Technology Remains a Drag on the Broader Market but Wide-Moat Software Stocks Are Still Attractive

Quarter to date, tech only rose 2.78% while the U.S. equity market rose 6.91%; however, we view the electronic components space as underappreciated.

Technology was an outperformer in the market in recent years but has crashed back to earth and has been a clear underperformer in 2022. Mega-cap tech stocks (Apple, Microsoft) are still faring better than the overall group, but we see carnage among high-flying growth stocks within tech. The dip doesn’t deter our optimism around several secular tailwinds in technology, such as cloud computing and rising semiconductor demand.

Yet, a softer macroeconomic environment and a stronger U.S. dollar may delay some software upgrades and transitions in the near term. PC- and Android-based smartphone demand remains in the doldrums, which continues to pressure chipmakers and device makers with exposure here. Chip demand into automotive and large industrial equipment remains resilient. All in all, we see buying opportunities within tech for long-term, patient investors, especially in wide-moat names across semis and software.

The Morningstar US Technology Index fell 32.29% year to date through Dec. 27, 2022, a massive reversal for a sector that was up 34.42% in 2021. Tech’s drop is worse than the U.S. equity market, down 19.70% (Exhibit 1).

Quarter to date, tech only rose 2.78% while the U.S. equity market rose 6.91%. The median U.S. technology stock was 20% undervalued, a complete flip-flop from a sector that was 6% overvalued at this time a year ago. Software remains the most attractive subsector of tech as the median stock is 23% undervalued. The median semiconductor stock is 12% undervalued, as compared with 23% undervalued just a quarter ago. The median hardware stock is 15% undervalued.

