Where We See Opportunities in June as Stocks Recover Losses

Can’t keep a good market down: Stocks recover April losses.

Key Takeaways:

- Value and small-cap stocks remain most attractively priced for long-term investors.

- Real estate, energy, and consumer cyclicals are the most undervalued sectors.

- Expect Fed to cut in September and the yield curve to shift down.

Can’t Keep a Good Market Down

Following a brief retreat in April, markets bounced right back in May. The Morningstar US Market Index, our proxy for the broad US equity market, rose 4.72%, offsetting the 4.30% decline in April. Year to date through May 31, the Morningstar US Market Index has risen 10.48%.

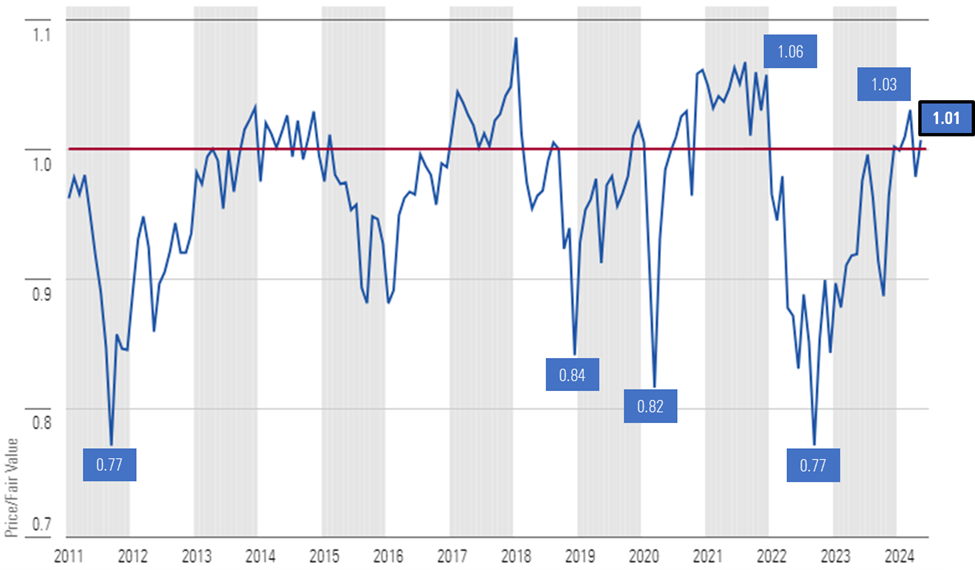

Following this rally, as of May 31, the price/fair value of the US stock market rose to 1.01 after hitting 0.98 at the end of April.

Price/Fair Value of Morningstar's US Equity Research Coverage at Month-End

As the markets consolidate around fair value, we have found fewer dislocations in sector level valuations and undervalued opportunities for investors. In this period of consolidation, for investors to outperform the market, we think they will need to look to contrarian investment opportunities, especially in those areas that have underperformed, are unloved—and most importantly—undervalued. These contrarian plays are often “story stocks,” which are typically situations such as emerging turnarounds or other catalysts that may have greater short-term risk, require a greater amount of analysis, and often take time for the story to work out.

One such “story stock” is International Flavors & Fragrances IFF. Over past few years, International Flavors & Fragrances has suffered from both self-inflicted wounds as well as industry volatility from the pandemic. From the perspective of self-inflicted issues, the company has made a number of acquisitions that have not turned out as planned and is now divesting some business lines to focus on its core competencies. From an industry perspective, the pandemic led to volatility in customer ordering patterns in which customers over-ordered in 2021 and 2022 due to excess demand from the pandemic and in response to shipping/supply chain bottlenecks. These same customers slashed orders in 2023 as they used up excess inventory. We expect that this destocking is coming to an end in 2024 and expect modest growth this year and a normalized growth pattern in 2025.

Growth Stocks Recover

By style, the growth category rose the most in May, rising 4.59%, followed by value at 3.79%, and then core at 3.17%. By capitalization, large-cap stocks once again took the lead, rising 5.43%, followed by small-cap stocks at 4.24%, and then mid-cap at 2.40%.

