Technology Stock Sector Outlook: After Q1 2023 Bounce, We Still See Opportunities in Wide-Moat Software Stocks

We expect tech’s secular tailwinds including cloud computing and semiconductor demand to continue.

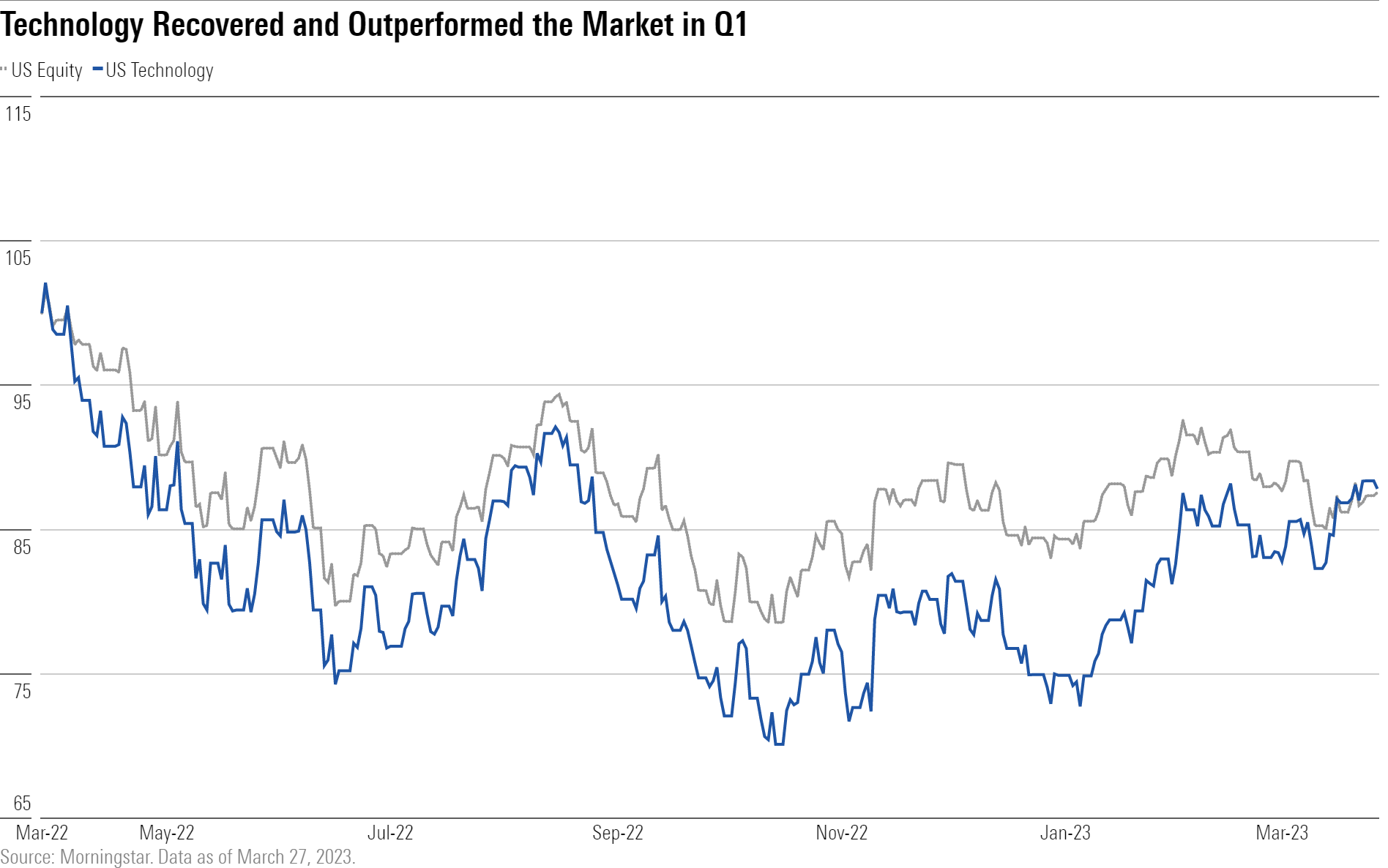

After a brutal 2022 for the technology sector, we saw a rally in tech in the first quarter of 2023, and the sector is now a modest outperformer to the broader market over the past 12 months. Mega-cap tech stocks (Apple AAPL, Microsoft MSFT) are still faring better than the overall group, but it appears that high-flying growth stocks also recovered this quarter.

