Markets Brief: Looking Ahead to Friday’s Jobs Data

Plus: Nvidia falls, investors back a soft landing, and communication stocks look undervalued.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

Markets Started August Badly but Recovered

Investors ended August in an optimistic mood, despite the pessimism that engulfed the market at the start of the month. The Morningstar US Market Index rose 2.6% in August and is now up 18.5% for the year to date and 26.5% over the last 12 months. Large companies with higher expected future growth rose more than smaller companies and those with more modest expectations. US equities now appear slightly overvalued and more vulnerable to decline if investors become less confident. For more details on these movements and their impact on the market’s valuation, check out Morningstar’s new Markets page.

Can the Economy Make a Perfect Landing?

Commentators were buoyed by better-than-expected inflation data on Friday, reinforcing predictions of a near-perfect landing for the US economy following a period of high inflation. Such expectations are dangerous, as they are so easy to disappoint. And the more investors become focused on a single outcome, the more likely they’ll be surprised. Upsets tend to provoke poor decisions, which can have long-lasting impacts on one’s financial health. As confidence grows in a single outcome, it is important to consider how your portfolio will behave in other scenarios.

Nvidia Stock Falls Despite Beating Expectations

The US market’s high valuation is driven by an unusual concentration in technology companies. One of the key factors here is the growth of Nvidia NVDA, which released its hotly anticipated earnings last week. Despite beating lofty expectations, the stock’s price fell 7.7% over the week, but shares continue to trade 14% above Morningstar’s estimate of their fair value. Read Brian Colello’s take on the latest results. You can track which companies are reporting with Morningstar’s new earnings calendar.

Attractive Stock Sectors

While the US market overall appears overvalued, Morningstar equity analysts and portfolio managers continue to see good investing opportunities in both the US and overseas markets. Within the US, one of the most attractive sectors appears to be communication services, which includes the big internet advertisers such as Meta Platforms META and Alphabet GOOGL, as well as traditional telecom companies. Michael Hodel recently wrote a detailed review of the sector.

Non-Farm Payrolls Ahead

Plenty of economic news will keep commentators busy this week, culminating in Friday’s closely watched jobs data. While such data is a poor indicator of future returns, it can impact investor sentiment and spur market volatility. You can find what is happening this week on Morningstar’s new market calendar.

Highlights of This Week’s Market and Investing Events

- Tuesday, Sept. 3: July Construction Spending, August ISM Manufacturing, earnings from Zscaler ZS

- Wednesday, Sept. 4: July Job Openings and Labor Turnover Survey, Federal Reserve Beige Book

- Thursday, Sept. 5: August ADP Employment Survey, Initial Unemployment Insurance Claims report for the week ended Aug. 31, August ISM Services PMI, earnings from Nio NIO and Broadcom AVGO

- Friday, Sept. 6: August Employment Situation Report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended Aug. 30

- The Morningstar US Market Index was up 0.23%.

- The best-performing sectors were financial services, up 2.60%, and industrials, up 1.33%.

- The worst-performing sector was technology, down 1.05%.

- Yields on 10-year US Treasury notes rose to 3.91% from 3.81%.

- West Texas Intermediate crude prices fell 2.94% to $73.59 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 440, or 63%, were up, and 264, or 37%, were down.

