Are There Any Values Left in Tech?

The sector's expensive overall, and some valuations are downright alarming.

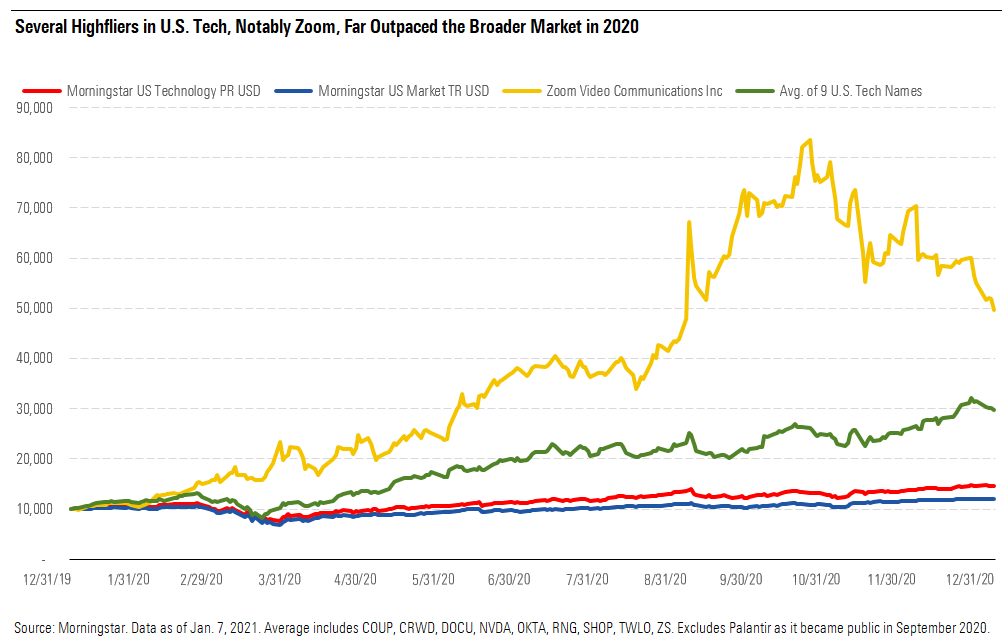

Much went right for the U.S. technology sector in 2020. It significantly outperformed the broader U.S. market for the year, and more than a handful of stocks saw significant price appreciation. In some cases, tech stocks were a safe haven because enterprises did not slash their software budgets during the COVID-19 pandemic. In other cases, enterprises and consumers turned to a wave of cloud, remote working, and e-commerce technologies such as Zoom ZM, DocuSign DOCU, Shopify SHOP, Zscaler ZS, and others. Software companies like Coupa COUP and Twilio TWLO prospered from strong secular growth trends despite the pandemic. Zoom was a prime example of a countercyclical name, rising over 390% in 2020. Many other stocks doubled in the year, and prices exceeded our fair value estimates.

Looking at U.S. tech today, we would need a pullback in stock prices before we could recommend many names to investors with an adequate margin of safety. The median price/fair value estimate ratio across our coverage was 1.22 as of Jan. 21, one of the highest ratios we’ve seen since 2007.

These valuations have led investors to throw the "bubble" term around. However, our team’s view of a sector that is 22% overvalued does not point to a repeat of the dot-com bubble, in which the Nasdaq crashed 66% during 2000-02. Compared with the dot-com era, our U.S. tech coverage is in a steadier place. Companies within our universe (particularly in semiconductors, IT services, and mature software) generate healthy free cash flow that can support existing valuations to a large extent.

Even in software, where many companies do not have fundamental GAAP earnings, we think that many are wisely investing in sales and marketing in order to win new business during the once-in-a-generation shift to software as a service and cloud computing. Moaty software companies we cover have proved to us that they benefit from customer switching costs and have sticky customers where revenue per enterprise may rise over time.

While we can’t rule out any macroeconomic factors that might cause the market to crash, we’re not seeing bets across our coverage on highly risky technologies that are unlikely to gain adoption and cause investments to evaporate. Our analysis is limited to our U.S. tech coverage, which skews toward larger-cap, moaty names; we are not commenting on subsectors that tend to be considered "techlike" (electric vehicle technologies, fintech, social media) or other asset classes (say, cryptocurrencies).

