers.

For example, Starbucks SBUX reported a 7% decrease in foot traffic across its stores, McDonalds MCD reported relatively weak results, and Nike NKE shares dropped precipitously after it guided to a mid-single-digit percentage sales decline for fiscal 2025. On the flip side of the coin, discounter Walmart WMT reported an increase in comparable sales, driven entirely by traffic growth.

Middle-income consumers were originally able to offset high inflation over the past two years by using excess savings from the pandemic, but those savings appear to be used up. They have also eaten into their savings rate, but savings rates are already lower than prepandemic levels. We are seeing consumers pull back on those items that are considered indulgent as well as other discretionary items whose purchases can be delayed. However, other areas such as travel, where consumers have already bought or booked tickets and have set aside funds to pay for their summer vacations, remain steady.

Financial Services

A little over a year ago, Silicon Valley Bank failed and stocks across the entire regional bank industry plummeted. While we lowered our fair value on a number of these stocks, market prices fell further and faster. One year later, most of these stocks have regained much of their value, yet this is still where we see the best valuation as the mega banks are fully valued to overvalued. Among the regional banks, we continue to see value in 4-star-rated US Bank USB, which trades at a 25% discount to fair value. US Bank is the only regional bank we rate with a wide economic moat.

Communications

The valuation of the communication sector is skewed upward by 3-star-rated Alphabet and 2-star-rated Meta Platforms, as those stocks account for 44% and 24% of the Morningstar US Communications Services Index, respectively.

Within the sector, we see the best value among traditional communication names. For example, AT&T T and Verizon VZ are two 4-star-rated stocks that trade at close to 20% discounts to our valuation and whose dividend yields both yield near 6%. Among the media names, Comcast CMCSA is rated 5 stars, trades at a 30% discount to fair value, and its dividend yield is 3.2%.

Healthcare

The overall valuation of the healthcare sector has been skewed higher by the performance of Eli Lilly LLY on the back of its weight-loss drugs. Eli Lilly, rated 1 star, trades at a 68% premium to fair value, making it one of the most overvalued stocks across our coverage. Elsewhere within the healthcare sector, we are seeing a number of stocks that rarely have traded at much of a discount, such as Johnson & Johnson JNJ, slip into 4-star territory. Within healthcare we prefer stocks, such as 5-star-rated Zimmer Biomet ZBH and 4-star-rated Medtronic MDT. These are stocks that not only trade at a discount to our fair values and have long-term durable competitive advantages but also are tied to the long-term secular trend of the aging baby boomer generation.

Utilities

Obvious plays on the rapid growth of AI have already run up to levels that we think are fully valued to overvalued. As such, investors have been looking for other ways to play this growth. Recently we have seen an increase in the number of stories that make the case that the utility sector will benefit from the heightened demand for electricity. We agree with this thesis, as AI computing requires multiple times more electricity to power its semiconductors than traditional computing. In fact, in our 4Q 2023 US Market Outlook, we highlighted that the utility sector was trading at valuation levels that were near their lowest levels over the past decade, yet we noted that fundamentally the outlook for the sector was as strong as we had ever seen it. At that point, we had already incorporated into our forecasts that the amount of electricity demand growth from data centers would increase a cumulative 46% through 2032.

However, in our view, if you are just buying utilities today to play this theme, you are already nine months late to the game. Since the utility sector bottomed out on Oct. 2, the Morningstar US Utility Index has risen 28% through June 24.

One utilities stock that has lagged the sector but has upside leverage tied to AI electric demand, is 4-star-rated WEC Energy Group WEC. There are several data centers in development in Wisconsin, with Microsoft the most recent to announce its plans to build a data center in southeast Wisconsin. WEC trades at an 18% discount to our fair value estimate and yields approximately 4.3%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MMHQLYAKXBAGNG7XEYXPX4Y4S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OBA7UVI75RGFDOHGJTZ2FK542Q.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)