These Major Companies Aren’t Worried About Election Outcomes

While consumers are becoming more discerning about the future, many companies are doing the exact opposite.

Warren Buffett has described the engine powering the US economy as millions of Americans getting up every single day trying to improve their station in life.

This simple concept is worth keeping in mind as the political theater puts out new acts between now and November.

Amazon’s annual summer Prime Day provides a very simple microcosm of what Buffett describes. July was the 10th time Amazon has held a summer sale, and according to the company, it was the biggest one yet—just as it was for the nine before it.

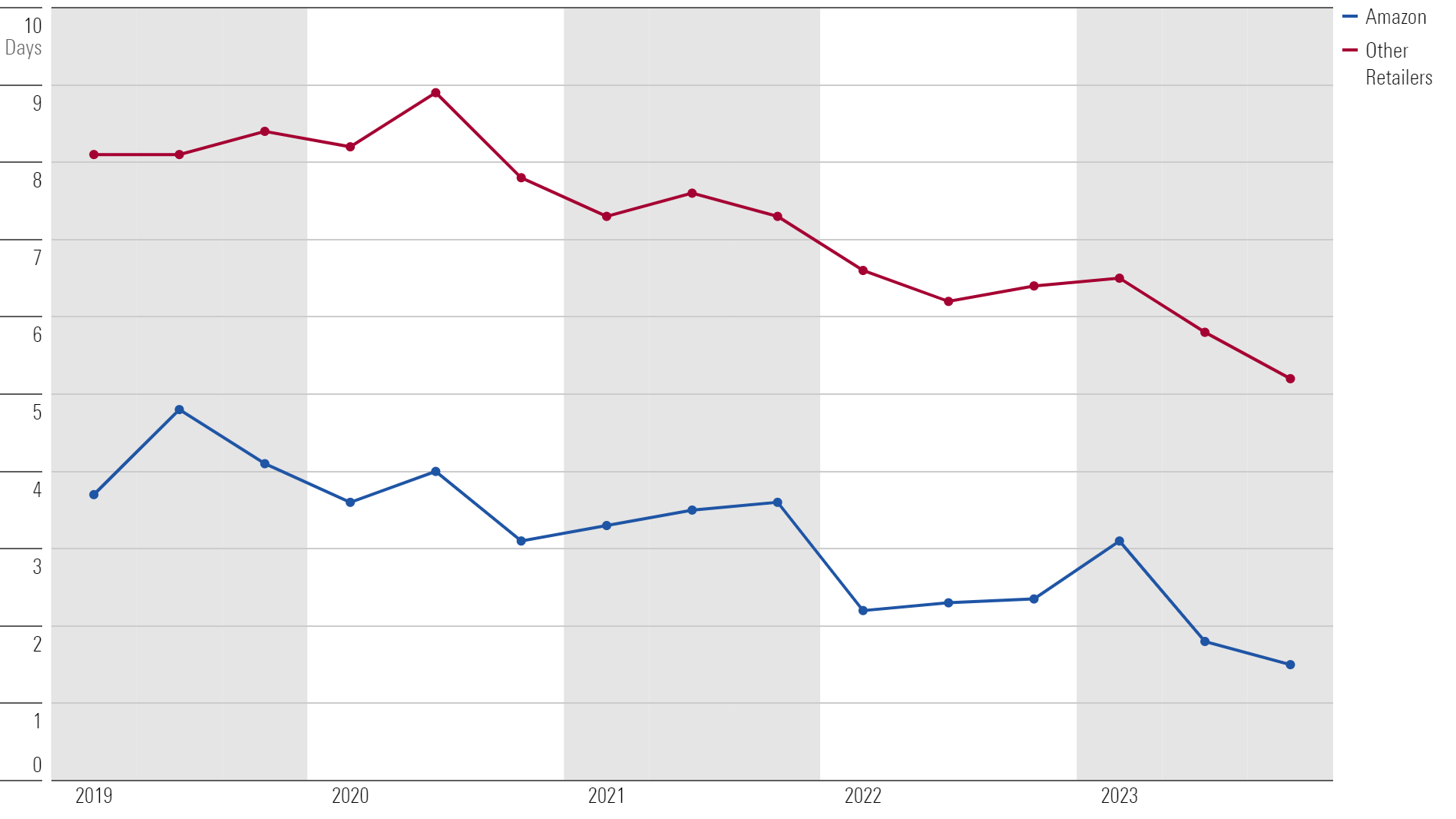

Amazon also disclosed that it was able to deliver to Prime members at the fastest speeds ever in the first half of the year, which is a statement that the company has been able to recycle every year since 2019. Data from Nielsen shows Amazon has reduced its delivery times from “click-to-door” by more than half (3.7 days to 1.5 days) since 2019. And to keep up with Amazon, other retailers have worked hard to push that metric lower as well—from 8.1 days to 5.2 days.

Click-to-Door Speed for US Online Purchases

Increases in productivity are what push the world forward. Amazon will continue to make the experience better for its customers. And the rest of retail will fight to keep up by doing the same. This framework permeates across every successful business and industry.

This is worth remembering as we dive into the thick of election season. Elections create uncertainty, which is expected to influence consumer spending decisions—something companies are acknowledging.

Marriott recently noted that its consumer is becoming more “judicious.” Disney mentioned that consumers are feeling “a little bit of stress.” Airbnb observed “hesitancy for consumers booking longer lead time trips around Thanksgiving and Christmas.”

