Utilities Have Rarely Been This Attractive

We see the best values in high-quality gas utilities.

Like many of us, utilities were happy to say goodbye to 2020. They lost all of their early-year momentum when the pandemic hit and have yet to recover. Utilities closed 2020 as the second-worst-performing sector behind energy and remain down 10% from their peak last February. After record-high valuations in early 2020, the sector pullback means more attractive valuations going into this year. Healthy balance sheets, secure dividends, and growing earnings should give investors comfort that utilities can play their traditional defensive, income-producing role in 2021.

Utilities Still Haven't Fully Recovered From Market Crash

Key Sector Themes in 2021

- Utilities' dividend yields and growth outlook have rarely been so attractive. The 220-basis-point spread between the sector's 3.5% dividend yield and the 1.3% 10-year U.S. Treasury yield is near a 30-year high. The current spread is also well above the average 140-basis-point spread since interest rates began their secular decline during the last two decades.

- Utilities will be leading investors in renewable energy and supporting infrastructure like transmission and smart grids. The U.S. is set to add nearly 50 gigawatts of solar and wind generation capacity in 2021-23 based on planned or under-construction projects. That would bring U.S. solar and wind capacity nearly equal to coal generation capacity. New government renewable energy incentives and mandates could accelerate growth. And where governments stop, corporations have picked up, with widespread commitments to reducing greenhouse gas emissions. In December, Amazon signed a deal for 3.4 GW of global renewable energy projects, one of the largest corporate deals ever.

- The winners in 2021 and beyond will be the utilities that can complete projects on time and on budget, maintaining steady earnings growth. We expect better than 5% annual earnings and dividend growth on average across the sector for at least the next four years. Utilities that execute their growth plans flawlessly could produce 7%-9% annual growth.

- Relationships with regulators and policymakers will be paramount, particularly as clean energy gains political momentum. Constructive policymaking could mean a decade or more of growth opportunities for the sector, resulting in annual earnings growth topping 8% for some well-positioned utilities with strong regulatory relationships.

- Utilities could benefit from a valuation uplift if more of them can break into environmental, social, and governance funds. Assets in U.S. ESG-focused funds more than doubled from 2016 to 2019, but utilities are underrepresented in many of these funds relative to category averages. This is particularly true among ESG funds that focus on large-cap U.S. stocks. Utilities also tend to be underrepresented in equity allocation and U.S. small-cap ESG funds. Utilities tend to be overrepresented in international funds, primarily because of European utilities' more favorable ESG profiles.

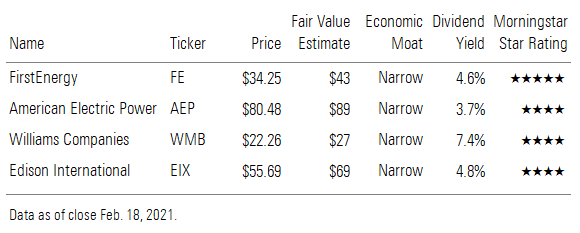

We think the best investment opportunities are utilities that trade at or below our fair value estimates, with attractive dividend yields and strong balance sheets. Some of these aren’t obvious beneficiaries of the renewable energy movement.

Top Picks FirstEnergy's FE shares fell 30% in July and have not recovered following the arrest of the Ohio House Speaker and four others on racketeering charges. Although no FirstEnergy executives have been charged and FirstEnergy no longer owns the entity that benefited from the alleged bribery, we expect the company will have to repair regulatory and political relationships in Ohio, which represents less than 20% of earnings. FirstEnergy's underlying businesses are solid. As the bribery headlines and COVID-19 issues fade, we estimate 4.8% annual EPS and dividend growth driven by strong Federal Energy Regulatory Commission-regulated transmission investment.

American Electric Power AEP has aggressive renewable plans through the decade. Across much of AEP’s vast service territory, states were slower than others to adopt renewable energy standards. This has resulted in slower renewable energy growth for AEP. But state regulators overseeing AEP’s service territories are now embracing renewable energy development, providing significant growth opportunities beyond our five-year forecast. By 2030, AEP still expects 24% of its generation capacity from coal, down from 43% currently, in which the company could see further development opportunities to expedite its transition under the Biden administration. AEP will also benefit from investment opportunities in its transmission and distribution network, which is the largest in the United States, as other utilities also connect renewable energy projects. We think investors are too focused on the company’s near-term exposure to electricity demand and exposure in Ohio, where regulatory risk is high.

