Industrials: Sector Offers Investment Opportunities as Performance Lags Broader Market

Our top industrial picks are Honeywell, UPS, and Huntington Ingalls.

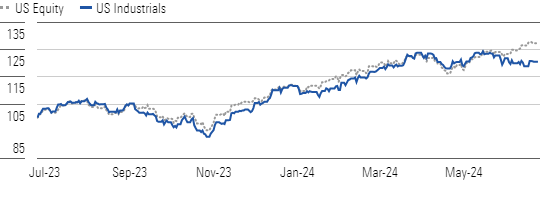

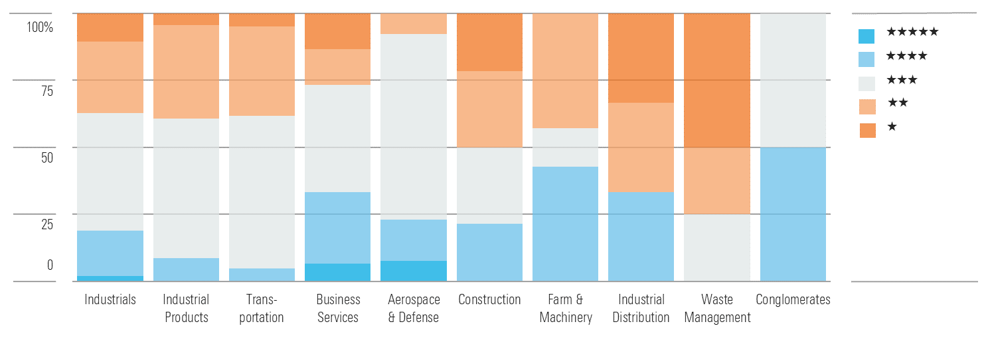

The Morningstar US Industrials Index underperformed the Morningstar US Market Index both during the second quarter and in 2024 to date. Looking at our North American industrials coverage, only construction and waste management have outperformed the broader market so far this year.

Industrial Stocks Continue to Underperform

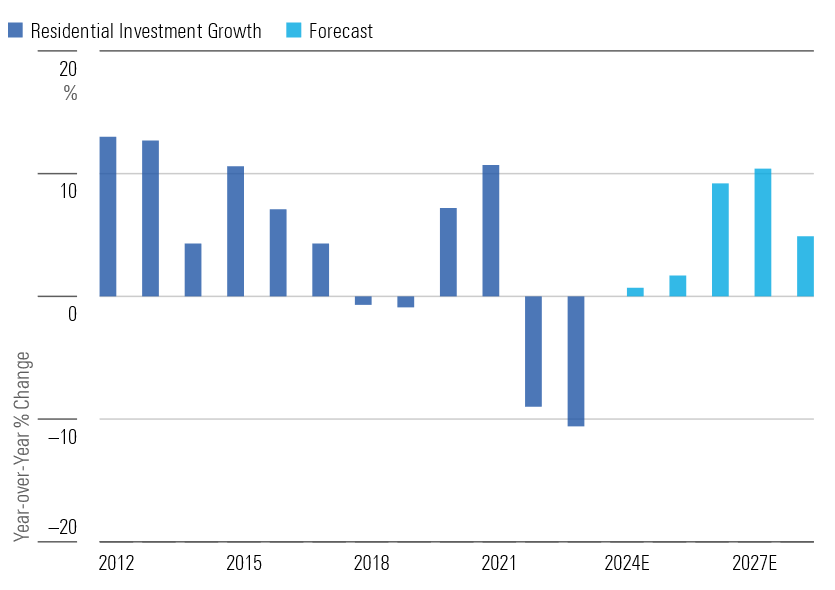

Our construction coverage comprises engineering and construction firms, heating, ventilation, and air-conditioning manufacturers, and building materials and equipment producers. Most firms with HVAC exposure have enjoyed robust stock performance, as investors see these companies as a play on climate change that should also benefit from increased US infrastructure spending. While we think such secular tailwinds will support above-GDP growth for HVAC companies, high valuations suggest market expectations have become too optimistic, in our view. Some firms with residential construction and repair and remodel spending exposure have lagged the broader market amid softer activity. That said, we forecast residential investment will significantly expand by 2026.

Industrial Valuations Ease; There Are Now More Opportunities

The waste management industry continues to consolidate, with Waste Management’s WM announcing the acquisition of medical waste specialist Stericycle SRCL during the quarter. We believe the largest players in traditional solid waste will increasingly rely on adjacent verticals to drive growth. In particular, we expect Waste Management to become a larger player in the medical waste industry, and for Republic Services RSG to do the same in hazardous waste disposal.

