AT&T Stock Hit a 30-Year Low. Is It a Buy?

Worries about lead pollution liability come at a time when telecom stocks have already been struggling.

Before bouncing Wednesday, AT&T T stock slid to a 30-year low as news reports about lead covering on telecom company cables worried investors and extended the stock’s multi-year slump. This article has been updated to reflect disclosures made by AT&T on July 19 regarding the extent of lead sheathing on its cables.

Here’s Morningstar’s take on AT&T’s prospects, key industry trends, and what to think of the company’s stock at this time.

Key Morningstar Metrics for AT&T

- Fair Value Estimate: $25.00

- Morningstar Rating: 5 stars

- Forward Dividend Yield: 7.0%

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

AT&T Stock Update

Lead Liability Concerns

A series of articles in The Wall Street Journal concerning cables covered in lead dealt yet another blow to investor sentiment around telecom stocks. While this situation warrants watching, we don’t expect the industry will bear substantial legal liability.

In more than two decades covering the telecom industry, we’ve never heard mention of an issue related to lead in cable sheathing. The WSJ cites a 2010 presentation to AT&T employees as proof that the firm has been aware of the issue, but that is not in dispute. Both the Centers for Disease Control and the National Institutes of Health websites house research conducted in the 1990s around complaints to OSHA from wire strippers who reported elevated blood lead levels, with steps to ensure worker safety. The Environmental Protection Agency has also studied cable sheathing materials, including through a partnership with the University of Massachusetts’ Toxic Use Reduction Institute. Nothing suggests telecom firms failed to follow proper procedures to protect employees when dealing with these cables, which were last deployed in the 1960s.

AT&T has disclosed that lead-clad cable constitutes less than 10% of its copper network based on strand miles. Two-thirds of this cable is buried or in conduit, and the vast majority of the remainder is strung on poles, with only a very small percentage underwater. The “overwhelming majority” of these cables remain in service. In a follow-up conversation, AT&T indicated that these figures encompass all of its potential exposure, including any abandoned cables.

While these details don’t put the issue to rest, AT&T believes they provide a frame of reference concerning its potential liability.

Telecom Industry Headwinds

Outside the lead issue, the telecom sector has faced a number of headwinds. Notably, there’s been a lack of clear revenue growth tied to 5G network deployments in recent years. The industry, including AT&T, shelled out more than $100 billion for additional spectrum at a series of auctions in 2020-22 while also spending to upgrade networks. There has been strong postpaid wireless phone customer growth since the onset of the COVID-19 pandemic, and AT&T has done a nice job of participating in that growth. But the recent pace of growth is unsustainable in the longer term, given the size of the United States. Other areas investors were excited about a couple of years ago, such as industrial automation or virtual reality, haven’t panned out—at least not yet.

In addition, cable companies have been taking wireless market share with aggressive bundling promotions, especially Charter Communications. The companies are leasing capacity on Verizon’s VZ network to offer wireless service. Another issue is the possibility that Amazon.com AMZN may enter the market with a similar wholesale arrangement. The carriers have all denied any interest in working with Amazon, but there’s still a fear that one will break ranks and allow it to enter and disrupt the market.

AT&T reported weak free cash flow during the first quarter ($1 billion) relative to management’s forecast for the year ($16 billion).

What’s Next for AT&T Stock?

An argument for owning AT&T is that the wireless industry is still in the early stages of realizing the benefits of past consolidation, especially T-Mobile’s TMUS merger with Sprint. The level of competition is gradually diminishing, and we’re starting to see pricing creep up. AT&T has continued to defend its free cash flow target for 2023, and it should be in a position to at least hold cash flow stable next year, depending on what happens with its DirecTV partnership, and grow cash flow thereafter.

Predicting how sentiment will evolve around the lead contamination issue is difficult.

Importantly, AT&T is already working to upgrade most of its copper network with fiber, and we suspect it will choose to prioritize decommissioning lead-sheathed cables.

We still have questions about the number of actual network route miles (miles traversed rather than length of cabling). This figure is likely to be more relevant in determining total potential replacement costs, especially if portions of buried cable ultimately need removal. The scope of any required environmental remediation work and legal liability also remains unknown, though this question would probably take years to settle if an entity pushed for more than basic removal and cleanup.

