Markets Brief: GDP and Inflation Back in the Spotlight

Plus: CrowdStrike chaos, tech stocks stumble, and Biden bows out.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

CrowdStrike Chaos

Travelers were left stranded and Microsoft users were facing the blue screen of death on Friday morning, as a failed update from internet security company CrowdStrike Holdings CRWD froze computers worldwide. Although the firm’s share price fell 11.1% on the day, its previous rise was so rapid that this retrenchment merely represents a move back to where it traded in early June. Morningstar analyst Malik Ahmed Khan maintains his fair value estimate of the stock at $300 per share, and he believes the current price represents a buying opportunity.

CrowdStrike Stock vs. Morningstar Fair Value Estimate

Technology Stocks Drag US Market

The prices of large technology companies fell sharply last week, with the Morningstar US Technology Index down 4.56%. It is worth noting that only 1.14% of this decline occurred on Friday, and therefore cannot be attributed solely to the disruption caused by the CrowdStrike debacle. Nvidia NVDA, which accounts for more than 15% of the index, fell 8.75% over the week.

Due to the weight of technology companies in the Morningstar US Market Index (32%), this decline dragged it down by 1.78%. However, this was not universal; the Morningstar US Value Index rose 1.04% and the Morningstar US Small Cap Index rose 0.46% over the week.

Biden Bows Out

Investors will naturally be considering the impact of President Joe Biden’s decision to cease running for reelection. Such speculation is fraught, due to our natural biases. Morningstar behavioral scientist Samantha Lamas brilliantly unpacks these unconscious motivators. Meanwhile, Emelia Fredlick summarizes Morningstar’s latest outlook on how the election may affect investors.

Falling Stock Prices Are a Feature, Not a Bug

Although sharp downward price moves can worry investors, they reflect a rational adjustment in a market that has witnessed a widening gulf in valuations between large technology-orientated companies and smaller traditional businesses. While this gulf is smaller as we enter a new week, it remains significant. Large growth companies are expensive, while small value companies are cheap. This ongoing valuation gap presents opportunities for patient investors to invest in overlooked or unloved names.

Stocks Fall Overseas

International equity markets also experienced declines last week, with the Morningstar Developed Markets ex-US Index falling 2.01% and the Morningstar Emerging Markets Index down 2.70%. Technology stocks also led these declines. This reminds us that when seeking diversification through overseas investment, it is important to understand the industry composition of those markets to ensure one is not simply adding to their concentration of existing US holdings. This may require investment in markets that have fared poorly relative to the United States. This can be uncomfortable and counterintuitive, but it’s essential to building a diversified portfolio.

GDP and Inflation Back in the Spotlight

Plenty of news will keep investors busy this week, with 138 of the largest 500 US companies expected to report their second-quarter results. Further significant economic updates include second-quarter GDP measures on Thursday and the PCE report on Friday. Economists anticipate year-over-year growth to improve from the first quarter and inflation to continue falling. Any deviation from such expectations may create additional volatility.

Highlights of This Week’s Market and Investing Events

- Monday, July 22: Earnings from Verizon Communications VZ

- Tuesday, July 23: Earnings from GE Aerospace GE, Coca-Cola KO, Alphabet GOOGL, Tesla TSLA

- Wednesday, July 24: Earnings from AT&T T, ServiceNow NOW, GE Vernova GEV

- Thursday, July 25: Q2 GDP, Earnings from American Airlines Group AAL

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended July 19

- The Morningstar US Market Index fell 1.8%.

- The best-performing sectors were energy, up 1.75%, and financial services, up 1.44%.

- The worst-performing sector was technology, down 4.56%.

- Yields on 10-year US Treasury notes rose to 4.25% from 4.18%.

- West Texas Intermediate crude prices fell 2.34% to $80.29 per barrel.

- Of the 702 US-listed companies covered by Morningstar, 385, or 55%, were up, 4 were unchanged, and 313, or 45%, were down.