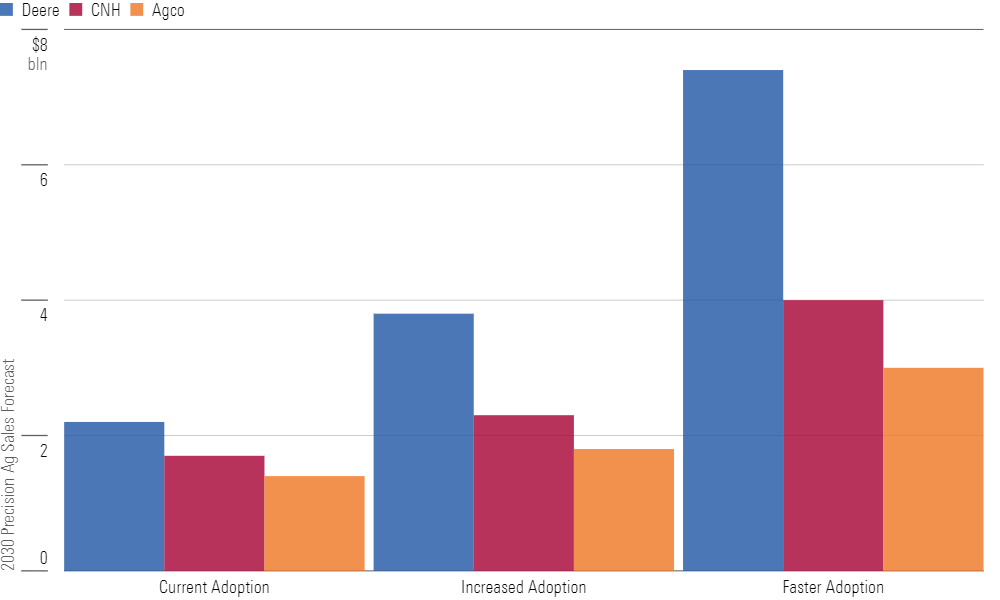

Increased Investment In Precision Equipment Will Benefit Agricultural Players

The ag downcycle continues to pressure agricultural machinery stocks, as farm and heavy construction machinery was the worst-performing industry during the quarter. Lower global prices have led to fewer farmers bringing crops to market, particularly in South America. Nonetheless, we are constructive on the industry. In our view, replacement demand can help partially offset weaker near-term new ag machine demand. Notably, average fleet ages continue to be higher in large ag equipment. We currently expect ag demand to start recovering in 2026. Furthermore, we see increased adoption of precision agriculture technology as a long-term tailwind for the industry.

Construction Names Should Benefit From Uptick In Residential Investment

Top Industrial Sector Picks

Honeywell International

- Fair Value Estimate: $238.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Honeywell HON is one of the stronger multi-industry firms in operation today. Its underlying strategy is similar in each end market: to embed its products in customer operations, from which recurring revenue can be generated through aftermarket servicing. Indeed, Honeywell has one of the largest installed equipment bases, resulting in predictable revenue streams. We believe Honeywell is poised for mid-single-digit organic top-line growth stemming from multiple secular trends such as building and warehouse automation, rising safety and emissions regulations, and a growing middle class in developing nations.

Huntington Ingalls Industries

- Fair Value Estimate: $317.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Low

Huntington Ingalls HII, a former subsidiary of Northrop Grumman NOC, is the largest military shipbuilder in the United States. Despite extraordinarily long planning horizons and budget visibility, small shifts in timing around big programs can lead to lumpy quarterly results, which we believe have affected the stock. Nonetheless, we think the company’s significant ties to the Department of Defense, its status as the sole provider of nuclear aircraft carriers and turbine-powered amphibious landing ships, and its position as one of two producers of nuclear submarines for the US Navy positions it for recurring profits well into the future.

United Parcel Service

- Fair Value Estimate: 158.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

UPS UPS is the world’s largest parcel delivery company, delivering about 22 million packages per day on average. The company’s growth has been hit by lower package volumes, stemming from muted retailer restocking and soft manufacturing end markets across Europe. Nonetheless, we expect volume trends to improve during the back half of 2024 as the company faces easier comps, a potential uptick in retail sector restocking, and better US import activity. Management has been expecting the domestic package margin to exit the year near 10%, implying significant confidence in second-half volume improvement and gains from productivity initiatives.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)