Networking Vendors Aren't Going Away

We think the cloud holds substantial--and underestimated--opportunity for some of these companies.

Networking technology may be undergoing its most radical change since the advent of the Internet, thanks to the cloud. Data is proliferating at an incredible rate, with increased connectivity requirements and distributed networking ecosystems. The solutions enabling faster, higher-quality transmission of services to users and devices anywhere, at any time, are in the early stages of disruption. From the data center to wireless connections to branch and edge locations, there is substantial opportunity for networking vendors outside, and within, the public cloud.

We take an alternative view to the prevailing market sentiment that public cloud adoption is going to kill the demand for networking vendors. The public cloud does mean less on-premises spending on networking, but we don’t think it will make key vendors obsolete, especially those with economic moats. In our view, the hybrid cloud--in which enterprises combine on-premises and cloud infrastructure for workloads--will be the norm. Investors have been provided with an overlooked opportunity in solutions that facilitate the transport of data, like switching, software-defined networking, and wireless. We believe the shift to the public cloud is oversimplified, and we expect networking companies to pivot their strategic wares to use the cloud as a sturdy growth catalyst. We expect widespread digital transformation efforts to continue, which will drive the $45 billion networking market to expand at a 4% five-year compound annual growth rate.

We expect that networking teams will predominantly adopt a hybrid cloud architecture, which we believe gives organizations the best of their legacy on-premises and private clouds, plus various public cloud offerings, alongside a growing edge presence. The public cloud offers many advantages for organizations, such as lower capital expenditures on IT infrastructure, unique developer assets, and great flexibility. However, we believe enterprises will use the hybrid cloud for five main reasons:

- It supports the criticality of existing infrastructure and protects legacy investments.

- Core business applications and data are critically important. and the public cloud may require overhauling.

- The hybrid cloud alleviates the sticker shock that organizations experience with pay-as-you-go cloud capacity.

- It allays compliance and security concerns.

- It provides tighter control with consolidated networking management and avoids public cloud vendor lock-in.

Networking companies are pivoting their offerings for a cloud-first world and have developed symbiotic relationships with the public cloud vendors. Public cloud vendors want workloads, while networking vendors are critical in facilitating the flow of workloads. These companies have also transformed their strategies to sell software-based versions of enterprise-class networking products. Networking vendors ease the cloud transition and customer switching costs are evident in enterprises desiring the same toolsets, support, and services across their networking ecosystem.

Networking technologies are evolving, and we believe growth opportunities exist for vendors as historical solutions decline. In our view, many legacy networking leaders are keeping pace with key technology trends in addition to overall public cloud adoption. Software offerings are crucial, faster transmissions and security features are driving upgrades as traffic patterns change, and vendors can holistically enable customers’ networking evolution.

Moaty networking vendors have strong GDP-plus to double-digit revenue growth rate possibilities alongside their resilient operating margins and robust free cash flow generation. Fortified balance sheets allow substantial organic development and acquisition investments for the vendors.

A Look at the Players

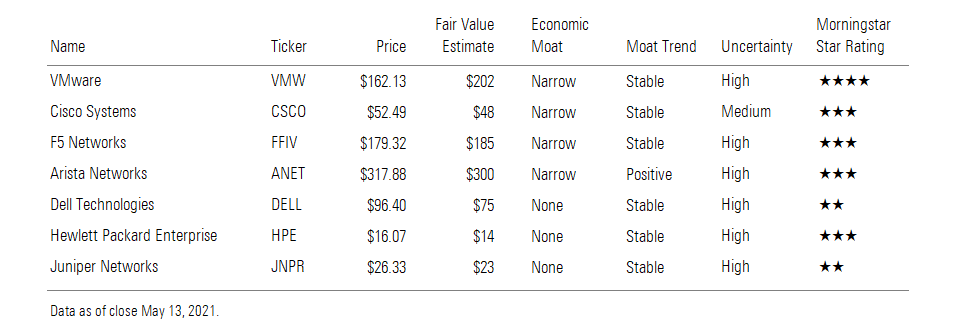

VMware VMW is our top investment pick. We believe the market is being pessimistic about VMware’s position in a cloud-led ecosystem and ability to grow as its core virtualization offerings face headwinds. We expect catalysts to include being the hybrid cloud platform of choice for enterprises, the shift to subscriptions from perpetual sales, product diversification into areas like security and containerization providing ample cross- and up-selling opportunities in adjacent market to its core virtualization customers, and the expected spin-off from Dell in late 2021. We expect VMware to outpace the market and model a 9% five-year revenue compound annual growth rate with low 30s adjusted operating margins in fiscal 2026, whereas we suspect the market believes growth will stagnate as a result of VMware not becoming a key element within the public cloud and not gaining leverage from subscription offerings.

Cisco Systems CSCO is a high-quality name that we recommend for those seeking shareholder returns, with at least 50% of free cash flow slotted to return to investors. The company is dominant across various networking subsegments, and we expect nascent growth prospects like 400 Gb switching, SD-WAN, Wi-Fi 6, and disaggregating software and hardware to buoy Cisco against the headwinds from legacy product lulls and the overarching cloud threat.

F5 Networks FFIV has a compelling turnaround story that we expect to continue gaining momentum. The shift to software is an ongoing trend in networking, and as this enterprise-focused company pivots toward software and application security and bridges the divide between developer and infrastructure teams, we expect it to accelerate its prospects via the cloud.

Arista Networks ANET may produce the highest annual revenue growth of the companies mentioned in this article. We expect it to be a key beneficiary of hyperscale cloud providers expanding their data center footprints by purchasing the latest switching solutions. This quality company is expanding its offerings into the campus market, and we believe the diversification will help its sustainability in the marketplace.

Arista, Cisco, F5, and VMware have narrow economic moats based on customer switching costs, in our view. Cisco and F5 have an intangible assets moat source as well. We believe these companies provide mission-critical products, support, and services in the networking landscape and customers can face terrible disruptions when pursuing alternatives.

Dell Technologies DELL, Hewlett Packard Enterprise HPE, and Juniper Networks JNPR all have no-moat ratings. Dell and HPE are working to bring the cloud to organizations as their core server and storage businesses face commoditization due to organizations renting compute and storage through hyperscale cloud vendors, and we expect Juniper to be outpaced by participants in the networking and security markets. While we believe these companies are key competitors in pockets of the networking market, we question their ability to produce excess returns over invested capital over a decade.

This information was published March 1 as part of a Technology Observer, which is available to Morningstar’s institutional clients.

/s3.amazonaws.com/arc-authors/morningstar/d1ac50a8-f491-405e-b965-33941cb88799.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d1ac50a8-f491-405e-b965-33941cb88799.jpg)