As one of the largest midstream energy firms in the U.S., Williams Companies WMB acts more like a utility than an energy company. Its premier assets, most importantly the Transco gas pipeline in the Eastern U.S., have long-term contracted or regulated rates that produce returns on capital often topping returns that distribution utilities earn. Williams sports a yield above 7%--double the utilities sector average--with a payout ratio, balance sheet, and growth outlook similar to most utilities. But the market is unwilling to award the company a valuation like a utility.

Edison International EIX offers a triple play of value, growth, and income. California political risk will always be a concern for the company. However, California’s progressive energy policies also create more growth opportunities than most other U.S. utilities. Edison’s electric-only business, recent regulatory success, and $5 billion annual investment plan give us confidence that it can increase earnings 6% annually beyond 2020. Management recently raised the dividend 4%, and we expect that pace to pick up. Edison has stakeholder support to harden the grid against natural disasters, integrate renewable energy, and support electric vehicle adoption.

FirstEnergy, American Electric Power, Williams Companies, Edicon International

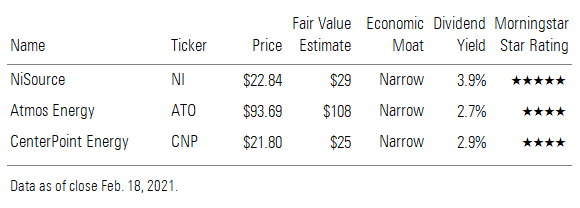

Cheap Natural Gas Utilities NiSource NI is set to become a renewable energy leader, a huge shift from its historical concentration on coal and natural gas energy. We estimate that NiSource will invest $1.9 billion in renewable energy in Indiana before its next planned rate case in 2023. This is just the start of its 20-year, $40 billion infrastructure investment plan. We estimate that this renewable energy investment and other capital expenditures in electric and natural gas distribution will allow annual earnings per share and dividend growth exceeding 7% for 2021-24, in line with management's 7%-9% guidance. Indiana regulation has been constructive in the past, and the commission has expressed support for renewable energy with Nipsco and other Indiana utilities in recent integrated resource plans. Thus, we are confident that regulators will approve the investment and allow constructive regulatory treatment.

Once one of the priciest utilities, Atmos Energy ATO is now one of the cheapest. Yet Atmos’ operations, earnings, and dividend remain a model of consistency. Favorable regulatory frameworks and large infrastructure investment opportunities have driven strong earnings growth and steady dividend increases averaging more than 7% annually in recent years. We expect over $12 billion of capital expenditures during the next five years, exceeding the top end of management’s $11 billion-$12 billion target. Over 85% of the total investment is for safety and reliability, such as replacing bare steel, cast iron, and vintage plastic pipes. We expect this growth investment to receive regulatory support and continue well beyond this decade. This should continue to drive dividend growth near the top end of management’s 6%-8% target over at least the next five years and possibly much longer.

CenterPoint Energy’s CNP regulated utilities have significant investment opportunities due to growing energy demand and infrastructure needs in its vast service territories. We estimate CenterPoint’s regulated earnings will grow over 7% annually and contribute more than 90% of consolidated operating earnings by 2023, based on its current portfolio of businesses. We don’t expect that growth trajectory to change significantly if management follows through on its plan to sell its gas distribution utilities in Arkansas and Oklahoma. CenterPoint’s largest utilities in Texas, Minnesota, and Indiana remain the primary areas of growth. The recently announced merger of 54%-owned Enable Midstream Partners ENBL with Energy Transfer ET will provide more a more liquid investment that we expect CenterPoint to eventually divest. Divestiture would eliminate CenterPoint’s nonutility exposure and we believe provide a simpler story for investors. We think the dividend is secure after its 48% cut in the second quarter last year due to Enable's distribution cut and COVID-19-related issues. Eventually we expect dividend growth in line with the growth in the utilities’ EPS contribution.

NiSource, Atmos Energy, Atmos Energy, and CenterPoint Energy

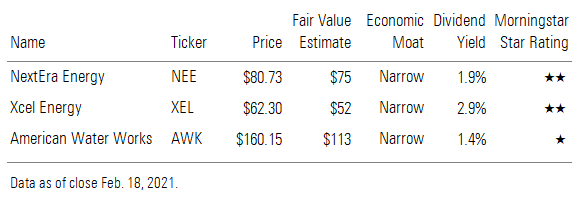

Rich Aristocrats Valuations for the highest-quality utilities with the best earnings and dividend growth are rich, and investors should be cautious.