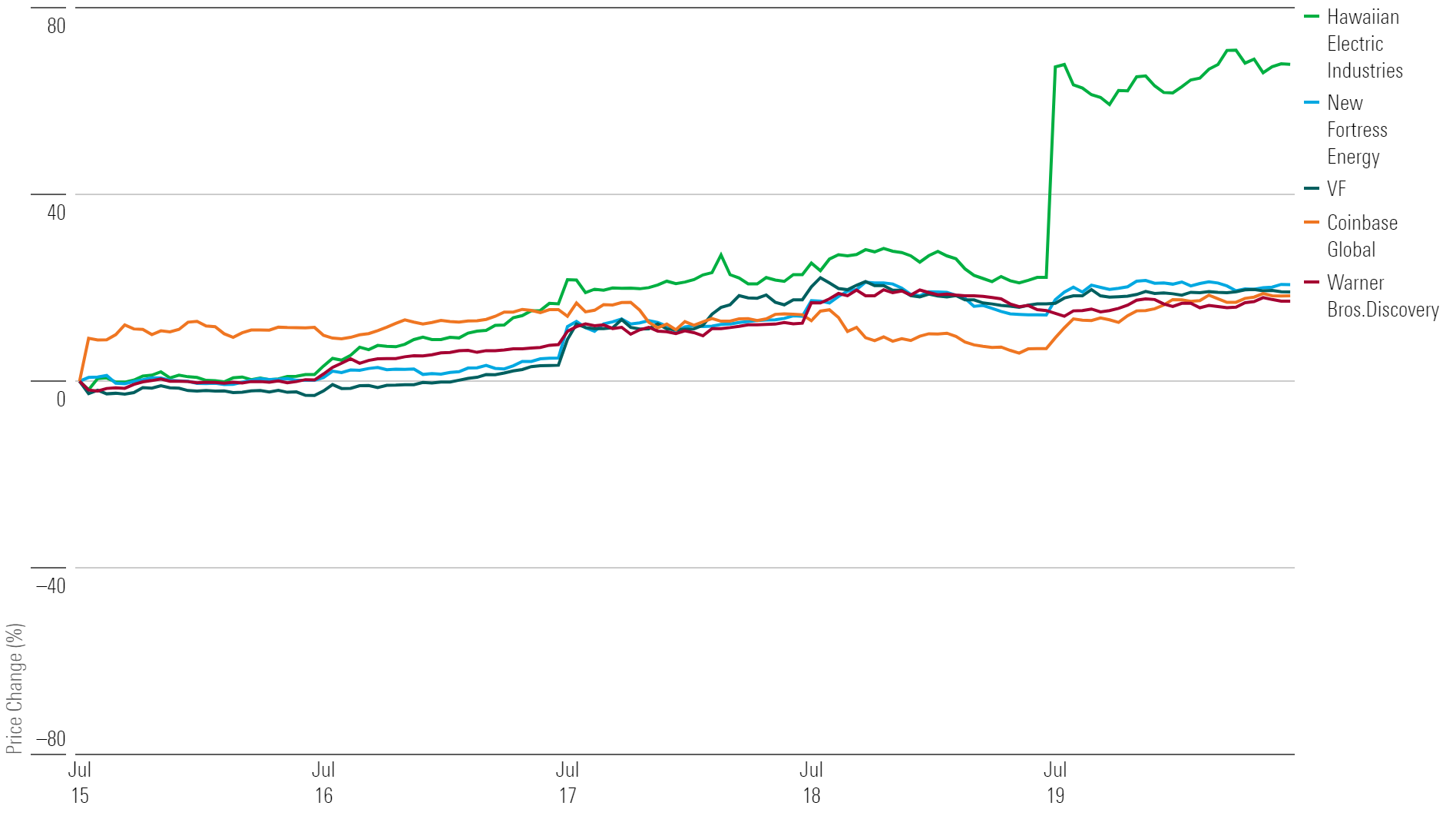

What Stocks Are Up?

