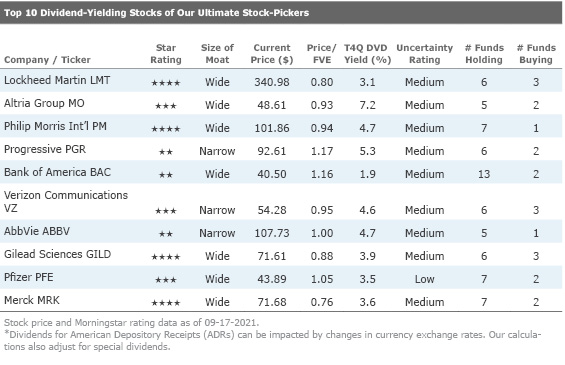

Our Ultimate Stock-Pickers' Top 10 Dividend-Yielding Stocks

A majority of the top 10 dividend-yielding names are undervalued.

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have sustainable competitive advantages that should allow them to generate the excess returns necessary to maintain their dividends over the longer term. We also look for firms where there is lower uncertainty on our analysts' part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

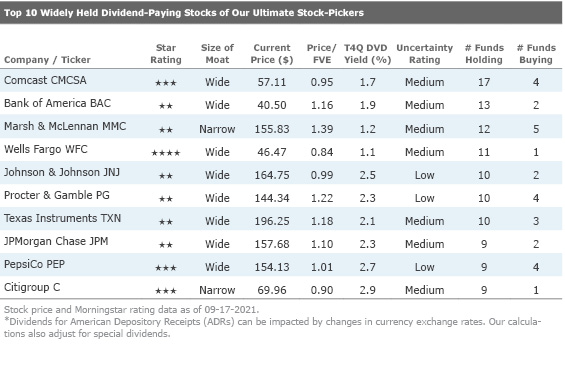

Once our filtering process is complete, we create two different tables--one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 1.30% as of September 2021. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that the majority of the new list is composed of names that were also present on the previous list that we published in March 2021. These names include Philip Morris International PM, Progressive PGR, Bank of America BAC, Verizon VZ, AbbVie ABBV, Gilead Sciences GILD, Pfizer PFE, and Merck MRK. Similarly, the top 10 widely held dividend-paying stocks also remained largely the same. We saw a shift in ordering of this list. Some notable mentions were Wells Fargo WFC climbing five spots to finish the third quarter at the number 4 spot on our list and Citigroup dropping four spots to number 10.

In the last edition of the Ultimate Stock-Pickers article discussing dividend-yielding stocks, we highlighted the recovery of the global economy from the COVID-19-induced demand slowdowns. This recovery continued through the first half of 2021 as positive vaccine news, better-than-expected unemployment data, and a widespread lifting of lockdown buoyed the economy. Given the recent run-up in the stock market, based on our aggregate price to fair value estimates, we view the energy and telecommunications sectors as the only undervalued sectors today, with investors still focused on "pandemic-proof" companies such as those in the technology space.

Searching for yield in this type of environment can be risky. Price risk remains elevated as does the risk that companies may not be able to sustainably maintain current dividends due to economic strain. To alleviate some of these risks, we eliminate high-uncertainty rated stocks from our screening process. Although the market has recovered, three stocks on our dividend-yielding list remain undervalued. Wide-moat rated Lockheed Martin LMT, Gilead Sciences, and Merck are all trading at or over a 12% discount to fair value. The average price to fair value estimate for the top dividend-yielding stocks was 0.97, indicating that we view these high-yielding stocks as fairly priced. The top 10 dividend-yielding stocks remain heavily overweight in the healthcare sector, which contributed four names to the top 10 list. The mix is different for our top 10 widely held dividend-paying stocks list, which includes just one healthcare stock, two consumer defensive stocks, and five financial services stocks.

Looking more closely at the two lists, there was only one company, wide-moat rated Bank of America, that appeared on both the top 10 dividend-yielding and top 10 widely held dividend-paying stocks.