NextEra Energy, Xcel Energy, and American Water Works

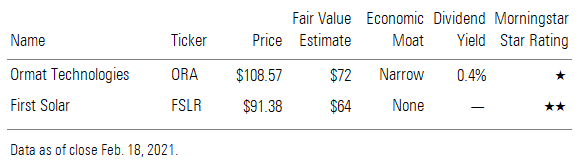

Clean Energy Clean energy stocks have soared, leaving the two largest pure-play renewable energy companies in our coverage substantially overvalued.

Ormat Technologies and First Solar

Value Find: Natural Gas Utilities Investors have turned sharply against natural gas utilities in the past 18 months, reversing a long stretch of outperformance. Between 2015 and late 2019, U.S. gas utilities outperformed the Morningstar US Utilities Index and the Morningstar US Market Index by 25 percentage points. But since October 2019, gas utilities have trailed both indexes.

We think gas utilities’ underperformance offers a good value opportunity. Three of the four cheapest U.S. utilities in our coverage are utilities with significant gas businesses that had been among the top performers until 2019. Atmos Energy, NiSource, and CenterPoint Energy all trade more than 10% below our fair value estimates. Atmos and NiSource had traded at substantial premiums to our fair value estimates as recently as early 2020.

Gas Bans Spook Investors Investors appear worried that a fringe movement to eliminate natural gas use in residential and commercial buildings could spread as states and municipalities aim to reduce carbon emissions. In July 2019, Berkeley, California, was the first city in the U.S. to restrict new gas infrastructure. Some 40 other California cities, counties, and municipalities have followed, primarily by adjusting building codes to restrict gas use in new construction. San Francisco, San Jose, and Oakland passed certain restrictions in 2020. Politicians in Seattle are the latest to follow California's lead with a proposed gas ban for new commercial and large apartment buildings.

New York has taken a different approach, using state environmental regulations to limit new gas supply into the state. This led National Grid NGG to halt new connections based on potential supply constraints during high-usage periods. State utility regulators ordered National Grid to resume new hookups, but gas supply remains an issue. Opposition to gas pipeline expansion along the East Coast and into the Northeast also could constrain supply. Communities around Boston have discussed gas bans recently, but those efforts stalled after the state’s attorney general ruled against a gas ban in Brookline.

Gas Utilities Have Staying Power We think the market has overreacted to the industry's potential long-term threats. Here are some reasons we think gas utilities will survive--and even thrive--for at least the next decade:

- Using gas for space heating, hot water, and cooking remains cheaper than electricity in many areas of the U.S. Space heating and hot water represent more than 70% of home energy use. The annual natural gas energy required to heat a home is over 10 times the electrical energy required to cool a home. If hot water is included, the ratio is over 15 times. Thus, switching away from natural gas for heating and hot water will require massive amounts of additional electric energy. In colder climates, electricity demand would likely double. This is not technically or economically feasible based on the existing energy infrastructure. Switching to electricity also would raise bills for many residential customers.

- Gas bans remain a fringe movement. Although they have gained support in some metropolitan areas of California, Washington, and the Northeast, we don't expect gas bans to spread widely. At least eight states have passed or proposed legislation that would prohibit gas bans. Many gas utilities are reporting customer growth from new homes and businesses or from customers who are switching away from propane or fuel oil. The number of residential gas customers in the U.S. has been growing 0.7% annually on average since 2010 and has picked up speed since 2014 as gas prices plummeted.

- Gas utilities have had several deadly explosions during the past 10 years, including tragic incidents in San Bruno, California (2010), New York City (2014), Dallas (2018), and Boston (2018). Many believe PG&E's PCG gas pipeline explosion in San Bruno was the wake-up call for the industry and regulators. Hundreds of thousands of miles of pipe currently in use is made from cast iron, bare steel, and vintage plastics now considered substandard for natural gas distribution piping. The industry was replacing this pipe but at a rate that would take 50-100 years. San Bruno changed that, and gas utilities stepped up the pace of replacement. As these system upgrade investments flow into rate base, utilities will be able to raise customer rates to recover those costs and a return on those investments. That will drive earnings growth even if gas use slows.

- Green hydrogen and renewable natural gas are likely a decade away from being economic on a large scale, but the technologies will give regulators and politicians a reason to continue supporting investment in the existing gas distribution system.

Andrew Bischof, CFA, CPA, also contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)