However, while consumers are becoming more discerning about the future, many companies are doing the exact opposite.

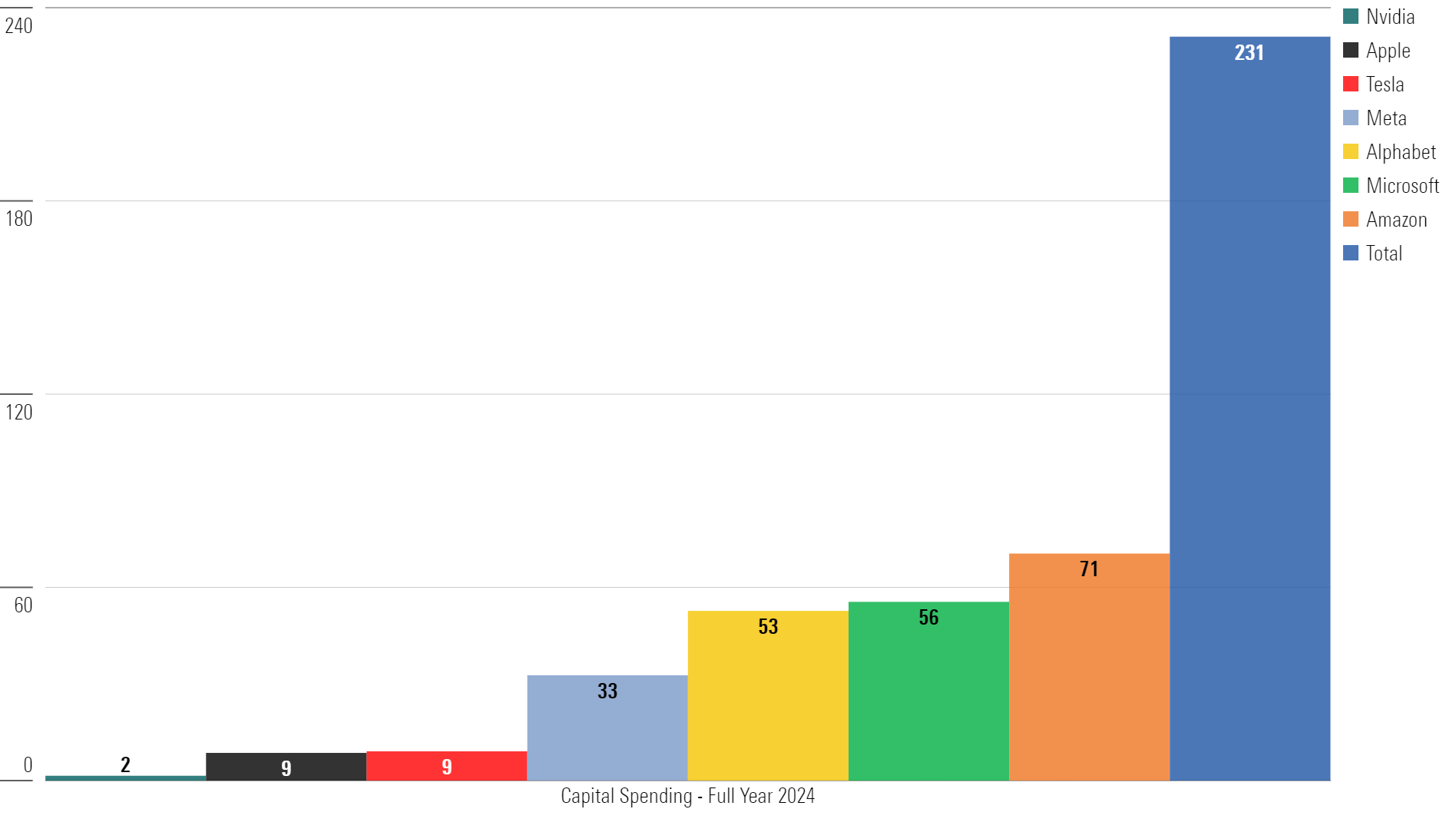

One way to gauge this? Corporate investment, specifically in areas like artificial intelligence. AI could be the next wave that drives future productivity, like what is illustrated in the chart above.

Blackstone CEO Steve Schwarzman recently remarked, “AI has the potential to be one of the greatest drivers of transformation in a generation.” This sentiment appears to be widely shared. Expectations indicate that approximately $1 trillion in capital spending will be directed toward building and supporting new data centers in the US over the next five years, with an additional $1 trillion to be spent internationally.

In a recent statement, Google’s CEO highlighted the importance of this investment, stating, “The risk of under-investing is dramatically greater than the risk of over-investing,” while answering questions about its $50 billion in expected AI-related spending this year.

These spending numbers are becoming so enormous it’s difficult to wrap your head around them. The combined total spending of the Magnificent Seven companies—Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla—this year is expected to exceed $230 billion.

Magnificent Seven Capital Expenditures (2024)

If that spending were a country’s gross domestic product, it would rank 53rd in the world.

These companies are spending this money because they have a great deal of optimism about the future. The executives behind these spending decisions don’t know who will win the presidency in November, and from a business perspective, the argument could be made they don’t really care. They are investing these huge sums because they are focused on growing their business and will continue to do so regardless of who holds office.

And there lies a key point: The decisions made by these businesses—and the returns they generate over the next decade—will have a far greater impact on the long-term health of the economy, and potentially the stock market, than what happens at the polls in November.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)