Interestingly, all of the top 10 widely held securities were held by nine or more funds. This period's list of widely held dividend-paying stocks was less undervalued than the top dividend-paying stocks. Three of the 10 stocks were materially undervalued, averaging a price to fair value of approximately 107% compared with an average of 97% for our top 10 highest dividend-yielding stocks.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat rated Lockheed Martin is trading at a significant discount to fair value, so we will focus on it in this piece. We also highlight wide-moat rated Altria Group MO and Marsh & McLennan Companies MMC in this edition of Ultimate Stock-Pickers.

Lockheed Martin LMT

Wide-moat rated Lockheed Martin currently trades at a 20% discount to Morningstar analyst Burkett Huey’s $425 fair value estimate. Lockheed Martin is the largest defense contractor globally and has dominated the Western market for high-end fighter aircraft since being awarded the F-35 program in 2001. Lockheed’s largest segment is Aeronautics, which is dominated by the massive F-35 program. Lockheed’s remaining segments are rotary & mission systems, which is mainly the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

We view Lockheed Martin as the highest-quality defense prime contractor, due to its exposure as the prime contractor on the F-35 program and its missile business. The defense budget and the allocation of the budget is a political process, which is inherently difficult to predict. Therefore, we favor companies with tangible growth profiles through a steady stream of contract wins, ideally to contracts that are fulfilled over decades.

At the same time, it is important to note that companies such as Lockheed are implicitly a play on the defense budget, which we think is ultimately a function of both a nation’s wealth and a nation’s perception of danger. The fiscal stimulus used to support the U.S. economy during the COVID-19 pandemic dramatically increased the U.S. debt, and higher debt levels are usually a forward indicator of fiscal austerity. We expect a flattening, rather than declining, budgetary environment as we think that heightened geopolitical tensions between great powers are likely to buoy spending despite a higher debt burden.

This belief plays into our moat rating. We believe Lockheed Martin’s business merits a wide moat rating. At first glance, an analyst may believe that the defense prime contractors operate in an industry where it is difficult to earn excess returns. Defense prime contractors generate products on the cutting edge of technology, yet pricing can often be deflationary on a per-unit basis. These companies effectively operate in a near-monopsony, with a customer that has rapidly evolving needs and a tendency to change product requirements. While these are undoubtedly challenges, we believe that wide moats are prevalent in the defense business. They exist because of intangible assets: product complexity that thwarts new entrants, contract structures that reduce risk for the contractor, decades-long product cycles, a lack of alternative suppliers, and the switching costs of a risk-averse customer facing a significant time investment to switch over products.

With specific regard to Lockheed, we think that the firm’s product complexity (especially in the aeronautics segment with the F-35), long product cycles, and high switching costs all contribute to the company’s wide moat rating. To put this in perspective, we believe that production and sustainment of the F-35 aircraft will last until 2070, providing Lockheed with cash flows well out in the future.

Altria Group MO

Wide-moat rated Altria Group currently trades at a 7% discount to Morningstar analyst Phillip Gorham’s $52 fair value estimate. Altria is composed of Philip Morris USA, U.S. Smokeless Tobacco, John Middleton, Ste. Michelle Wine Estates, Nu Mark, and Philip Morris Capital, although the company plans to wind down Philip Morris Capital by the end of 2022. It holds a 10.2% interest in the world's largest brewer, Anheuser-Busch InBev BUD. Through its tobacco subsidiaries, Altria holds the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company's Marlboro brand is the leading cigarette brand in the U.S. with a 43% share in 2020.

Altria is no longer a pure play on U.S. cigarettes. Over 15% of our valuation is derived from its 10.2% share of Anheuser-Busch InBev, and of the consolidated business, 15% of EBIT came from oral tobacco and wine in 2020, while recent acquisitions in vaping and cannabis are likely to be contributors to EBIT in the near future. Nevertheless, U.S. cigarettes remains the driver of Altria's earnings because following the breakup of Philip Morris in 2008, Altria operates solely in the U.S., while Philip Morris International (PMI) owns the rights to the brands elsewhere.