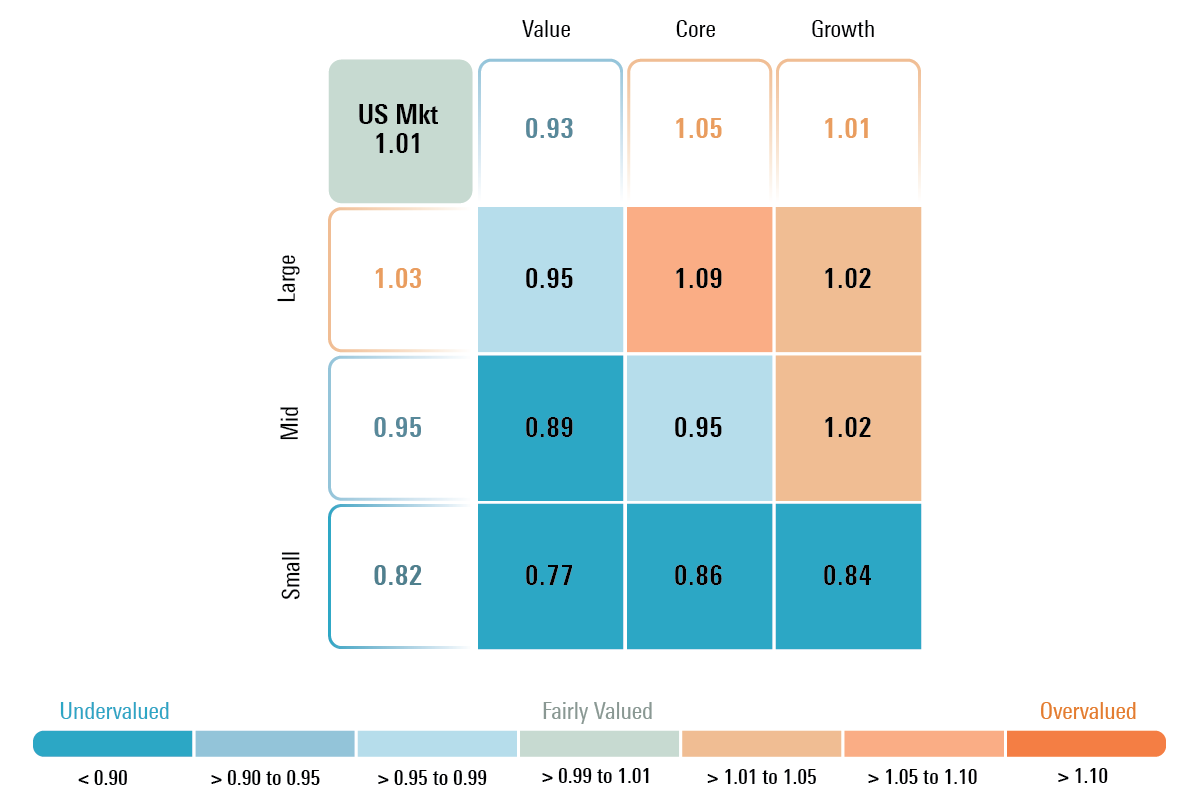

The value category remains the most attractive, trading at a 7% discount to fair value. Growth stocks trade at the broad market average with a 1% premium, and core stocks remain most overvalued at a 5% premium.

By capitalization, small-cap stocks remain the most attractive at an 18% discount, followed by mid-caps at a 5% discount, while large caps are slightly above fair value, trading at a 3% premium to a composite of our fair values.

Based on these valuations, we recommend an overweight position in value, an underweight in core, and market weight in growth. By capitalization, we advocate for an underweight position in large-cap stocks in favor of overweighting small-cap stocks and a slight overweighting in mid-cap stocks.

Price/Fair Value by Morningstar Style Box Category

Utilities Surge, Tech Trounces, and Communications Gains

The three best-performing sectors in May were led by utilities, which surged 8.64%, followed closely by technology, which rose 8.47%, and communications, which increased 6.28%.

Obvious plays on the rapid growth of artificial intelligence have already run up to levels that we think are fully valued to overvalued. As such, investors have been looking for other ways to play this growth. Recently, we have seen an increase in the number of stories that make the case that the utilities sector will benefit from the heightened demand for electricity. We agree with this thesis, as AI computing requires multiple times more electricity to power its semiconductors than traditional computing. However, in our view, if you are just buying utilities today to play this theme, you are already eight months late to the game. Since the utilities sector bottomed out on Oct. 2, the Morningstar US Utilities Index has risen 32%.

In our 4Q 2023 US Market Outlook, we highlighted that the utilities sector was trading at valuation levels that were near their lowest over the past decade, yet we noted that fundamentally the outlook for the sector was as strong as we had ever seen it. At that point, we had already incorporated into our forecasts that the amount of electricity demand growth from data centers would increase a cumulative 46% through 2032.