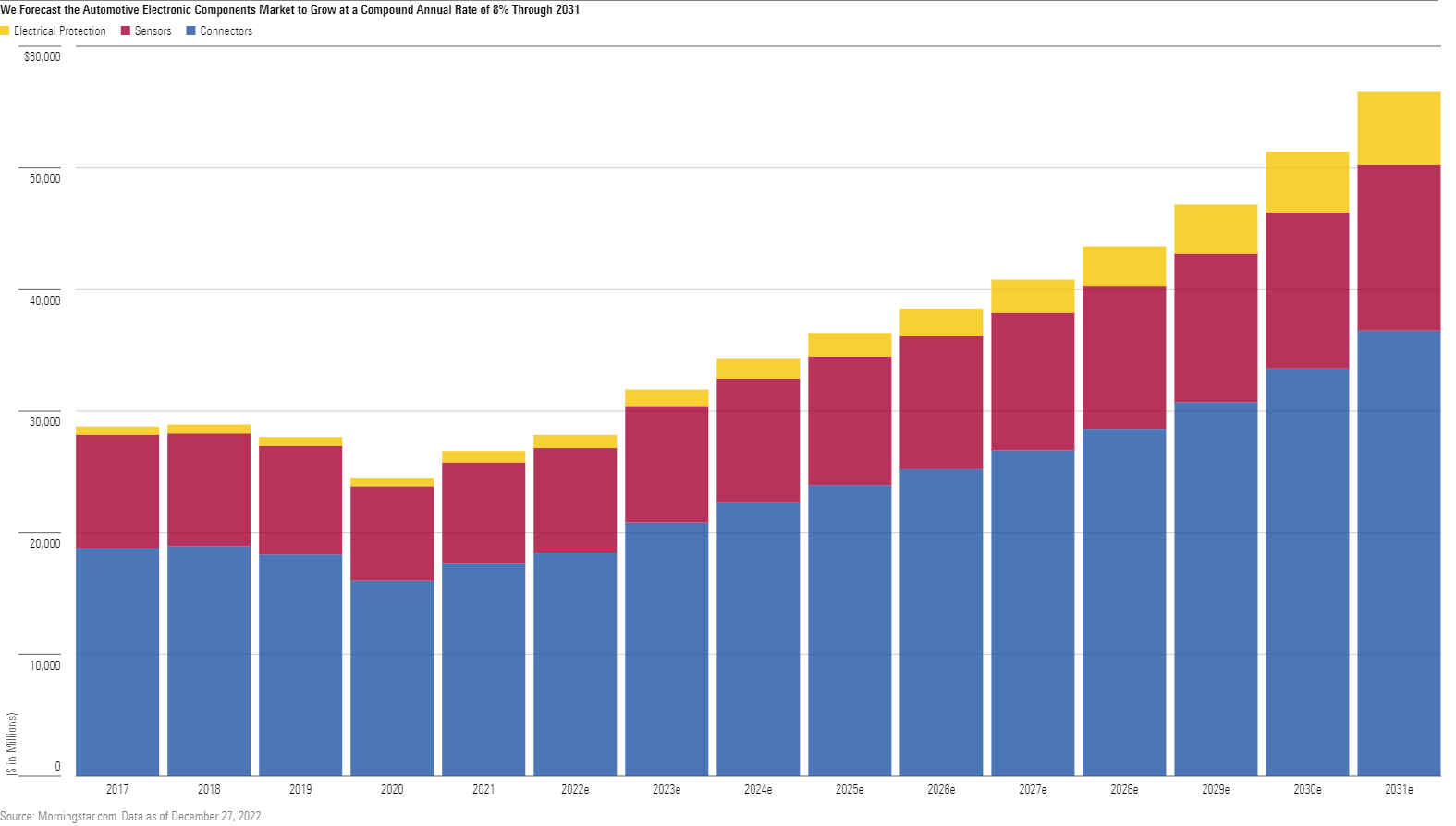

We view the electronic components space (sensors, connectors, electrical protectors, and so on) as underappreciated. These mission-critical electronic components ensure flawless performance of planes, trains, and cars, hence the strong switching costs and pricing power. The electrification of the automotive market is an increasingly important growth theme for suppliers (Exhibit 2).

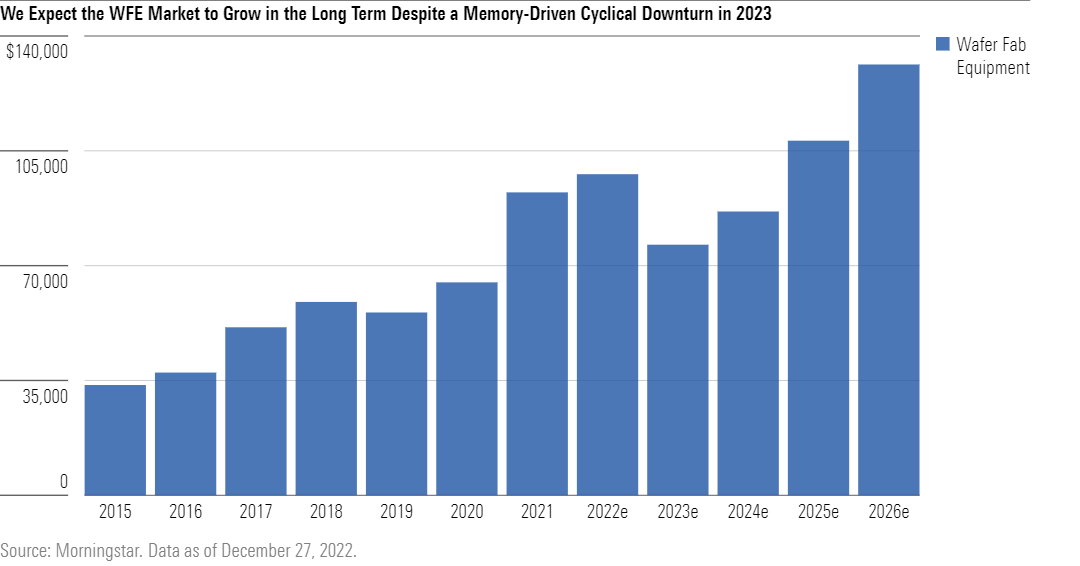

The wafer fab equipment segment has seen strong demand, thanks to secular tailwinds like the rise in public cloud and AI processors. Ongoing chip supply shortages have also boosted equipment spending and fueled a push for local manufacturing in the U.S. and Europe (versus the bulk of production today in Asia). We foresee a dip in spending in 2023 because of headwinds in the memory and PC markets, but it should grow nicely in the long term, providing opportunities for long-term investors (Exhibit 3).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)