AT&T Stock Price

Fair Value Estimate for AT&T Stock

With its 5-star rating, we believe AT&T’s stock is significantly undervalued compared to our long-term fair value estimate.

Our $25 fair value estimate assumes AT&T will deliver modest revenue growth and gradually expanding margins over the next several years as its wireless and fiber network investments pay off. Our fair value estimate implies an enterprise value of 8 times our 2023 EBITDA estimate and a 7% free cash flow yield.

In wireless, we expect AT&T will slowly gain market share over the next few years, though the near term could prove bumpy as cable companies continue working to establish their wireless businesses. We believe postpaid revenue per phone customer will grow modestly amid a relatively stable competitive environment, hitting $60 per month in 2027 versus $55 in 2022. We estimate AT&T generates around $2 billion in revenue annually from connected devices like cars. We model this revenue roughly doubling over the next five years as things like edge computing gain adoption, but this estimate is highly uncertain.

In total, we expect wireless service revenue will increase 3%-4% annually on average through 2027, with wireless EBITDA margins holding in the low 40s, as cost-efficiency efforts and benefits from slower customer growth offset rising network operating costs.

Read more about AT&T stock’s fair value estimate.

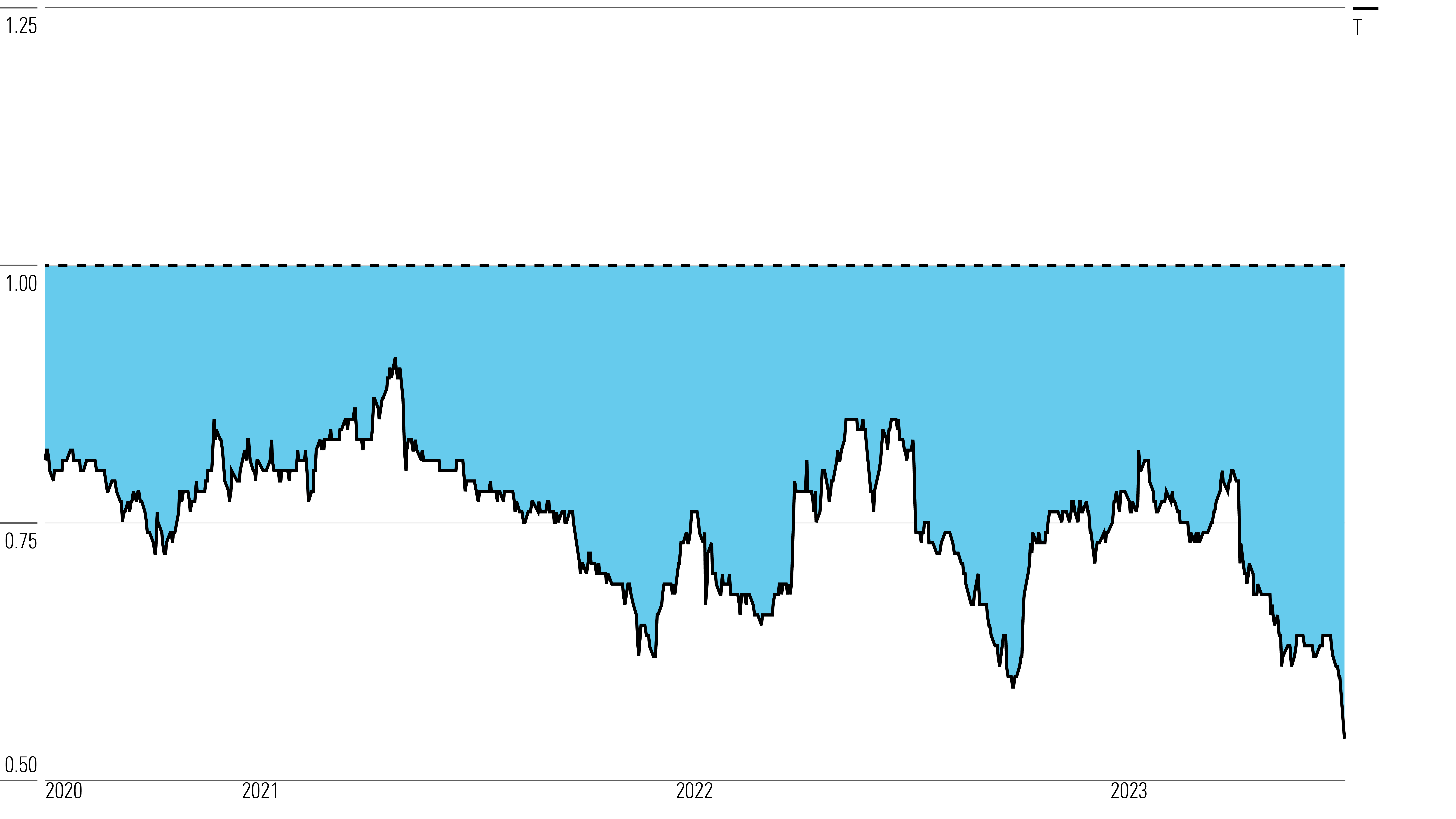

AT&T Stock Historical Price/Fair Values Ratios

Economic Moat Rating

Wireless is AT&T’s most important business. Returns on capital in wireless have eroded somewhat in recent years, as the firm has spent heavily on wireless spectrum and invested to put that spectrum to use. We estimate the wireless business produced a return on capital in 2022 of roughly 8%, or about 10% excluding goodwill—modestly above our estimate of the firm’s cost of capital. These figures are down from about 10% and 12%, respectively, in 2018. Over those four years, segment operating income is up 13% cumulatively, while the invested capital base has expanded about 30%, primarily on $40 billion of spectrum purchases.

We expect wireless returns will remain ahead of AT&T’s cost of capital. Verizon, AT&T, and T-Mobile dominate the U.S. wireless market, collectively claiming nearly 90% of retail postpaid and prepaid phone customers between them and supplying the network capacity to support most other players. Providing solid nationwide coverage requires heavy fixed investments in wireless spectrum and network infrastructure. While a larger customer base does require incremental investment in network capacity, a significant portion of costs are either fixed or more efficiently absorbed as network utilization reaches optimal levels in more locations.

