Markets Brief: Tech Rebounds, Small Caps at Discount

Plus: Investors await confirmation of more rate cuts in FOMC minutes.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Confidence Returns

Investor moods were buoyant last week, evidenced by a 3.91% rise in the Morningstar US Market Index. This optimism was reflected globally by the Developed Markets ex-US Index (up 4.04%) and Emerging Markets Index (up 2.61%). Japanese stocks, at the vanguard of the fall in prices a couple of weeks ago, experienced a particularly strong rise of 6.87%.

Such rapid price changes do not reflect changes in companies’ values, but rather changing sentiment during a holiday. Fewer participants means such changes can have a bigger impact and prices move more rapidly than normal. Investors who separate market noise from genuine changes in asset values were again rewarded for their steadfastness in the face of panic.

Mind the Gap

The benefits of patience are illustrated by Morningstar’s annual Mind the Gap report, which highlights the difference between the returns of investment funds and the returns investors achieve by investing in those funds. While these outcomes should be the same, mistimed buying and selling create a gap.

This gap amounted to an average loss of 15% of the total fund return over the last decade. Such a loss can push an investor’s goal further back and overwhelm attempts to lower the cost of investing. To go deeper, read Jeffrey Ptak’s summary of the research and download the report here.

Attribution Is Easier Than Prediction

The recent declines in stock prices have been attributed to growing concerns about a recession, following weaker-than-expected economic data. While it’s easy to attribute market movements to current events with the benefit of hindsight, predicting the future and how investors will react is an uncertain exercise. This is illustrated by John Rekenthaler’s column this week, which delves into the predictability of recessions and their impact on equity prices. It reminds us that we must always consider a range of potential outcomes when investing and not fixate on a certain path or prediction. Even if a prediction is correct, events often impact asset prices in surprising ways.

The Best Things Can Come in Small Packages

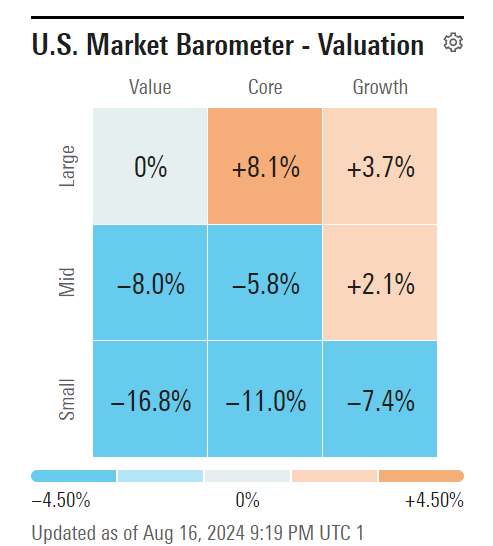

Last week’s rise in stock prices was not evenly distributed. The prices of larger companies rose further than those of their smaller peers. Consequently, we again see a substantial gap in the valuation (and therefore our expectation of future returns) between larger and smaller companies, illustrated by the US market barometer below.

Morningstar’s Investment Management team has highlighted the opportunities in smaller companies stemming from this valuation gap. Philip Straehl recently updated this view. And analyst Nour Al Twal has written about small-value funds.

Small-Cap Valuations Continue to Lag Behind Large-Caps

FOMC Minutes and Jackson Hole Conference in the Spotlight

With earnings season virtually over and little economic data forthcoming, the week’s focus will likely be the minutes of the last Federal Reserve Open Market Committee meeting, which will be released Wednesday, along with news from the Fed’s annual conference in Wyoming. Market commentators will seek confirmation of forthcoming interest rate cuts. While this is the most likely outcome, an absence of supportive comments could trigger further volatility.

Highlights of This Week’s Market and Investing Events

- Monday, Aug. 19: July Leading Indicators

- Tuesday, Aug. 20: Earnings from Lowe’s Companies LOW

- Wednesday, Aug. 21: Minutes from the August FOMC meeting, earnings from Macy’s M, Target TGT, and Snowflake SNOW

- Thursday, Aug. 22: Initial Unemployment Insurance Claims report for the week ended Aug. 17, earnings from Baidu BIDU

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended August 16

- The Morningstar US Market Index was up 3.85%.

- The best-performing sectors were technology, up 6.88%, and consumer cyclical, up 4.77%.

