Markets Brief: Fed Rate Cut in Focus

Plus: Oil stocks, the power of compounding, active vs. passive and core inflation.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Tech Stocks Rebound

The pendulum of market sentiment swung again last week as resurgent optimism among investors pushed the Morningstar US Market index up 4% in sharp contrast to the previous week’s fall of 4.3%. As ever, the rise in prices was not evenly distributed. Technology led the way with several of the index heavyweights that dragged on that sector in the previous week providing support. Most notable among these was Broadcom AVGO which rose 22.4% following quarterly results the previous Thursday. You can read Morningstar’s Broadcom analyst, William Kerwin’s take on those results here.

In contrast energy stocks continued to fall and are now down 3.4% over the last six months, underperforming the broader market by 12.4% against a background of weak oil prices with the Brent crude benchmark down 14.3% over the same period. Although oil prices are a key driver of returns and there is evidence of excessive supply, Morningstar analysts believe investors are overly pessimistic about the sector, which is now priced 13.7% below their assessment of its fair value. To find out more, check out our Oil & Gas Pulse report which we published last week.

Inflation Data Backs Rate Cut Argument

The inflation data for August were a mixed bag with core inflation (which excludes volatile food and energy prices) a little higher than expected at 0.3% rather than 0.2% and annualized headline inflation lower than expected at 2.5% compared to 2.6%. While the Federal Reserve tends to focus on core inflation rather than the headline number, this latest data appeared to encourage expectations of a 0.5% cut in interest rates this week with the probability of a larger cut increasing to 45% from 30% a week ago (source CME FedWatch). You can find out what Morningstar’s chief US economist, Preston Caldwell thought about the data here.

Charlie Munger and Compounding

When experiencing volatile markets, it is easy to become excessively focused on the immediate future and forget that investing should be a demonstration of compounding growth. The key drivers of investing returns act slowly over a period of years or even decades and consequently patience is essential to successful investment. It is well known that humans struggle to intuit the impact of compounding returns and so prioritize near-term gains rather than long-term success. Morningstar’s Danny Noonan illustrates the dangers of such an approach by contrasting two investment approaches in his latest article. Investing legend Charlie Munger expressed it well: “The first rule of compounding: Never interrupt it unnecessarily”. While there is much more to successful investing that merely patience, the latter is essential to the former.

When Does it Pay to Go Active?

Many investors believe that the best way to access compound growth is through passive investment as there is less temptation to make changes to the portfolio. This theory is tested by the latest edition of Morningstar’s semi-annual US Active/Passive Barometer which analyzes over 8,000 funds across categories. The report highlights the variation in the success rates of active and passive funds and demonstrates where active managers have been more successful. You can access this report here.

Fed Fever Approaching

Investors’ commitment to following Munger’s advice on patience may be tested again this week as the Federal Reserve Open Market Committee (FOMC) meets to set interest rates. With expectations almost evenly divided between a cut of 0.25% and 0.50%, there is plenty of opportunity for elation, disappointment, extrapolation and volatility. Alongside this, several measures of economic activity are being released which could challenge market expectations and unsettle investors. You can find out more about what is happening this week on Morningstar’s new market calendar page here.

Highlights of This Week’s Market and Investing Events

- Sept. 17: August Retail Sales, August Capacity Utilization, August Industrial Production, July Business Inventories

- Sept. 18: August New Residential Construction report, September Federal Open Market Committee decision on interest rates

- Sept. 19: Initial Unemployment Insurance Claims report for the week ended Sept. 14, August Leading Indicators

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended Sept. 13

- The Morningstar US Market Index rose 4.03%.

- The best-performing sectors were technology, up 6.76%, and consumer cyclical, up 5.39%.

- The worst-performing sector was energy, down 0.52%.

- Yields on 10-year US Treasury notes fell to 3.66% from 3.72%.

- West Texas Intermediate crude prices rose 1.04% to $69.29 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 550, or 78%, were up, five were unchanged, and 154, or 22%, were down.