While we still see a number of attractive stocks in the utilities sector, such as 4-star-rated Entergy ETR and NiSource NI, following the rally in May, the utilities sector as a whole is now trading at a 4% premium from fair value. Following this rally, while the sector is not yet trading in overvalued territory, it is feeling stretched, and we would recommend a market-weight position.

After registering as the second-worst-performing sector in April, technology was the second-best-performing sector in May. We had recommended moving to a market weight from underweight last month and recommend maintaining that market weight. Within the technology sector, all eyes were focused on Nvidia’s NVDA earnings report in May, and Nvidia did not disappoint. We ratcheted up our fair value to $1,050 as we modeled in stronger data center revenue growth over the next several quarters while maintaining our longer-term growth rates. Over the next four to six quarters, we expect that heightened demand for Nvidia’s artificial intelligence GPUs will well outstrip supply. Looking forward, we recommend investors keep a close eye on Nvidia’s largest cloud customers. Once those customers begin to start slowing their capital-expenditure spending, that may be an early indication that Nvidia’s growth rate has likely peaked.

Meta Platforms META and Alphabet GOOGL led the way higher within the communications sector as these two stocks accounted for 78% of the sector’s return in May. The communications sector trades at a 2% discount to fair value, but in our view, the best opportunities lie among the traditional communications providers. Meta is currently rated 2 stars as its stock trades at a 17% premium to our valuation, and Alphabet is rated 3 stars as it only trades at a slight discount. We see much better value in AT&T T or Verizon VZ, two 4-star-rated stocks that trade at over 20% discounts to our valuation and whose dividend yields are both yield over 6%. Among the media names, Comcast CMCSA is rated 5 stars, trades at a 30% discount to fair value, and had a dividend yield of 3.10%.

Energy, Consumer Cyclicals, and Industrials Lag to Upside

The three worst-performing sectors in May were energy, consumer cyclicals, and industrials. While these were the worst-performing sectors, it should be noted that none of them posted a loss this past month.