We saw a subset of tech names with massive stock price appreciation in 2020, well beyond what we tend to observe in a normal year. As we watched prices soar past our fundamental valuations, we asked two main questions:

- How common are these large moves in U.S. tech equities?

- Does the market get it right to pile into these names, or do these massive market moves end poorly for investors?

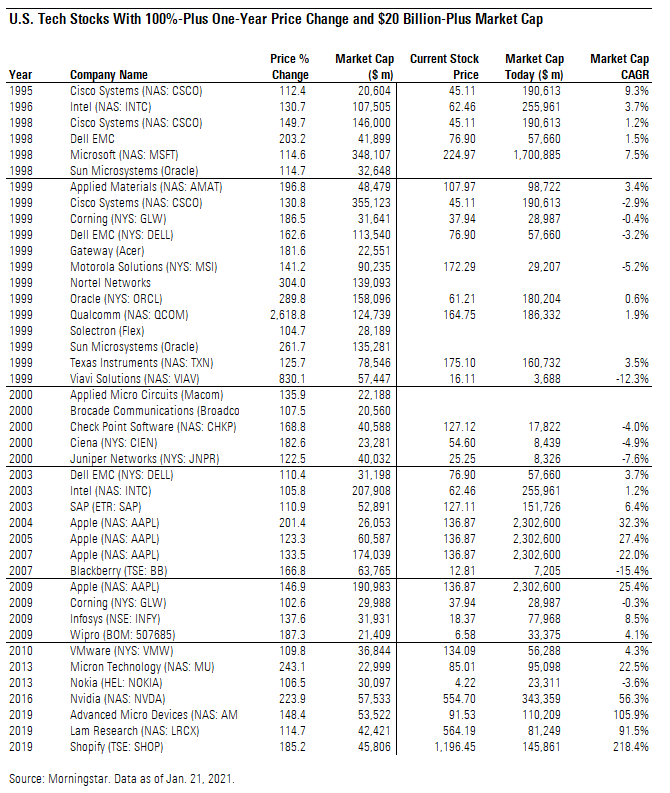

First, we identified 11 companies under our U.S. tech coverage where the stock price rose 100%-plus while reaching at least a $20 billion market cap, meaning that the company added at least $10 billion of market value in a single year (this strips out small-caps, takeovers, and lesser-known companies): Coupa, CrowdStrike CRWD, DocuSign, Nvidia NVDA, Okta OKTA, Palantir PLTR, RingCentral RNG, Shopify, Twilio, Zoom, and Zscaler.

We then looked at data going back to 1990 to see how many U.S. tech companies made similar moves. We typically saw only one or two companies receive such a large infusion of investor dollars in a single year, and 1999 was the last time we saw more than five names make similar moves.

To answer our second set of questions, we looked at how these U.S. tech stocks performed after investors piled into them. In general, the market got it right a reasonable number of times, especially in recent years and if we expand our search slightly to include the FAANG names: Facebook FB, Amazon AMZN, Apple AAPL, Netflix NFLX, and Alphabet GOOG/GOOGL. Ultimately, future revenue growth and earnings potential justified such moves.

However, the last time we saw more than a handful of names receive such an infusion of investor dollars, it was 1999, just before the dot-com crash. The outcome was not pretty for investors thereafter. In a best-case scenario, if investors held those stocks until today, they would have been about 10-20 years too early in terms of witnessing long-term fundamental revenue and earnings growth that justified these enormous valuations in 1999.

Looking at these 11 stocks today, we like all of these businesses, as we award 10 of them with narrow economic moat ratings (Zoom is the exception with no moat) and award many of them with positive moat trend ratings. We see strong growth prospects for these companies in large potential end markets, and we would not hesitate to recommend them if valuations were more reasonable.

On the other hand, based on today’s prices, we would anticipate poor outcomes for many investors, most notably in Zoom and Shopify. To come close to such valuations today, these companies not only require tremendous future growth and earnings power but also wide economic moats, whereas we are more skeptical about the ability of these companies to fend off competition. Most of these companies have to emerge as powerhouses as far out as 2040 to justify current prices.