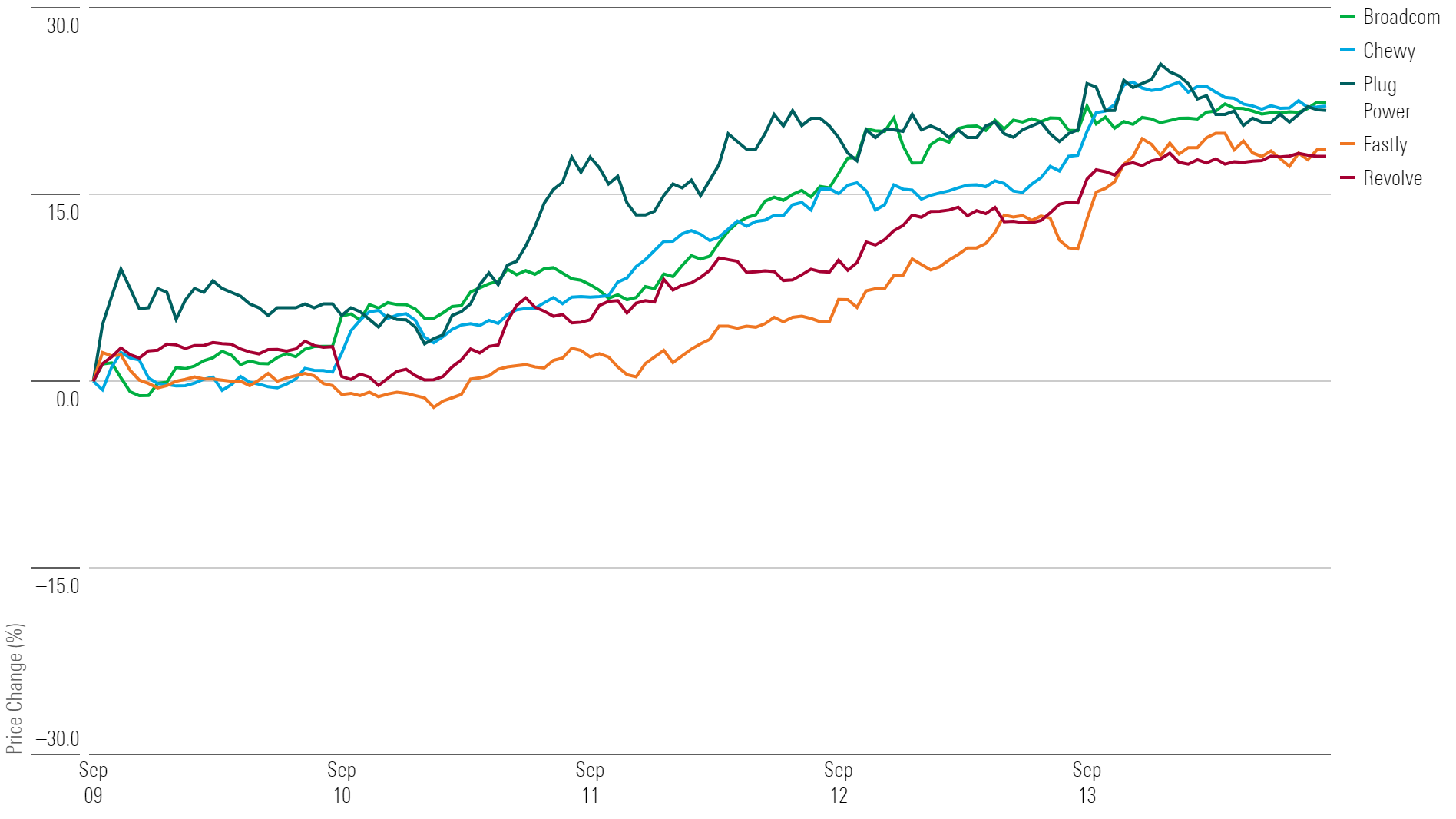

What Stocks Are Up?