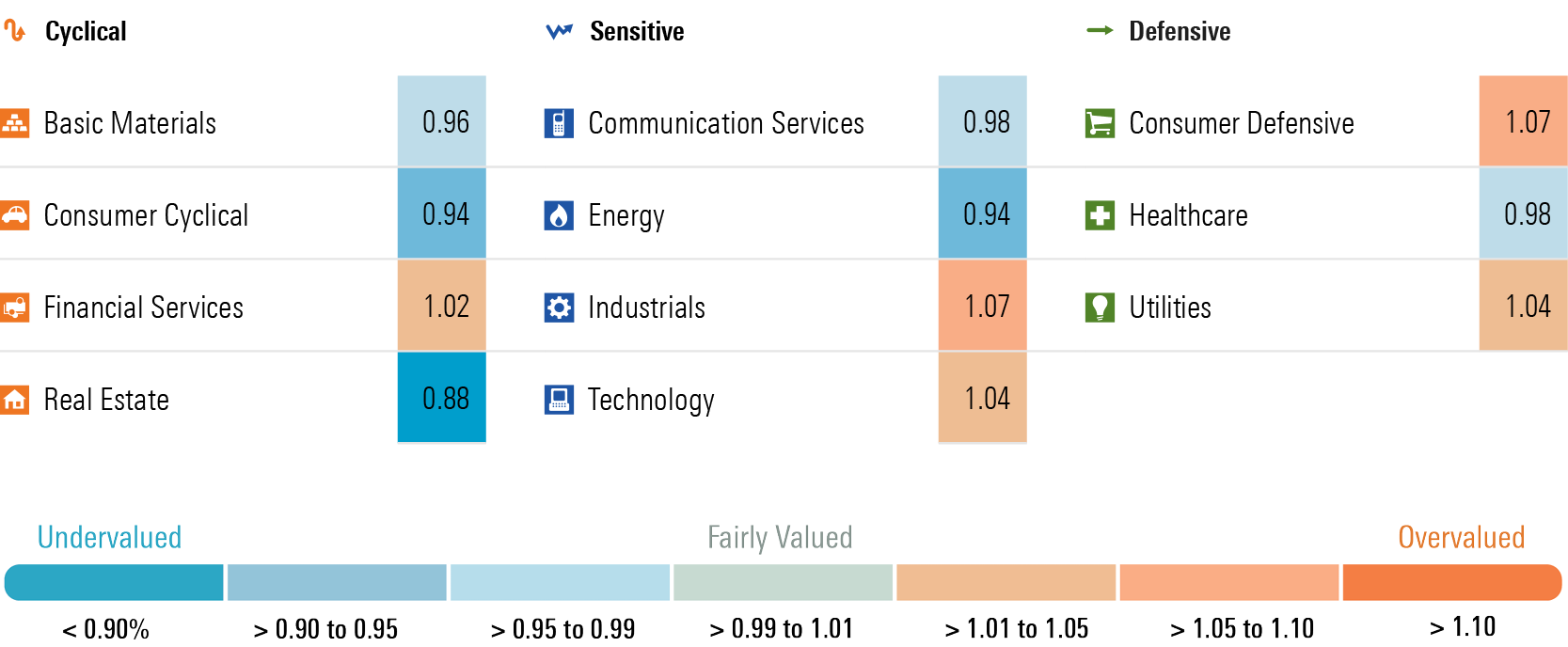

Energy was essentially unchanged as the Morningstar US Energy Index only rose 0.03% in May. While oil prices slipped slightly during April, we continue to see value across the sector as it trades at a 6% discount to our fair valuations. We also think exposure to the energy sector provides a good, natural hedge to portfolios to hedge against rising geopolitical risk and if inflation were to stay higher for longer.

The consumer cyclical sector only rose 1.14% last month. Two of the leading detractors were Starbucks SBUX and McDonald’s MCD, whose stocks slid 9.35% and 5.18%, respectively. These two companies’ earnings results may be the canary in the coal mine indicating that the compound impact from two years of high inflation are weighing on the middle-income consumers.

Middle-income consumers were originally able to offset high inflation by using excess savings from the pandemic, but those savings appear to be used up. They have also eaten into their savings rate, but savings rates are already lower than prepandemic levels. We are seeing consumers pull back on those items that are considered indulgent as well as other discretionary items whose purchases can be delayed. However, other areas, such as travel where consumers have already bought or booked tickets and have set aside funds to pay for their summer vacations, remain steady. The sector overall is trading at a 6% discount to fair value, but investors will need to discern between those areas where spending is holding up versus those that are at risk.

The industrial sector only rose 2.16% last month. We have noted that the sector is currently the most overvalued as compared with our valuations. In our view, industrials should remain underweighted in portfolios, especially the transportation names that are the most overvalued. For example, 2-star-rated Southwest Airlines LUV and United Airlines UAL, which trade at 50% and 40% premiums, respectively, remain some of the most overvalued names across our coverage. In addition, 2-star stocks such as XPO Logistics XPO and Saia SAIA remain at high premiums of 30% and 24%. One of the few areas we see undervalued stocks in the sector includes the aerospace and defense contractors such as RTX Corporation RTX.

What We See Across Our Remaining Sector Coverage

Real estate rose 4.86% in May, but year to date remains down 4.35%. The sector trades at a 12% discount to a composite of our fair values, the most undervalued sector across our coverage. While valuations in urban office space appear to have greater short-term risk, we continue to see opportunities in real estate assets that have defensive characteristics, such as those tied to healthcare facilities (5-star-rated Ventas VTR and HealthPeak DOC) or triple net lease providers (5-star-rated Realty Income O), that trade at a wide margin of safety from our intrinsic valuation and pay healthy dividends.

The basic materials sector is trading at a 4% discount. Within the sector, two areas we find especially attractive include the gold miners and crop chemical producers. Gold miners such as 4-star-rated Newmont Mining NEM trade at a deep discount to our fair value, even though we have a relatively bearish view on the long-term price of gold. If gold prices stay elevated or move higher, we think there is a lot of upside leverage. Crop chemical producers, such as 5-star-rated FMC FMC, fell throughout 2023. The agricultural industry over-ordered product in 2021-22 because of supply constraints and shipping bottlenecks. As a result, sales were constrained in 2023 as those excess inventories were used up. We think the supply/demand dynamics will normalize this year and therefore see opportunity in undervalued crop chemical producers.

Healthcare lagged the market rally in May and is now trading at a 2% discount as opposed to a premium earlier this year. Within the healthcare sector, we are seeing a number of stocks that rarely have traded at much of a discount, such as Johnson & Johnson JNJ, slip into 4-star territory. On the other side of the coin, we continue to caution investors that we think stocks tied to the GLP-1 class of weight loss drugs are overvalued. For example, 2-star-rated Eli Lilly LLY is significantly overvalued as compared with our valuation and is in fact one of the most overvalued stocks across our coverage. Within healthcare, we prefer stocks such as 5-star-rated Zimmer Biomet ZBH and 4-star-rated Medtronic MDT. These are stocks that not only trade at a discount to our fair values and have long-term durable competitive advantages but are also tied to the long term secular trend of the aging baby boomer generation.