Read more about AT&T’s moat rating.

Risk and Uncertainty

We have changed our Morningstar Uncertainty Rating for AT&T from High to Medium to better reflect the volatility we expect investors will face relative to our global coverage. Regulation and technological change are the primary uncertainties facing the firm. Wireless and broadband services are often considered necessary for social inclusion in terms of employment and education. If AT&T’s services are deemed insufficient or overpriced, especially if in response to weak competition, then regulators or politicians could step in.

The firm is also still responsible for providing fixed-line phone services to millions of homes across the U.S., including many in small towns and rural areas. It could be compelled to invest more in rural markets even if economic returns are insufficient.

On the technology front, wireless standards continue to evolve, putting more spectrum to use more efficiently. The cost to deploy wireless networks could come down to the point where numerous new firms are able to enter the market. The cable companies are already making attempts to leverage their existing networks to provide limited wireless coverage. Technology could quickly enhance these efforts. While unlikely, in our view, wireless technology could also remove the need for AT&T’s fixed-line networks, killing returns on its fiber investments.

Read more about AT&T’s risk and uncertainty.

T Bulls Say:

- Following a period of investment, AT&T will hold a nationwide 5G wireless network with deep spectrum behind it and a fiber network capable of reaching nearly one-fourth of the U.S.

- AT&T has the scale to remain a strong wireless competitor over the long term. With three dominant carriers, industry pricing should be more rational going forward.

- Combining wireless and fixed-line networks with new technologies and deep expertise makes AT&T a force in enterprise services.

T Bears Say:

- The cost of maintaining dominance in the wireless industry by controlling spectrum has been exceptionally high over the years. AT&T has spent $40 billion over the past three years for licenses with few prospects for incremental revenue.

- Advancing technology will eventually swamp AT&T’s wireless business, enabling a host of firms to enter the market, further commoditizing this service.

- AT&T’s massive debt load will catch up with it. Even after spinning off Warner with a huge amount of debt, AT&T carries far higher leverage than it has historically, and its dividend payout remains high.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)