Although it is in secular contraction, the U.S. cigarette market is a relatively attractive one. We forecast the volume decline rate of the U.S. cigarette to be around 4% per year, a slightly faster rate of decline than most markets. However, the ability to consistently price above the rate of volume declines should ensure that Altria can continue to increase its revenue, earnings, and dividend. We estimate that the U.S. is the fourth most affordable market for cigarettes among the OECD countries, as measured by the minutes of labor required to meet the retail price of a pack of 20 sticks. This allows manufacturers ample room for raising prices over time. With a portfolio skewed to the premium segment, Altria must manage the price gap over the discount segment, so this pricing opportunity is likely to be realized over many years.

On the economic moat front, we believe Altria merits a wide economic moat with a negative moat trend. An addictive product and almost insurmountable barriers to entry in the tobacco industry form strong intangible assets and give Altria a wide economic moat, in our opinion. Tobacco contains nicotine, an addictive substance that suppresses the cessation rate. According to data from the Tobacco Atlas, more than 60% of all smokers intend to quit and 42% have attempted to quit over the past 12 months. Yet in most markets, the smoking rate is in only a very modest decline, implying that the majority of smokers attempting to quit fail to do so.

The addictive nature of the product forms a powerful competitive advantage when combined with very tight government regulation that over the years has served to dampen market share volatility and competition on price. In the U.S., the FDA has imposed restrictions on marketing new or modified products that essentially keep new entrants out of the market. Even if new entrants were to receive FDA approval for a new product, other regulations make it difficult to build market share. Tobacco advertising is severely restricted in the U.S., with bans on most forms of mass marketing. This not only makes it very difficult for hypothetical new entrants to gain the attention of smokers, but it also dampens competition between incumbent manufacturers.

On the trend front, we believe Altria’s moat trend is negative because we suspect recent evidence regarding the economics of NGPs may signal a deterioration in Big Tobacco’s intangible assets in the long term. Cigarette brand equity appears to be less transferable to NGPs than we had initially thought. Altria’s primary NGP investment so far has been in vaping (it owns the Juul U.S. vaping brand) but it also has an exclusive agreement with PMI to market iQOS in the U.S. and is beginning to commercialize the product in specific markets.

Marsh & McLennan Companies MMC

Narrow-moat rated Marsh & McLennan Companies currently trades at approximately a 39% premium to Morningstar analyst Brett Horn’s fair value estimate of $112. Marsh & McLennan is a professional-services firm that provides advice and solutions in the areas of risk, strategy, and human capital. The company operates through two main segments: risk and insurance services and consulting. In risk and insurance services, the firm offers services via Marsh (an insurance broker) and Guy Carpenter (a risk and reinsurance specialist). The consulting division is composed of Mercer (a provider of human resource services) and Oliver Wyman (a management and economic consultancy).

We view Marsh & McLennan as something of a tollbooth business. Its leading position in the brokerage industry would be difficult to displace, and its sticky customer relationships allow it to benefit from a relatively stable level of insurance transactions, although it does have some exposure to the insurance pricing cycle. We think Marsh & McLennan’s long-term future will largely resemble its past, with moderate growth and attractive profitability, although the coronavirus has created some near-term ups and downs.

With regard to the economic moat, Marsh & McLennan's strong customer relationships and global footprint place a narrow moat around its business, in our view. Marsh & McLennan’s insurance brokerage segment represents a little over half the business. The company acts as an advisor and insurance and reinsurance broker, helping clients manage their risk by negotiating and placing their insurance risk with insurance carriers through a global distribution network. Insurance brokers such as Marsh & McLennan are uniquely positioned to serve a necessary risk-management function.

At the same time, we think Marsh & McLennan’s moat trend is stable. We view the competitive environment on the brokerage side as relatively stable, with the upper tier of the market settled into a somewhat oligopolistic condition. On the consulting side, the company’s margins have improved markedly in recent years. However, we would attribute this primarily to management’s moves to aggressively cull low-margin business, rather than an underlying improvement in the competitive position of the segment’s constituent parts.

Disclosure: Malik Ahmed Khan, Justin Pan, and Eric Compton have no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)