Markets Brief: Fed Interest-Rate Decision Looms

Plus: Tech sells off, consumers keep the economy growing, and small-cap stocks outperform again.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Are Stocks a Bargain or Just on Sale?

Large technology companies led the fall in equity prices last week. Communications services were the weakest sector, dragged 3.64% lower following earnings results from index heavyweights Alphabet GOOGL and Netflix NFLX. Meta Platforms META, which holds the largest position in the Morningstar US Communication Services Index, reports this week. See what analyst Michael Hodel expects from the social-media giant.

Small-Company Stocks Outperform

Although falling stock prices create a better opportunity to buy, savvy shoppers know there’s a difference between a sale (when prices are reduced) and a bargain (when stocks are priced below their true value). While prices have fallen over the last few weeks, large technology-oriented companies are not yet in bargain territory. In contrast, smaller companies—especially those in traditional industries—have been trading at thrift-store prices for months and have recently fared better than their larger peers, with the Morningstar US Small Cap Index finishing the week 2.14% higher.

Economy Shows Strong Growth

While politics dominated the headlines this week, there was plenty to keep economic commentators busy, as the latest GDP measure of the US economy was surprisingly strong at 2.8% annual growth, spurred by stronger consumer spending.

Further good news came from the Personal Consumption Expenditure measure of inflation, which was in line with expectations at an annual rate of 2.6% for core inflation. The appetizing combination of higher growth and low inflation took the edge off the week’s earlier falls. It is important to remember that all economic data is backward-looking, while investment is a function of expectations. Morningstar chief investment officer Philip Straehl discusses how this dynamic creates opportunities around assets with lower expectations.

Attention Turns to the Fed Again

As we approach the Federal Reserve Open Market Committee’s next meeting on Wednesday, investors have become more optimistic about the number of interest-rate cuts this year. CME FedWatch indicates a 64% probability of three or more cuts, compared with only 18% a month ago. In contrast, longer-term bond yields have remained relatively stable, with the 10-year Treasury yield falling only 0.2% over that same period. Nervous investors would have preferred bond yields to decline further as equity prices have fallen, helping to balance their portfolios. However, an environment in which government bonds yield more than inflation creates a stronger foundation for accepting investment risk.

Highlights of This Week’s Market and Investing Events

- Tuesday, July 30: Corporate earnings from SoFi Technologies SOFI, Procter & Gamble PG, Microsoft MSFT

- Wednesday, July 31: Federal Open Market Committee meeting, corporate earnings from Boeing BA, Meta Platforms META

- Thursday, Aug. 1: Corporate earnings from Albemarle ALB, Apple AAPL, Amazon AMZN

- Friday, Aug. 2: July Employment Situation Report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended July 26

- The Morningstar US Market Index fell 0.6%.

- The best-performing sectors were utilities, up 1.7%, and basic materials, up 1.62%.

- The worst-performing sector was communication services, down 2.29%.

- Yields on 10-year US Treasury notes fell to 4.20% from 4.25%.

- West Texas Intermediate crude prices fell 4.13% to $76.82 per barrel.

- Of the 702 US-listed companies covered by Morningstar, 447, or 64%, were up, five were unchanged, and 250, or 36%, were down.

