Utilities: Falling Interest Rates, Growth Outlook Boosting Stocks

In the utilities sector, our top picks are NiSource, Evergy, and WEC.

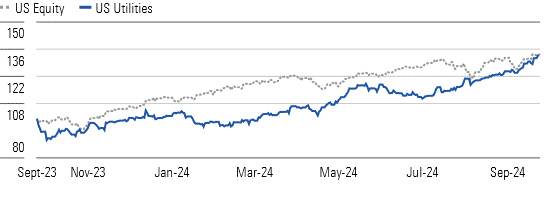

Investors still can’t get enough of utilities. The sector’s run, which started in late 2023, is approaching its one-year mark. The Morningstar US Utilities Index is up 45%, including dividends, since its low last October, and it’s reached an all-time high. We expected utilities to rebound this year after their woeful underperformance for most of 2023, but the rebound has lasted longer and gone higher than we expected. The sector has gone from 16% undervalued late last year to 14% overvalued as of Sept. 23.

Utilities Rally Since March Handily Beat the Market

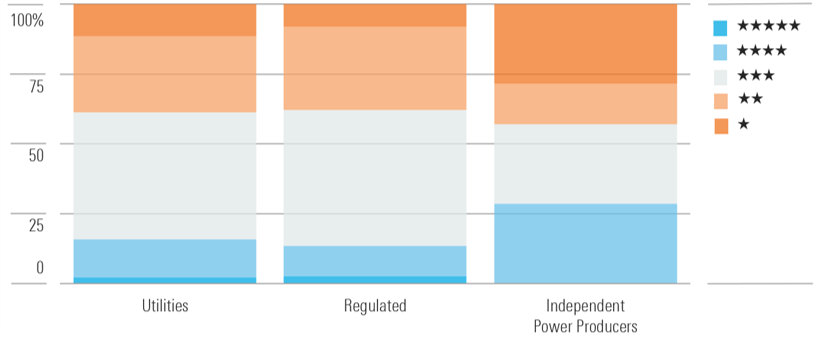

Utility stocks look pricey even after incorporating tailwinds like falling interest rates and accelerating energy demand growth. The sector’s 19 median P/E is above the 20-year average, and the 3.4% median sector dividend yield is the lowest it’s been since early 2023, even after sector-wide dividend increases.

Only a Few Utilities Trade Below Fair Value Estimate After 2024 Outperformance

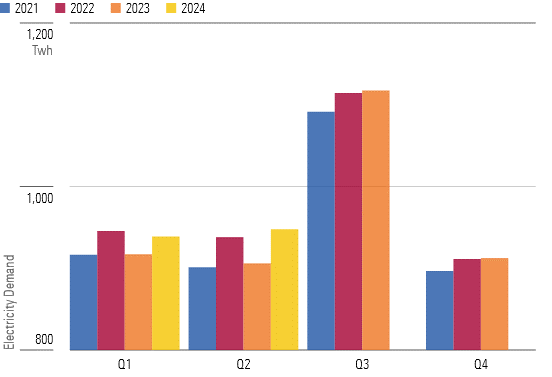

We think utilities still deserve premium valuations relative to recent history because of their attractive growth opportunities. Electricity demand growth is accelerating in most parts of the United States, particularly among industrial customers adding factories and production. We think the excitement around data center demand is warranted, but logistical and regulatory constraints could push out timelines. Renewable energy growth continues unabated. Election outcomes in November are unlikely to slow growth, given the state-level policies, favorable economics, job creation, and corporate demand to meet environmental targets.

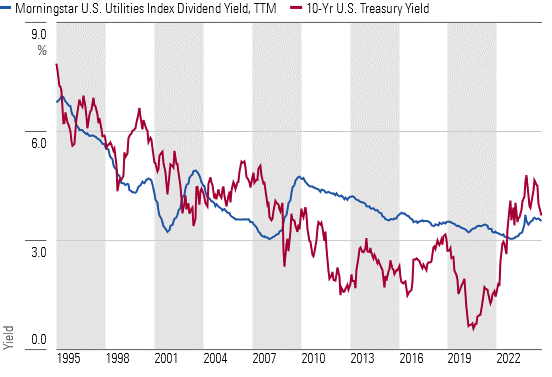

Utilities' Dividend Yield and Interest Rates Converging

The sharp drop in interest rates since this summer and continued dividend growth from nearly all utilities mean 10-year US Treasury rates and utilities’ dividend yields are nearly the same for the first time since mid-2022. We expect another round of robust dividend increases for almost all US utilities in 2025, given the sector’s solid fundamentals. Thus, we believe dividend yields will remain above 3% well into 2025, even if utility stocks continue to rally.

Accelerating Electricity Demand Tailwind for Utilities

Top Utilities Sector Picks

NiSource

- Fair Value Estimate: $35.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

We think NiSource NI deserves a premium valuation relative to its peers because of its long and transparent runway of growth. NiSource’s transition from fossil fuels to clean energy in the Midwest supports at least a decade of faster growth than most US utilities. It plans to replace all coal generation with wind, solar, and energy storage by 2028. Energy demand from new industrial onshoring and data centers is another source of growth. We expect NiSource to invest $17 billion over the next five years and as much as $30 billion during the next 10 years, leading to 7% earnings growth and similar dividend growth. Its six gas utilities have ample near-term investment and regulatory support in regions unlikely to abandon gas.

Evergy

- Fair Value Estimate: $65.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

Evergy EVRG trades at one of the lowest earnings multiples (16 P/E) and highest dividend yields (4.2%) of any US utility as of mid-September. Though the market seems concerned about Evergy’s growth prospects, we forecast 6% annual earnings growth, in line with most other utilities. We think management will raise its $13 billion capital investment plan through 2028 based on demand growth and power generation needs. Alphabet GOOGL/GOOG, Meta Platforms META, and Panasonic PCRFF have announced large development plans in Evergy’s service territory. Positive legislative and regulatory developments also could boost earnings and dividend growth.

WEC Energy Group

- Fair Value Estimate: $97.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Low

WEC Energy WEC combines best-in-class management and above-average growth opportunities, supported by constructive regulation across most of its jurisdictions. The company’s new five-year capital investment plan totals $23.7 billion, a nearly 20% increase from its prior plan. WEC will increase investments in renewable generation, natural gas generation, and transmission due to significant economic development in southeastern Wisconsin. This supports our growth estimate at the high end of management’s 6.5%-7.0% guidance range.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JCN26JDJBFA5BYKGBL2ATIHCU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)