Markets Brief: Non-Farm Payrolls in the Spotlight Again

Plus: China’s recovery, uneven investing returns and bond yields.

Emerging Markets Boosted by China’s Recovery

China roared back into the spotlight last week as the Morningstar China Index rose 13.7% following the announcement of massive stimulus package by the Chinese government that includes a 800 billion Chinese yuan ($114 billion) support to the equity markets. Given the market capitalization of the index is $2 trillion, this is a significant injection of capital designed to overcome the pessimism that has dogged that market over the last couple of years. The impact of this rise was also seen in the Morningstar Emerging Market Index which rose 5.5% over the week.

Closer to home, the effect of the Chinese stimulus on the Morningstar US Market Index (up 0.6%) was primarily seen through the basic materials sector which rose 3.2% on expectations of an increase in demand for industrial metals in China. You can find out more on Morningstar’s new markets page here.

Market Volatility Can Be Challenging

As a result of these moves, the China market is now ahead of the US over the year to date (21.9% compared to 20.5%). This reminds us that returns from investing in undervalued securities can be lumpy. When modeling future investment returns, it is natural to forecast a gradual move from the current price towards the fair value of the asset. However, these moves (both down as well as up) can occur abruptly, creating behavioral challenges for investors. While we are more familiar with these challenges when an asset falls in price, it is equally relevant when it rises.

It is always tempting to sell an asset when it has risen swiftly. This neglects the fact that having sold an investment, one must find a replacement or simply accept the returns from holding cash. For investors, the decision to sell should therefore be driven by the same thought process as the decision to buy, which is the relationship of the price of the asset to its fair value. Just because an asset has risen in price sharply does not make it unattractive if it remains below or near its fair value.

Chinese Stocks Still Undervalued

Despite the recent price rise, Chinese equities remain significantly undervalued in the view of Morningstar’s equity analysts and consequently could continue to deliver above average returns over the long term. However, don’t expect these returns to be smooth! To find out more about Morningstar global equity valuations check out the Global Market Barometer.

Bond Yields Normalize

Two-year treasury bond yields fell sharply on Friday as investors become more optimistic about the potential for future interest rate cuts following the PCE measure of inflation which was a little lower than expected. The interest premium investors receive for holding 10-year government bonds over two-year bonds increased to 0.18%, which may appear insignificant, but it reflects a further normalization of the relationship between short- and longer-term interest rates and a better investing environment with fewer distortions. You can find out more about the inflation report in this article by Morningstar’s chief markets editor Tom Lauricella.

All Eyes on US Jobs

US employment data in the form of the non-farm payrolls on Friday is likely to take center stage in the minds of market commentators this week. The unemployment rate is expected to hold steady at 4.2%. A number significantly greater than this would likely to spark concerns about a recession and deeper cuts to interest rates. You can find out more about what is happening this week here.

Highlights of This Week’s Market and Investing Events

- Monday, Sept. 30: Chicago PMI

- Tuesday, Oct. 1: Construction Spending, ISM Manufacturing, Job Openings and Labor Turnover Survey, earnings from Nike NKE

- Wednesday, Oct. 2: ADP Employment Survey

- Thursday, Oct. 3: Initial Unemployment Insurance Claims, ISM Services PMI

- Friday, Oct. 4: Employment Situation Report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended Sept. 27

- The Morningstar US Market Index rose 0.61%.

- The best-performing sectors were basic materials, up 3.17%, and consumer cyclical, up 2.20%.

- The worst-performing sector was healthcare, down 1.20%.

- Yield on the 10-year US Treasury notes rose to 3.75% from 3.73%.

- West Texas Intermediate crude prices dropped 5.69% to $68.57 per barrel.

- Of the 703 US-listed companies covered by Morningstar, 427, or 61%, were up, five were unchanged, and 276, or 39%, were down.