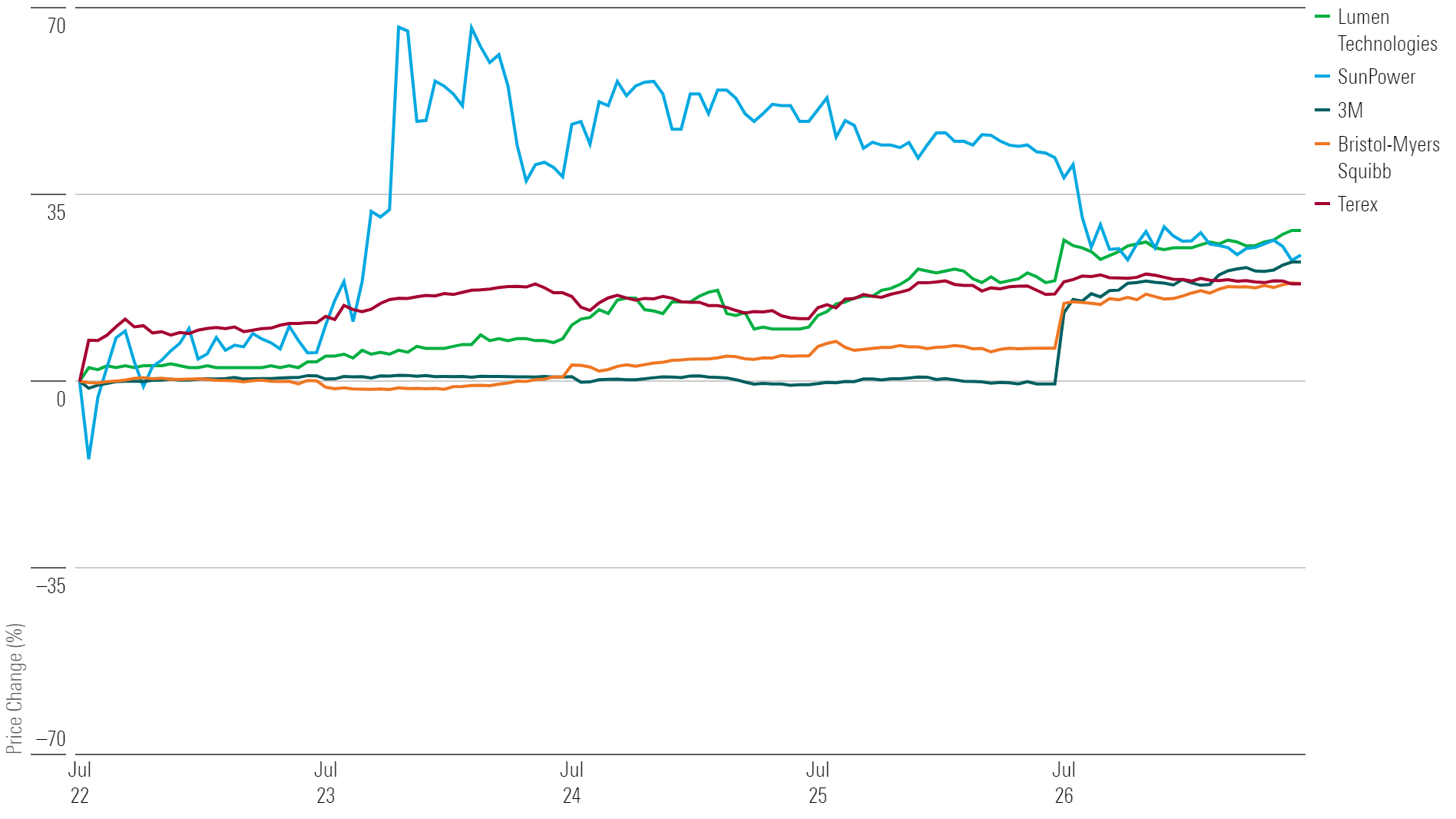

What Stocks Are Up?

Lumen Technologies LUMN, SunPower SPWR, 3M MMM, Bristol-Myers Squibb BMY, Terex TEX

Best-Performing Stocks of the Week

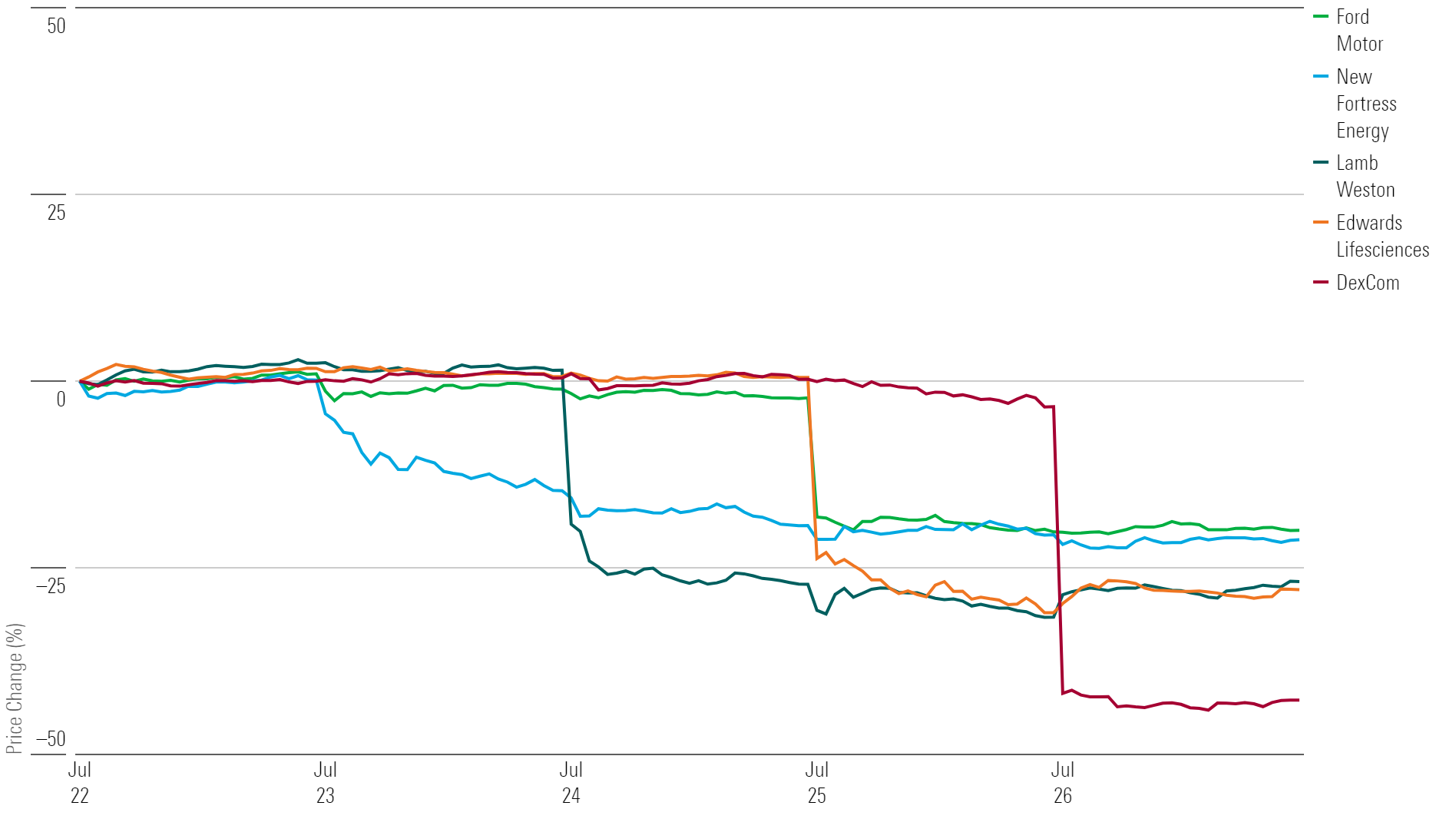

What Stocks Are Down?

DexCom DXCM, Edwards Lifesciences EW, Lamb Weston Holdings LW, New Fortress Energy NFE, Ford F

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)