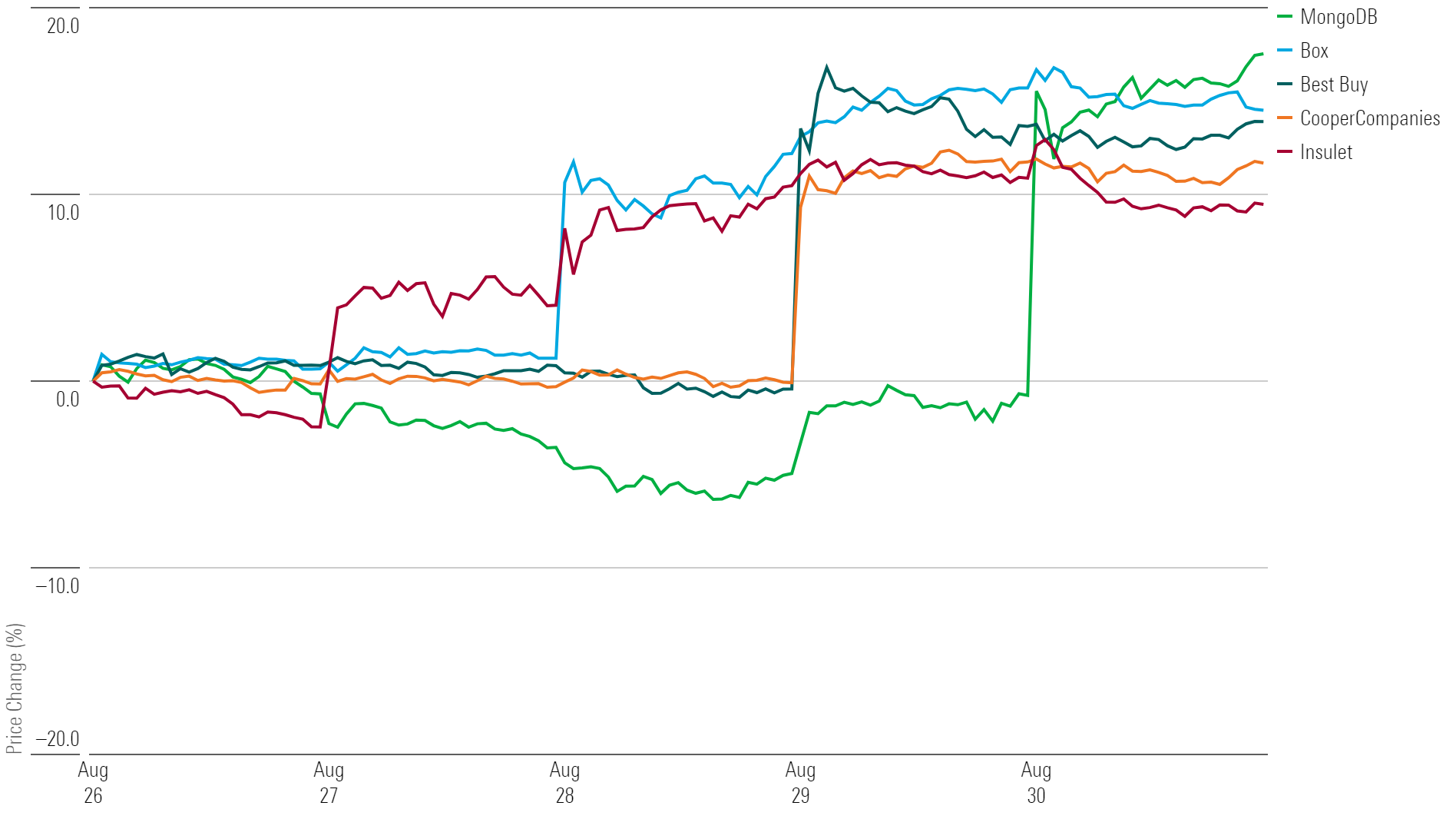

What Stocks Are Up?

MongoDB MDB, Box BOX, Best Buy BBY, Cooper Companies COO, Insulet PODD

Best-Performing Stocks of the Week

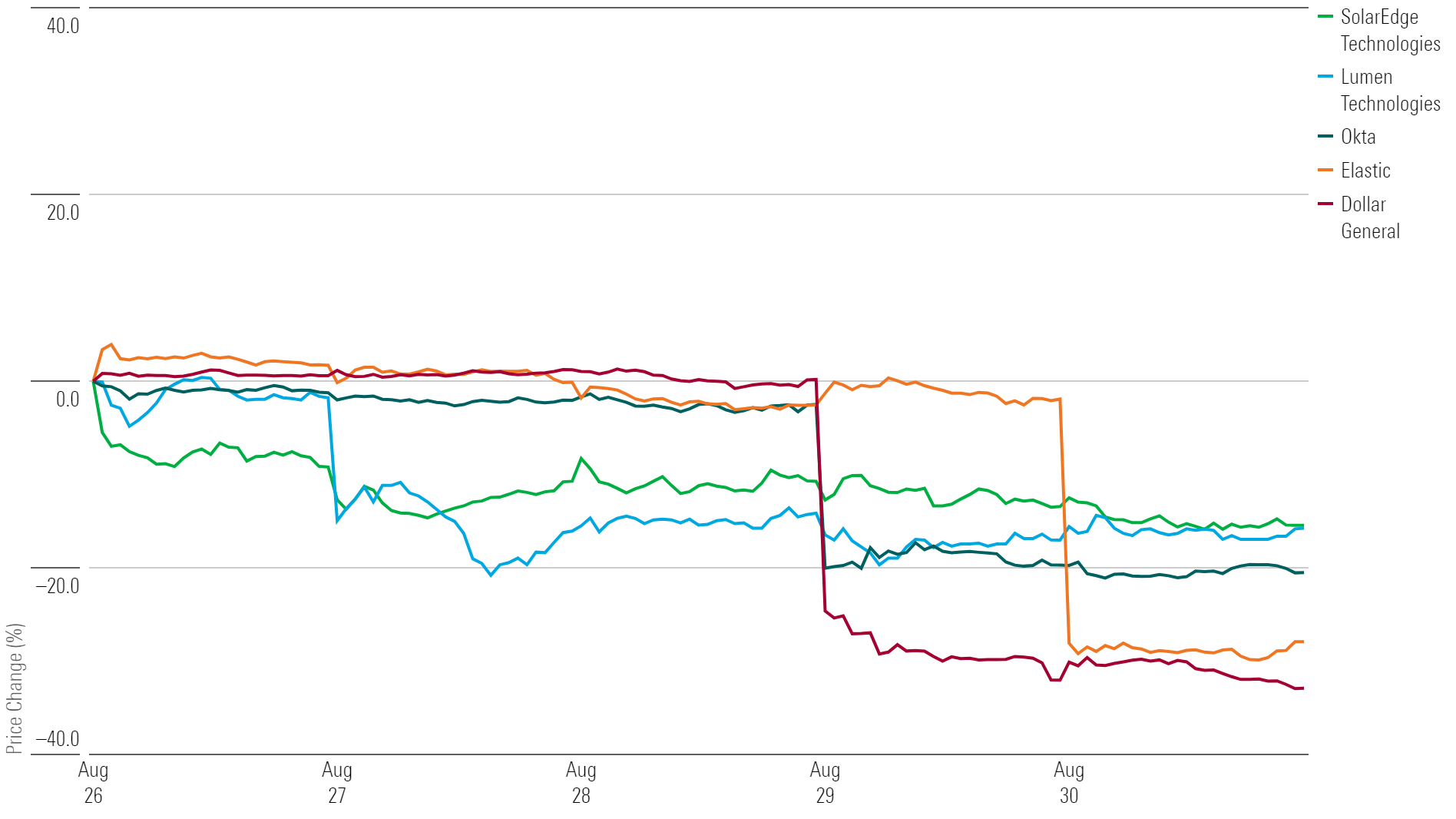

What Stocks Are Down?

Dollar General DG, Elastic ESTC, Okta OKTA, Lumen Technologies LUMN, SolarEdge Technologies SEDG

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)