The consumer defensive sector lagged the broad market rally, only rising 2.66%. This sector ties the industrials sector to trade at the most overvalued level. To some degree, valuations in the sector are barbell-shaped, with several large-cap stocks such as 1-star-rated Costco COST and 2-star-rated Target TGT trading well above our intrinsic valuations, whereas consumer packaged foods such as 4-star-rated Kellanova K and General Mills GIS trade at discounts. Many packaged-food companies have been under pressure as they have struggled to raise prices as fast as their own costs, but as inflation moderates, we expect they will be able to raise their operating margins back toward historical averages as price increases and efficiencies improve.

Morningstar Price/Fair Value by Sector

Monetary Policy and the Bond Market: What’s Next?

Morningstar’s US Economics team expects a combination of moderating inflation and slowing economic growth will provide the backdrop for the Fed to begin cutting the federal-funds rate at the September meeting. Our base case projects the federal-funds rate will end 2024 at a range of 4.75% to 5.00%. We also forecast the Fed will continue to cut the federal-funds rate further throughout 2025.

In the longer end of the yield curve, our US Economics team also projects that long-term interest rates will be on a downward path in the second half of 2024 and in 2025. They project the 10-year US Treasury yield will average 4.25% in 2024 as compared with its current market yield of 4.40% and average 3.50% in 2025.

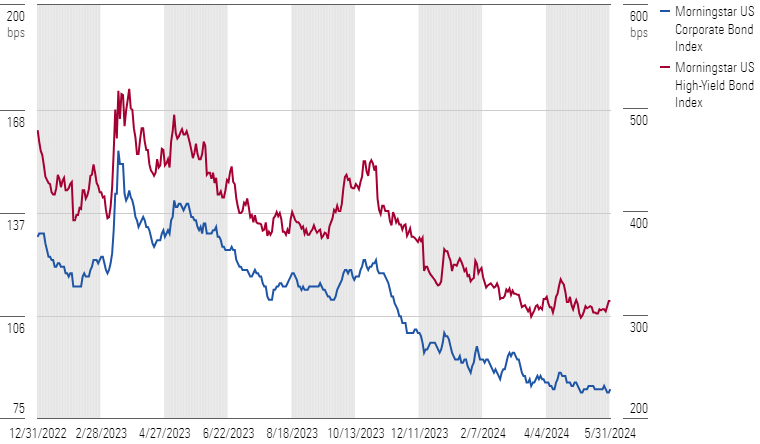

As such, with interest rates poised to decline, we think it’s a good time to lengthen duration to lock in the currently high interest rates. One caveat, though: We’d recommend sticking with US Treasuries as opposed to corporate bonds. In our second-quarter 2024 market outlook, we moved to an underweighting on corporate bonds as credit spreads have tightened to near their historically lowest levels. At these narrow spreads, we don’t think investors are currently being appropriately compensated for rating downgrade and default risk.

Morningstar US Corporate and High-Yield Bond Indexes Credit Spread

What’s an Investor to Do?

Steady as she goes, as very little has materially changed this past month. With the broad equity market trading at fair value, we advocate for investors to position themselves at a market weight within their targeted long-term asset allocations between equity and fixed income. With the rate of economic growth projected to slow for the next few quarters, stock markets could become increasingly volatile this summer and pullbacks could provide an opportunity to move back to overweight equity positions.

Within the equity portion of their portfolio, we continue to see the best valuation in the value category and in small-cap stocks. Undervalued sectors to overweight include real estate, energy, and consumer cyclical. However, within these sectors, we think individual stock-picking remains vital.

Within the fixed-income allocation of portfolios, we advocate for moving further out on the yield curve to lock in currently high interest rates as our US Economics team forecasts both short-term and long-term rates to decline. However, we continue to think that credit spreads for both investment-grade and high-yield corporates are not wide enough to compensate investors for downgrade and default risk; as a result, we suggest investors stick with US Treasuries.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-28-2024/t_1377507e2da0485faab7721e212e9baf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RXEHKWMHQNDBLD3ZFOOZOB5VIU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HU3X6PAILNCOVAUSKMJBJCVK6U.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)