- The worst-performing sector was real estate, up 0.16%.

- Yields on 10-year US Treasury notes fell to 3.89% from 3.94%.

- West Texas Intermediate crude prices fell 1.97% to $76.74 per barrel.

- Of the 701 US-listed companies covered by Morningstar, 593, or 85%, were up, and 105, or 15%, were down.

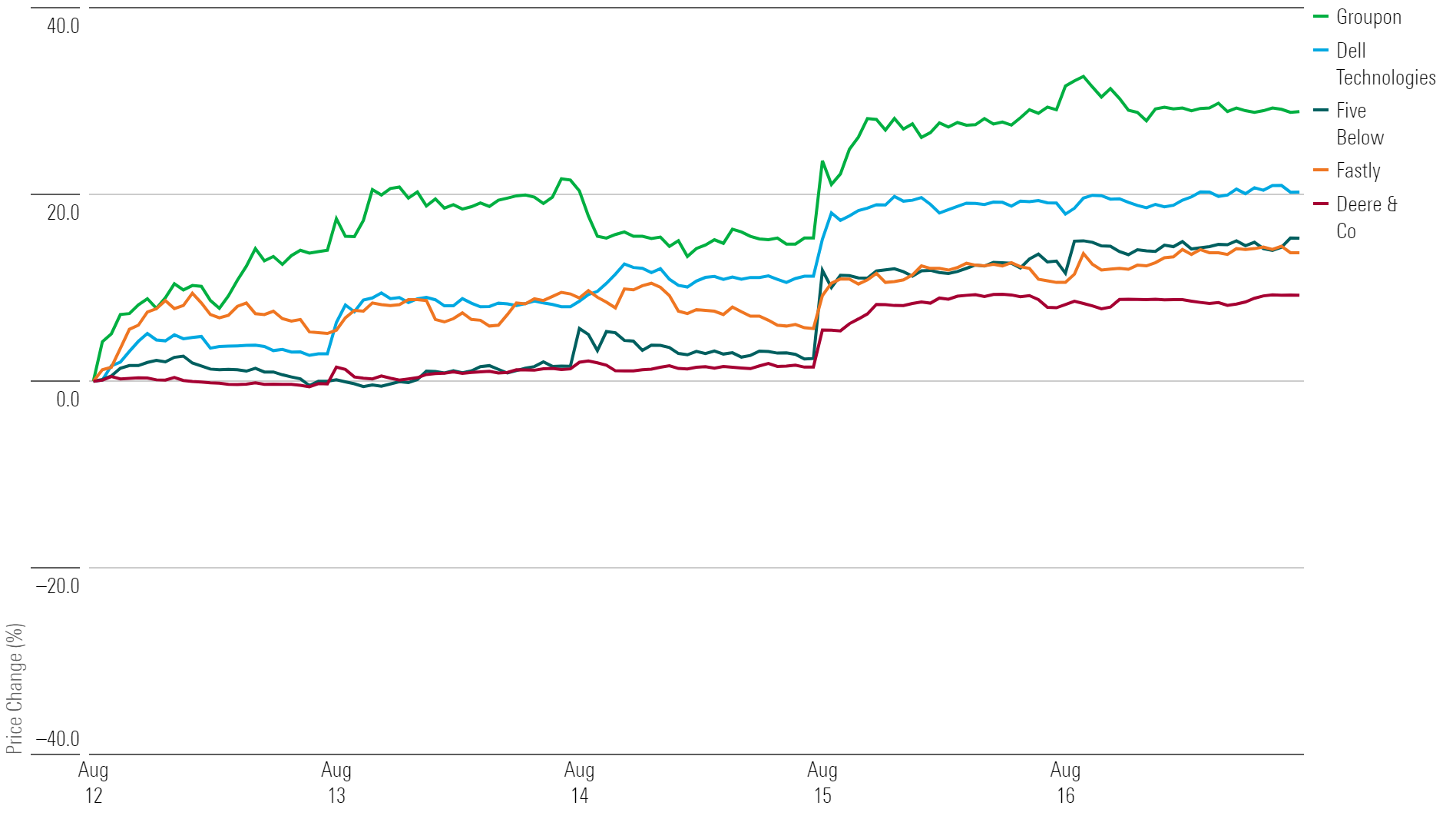

What Stocks Are Up?

