Markets Brief: Is 16% a Good Return?

Plus: Earnings season, CPI, and high-yield bonds.

Emerging Markets Outperform

The fourth quarter has started with investors in a buoyant mood. The Morningstar US Market Index rose 6% over the third quarter, despite the short periods of panic that afflicted investors in August and September. However, these returns were eclipsed by markets outside the United States, as the Developed Markets ex-US and Emerging Markets indexes both rose 8.2%. The latter was aided by China, which rose 28.6% in the quarter. Emerging-market stocks were flattered by the weakness of the US dollar, which fell 4.3% against the euro over the quarter.

Job Numbers Drive the Dollar

Against this optimistic background, Friday’s employment data was well-received. The unemployment rate unexpectedly fell to 4.1% as more jobs were created in September (254,000 vs. the expected 150,000). The dollar rose 0.5% against the euro over the week, and the yield on 2-year Treasury bonds rose 0.2% as market participants digested the implications for future interest rate cuts. Morningstar’s chief markets editor Tom Lauricella digs deeper into the data.

European Stocks See Better Value

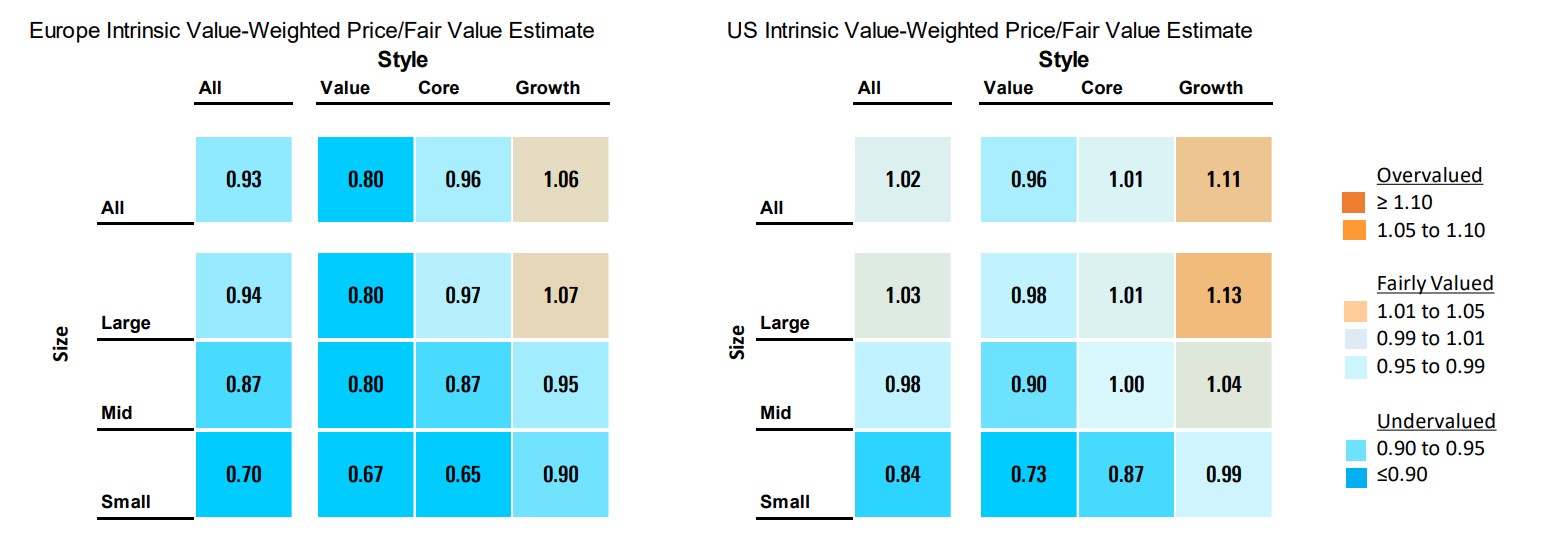

Despite the recent sharp rise in stock prices, Morningstar’s analysts continue to see value in parts of the US market, as Morningstar chief US market strategist David Sekera highlights in his Q4 stock market outlook. However, we see greater opportunities outside the US, as shown by the tables below from Morningstar’s Q4 European market outlook, which compare the price/fair value ratios for US and European stocks as of Sept. 19. While there are opportunities in similar parts of these markets, European assets appear to offer better value than the US.