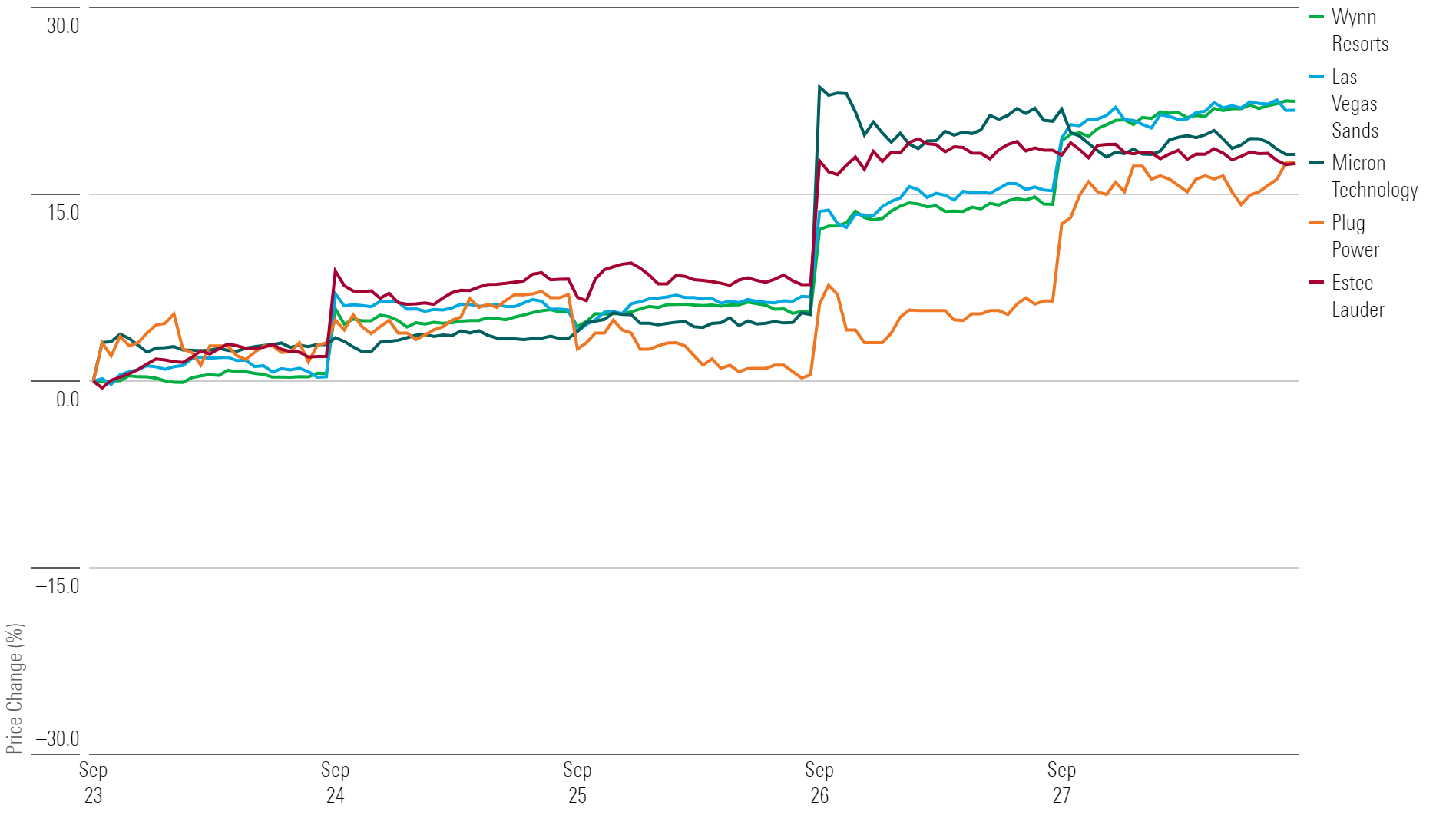

What Stocks Are Up?

