China Tech Stocks: Investor Fears Could Bring Opportunity

China’s past performance has painted a bleak picture of the future that may not be accurate.

Underperformance is never pleasant. Whether it’s a baseball team (two in Chicago doing this!) or an asset class you’re invested in.

Arguably, no asset class has underperformed more than emerging markets in the past decade. And the funny truth about that underperformance? Most of it has come from one country: China.

China constitutes around 25% of the MSCI Emerging Markets Index. Its annualized return since 2014 has been 0.7%—a lost decade.

Simply put, China has acted like an anchor on emerging markets.

While it’s easy to shy away from such results, we believe there might be opportunities. As one example, the asset class with the current highest approval rating—the S&P 500—is familiar with lost decades. From 2000 to 2009, the S&P 500 lost nearly 10%.

Change can happen fast, and everything eventually reaches a price that makes sense. China’s past performance has painted a bleak picture of the future that may not be accurate.

Regarding China, Apple AAPL CEO Tim Cook recently said, “I don’t know how every chapter of the book reads, but we’re very confident in the long-term.”

The past few chapters have been tough, and no one could argue otherwise. A simple illustration would be a comparison between Alibaba BABA (China’s largest tech company) and Amazon.com AMZN.

Both companies have delivered enormous revenue growth over the past decade operating e-commerce and cloud computing businesses. However, the market currently values Amazon as a true growth company, while Alibaba is priced like something on the rack at T.J. Maxx TJX.

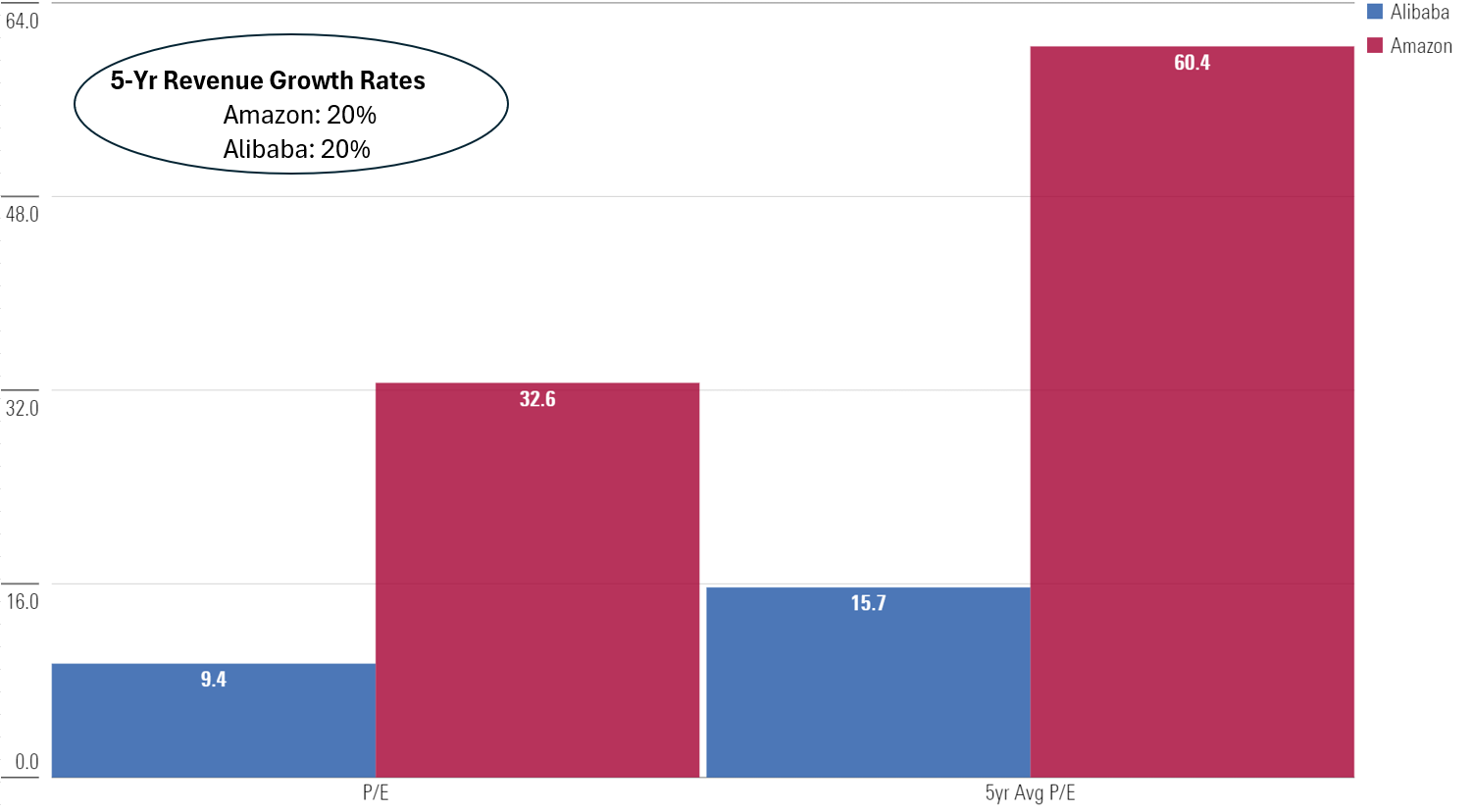

- Alibaba’s forward price/earnings ratio is 9.4, versus 32.6 for Amazon. Alibaba trades at about a 70% discount to Amazon.

- Further, the five-year average forward P/E for Alibaba is 15.7, meaning the company currently trades at about a 40% discount to its own average multiple.

- Both companies have five-year annualized revenue growth rates of 20%. However, we should acknowledge there has been significant volatility in Alibaba’s growth rate in the past two years.

Valuation Comparison: Amazon & Alibaba (Forward P/E and 5-Year Avg.)

To be clear, Alibaba should trade at a discount to Amazon for reasons that include a US advantage in intellectual property rights, regulatory clarity, and investor protections. These are just a few reasons Alibaba trades at such a significant discount to its five-year average.

But the question becomes: How much of a discount is appropriate? While a precise number can’t be calculated, the valuation has reached a point where a contrarian investor should be taking notice.

There is a significant amount of noise surrounding China—all of it negative—but the potential upside, especially in high-quality sectors, makes it worth considering. However, it’s crucial to manage the exposure to these risks carefully. For instance, avoiding more volatile sectors in China like real estate and financial services, there is value in focusing on China’s leading tech companies, such as Alibaba.

These companies are attractively priced, boast strong balance sheets, and face low market expectations. Given these factors, they present a compelling case for inclusion in a diversified portfolio while controlling for the obvious risks.

We know that every chapter of investing in China won’t read easily, but opportunities might exist for patient investors with the proper risk controls.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/A5UY22L42ZASPAW6OW75IQHR2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SRXFRUTTFZGPPK6U6Y5EG4WGMY.png)