European fair values

High-Yield Bonds Lag Equities

When assessing whether a return is attractive, people tend to use either an absolute lens (how far it rose) or a relative one (whether it provided higher returns than other assets that exhibit similar risks). However, for most investors, a third lens is more helpful: Did it do the job required?

This is especially relevant when considering US high-yield bonds, which delivered a 5.3% return over the quarter and 15.7% over the last 12 months. Since these assets combine some of the characteristics of equities and higher-quality bonds, investors can choose whether they should control risk or deliver returns in a portfolio. While a 15.7% return is high, it’s lower than what equities delivered over the same period and would be a disappointing substitute. And while high-yield bonds did not fall as far as equities in early August, they demonstrated a positive correlation, which is not helpful if an asset is being used to control risk. In this context, the return on high-yield bonds can be considered disappointing.

This demonstrates the importance of giving every asset a clearly defined role in a portfolio. Otherwise, it’s easy to misjudge the attractiveness of the prospective and realized returns and make avoidable errors when changing the portfolio.

Earnings Season Cranks Up Again

Individual stocks will be back in the spotlight over the next few weeks as US companies report their third-quarter earnings, starting with banks and asset managers. Analysts have downgraded their expectations for profit growth for the US market from 7.8% at the end of June to 4.2% last week. This is not unusual, as firms are keen to lower expectations ahead of results to create positive “surprises” and associated bumps in stock prices.

Rather than engage in this tedious game of expectation management, our analysts use the data provided by companies to identify changes in the long-term prospects of the business and consequently its fair value. You can follow this work on our dedicated earnings page and find out when companies will report with our new earnings calendar.

CPI Data Due

Following the fall in unemployment last week, market commentators will keenly focus on the latest inflation data, which will be released Thursday. Annualized core consumer price inflation is expected to remain steady at 3.2%. A high number would likely cause concern that the Federal Reserve will need to moderate future interest rate reductions and lead to volatility in asset prices.

Highlights of This Week’s Market and Investing Events

- Monday, Oct. 7: Consumer Credit

- Wednesday, Oct. 9: Minutes from the March Federal Open Market Committee meeting

- Thursday, Oct. 10: Consumer Price Index report, Initial Unemployment Insurance Claims report, earnings from Tilray Brands TLRY

- Friday, Oct. 11: Producer Price Index report, Preliminary University of Michigan Index of Consumer Sentiment, earnings from BlackRock Finance BLK, JPMorgan Chase JPM, Wells Fargo WFC

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended Oct. 4

- The Morningstar US Market Index rose 0.21%.

- The best-performing sectors were energy, up 6.85%, and utilities, up 1.17%.

- The worst-performing sector was real estate, down 1.97%.

- The yield on 10-year US Treasury notes rose to 3.98% from 3.75%.

- West Texas Intermediate crude prices rose 8.51% to $74.57 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 427, or 61%, were up, five were unchanged, and 276, or 39%, were down.