Groupon GRPN, Dell Technologies DELL, Five Below FIVE, Fastly FSLY, Deere & Company DE

Best-Performing Stocks of the Week

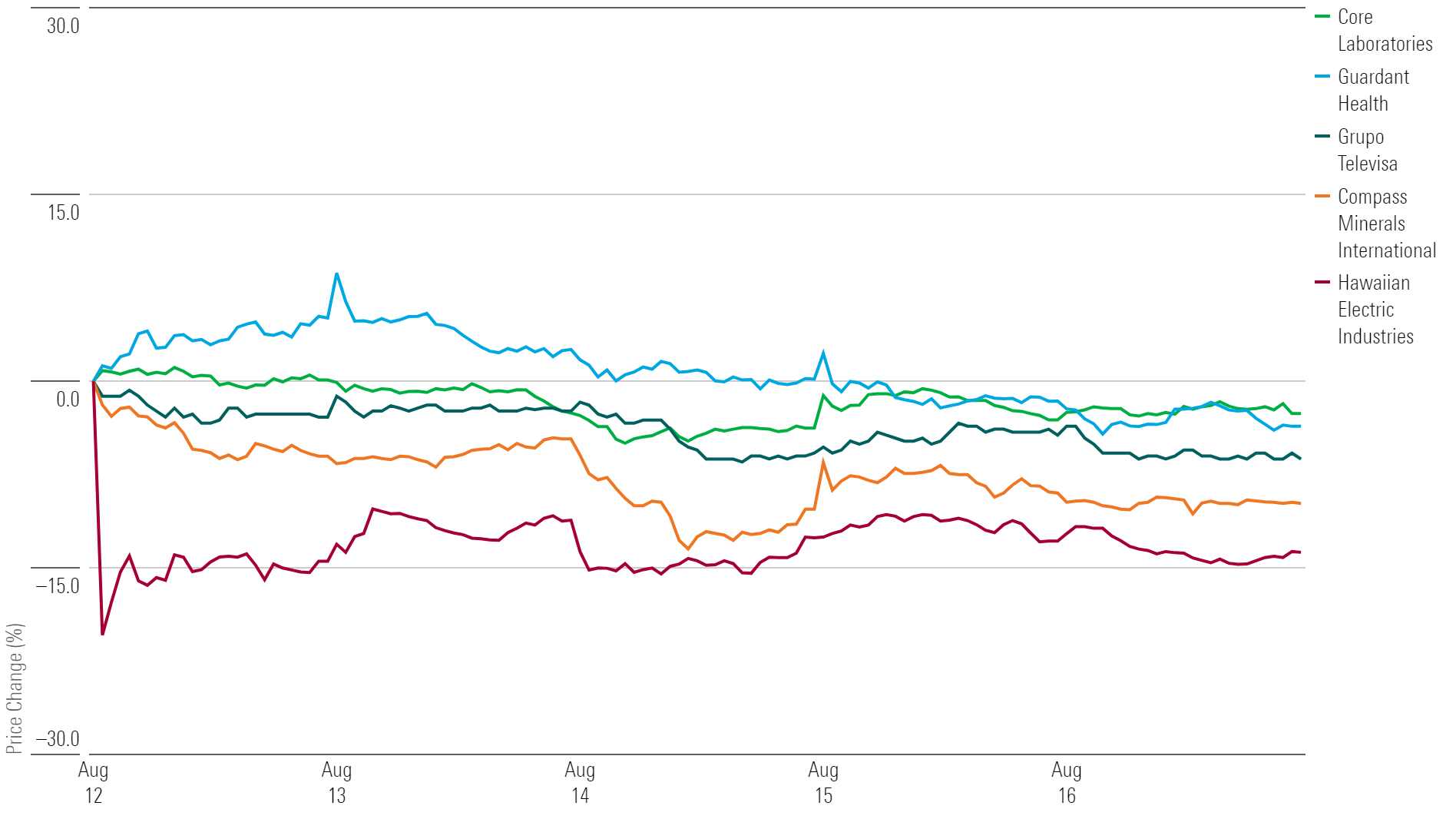

What Stocks Are Down?

Hawaiian Electric Industries HE, Compass Minerals International CMP, Grupo Televisa TV, Guardant Health GH, Core Laboratories CLB

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)