Consumer Cyclicals: Even Amid Moderating Consumer Spending, We See Discounts

Our favorite stocks in this sector are Nike, Kohl’s, and Bath & Body Works.

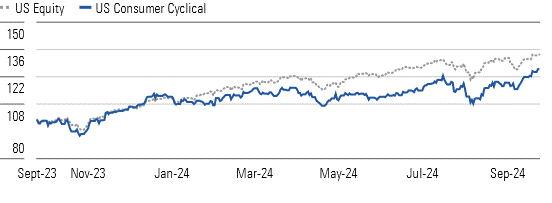

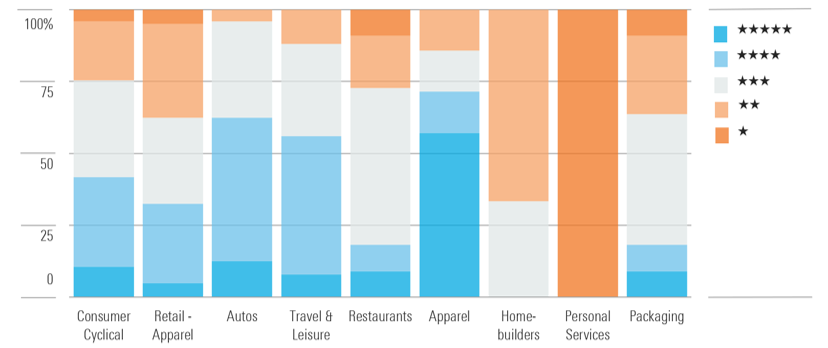

The Morningstar US Consumer Cyclical Index rose in the third quarter, outperforming the overall market. Despite this move, we believe opportunity still exists in the sector, as 44% of the companies we cover sit in 4- and 5-star territory, with the median stock trading at an 11% discount to our fair value estimates. Looking closer, most opportunities exist in the travel and leisure sector, as well as apparel. We think investor reticence is anchored in the financial burdens consumers are navigating and the potential impact that could have on discretionary spending.

Consumer Cyclical Stocks Outpace the Broader Market in Q3

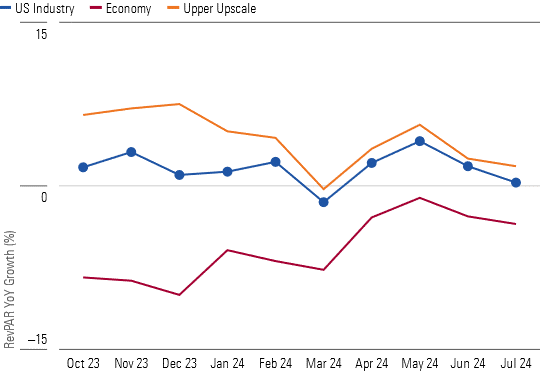

Consumers have been inundated with higher prices across staples like gas, food, and housing. Rising costs have directly impacted travel demand, which has begun to wane. Evidencing this is the way overall industry revenue per available room has slowed, averaging 1.6% over the past 12 months through July versus 12.6% in the 12-month period prior to July 2023. The waning demand has been driven by a 5.8% revPAR decline at economy hotels over the past 12 months, compared with a decrease of 2.4% in the prior 12 months, while upper upscale revPAR has slowed to 4.7% in the most recent 12 months from 26.8% in the 12 months prior. This suggests that flagging travel demand is not specific to more value-oriented consumers.

Apparel and Travel Sectors Remain on Sale

Despite scale advantages and efforts to invest in marketing and IT infrastructure, we expect revPAR growth will remain below long-term levels into 2025 given the challenging macroeconomic backdrop. However, we surmise alleviating pressures and investments to unlock dynamic pricing and support loyalty membership in the long term should buoy a reacceleration in revPAR growth beyond 2025.

Demand for Travel Moderating as Consumer Financial Strain Mounts

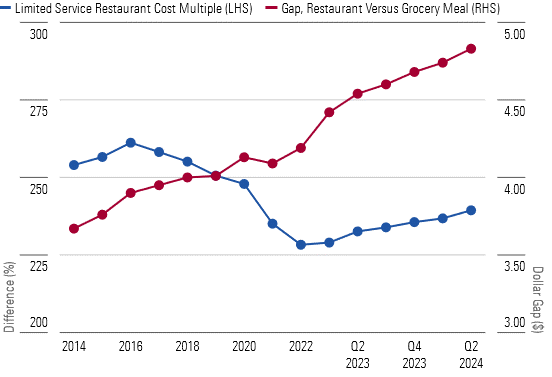

Beyond travel, consumers are employing more discretion as to where they consume meals. This has been evident in restaurant traffic declining each month since 2022. And the widening gap between restaurant and comparable grocery store meals (now at $4.83) is unsurprising. Against this challenging backdrop, we expect restaurant players investing in technology, like digital ordering, and loyalty programs will win out in the long term.

As the Price Gap Widens, We Expect At-Home Food Consumption to Grow

Top Consumer Cyclical Sector Picks

Bath & Body Works

- Fair Value Estimate: $67.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

We view Bath & Body Works BBWI shares as compelling, trading at a roughly 57% discount to our fair value estimate. We believe the company has a solid competitive edge in the sizable addressable markets in which it operates. Its strong brand intangible asset is supported by its leadership position across the bath and shower and candle and air freshener industries in recent years, bolstered by the firm’s quick response to consumer trends. We expect product innovation and productivity gains of new store formats will support top- and bottom-line growth over time.

Nike

- Fair Value Estimate: $124.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

Nike NKE is currently in 5-star territory, with shares sitting at a 30% discount to our fair value estimate. We award Nike, the global sportswear leader, a wide moat, based on its brand intangible asset. Its sales growth has stalled, but it achieves premium prices for its products through its innovation, marketing, and direct selling. The firm is also cutting costs through restructuring efforts, planning to reduce annual expenses by $2 billion by 2026. Areas of growth include China, and as the market leader, it should continue to benefit from government investment in athletics.

Kohl’s

- Fair Value Estimate: $48.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

We believe Kohl’s KSS, trading at around a 60% discount to our fair value estimate, is an attractive investment opportunity. Although Kohl’s and other department stores have been struggling, CEO Tom Kingsbury is focused on improving the customer experience, managing inventory, and rationalizing pricing. The firm’s strengths include its large e-commerce operation, which benefits from direct shipments from stores and a buy online/pickup in store offering. In addition, Kohl’s has greatly improved its competitiveness in beauty through its partnership with Sephora.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JCN26JDJBFA5BYKGBL2ATIHCU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5FJIYHKNZRBM3LAKQL2QEUMDTA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)