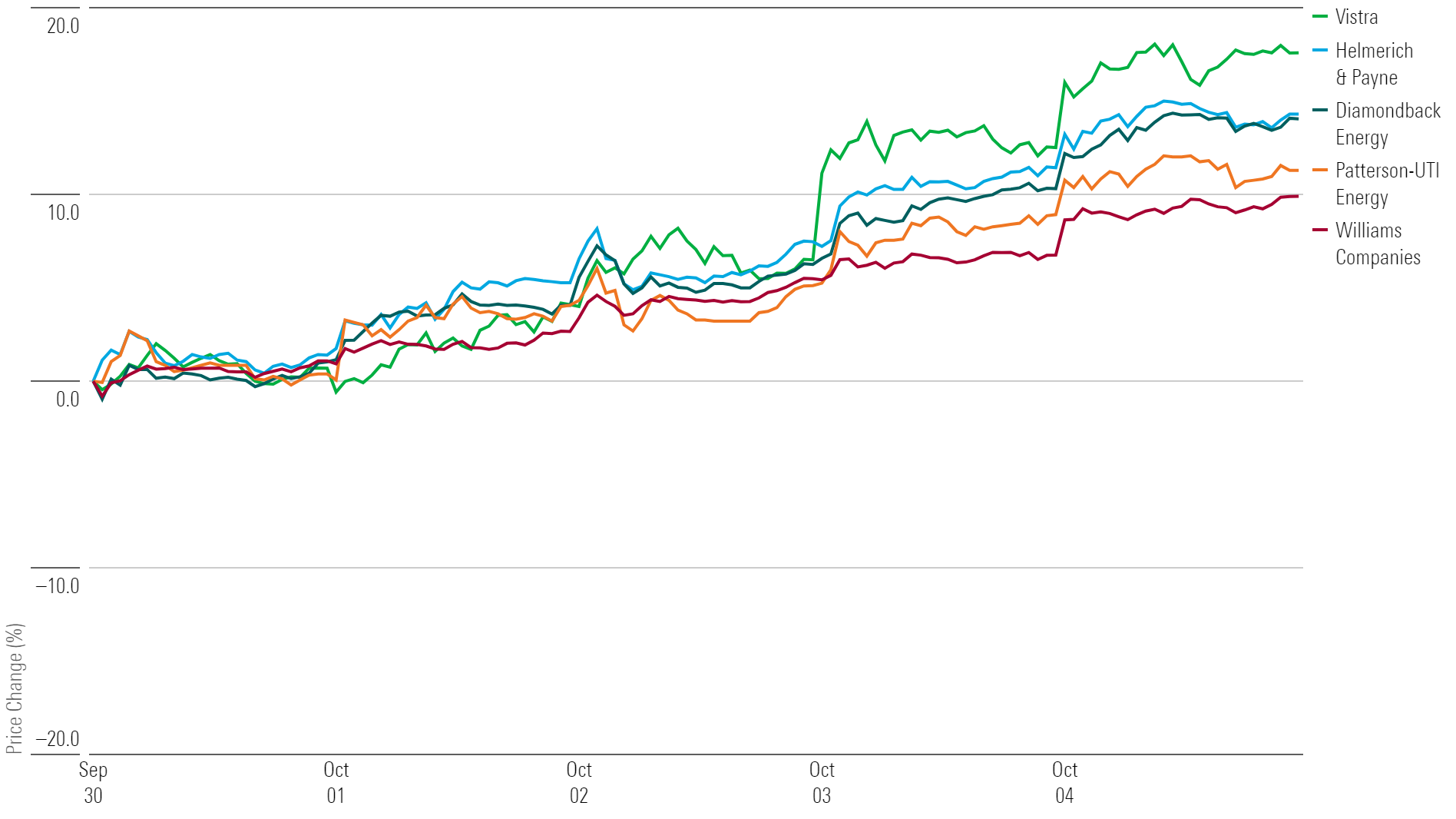

What Stocks Are Up?