Hawaiian Electric Industries HE, New Fortress Energy NFE, VF VFC, Coinbase Global COIN, Warner Bros. Discovery WBD

Best-Performing Stocks of the Week

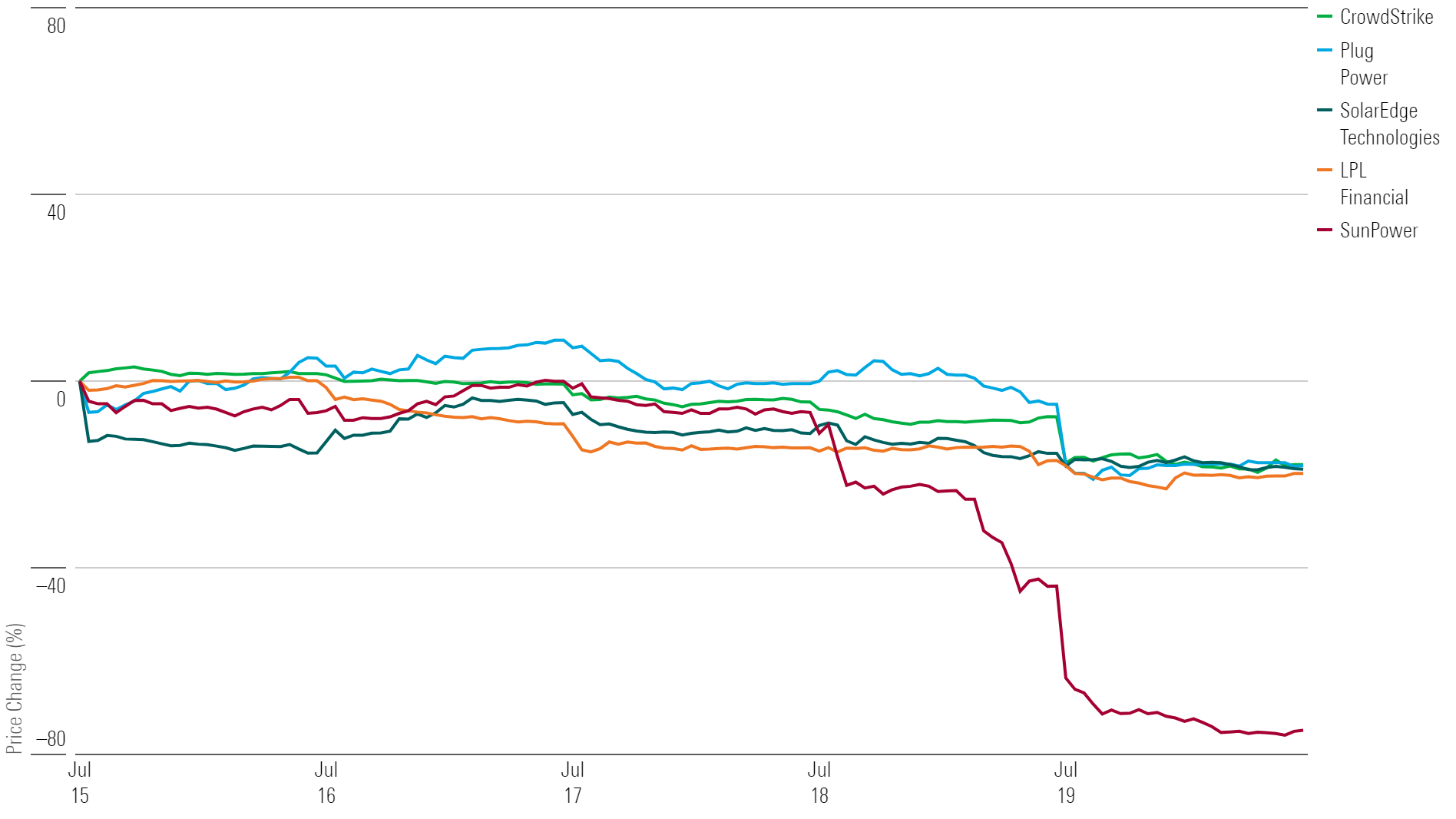

What Stocks Are Down?

SunPower SPWR, LPL Financial Holdings LPLA, SolarEdge Technologies SEDG, Plug Power PLUG, CrowdStrike Holdings CRWD

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)