Chewy CHWY, Plug Power PLUG, Broadcom AVGO, Fastly FSLY, Revolve Group RVLV

Best-Performing Stocks of the Week

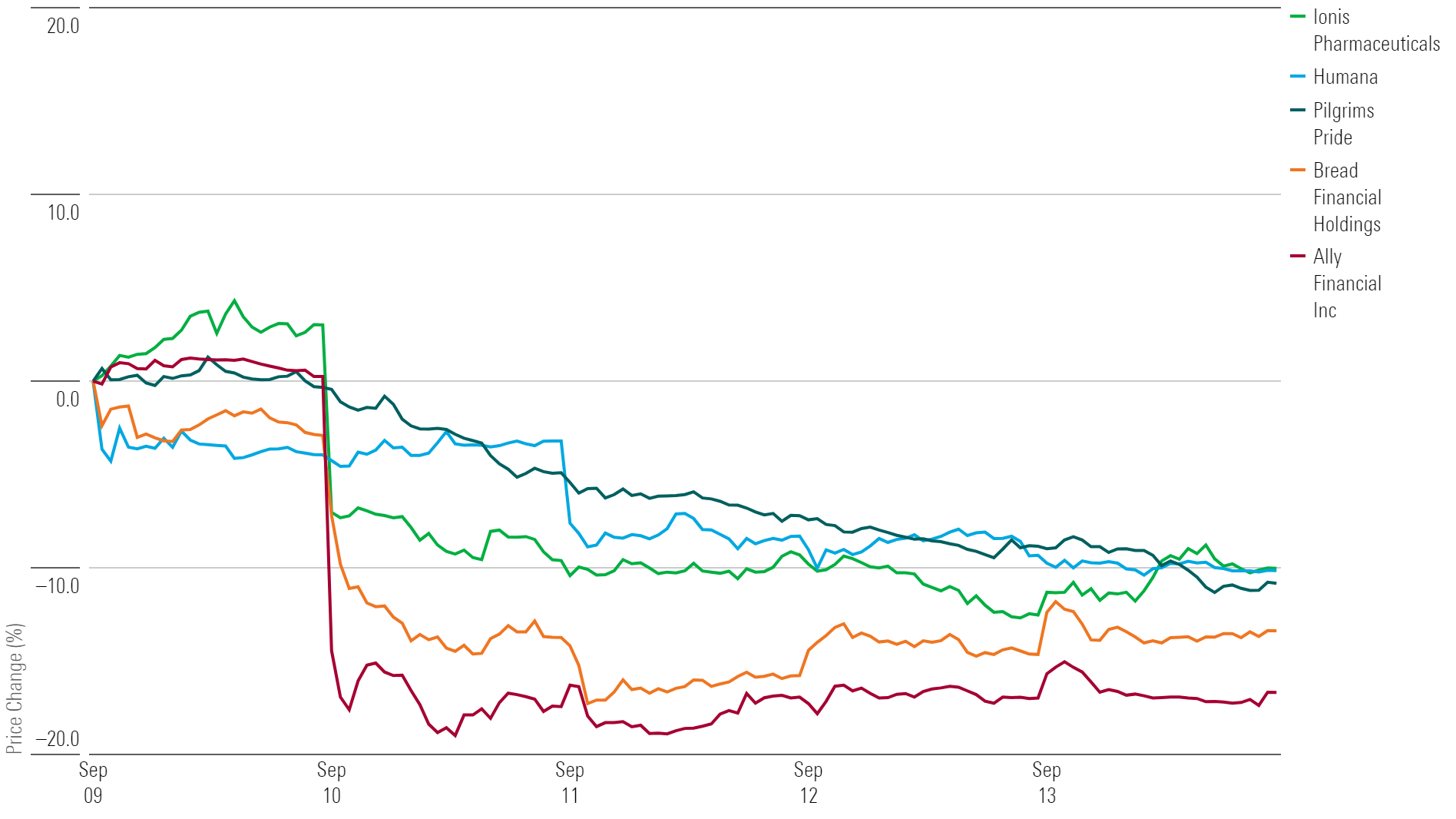

What Stocks Are Down?

Ally Financial ALLY, Bread Financial BFH, Pilgrim’s Pride PPC, Humana HUM, Ionis Pharmaceuticals IONS

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)