Regardless, we remain confident in secular tailwinds in technology, such as cloud computing and rising semiconductor demand. We’d encourage investors to focus on the bright long-term prospects in software as a service and data center expansion, despite the cautious tones that we’re hearing because of macroeconomic concerns.

Across the tech landscape, we still see weak demand for PCs and Android-based smartphones, while Apple iPhone demand is holding up relatively better. Chip demand into automotive remains healthy, while the end market for large industrial equipment remains resilient. We still see buying opportunities within tech for long-term, patient investors, especially in wide-moat names across semis and software.

The Morningstar US Technology Index was down 8% on a trailing-12-month basis, compared with the U.S. equity market down 10%. Quarter to date, tech rose a whopping 17.25% while the U.S. equity market rose only 3.83%. On an intrinsic value weighted basis, the U.S. technology sector is 5% undervalued, and we see less of a margin of safety than when these stocks were 20%-25% undervalued just six months ago. Software remains the most attractive subsector of tech as the median stock is 16% undervalued. The median semiconductor stock is 10% undervalued, while the median hardware stock is 11% undervalued.

Opportunities in Wide-Moat Software Stocks

We anticipate healthy revenue growth in the software end market for years to come, as software makes businesses more efficient and provides companies with insights. Still, software revenue growth has been slowing over the course of the past year. U.S. dollar strength has been a headwind, while customers are showing some caution with elongated sales cycles. Nonetheless, we foresee a snapback in calendar 2024.

Longer term, we still foresee robust growth for the industry. Elsewhere, we still view the electronic components space (sensors, connectors, electrical protectors, and so on) as underappreciated. These mission-critical electronic components ensure flawless performance of planes, trains, and cars, hence the strong switching costs and pricing power. The electrification of the automotive market is an increasingly important growth theme for suppliers.

Top Technology Stock Picks

Salesforce CRM

- Fair Value Estimate (USD): 245.00

- Star Rating: 4 Stars

- Uncertainty: High

- Economic Moat: Wide

We believe Salesforce.com represents one of the best long-term growth stories in large-cap software. Its ever-expanding portfolio of complementary solutions allows users to completely embrace their customers, thereby building relationships, strengthening retention, and driving revenue. In our view, Salesforce will benefit further from natural cross-selling among its clouds, upselling more robust features within product lines, pricing actions, international growth, and continued acquisitions such as the recent deals for Slack and Tableau.

ServiceNow NOW

- Fair Value Estimate (USD): 600.00

- Star Rating: 4 Stars

- Uncertainty: High

- Economic Moat: Wide

ServiceNow excels at executing the land-and-expand strategy, and it continues to leverage its strength in workflow automation to penetrate existing customers more deeply in IT and more broadly with HR, customer service specific, and other back-office products. We expect both tiered offerings and vertical specific versions to continue to provide a nice tailwind to revenue. We think ServiceNow has become a key partner in digital transformation as shown in retention statistics, which remain at the elite level. Notably, we are impressed with ServiceNow’s excellent balance between strong and highly visible revenue growth and robust margins.

ASML Holding ADR ASML

- Fair Value Estimate (USD): 700.00

- Star Rating: 4 Stars

- Uncertainty: Medium

- Economic Moat Wide

ASML is one of our top picks in the semiconductor space, thanks to the increasing adoption of extreme ultraviolet lithography at large chipmakers such as TSMC and Intel to support explosive chip demand. Although the firm’s near-term outlook is negatively affected by supply chain constraints, we think ASML will outgrow the wafer fab equipment industry in the coming years. With TSMC, Intel, and Samsung all vying for process technology leadership, we expect ASML to be a primary beneficiary as it sells tools to all three of these firms.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)