Ultimately, we would steer investment dollars away from these 11 highfliers. Since the U.S. tech sector is relatively expensive, we would instead point investors to our remaining handful of undervalued names (Intel INTC, Splunk SPLK, Blackbaud BLKB, VMware VMW) or even fairly valued wide-moat bellwethers (Microsoft MSFT, Salesforce CRM).

What Went Right for Technology in 2020 2020 was a banner year for technology investors. As of Dec. 7, the Morningstar U.S. Technology Index was up a whopping 43.3% on a trailing 12-month basis, vastly outperforming the U.S. equity market, which was up 18.4% over the same period. U.S. technology was an outperformer during both the COVID-19-related market sell-off in March 2020 and the subsequent market recovery.

Ultimately, we think tech in 2020 could be viewed as all things to all investors--both a safe haven and a sector with strong secular growth. First, during the depths of the downturn, tech was considered by many to be a safe haven, and we'd concur with this view. As we wrote in April 2020, we did not anticipate deteriorating fundamentals at wide-moat software names like Microsoft, ServiceNow NOW, Salesforce, or Tyler Technologies TYL. These moaty software names have sticky customer bases and healthy deferred revenue balances with excellent visibility and were still poised to expand within existing customers. As the world shifted to remote working, we were highly skeptical that enterprises would start slashing their software budgets, giving their workers fewer tools and adding workflow disruptions to their daily businesses. White-collar workers didn't stop using Office 365 during the pandemic, sales representatives didn't abandon Salesforce, and human resources professionals didn't cut back on their use of Workday WDAY. Admittedly, revenue growth and new software wins were damped in 2020 versus our expectations at the start of the year, but the software sector fared far better than many others.

Second, secular growth drivers in tech remained intact. The shift toward cloud computing and the outsourcing of IT workloads remained in full force during the pandemic as businesses strove to keep up with a more flexible workforce and changing world. Microsoft Azure, for one, continued to perform well with 48% year-over-year growth in the third quarter of 2020.

Third, the shift to remote working led to a near-term boost in IT spending in enterprises, as companies raced to equip their employees with newer PCs, monitors, and peripherals. Similarly, data center spending, especially in the cloud, remained robust. This accelerated refresh cycle won’t last forever (and may have already reverted back to the mean), but it led to some decent results in semiconductors and hardware.

Fourth, and perhaps most notable, were tech names that were countercyclical to the pandemic and appear poised to be winners in the new working world once the pandemic subsides. Zoom was the big winner here, with the stock rising 391% in 2020 and making massive moves on days when the market was most panicked. A good portion of this move was justified. In Zoom’s first quarter, we wrote that the company had reported one of the greatest quarters in the history of the software sector and we stand by this comment. It isn’t every day that revenue grows 169% year over year, and the company reported $328 million of revenue versus CapIQ consensus of $202 million and its own guidance of $200 million. DocuSign and Shopify were other companies poised to benefit from a rise in e-commerce and fewer face-to-face interactions.

The 11 Horsemen of U.S. Tech in 2020 Thanks to these trends, many U.S. tech stocks not only outperformed the broader market in 2020 but appreciated in eye-popping fashion. We identified 11 stocks in our U.S. technology universe that rose more than 100% in 2020 while adding $10 billion or more of market capitalization. We think the latter criterion is important--these companies weren't taken over or popped based on a single customer or design win; rather, they received a significant inflow of capital. The market has given these 11 stocks some credibility regarding their future outlooks.

We would put these stocks into three broad categories, along with a couple of other outliers.

1. The acceleration of remote working and online everything: Zoom, RingCentral, DocuSign, Shopify, Twilio.

In a world where everything moved remotely, several names were countercyclical to the market and beneficiaries of the online trend. Zoom’s video communications are now a part of the daily lexicon, as it seems as if everyone partook in Zoom calls for business or pleasure in 2020. RingCentral’s unified communications as a service replaces the physical office phone with a virtual solution that can be accessed from anywhere. DocuSign is a leader in e-signatures, which remains an obvious use case to us as it replaces the tedious nature of shipping, signing, and reshipping paper documents. Shopify’s e-commerce tools have been vital to retailers large and small during the pandemic. Twilio’s focus on customer engagement was critical as enterprises strived to interact with customers in new ways during the year. For example, Twilio’s platform may have been the backbone for providing consumers with text alerts that their curbside orders were ready for pickup.