Wynn Resorts WYNN, Las Vegas Sands LVS, Micron Technology MU, Estee Lauder Companies EL, Plug Power PLUG

Best-Performing Stocks of the Week

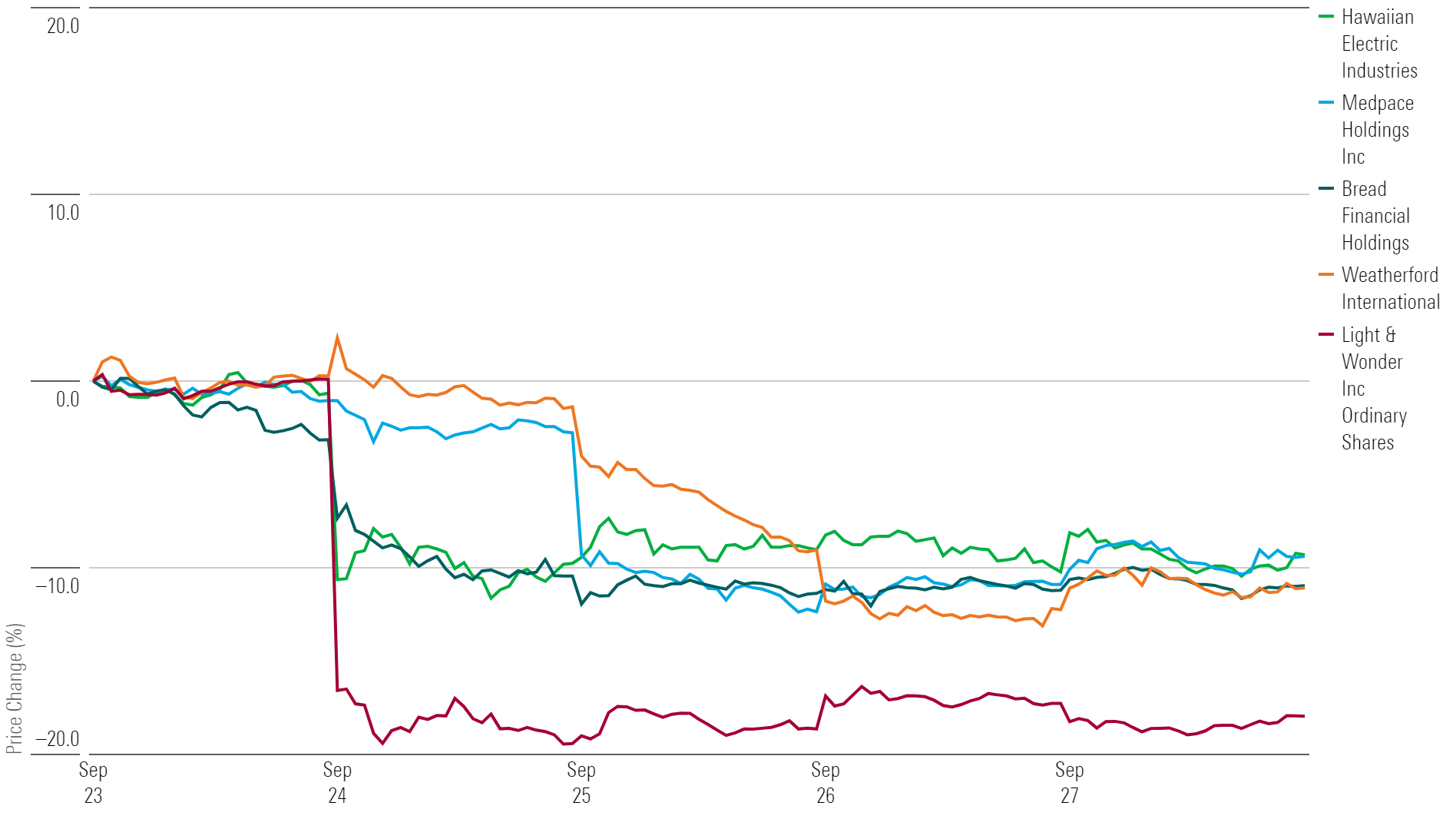

What Stocks Are Down?

Light & Wonder LNW, Bread Financial BFH, Weatherford International WFRD, Medpace Holdings MEDP, Hawaiian Electric Industries HE

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)