Vistra VST, Helmerich & Payne HP, Diamondback Energy FANG, Patterson-UTI Energy PTEN, Williams Companies WMB

Best-Performing Stocks of the Week

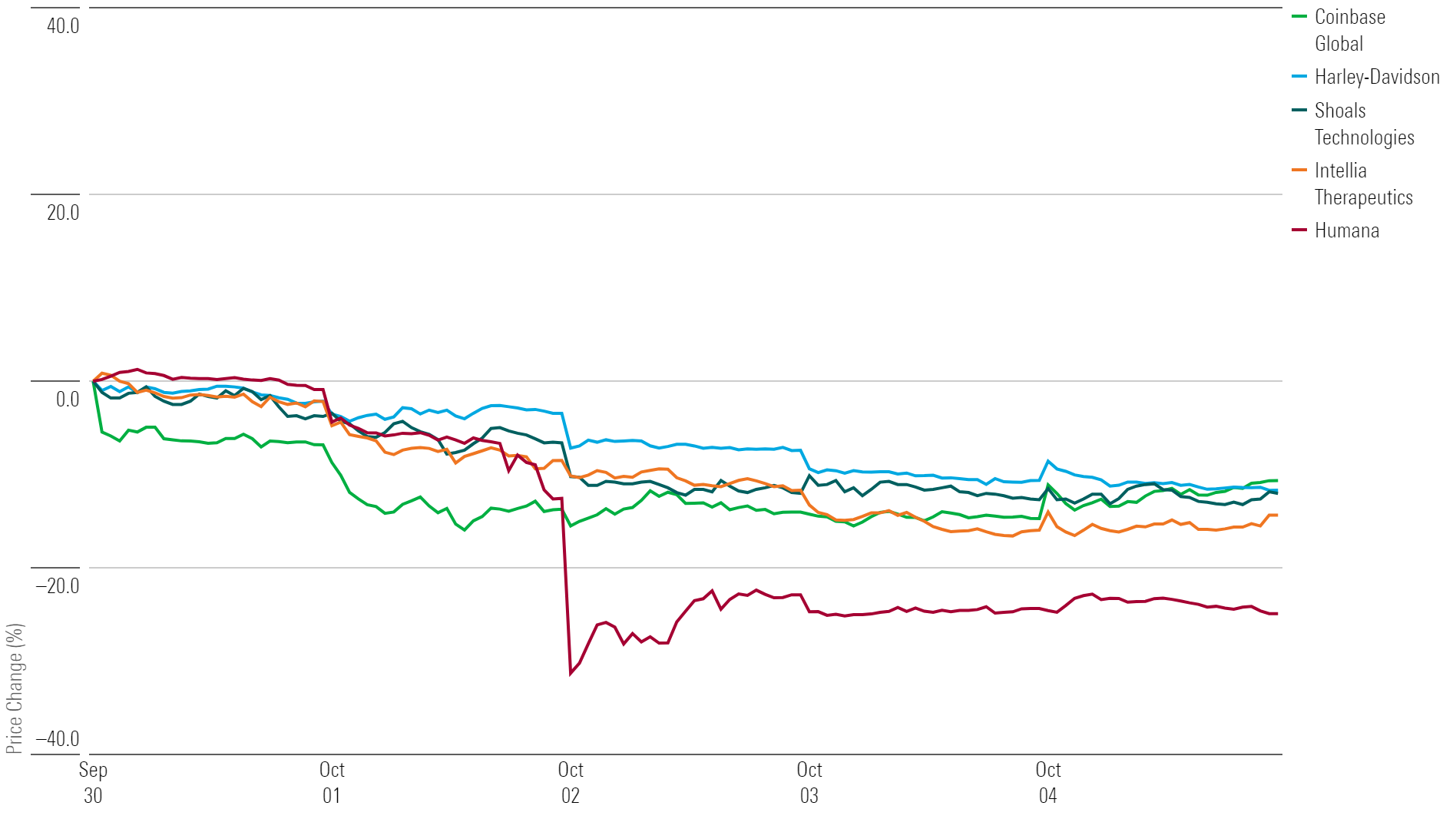

What Stocks Are Down?

Humana HUM, Intellia Therapeutics NTLA, Shoals Technologies Group SHLS, Harley-Davidson HOG, Coinbase Global COIN

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)