In each of these cases, we anticipated strong growth for these companies in the decade ahead. But in a quote from Vladimir Lenin that we heard quite often in 2020, "there are weeks where decades happen," and gradual shifts toward these technologies turned into a mad rush.

2. The rush for cloud-based cybersecurity: Okta, CrowdStrike, Zscaler.

As we wrote last summer, the rise of remote working led to more employees accessing more enterprise tools from a far wider variety of locations. All the while, cybersecurity threats during the pandemic were on the rise. Adoption of cloud-based security tools from Okta, CrowdStrike, and Zscaler, in particular, accelerated during the pandemic, and we do not expect this trend to revert after workers return to offices.

3. Ongoing secular strength in SaaS and a year of beats and raises: Twilio, Coupa Software.

The rise of cloud computing and software as a service continues to be the strongest secular trend in technology, and COVID-19 did nothing to abate these tailwinds. Regardless of where employees worked, more and more enterprises became reliant on a greater assortment of cloud-based software tools. Twilio and Coupa were shining examples of this in 2020. Twilio’s importance during COVID-19 was mentioned above. Coupa’s software helps enterprises streamline their spending on indirect expenses, and belt tightening during COVID-19 likely made it all the more attractive.

Outside of these three themes, we have a couple of one-off highfliers. Palantir came public in September 2020, and after a rough start, investor dollars flooded the offering. We were on the high side of Street targets with a $13 fair value estimate in September. Yet the stock rose 167% in the month of November alone, from $10.50 to the high $20s.

Nvidia landed on this list of 100%-plus, $20 billion-plus tech companies in 2020 (and in prior years as well), and the rise of its best-of-breed or graphics processor units continues. Nvidia remains well positioned to supply server GPUs for accelerating the training of artificial intelligence models and was well exposed to rising data center spending in 2020. Meanwhile, the company leveraged its high stock price to make a wise strategic deal (still pending) to acquire ARM Holdings, which we rated as a wide-moat stock when it was publicly traded several years ago.

Where Does Tech Go From Here? The median price/fair value estimate ratio for our entire U.S. technology coverage sat at 1.22 as of Jan. 21. This is one of the highest we've seen since 2007 and implies that U.S. tech is broadly overvalued. We'd welcome a correction in tech stocks in order to provide investors with some potential buying opportunities.

Since we believe that the median U.S. tech stock is more than 20% overvalued, we wouldn’t be surprised at all if valuations were to pull back a bit at some point. We think tech provided some relative safety to investors during the turbulence of the COVID-19 pandemic, while also providing attractive growth opportunities in other areas thanks to the shift to remote working and IT upgrades. However, as the world recovers from COVID-19 in 2021 and vaccines roll out, it is possible that beaten-up sectors like hospitality and airlines could begin to recover as well, perhaps pulling investment dollars out of tech and remote working names.

In a way, our tech coverage appears to have fallen into two categories. We have one bucket of coverage (again, skewing larger-cap and moaty) that is expensive but has fundamental earnings and well-established technological trends in its favor. In the second bucket, we have at least 11 stocks that have skyrocketed in 2020, most of which are well above our fundamental valuations. The former bucket doesn’t appear prone to a massive destruction in value similar to the dot-com bubble in 2000. The latter grouping might be, though.

Again, it has been over 20 years since we’ve seen so many tech stocks receive such large infusions of investor dollars in a single year, and this last instance was in the middle of the dot-com bubble. Looking deeper, 4 of these 11 stocks with a $20 billion-plus market cap have tripled in 2020, more than the number of stocks tripling or more in the past 20 years combined. Further, looking at these stocks on a fundamental basis, 9 of the 11 stocks we identified are at least 30% overvalued as of the end of 2020. We’d welcome a correction broadly, but for most of these highfliers, a significant pullback wouldn’t be surprising.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)